Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction

What is sexual reproduction? What is the significance of this process?

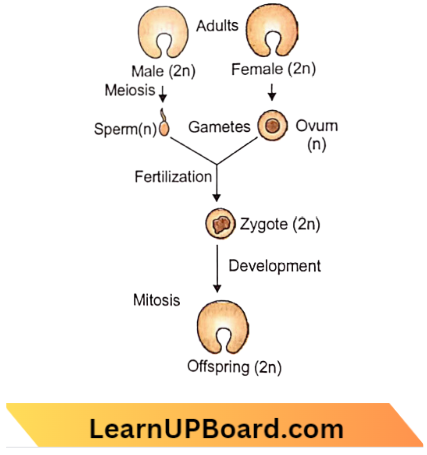

Sexual reproduction is a mode of multiplication or formation of young ones through the process of formation and fusion of gametes. The fusing gametes generally come from different parents so sexual reproduction in most animals is biparental. It is well known that a bull is unable to produce a calf alone and a hen is unable to produce chicken without the other sex.

However, biology being a science of exceptions many lower animals and the majority of plants have both sexes in the same individual. Even then everywhere in sexual reproduction two types of gametes come together and fuse to form a zygote that forms the new individual.

Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction Why The Sexual Mode Of Reproduction

Variations are important in the adaptability of organisms to the changing environment and in the struggle for existence. Some variations appear in asexual reproduction due to errors in DNA copying. However, these errors are either minor or drastic. The latter often kills the cells. Therefore, only minor variations are found in asexually reproduced organisms.

However, in this vast sea of life, individuals must have many variable variations. In sexual reproduction, there is an accumulation of a good number of useful variations that come from different individuals involved in this reproduction. Further, there is a reshuffling of variations due to the reshuffling of genetic materials or chromosomes during their separation and crossing over in meiosis and chance combination during fertilization along with the appearance of mutations during DNA copying.

Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction Basic Features Of Sexual Reproduction

1. Parents:

In most animals and some plants, there are two types of parents, male and female. Such organisms are called unisexual and their sexual reproduction is called biparental. In plants, the two types of sex organs may occur in different flowers of the same plant. They are called monoecious,

For example: Cucurbits, Maize, Castor

In others, the two sexes are borne in flowers of different plants

For example: Date Palm, Papaya. They are called dioecious.

In most plants and some animals (Sponges, Tapeworm, Earthworm) both sexes are present in the same parent. They are called hermaphrodites or bisexuals.

2. Meiosis:

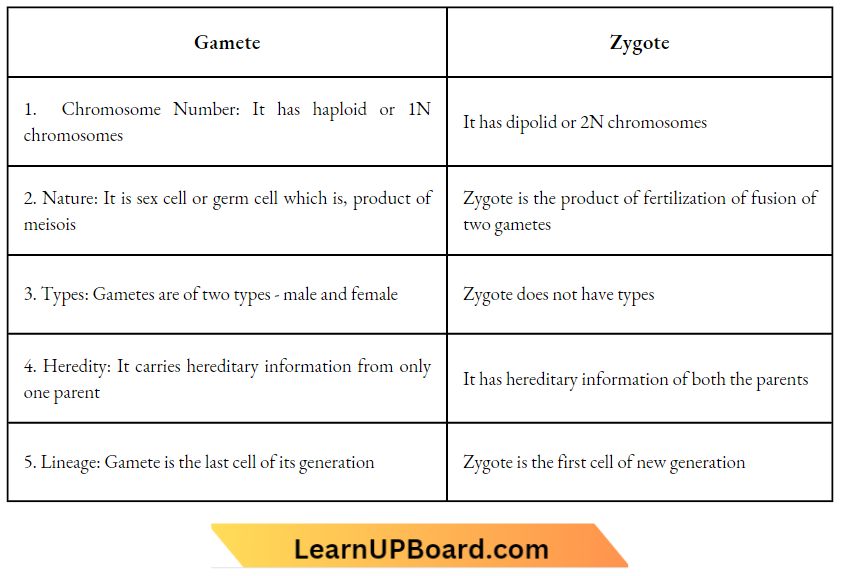

Gametes are always haploid. They are formed through meiosis.

3. Gametes:

In lower organisms, the gametes are often similar (isogamous). In higher animals and plants there are two types of gametes (anisogamous, oogamous), motile male or sperm and nonmotile female or eggs. The female gametes are often food-laden to provide nourishment to growing embryos.

4. Fertilization

It involves the fusion of two types of haploid gametes. Fusion of gametes or fertilization recreates the diploid state in the life cycle by forming a zygote.

5. New Organism:

The single-celled diploid zygote undergoes repeated mitotic divisions to form the young individual

Sexual Reproduction:

Merits of Sexual Reproduction

- Flow of Genes: There is a broad resemblance in the morphology and physiology of all the individuals of a population due to the flow or intermixing of genes during sexual reproduction.

- Vigour and Vitality: Reshuffling or flow of genes in the population during sexual reproduction helps in maintaining the vigor and vitality of the individuals

- Variations: Sexual reproduction introduces a lot of variations due to the reshuffling of paternal and matcha chromosomes, crossing over, chance combination of chromosomes during fertilization, and appearance of mutations. Variations are basic to competitiveness among individuals.

- Adaptability: Sexual reproduction provides variations that help individuals to adapt to changing environments.

- Chromosome Number: It maintains the chromosome number of the species constant generation after generation.

- Harmful Traits: They often remain suppressed in sexual reproduction due to the occurrence of dominant normal traits.

- Evolution: Some of the variations in accumulation play an important part in the formation of new varieties and species.

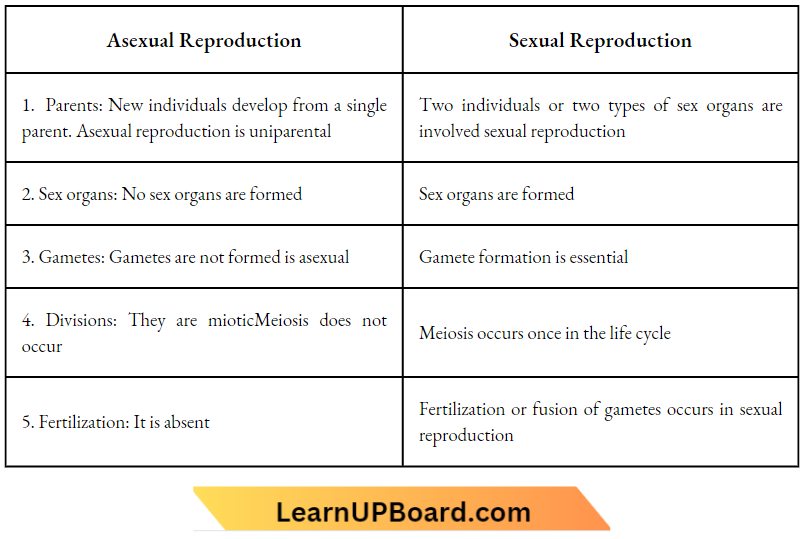

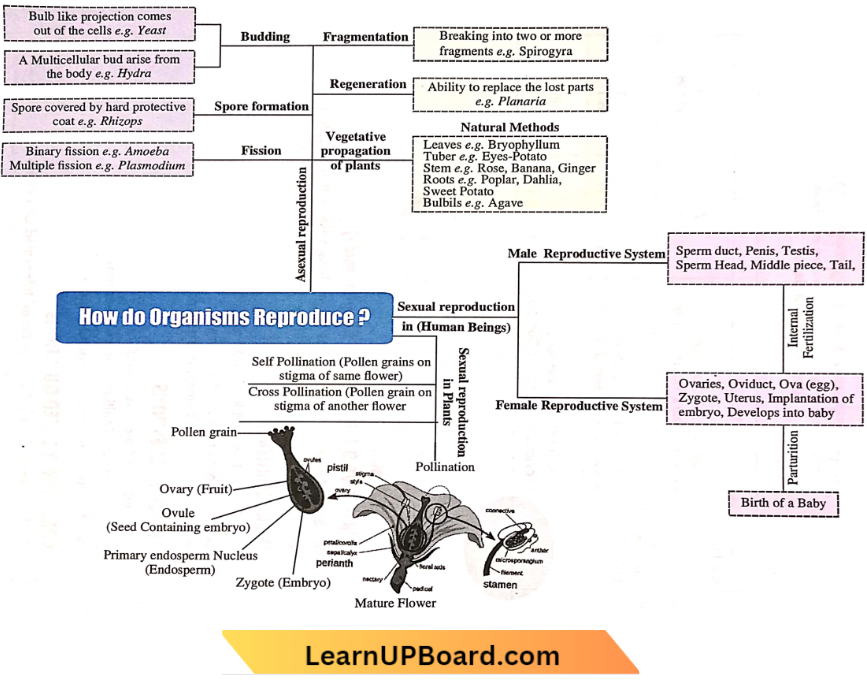

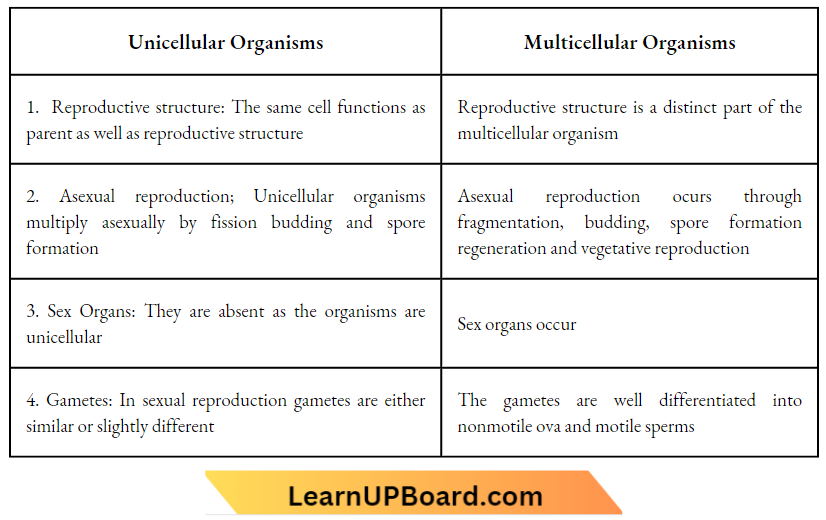

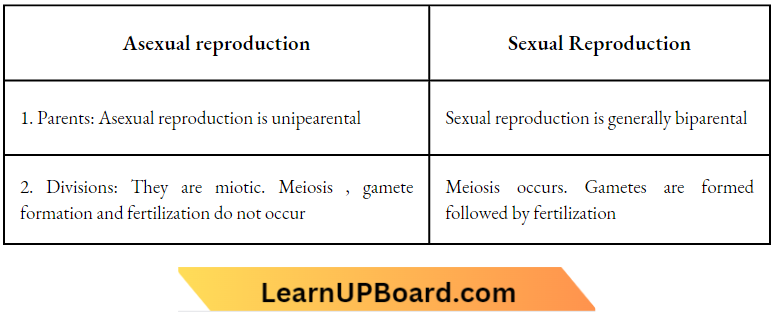

Differences between Asexual and Sexual Reproduction:

Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction Flowering Plants

What is the flower? How is it unisexual or bisexual?

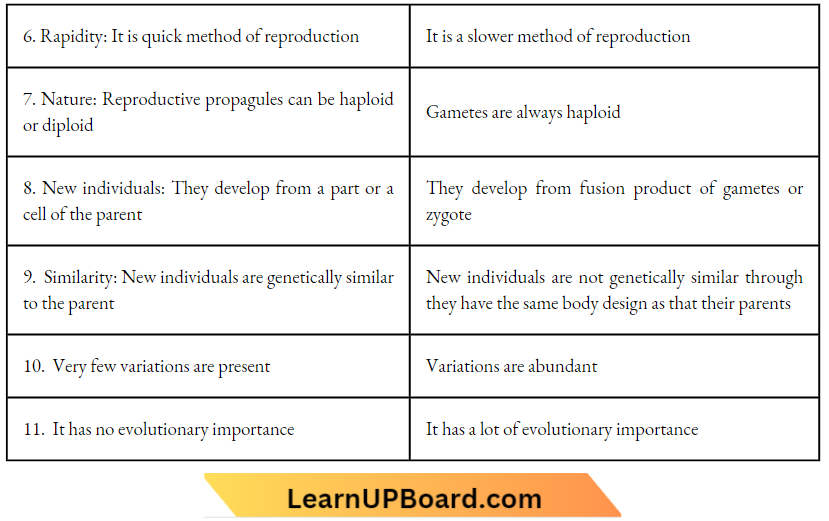

In flowering plants or angiosperms, the reproductive organs are located in flowers. Flowers are specialized condensed shoots which are also called reproductive shoots as they take part in sexual reproduction. Each flower is borne on a stalk named pedicel.

The pedicel leads to a broad base of the flower called the thalamus. Four types of floral organs are borne over the thalamus. They are sepals, petals, stamens, and carpels (or pistils). Stamens and carpels ( pistils) are essential floral organs that are born over the thalamus

They take part in sexual reproduction. Sepals and petals arc accessory or non-essential floral organs A flower having both stamens and carpels is called bisexual,

Example: Mustard, Hibiscus.

A flower having only one type of reproductive organ is known as unisexual. It is of two types, staminate or male and pistillate or female. In dioecious species male and female flowers occur on different plants,

Example: Date Palm, Papaya.

In monoecious species, both male and female flowers occur on the same plant,

Example: Maize, Castor, Cucurbits.

V.S. Flower:

- Sepals (Calyx): They are flat, green, lowermost floral organs that cover and protect the flower in the bud condition. Later on, they provide support to the remaining floral parts.

- Petals (Corolla): They are flat, colored, and often fragrant floral organs that lie above the sepals. They attract insects for pollination.

- Stamens (Androecium): They constitute the third floral whorl. Stamens are the male reproductive floral organs

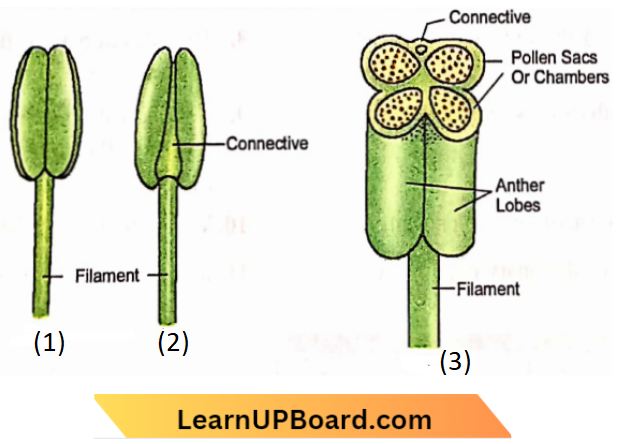

Each stamen consists of two parts, a slender stalk or filament and a terminal knob-like fertile part called anther. An anther has two lobes. They are attached by a sterile band called a connective. An anther has four long cylindrical pollen sacs, two in each anther lobe. Yellowish powdery haploid pollen grains develop in the pollen sacs through the meiotic division of diploid microspore mother cells. A mature pollen grain usually comes to have one tube cell and two male gametes.

Parts of stamen:

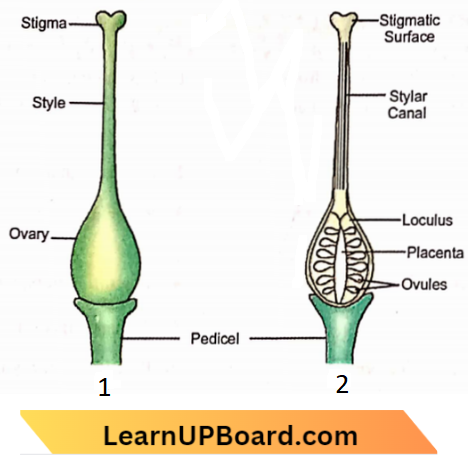

Carpels (= pistils, Gynoecium). They are the centrally placed female reproductive organs of the flower. Depending upon the number of carpels, the flower is called monocarpellary, bicarpellary or polycarpellary.

- Each carpel or pistil is flask-shaped in outline. It has a basally swollen ovary, a stalk called style, and a terminal pollen-receptive part called a stigma. The ovary contains one or more chambers or loculi.

- Each chamber has a parenchymatous cushion called a placenta.

- On the placenta are borne stalked ovoid structures called ovules. An ovule has one or two coverings called integuments with a terminal pore named a micropyle. Internally it contains a diploid parenchymatous nucellus and an oval haploid female gametophyte called embryo sac.

- The embryo sac is seven-celled and has eight nucleates. There is a three-celled egg apparatus, three antipodal cells, and a large central cell with two polar nuclei. In the egg apparatus, there is one female gamete called egg or oosphere and two helper cells named synergids.

Parts of stamen:

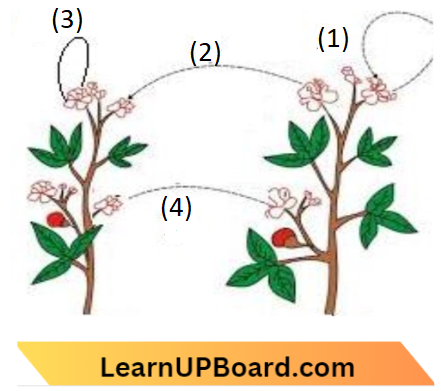

What does happen in pollination? Why it is needed for fertilization and fruit seed formation?

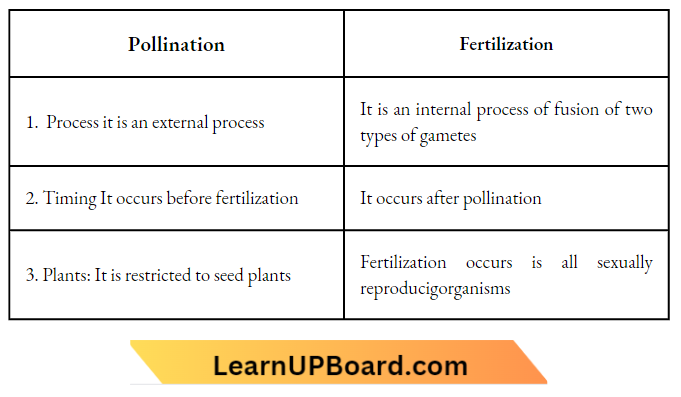

Pollination:

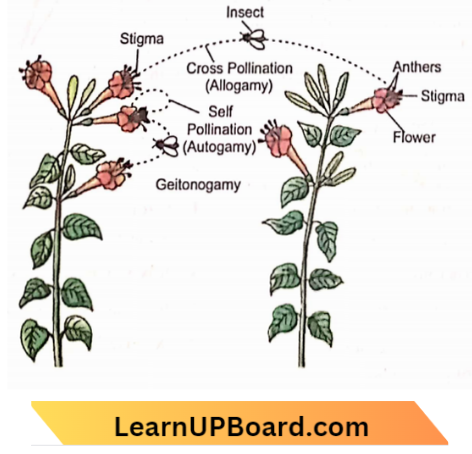

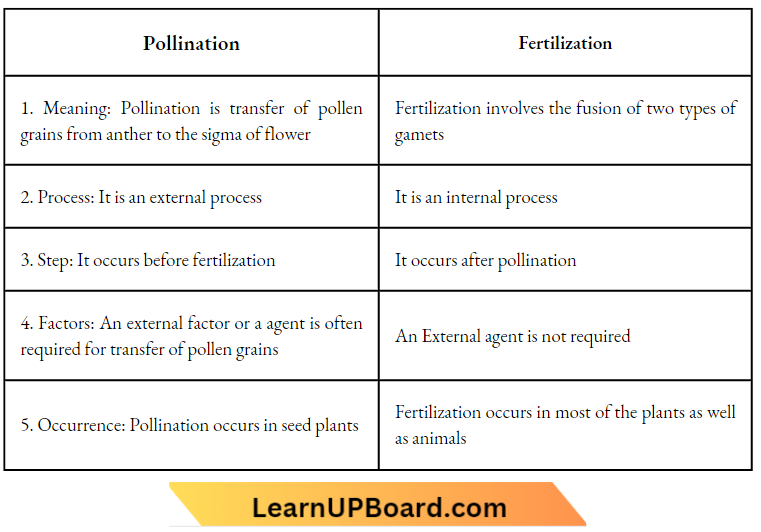

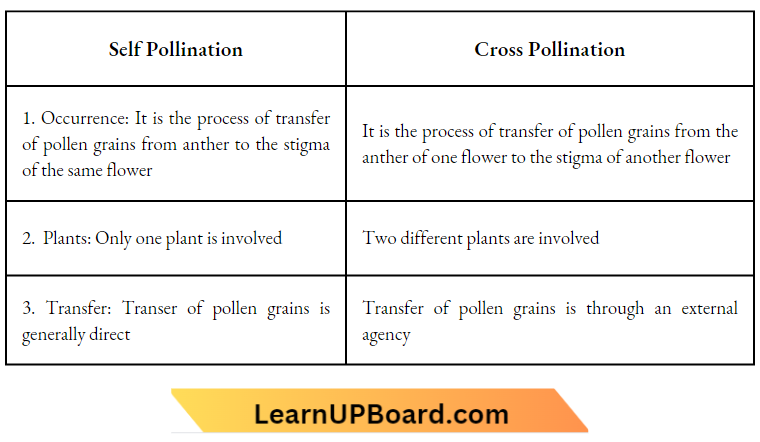

It is the transfer of pollen grains from another to the stigma of the flower. There are two types of pollination-self pollination and cross-pollination. In self-pollination, the pollen grains of a flower arc are transferred to the stigma of either the same or genetically similar flower.

- It is autogamy if pollination is between the anther and stigma of the same flower of the same plant It is geitonogamy if pollination occurs between the anther of one flower and the stigma of another flower of the same plant.

- In cross-pollination (Allogamy, Xenogamy) the pollen grains from the anther of one flower are transferred to the stigma of plant another.

- The transfer of pollen grains is carried out by an external agency like wind, water (both abiotic agencies), insects, birds, bats (all biotic agencies), etc

Pollination:

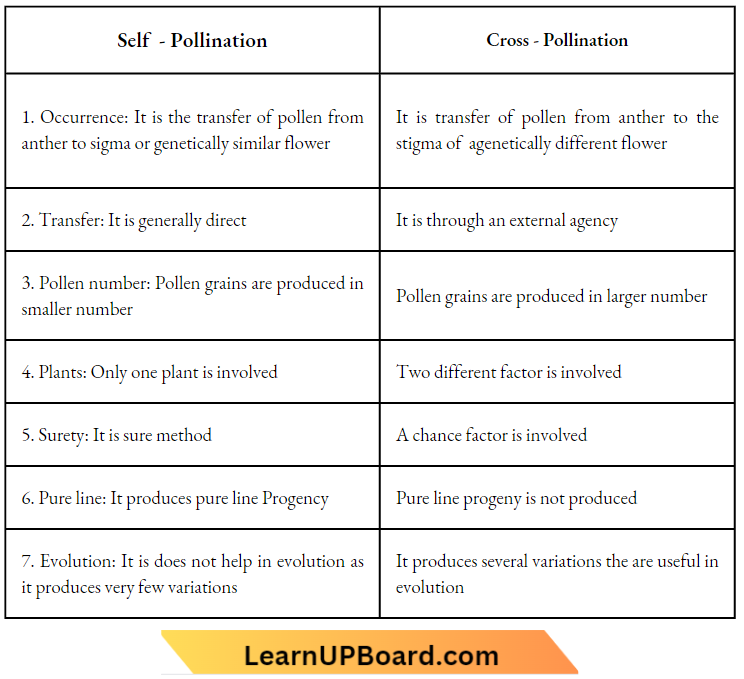

Differences between Self-Pollination and Cross-Pollination

Fertilization:

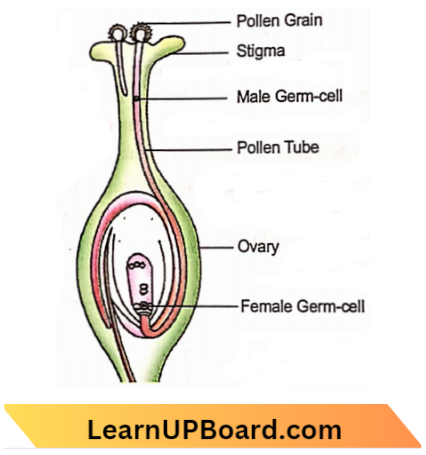

It is the process of fusion of male and female gametes. The process is initiated when a pollen grain falls on a compatible stigma. It absorbs water and nourishment.

- The pollen grain forms a tube called a pollen tube. Pollen tube passes through the style, reaches the ovary, and enters an ovule, generally through its micropyle. It carries a tube nucleus and two male gametes.

- The pollen tube enters the embryo sac and bursts open into it to release the two male gametes. One male gamete fuses with oospHefe (=egg) to form a diploid zygote.

- The zygote-later forms the embryo. The second male gamete fuses with the central cell to form a triploid primary endosperm cell. This is called triple fusion as it involves the fusion of three nuclei. Primary endosperm cell produces a nutritive tissue called endosperm.

- Embryo obtains nourishment from endosperm while endosperm obtains nourishment from nucellus and the plant.

- Functioning of both the male gametes in the same ovule of flowering plants is called double fertilization. The endosperm may persist or get consumed by the embryo

Flowering Plant:

Differences between Pollination and Fertilization:

Fate of Floral Organs

Petals, stamens, style, stigma, and sepals shrivel and arc shed. Sepals persist in some cases. Fertilized ovule matures into a seed and ovary matures into a fruit.

Seed and Fruit Formation

How is seed and fruit a result of pollination and fertilization?

After fertilization, the ovule slowly matures into seed while the ovary develops into a fruit. In the beginning, the zygote undergoes divisions. It obtains nourishment from the endosperm and grows to form the embryo.

The food reserve for the future may remain in tire endosperm or get transferred to the embryo. In the latter case, the food is stored in the cotyledons of the embryo. The mature embryo becomes dormant. The integuments of the ovule form tough and impermeable seed coats. The ovary wall forms the pericarp (fruit wall). It may be dry (e.g., Groundnut, Mustard) or fleshy

Example: Tomato, Mango

Advantages of Seed Formation:

- Complete Package: Seed is a complete package for the survival and growth of future plants due to dormancy of embryo, presence of reserve food, and protective seed coats.

- Perennation: Because of their tough seed coats and dormant embryos, seeds can pass through unfavorable seasons without any harm.

- Dispersal: Being small and light, seeds can easily be dispersed to long distances.

- Food: Seeds are a major item of human food.

- Delayed Germination: Seeds can be stored for months and even years. They will germinate only when provided with suitable conditions.

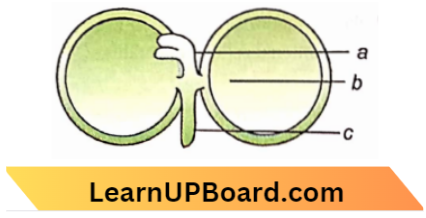

Activity 1: Study of Seed Structure

Take a few seeds of Bengal Gram. Soak them in excess water overnight. Next day drain out excess water and cover the wet seeds with a wet cloth for a day. Keep the cloth wet from time to time. Remove the cloth and study the seed for external features and internal structure.

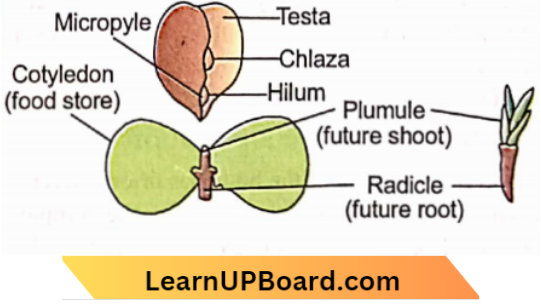

External Structure:

The seed is a conical pyriformis outline. It has a pointed curved beak at one end. The other end is broad with a depression in the middle. The depression extends on one side upto the pointed end. This site bears a rhomboid dark patch in the middle. The same is called chalaza.

Ahead ofchalaza, towards the pointed end is an oval scar called f hilum. It is the place where the ovule and then the seed bear a stalk for attachment to the placenta. A fine pore called a micropyle occurs between the hilum and the pointed end. On pressing the seeds a small drop of water can be found to ooze out of it.

Internal Structure:

- Cut the seed lengthwise from the depressed part of the broader side towards the pointed end carefully and slowly. Open the seed without breaking it into parts.

- Find out that the seed is covered by two seed coats. The outer is tough and thick testa. The inner is thin and delicate tegmen. The whole interior is occupied by the embryo.

- The embryo has a small embryo axis. Two large food-laden yellow cotyledons are attached to the middle of the embryo axis using short stalks.

- The micropylar end of the embryo axis bears a radicle. The other end bears plumule.

- The radicle is the future root of the plant. Plumule is the future shoot of the plant. It possesses small leaf primordia. The area of the embryo axis between the origin of cotyledons and plumule is called epicotyl.

- The area of the embryo axis between the origin of cotyledons and the radicle is called hypocotyl. Gram seed is dicotyledonous and non-endospermic (= exalbuminous).

Seed Germination

Under favorable conditions, of growth (moisture, aeration, and temperature) the seed absorbs water and swells up. c embryo becomes active. Stored food is mobilized and transferred to the tips of the embryo axis. Radicle is the first to grow. breaks the seed coat and passes into the soil to form the root system. On growth, the activated plumule comes out of the soil and forms the shoot system. This converts the germinating seed into a seedling.

Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction Human Beings

What is puberty? Why do growth and sexual maturity take a long time to complete?

Human beings reproduce only sexually. They are unisexual or dimorphic with the distinction of male and female sexes. The distinction becomes more apparent as the children grow.

- Growth and sexual maturity proceed simultaneously and do take a long time to complete.

- The reason is that the energy and resources of the body are simultaneously being used or the two.

- Puberty is the process of physical changes by which young persons reach maturity and become adults. It begins at the age of 10 to 14 years in girls and 13 to 15 years in boys.

- At this time the primary sex organs become functional but the secondary sex organs are yet to mature.

- Another term used along with puberty is adolescence. Adolescence is a period of psychological and social transition between childhood and adulthood.

- The period of puberty or adolescence is 10 to 20 years. The changes are initially slow but often become rapid later on.

- However, there is no similarity and uniformity in development patterns and speed of changes in different individuals. It is because the changes that occur during this period are partly due to physical growth and partly due to the effect of hormones produced by primary sex organs.

Some of these changes are similar in boys and girls while others are different in the two.

Similar Changes in Girls and Boys:

- Thick Hair: There is growth of thick hair in the genital area and in the armpits.

- Thin Hair: Thin hair appears all over the legs, arms, and face.

- Genital Area: It often becomes darker.

- Oil: Skin becomes oily. It results in the development of acne and pimples mostly over the face.

- Body Awareness: The children slowly become aware of changes in the body as well as changes in the body of others.

Different Changes in Boys:

- Facial Hair: Moustaches and beards appear.

- Cracking Voice: The voice becomes low-pitched and cracking.

- Adam’s Apple: The larynx grows to form Adam’s Apple.

- Shoulders: They become broad

- Pelvis: The pelvis remains narrow. It becomes strong.

- Musculature: Skin thickens, the body becomes muscular and bones become strong.

- Enlargement: Enlargement of sex organs and occasional activation of the penis.

Different Changes in Girls:

- Breasts: They become enlarged. Skin becomes dark below the nipples.

- Menstruation: After its beginning or menarche in early puberty, it becomes regular.

- Voice: It becomes high-pitched.

- Pelvis: It becomes broad.

- Skin: It remains thin. The vasculature is more so that there is increased warmth of the skin.

- Fat: It gets deposited over the buttocks, thigh, and face.

- Contours: Body contours round off.

- Enlargement: There is an enlargement of sex organs (ovaries, fallopian tubes, vagina, uterus) and labia.

Why Does Reproductive Maturity Appear Late:

The general growth of the body has priority over sexual maturity. Therefore, as the individual is growing, there is slower development of sex organs

- Only after the completion of body growth, the resources of the body are diverted for sexual maturity. The male must develop the ability to develop millions of sperms as a single ejaculation consumes up to 400 million sperms.

- The glands should also become active to form the fluid part of the semen.

- The penis must be able to become erect. Similarly, in females the genital tract becomes mature. The uterus carries the baby for a long period and nourishes the same. The mother provides milk to the neonate for nourishment an event after parturition.

Primary and Secondary Sex Organs

Primary sex organs are those sex organs that give rise to gametes. They are the gonads, and testes in males and ovaries in females. Testes produce sperm and the hormone testosterone. Ovaries produce ova and hormones estrogen and

Secondary sex organs are those organs, glands, and ducts which do not form gametes and hormones but are essential for sexual reproduction because they conduct and nourish the gametes, e.g„ vasa deferentia, prostate gland, penis, uterus, vagina, mammary glands.

Sex Organs and Sex Characters:

Sex organs arc organs that produce, nourish, and conduct Sex cells. Sex characters arc traits that distinguish a male from a female,

Example: Beard in males and clean face in females. are

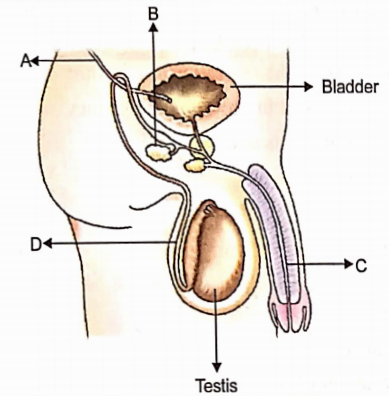

Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction Male Reproductive System

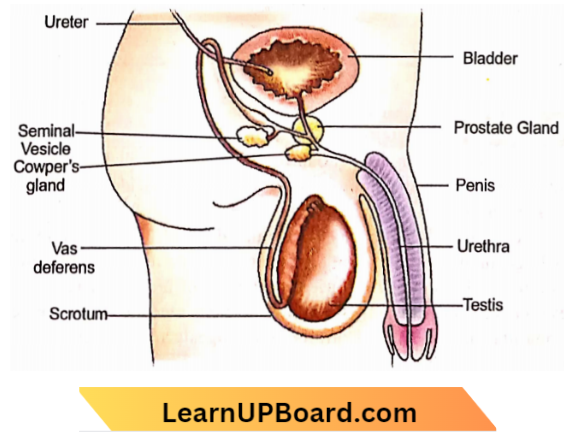

It is a system of organs that produce sperm and take the latter near the site of fertilization. The various components of the male reproductive system are testes (a pair), vasa efferentia (12-14 pairs), epididymis (a pair), vasa deferentia (a pair), seminal vesicles (a pair), urinogenital duct, prostate gland, Cowper’s gland (a pair) and penis.

1. Testes (Singular Testis:

- They are a pair of oval primary male sex organs or gonads. They lie outside the body in a two-chambered pouch of loose skin called scrotum. Scrotum lies behind the penis in between the two thighs.

- The scrotum maintains a slightly lower temperature (34°-35°C) than that of the body (37°C).

- It is required for the formation of viable sperms. A testis has 200-300 lobules with each lobule having 1-3 seminiferous tubules embedded in a connective tissue.

- Connective tissue has Lcydiÿ, cells that secrete the male sex hormone testosterone. Testosterone regulates spermatogenesis and expression of male sex characters. Seminiferous tubules produce sperm.

2. Vasa Efferentia:

They are 12-14 pairs of fine tubules that drain out freshly formed sperms using current created by their ciliated cells.

3. Epididymcs (singular Epididymis):

They are two 4-6 m long tubes that lie coiled and compacted along the base, side, and head of the testes. They store and nourish the sperm for several days. The unejaculated sperms degenerate and are reabsorbed ultimately.

4. Vasa Deferentia (singular Vas Deferens):

They are a pair of 30-35 cm long muscular tubes. Each vas deferens arises from the epididymis, comes out of the scrotum through the inguinal canal, and enters the abdomen.

- It receives a duct from the seminal vesicle and forms an ejaculatory duct.

- In the interior of the prostate gland, the two ejaculatory ducts join the urethra to form the urinogenital duct.

- The urinogenital duct receives the secretion from the prostate gland and the Cowper’s glands.

- It then passes into the penis to open at its tip.

5. Seminal Vesicles:

They are pairs of lobulated racemose glands present between the urinary bladder and rectum. They produce a viscous alkaline secretion rich in fructose, proteins, prostaglandins, and fibrinogen. The secretion forms 60-70% of total seminal plasma.

6. Prostate Gland:

It is a large pyramidal gland that lies in the area of the union of the urethra and ejaculatory ducts. It opens into the urinogenital duct by some 3040 tubules. The secretion is alkaline, viscous, and milky. The secretion is essential for the motility of sperm. It constitutes 20-30% of semen plasma. Muscles of the prostate gland provide the force for ejaculation.

7. Bulbourethral or Cowper’s Glands:

They are a pair of small glands that open into the urinogenital duct separately. Their secretion is alkaline and rich in mucus. It lubricates the genital tract as well as neutralizes the acidity

8. Penis:

It is an erectile male copulatory organ. Its tip is broad and sensitive. The same is called Glans.

It is covered by a fold of skin called prepuce. The prepuce is removed in many cases by circumcision. Internally penis contains three columns of spongy tissues which get filled with blood at the time of resection. The urinogenital duct (= urethra) passes through one of the spongy columns and opens at tip of the glans Semen

- Semen: It is milky white alkaline sperm containing viscous fluid that is passed out by males during orgasm. The amount is 2.54.0 mL.

- It contains 300 – 400 million sperms: Semen contains fructose (found in humans only in semen), fibrinogen, prostaglandins, and alkaline chemicals.

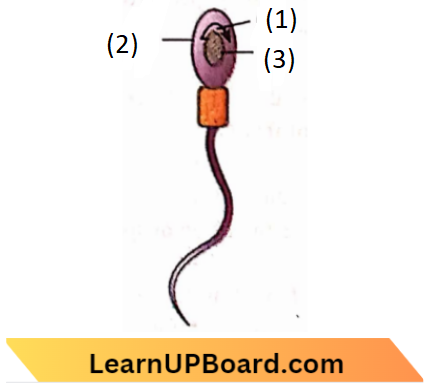

Sperms:

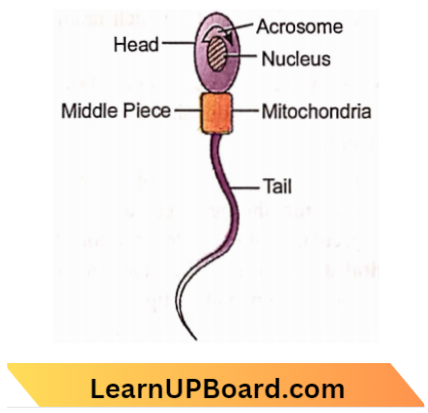

They are male gametes. Each male gamete is dart-like with three parts—

- Head: The Head has an acrosome for penetrating the egg coverings, nucleus, and proximal centriole.

- Middle piece: The middle piece has mitochondria and a distal centriole. It provides energy to the tail for movement.

- Tail: The tail is a long and narrow vibratile part of the sperm.

Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction Female Reproductive System

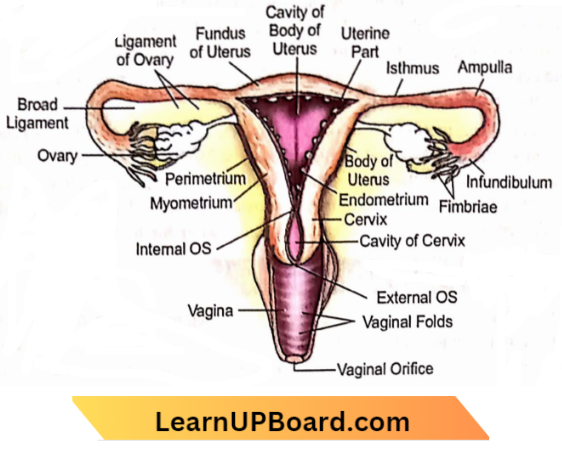

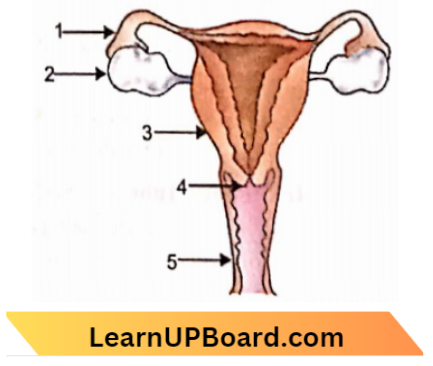

It is a system of organs that forms an egg periodically and helps in its fertilization and growth of fertilized egg into a fetus. The female reproductive system consists of a pair of ovaries, a pair of oviducts, a uterus, a vagina, external genitalia, a pair of Bartholin’s glands, and mammary glands.

1. Ovaries:

They are a pair of almond-shaped lobulated female gonads which lie near the kidneys.

- They contain a very large number of immature eggs even when the female child is just born.

- After puberty, one ovum matures alternately in the two ovaries at intervals of 28 days.

- The complex structure in which the ovum matures is called the Graafian follicle.

- Besides forming ova, the ovaries secrete two types of hormones, estrogen for maintaining the female traits and progesterone for the development of the uterine lining or endometrium.

2. Oviducts or Fallopian Ducts:

They are 10-12 cm long curved tubes having ciliated epithelium. They open distally into the uterus.

- Proximally each oviduct has a fimbriated funnel-shaped end called an infundibulum. The pore of the infundibulum is called ostium.

- It lies near the ovary. The oviduct or fallopian duct is slightly swollen behind the infundibulum.

- It is called ampulla. The narrow part behind the ampulla is called the isthmus. Fertilization generally occurs in the junctional area of the ampulla and isthmus

3. Uterus:

It is an inverted pyriform elastic bag. The uterus retains and nourishes the fetus at the time of pregnancy. The empty uterus is 8 cm long, 5 cm broad, and 2 cm thick.

During pregnancy, it enlarges to reach up to the epigastrial region. The lining of the uterus called endometrium is vascular and glandular. The lower tapering part of the uterus is called the cervix. It opens into the vagina.

4. Vagina:

It is a muscular distensible tube of 8-9 cm length. The vagina lies between the cervix and the vaginal orifice present externally. The vagina is the female copulatory organ. It is also a passageway for menstrual flow and the birth canal at the time of parturition.

5. External Genitalia:

A depression called vulva occurs around and above the vaginal orifice. The upper end of the vulva bears a urethral opening. Above it is present a pea-shaped sensitive outgrowth called the clitoris. It is considered to be homologous with a penis by some.

External genitalia consists of two pairs of fleshy folds or labia. The outer folds are larger, thicker, and hairy. They are called labia majora. The inner folds are smaller and nonhairy. They are named labia minora. Both the labia possess sebaceous glands.

6. Bartholin’s Glands:

They are a pair of small glands which occur lateral to the vaginal orifice but inner to the labia minora. The secretion of these glands is alkaline, thick, and rich in mucus. It lubricates the vagina as well as neutralizes its acidity.

7. Breasts:

They are a pair of near-rounded prominences present in the thoracic region of females. They grow during puberty but become active after childbirth. Each breast has a multiporous nipple. The base of the nipple is sensitive and pigmented. It is called areola. Internally each breast has 15-25 lobules having several milk-secreting alveoli embedded in fatty tissue.

Fertilization And Pregnancy

What is fertilization? When is a woman called pregnant?

Human females have a fertility phase of 2-3 days, commonly between 14-16 days of menstrual cycle.

- Coitus during this period will first deposit a large number of sperm in the vagina.

- The sperms then travel to all parts of the female reproductive tract partly by movement of the female reproductive tract and partly by mobility of sperms.

- Fertilization generally occurs in the junctional area of the ampulla and isthmus part of the fallopian tube. Only one sperm enters an ovum.

- The fertilized ovum undergoes cleavage. It first forms a solid ball of cells called a morula. The latter begins to descend the fallopian tube. Meanwhile, the momma gets transformed into a hollow structure called a blastocyst.

- By about the 7th day after fertilization, tfterWastocyst after reaching items, gets attached to its endometrium.

- The fixation of the blastocyst in the wall of items is called implantation.

- Soon after implantation, the blastocyst begins to produce a hormone called hCG (human chorionic gonadotropin). Its presence in urine indicates pregnancy.

The contact between the young embryo and the uterine wall grows into the placenta. The placenta is a disc-shaped structure formed by the joint activity of the embryo and uterus. It contains finger-like outgrowths called villi from the embryo side. From the mother’s side are present blood spaces around the villi. There is thus a large surface area for the exchange of materials. Glucose, amino acids, oxygen, and other biochemicals required by the embryo pass from the mother’s side to the embryo. Wastes of embryos pass in the reverse direction.

Development of fetus inside the uterus of the mother takes about 270 days. It is called the gestation period. After adding 10 days since the previous menstruation the period is considered to be 280 days or 40 weeks. A fully developed fetus and its placenta send out signals for parturition in the form of a fetus’s ejection reflex. The pituitary gland releases oxytocin that brings about uterine contractions. They first push the head of the baby towards the cervix and then push the baby out of the birth canal. Delivery of the baby is followed by the expulsion of the placenta. It is called after birth or decidua.

Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction What Happens When The Egg Is Not Fertilized

If the egg is not fertilized, it remains alive for one day and then begins to degenerate and descend into the uterus. The uterus had previously thick and spongy endometrium for receiving the fertilized egg. In its absence, the uterine lining begins to starve. It ultimately breaks down. The broken-down endometrium, mucus, and blood come out of the vagina as menstruation. Menstruation lasts for 2 to 5 days.

In case of nonfertilization, menstruation occurs after every 28 days. It is called the menstrual cycle. The cycle prepares and then dismantles all the preparations for rearing a fertilized egg. The first menstruation occurs in the beginning of puberty. It is called menarche. Menstruation stops completely between the age of 45 to 50 years. The permanent stoppage of menstruation in women is called menopause. Temporary stoppage of menstruation also occurs during a period of pregnancy.

Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction Reproductive Health

What is reproductive health? What are contraceptive devices? Name the different types.

It is a state of physical, social, and psychological fitness leading to a safe and responsible reproductive life.

- Sexual maturity occurs only after the completion of growth. However, due to several reasons including curiosity, pressure from friends, and family pressure for early marriage youngsters indulge in sex.

- Such an indulgence is fraught with dangers as unprotected sex can lead to venereal or sexually transmitted diseases (VD, STD) like gonorrhea and syphilis (bacterial infections), warts, and HIV-AIDS (viral infections).

- Pregnancy in the early stages adversely affects the health of the baby as well as that of the mother as the body of the lady is not yet ready to bear the burden of carrying and nourishing a fetus.

- Further, India is a highly populated nation with a high rate of population growth.

- All resources of the country get consumed in trying to meet the basic requirements of the population. Nothing is left for development.

- In a large family, the income of the bread earner is insufficient to provide proper education and upbringing to the children.

- Therefore, there is a need to get married only when a person is fully mature and capable of proper earning.

- There is also a need to prevent some pregnancies and spacing out the birth of the children in such a way that every child can be properly looked after and provided education.

- This is helped by family planning or family welfare departments through centers spread throughout the country. Its emblem of an inverted red triangle is put up on all such centers.

- The assistance provided to couples and women by the centers is free of cost.

The various methods of family planning are called contraceptive devices. They are as follows :

1. Mechanical Methods: They prevent the entry of sperm into the uterus so that chances of conception or pregnancy are avoided.

- Condom: It is a tubular rubber sheath that is worn over the penis during coitus. Condom also prevents the spread of sexually transmitted or venereal diseases.

- Cervical Cap: It is a rubber nipple that is fitted over the cervix during coitus.

- Vaginal Diaphragm: It is a tubular sheath with a flexible metal ring that is fitted in and over the vagina during coitus.

2. Intrauterine Contraceptive Devices (IUCDs): They are small rubber, plastic, or metallic devices (loop, copper-T) that are fitted in the uterus. IUCDs prevent the passage of sperm into fallopian tubes. However, in some cases, irritation may occur

- Hormonal Methods: They suppress the production of the ovum. The common hormonal method is oral pills. They contain progesterone alone or along with estrogen. i-Pill or T-72 prevents conception even after coitus. Hormonal methods can cause some side effects in some ladies due to disturbance in hormonal balance.

- Safe Period: The fertility period in women is from 14-16 days of menstrual cycle. Adding two to three days on both sides and avoiding sex during this period automatically prevents conception.

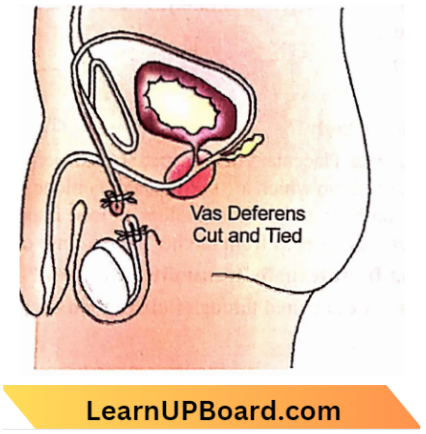

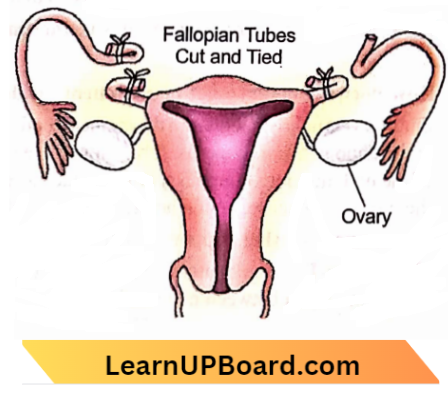

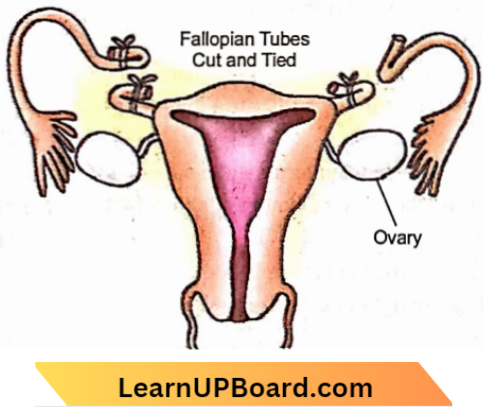

- Reversible Sterilization: It is a surgical technique that prevents the passage of sperm into semen in males and ova into fallopian tubes in females.

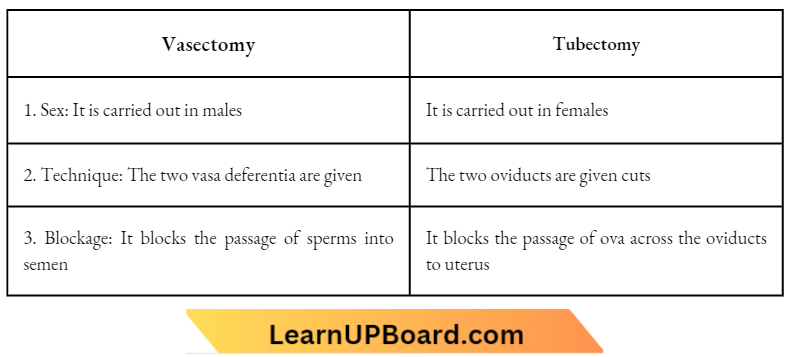

- Vasectomy: Small pieces of the two vasa deferentia are cut. The cut ends are tied separately.

- Ttibectomy: Small pieces of the two fallopian tubes are cut and the cut ends are tied separately

Vasectomy:

Tubectomy:

However, surgery has to be performed by skilled persons under completely aseptic conditions. The technique is reversible as the cut ends of vasa deferentia and oviducts can be joined together surgically if a situation requiring pregnancy arises.

Differences between Vasectomy and Tubectomy:

Class 10 Biology How Do Organisms Produce Chapter 3.3 Sexual Reproduction Long Question And Answers

Question 1. Answer questions number (A) to (d) based on your understanding of the following paragraph and the related studied concepts. The growing size of the human population is a cause of concern for all people. The rate of birth and death in a given population will determine its size. Reproduction is the process by which organisms increase their population. The process of sexual maturation for reproduction is gradual and takes place while general body growth is still going on. Some degree of sexual maturation does not necessarily mean that the mind or body is ready for sexual acts or for having and bringing up children. Various contraceptive devices are being used by human beings to control the size of the population.

- They list two common signs of sexual maturation in boys and girls.

- What is the result of reckless female foeticide?

- Wbicb contraceptive method changes the hormonal balance of the body?

- Write two factors that determine the size of the population.

Answer:

- Thick hair develops in the genital area and armpits Skin becomes oily. It results in the development of acne and pimples, mostly over the face.

- Decline in sex ratio, first in children and later in adults as well.

- Oral contraception pills.

- Rate of birth (natality) and death (mortality).

Question 2. What is reproduction? What are its two types? Which one of the two confers new characteristics in the offspring and how ?

Answer:

Reproduction:

It is the phenomenon of the formation of new young individuals by the mature individuals of an organism

.

ReproductionTypes: Two types

- Asexual and

- Sexual.

Sexual reproduction confers new characteristics to the offspring.

New Characters: They appear mostly in sexual reproduction because of (/) Reshuffling of variations.

- Chance separation of chromosomes during gamete formation, (in) Crossing over during meiosis.

- Chance combination of chromosomes during fertilization, (v) Mutations.

Question 3.

- Surgical methods can be used to create a block in the reproductive system for contraception purposes. Name such parts where blocks are created in

- Males and

- Females.

- State any two reasons for using contraceptive devices.

Answer:

1. Surgical methods are used to create cuts or blocks in the reproductive system of males and females to prevent the passage of gametes reaching the site of fertilization. Blocks are created in

- Vasa deferentia in males

- Oviducts in females.

2. Contraceptive devices are used to

- Limit the size of the family so that the resources of the family are not stretched,

- Spacing the birth of the children to provide attention to every child and take care of the health of the mother.

Question 4. Differentiate between

- Asexual and sexual reproduction

- Self and cross-pollination.

Answer:

1. Asexual and Sexual Reproduction:

Asexual reproduction is uniparental where an organism is formed from a somatic propagule of the parent without formation and fusion of gametes. Sexual reproduction is biparental involving the formation and fusion of gametes during the formation of offspring.

2. Self-pollination:

Self-pollination is the deposition of pollen grains from the anther to the stigma of the same or genetically similar flower. Cross-pollination is the deposition of pollen grains from the anther of one flower to the stigma of a genetically different flower.

Question 5. In tobacco plants, the male gametes have 24 chromosomes. State the number of chromosomes in

- Egg nucleus

- Zygote

- Endosperm

- Leaf cell.

Answer:

Male gamete has a haploid number of chromosomes. It is 24.

- The egg nucleus also possesses a haploid number of chromosomes. It should be, therefore, 24.

- Zygote has diploid number of chromosomes. 24 × 2 = 48.

- Endosperm has a triploid number of chromosomes. 24 × 3 = 72.

- Leaf cell also has a diploid number of chromosomes. 24 × 2 = 48.

Question 6.

- What is the site of implantation and development of young ones in human females?

- Mention two advantages of using mechanical barriers during sexual acts.

Answer:

1. Site of Implantation and Development of Young One. Uterus.

2. Advantages of Mechanical Barriers:

- No spread of sexually transmitted diseases

- Prevention of conception.

Question 7. What is the placenta? State its two roles during pregnancy.

Answer:

The placenta is a spongy vascular complex formed by maternal and fetal tissue in the wall of the uterus. Blood vessels

of the two are nearby inside the placenta.

Roles:

- Attachment of fetus.

- Providing nutrients and oxygen to the fetus and removing waste products of the fetus,

- Secretion of hormones for maintaining pregnancy,

Example: hCG.

Question 8.

- Name the organ which helps in providing nutrition to the embryo. Where is it located?

- What causes the delivery of a child from the mother’s uterus?

Answer:

- Organ for Nourishing the Embryo:

- Placenta. It is located in the endometrium of the uterus.

- The placenta is formed by the joint activity of the embryo (villi part) and endometrium (blood sinuses).

- Development of fetal ejection reflex by the fully developed fetus and the placenta that supports it.

- It induces the pituitary to release the hormone oxytocin.

- Oxytocin produces contractions of the uterus for parturition.

Question 9. List the modes of pollination and define each of them.

Answer:

Pollination or transfer of pollen grains from another to stigma is of two types, self-pollination, and cross-pollination.

Self-Pollination:

It is the passage of pollen grains from the anther to the stigma of either the same or genetically similar flower,

For example: Commelina.

Cross-Pollination:

It is the passage of pollen grains from the anthers of one flower to the stigma of a genetically different flower,

For example Salvia.

Question 10. Define any three of the following terms used about human reproduction :

- Fertilization

- Implantation

- Placenta

- Gestation

- Parturition

- Ovulation

Answer:

- Fertilization: It is the fusion of male and female gametes to form a diploid zygote.

- Implantation: It is the attachment of the embryo to the wall of the uterus for fixation, protection, and nourishment.

- Placenta: It is a spongy and vascular structure formed in the wall of the uterus by the joint activity of the fetus and uterus for attachment and nourishment of the embryo.

- Gestation: It is the period between conception and parturition that is passed by the baby in the body of the mother.

- Parturition: It is the process of giving birth to a baby by the mother.

- Ovulation: It is the release of the mature ovum by an ovary that occurs about the 13th or 14th day of the menstrual cycle.

Question 11. Explain double fertilization in plants

Answer:

The fusion of both the male gametes brought by pollen tubes with two different cells of the same embryo sac is called double fertilization.

- In double fertilization, one male gamete fuses with an egg to form a diploid zygote. It is called generative fertilization.

- The second male gamete fuses with the central cell having two polar nuclei.

- It forms a triploid primary endosperm cell or PEC. The second act of fusion is called triple fusion (fusion of three haploid nuclei) or vegetative fertilization.

- It gives rise to nutritive tissue endosperm for nourishing the embryo.

Question 12.

- How many eggs are produced every month by either of the ovaries in a human female? Where does fertilization take place in the female reproductive system?

- What happens in case of egg released by the ovary is not fertilized?

Answer:

- Every month only one egg is produced by ovulation from one of the two ovaries. The egg passes into the fallopian tube on its side. Its fertilization occurs in the region of the ampulla-isthmus junction.

- In case the egg is not fertilized, it loses its viability after about 24 hours. It begins to descend slowly and pass into the uterus. Meanwhile, the corpus luteum begins to degenerate. In the absence of hormones progesterone and estrogen, the glandular part of the endometrium breaks down. Endometrial pieces along with mucus and some blood is passed out as menstruation. Menstruation lasts for 2-5 days.

Question 13. State a function of each of the following parts of the human male reproductive system :

- Vas Deferens

- Testis

- Prostate gland.

Answer:

1. Vas Deferens: Passage of sperms from the epididymis to the ejaculatory duct in the lower abdomen.

2. Testis:

- Formation of sperms

- Production of male sex hormone called testosterone.

3. Prostate Gland: Formation of 20 to 30% of semen plasma which is essential for sperm motility. Its muscles help in ejaculation.

Question 14.

- Name the organ known as the birth canal.

- Give a reason for blocking fallopian tubes for birth control.

- Give two possible reasons for adopting contraceptives for

Answer:

- Vagina

- Blocking the fallopian tubes will not allow the egg to pass down and the sperm to reach the egg.

- Contraceptives are used to prevent pregnancy to have

- Fewer children

- Spacing birth of the children.

Question 15. List four points of significance of reproductive health in society. Name any two areas related to reproductive health that have improved over the past 50 years in our country.

Answer:

1. STDs:

- It protects from catching sexually transmitted diseases.

- Small family norms help proper care and education of the children.

- Less mortality among women and infants.

- Attainment of safe, responsible, and satisfying reproductive life.

2. Improvement:

- Reduction in the rate of population growth.

- People have started preferring small family norms.

- Decrease in the incidence of sexually transmitted diseases.

Question 16. State the basic requirement for sexual reproduction. Write the importance of such reproduction in nature.

Answer:

Basic Requirements :

- Two parents

- Meiosis and formation of two types of gametes

- Fertilization or fusion of two types of gametes to produce a diploid zygote.

Importance:

Sexual reproduction introduces variations and the formation of new characteristics due to chance separation and the chance of coming together of chromosomes and crossing over. It maintains the vigor and vitality of the race. Variations allow individuals to adapt to changing environments and develop fitness for the struggle of existence.

Question 17. List any four steps involved in sexual reproduction and write its two advantages.

Answer:

Steps:

- Meiosis and formation of two types of gametes

- Transfer of male gametes

- Fusion of male and female gametes

- Formation of diploid zygote

- Development of zygote into new individual.

Advantages of Sexual Reproduction:

- Formation of variations and new characteristics

- Maintenance ofvigour and vitality

- Adaptability to changes in the environment

- Evolution is due to the accumulation of variations and mutations.

Question 18. What is carpel? Write the function of its various parts.

Answer:

Carpel:

It is the female reproductive part or floral organ of a flower.

The carpel has three parts:

- Stigma

- Style, and

- Ovary

These are:

- Stigma: Pollen receiving part of the carpel.

- Style: Stalk for lifting the stigma to receive pollen grains conveniently, Passege-way for the pollen tube to reach the ovary.

- Ovary: Contains ovules which on fertilization form seeds while the ovary matures into fruit.

Question 19. Distinguish between pollination and fertilization. Mention the site and product of fertilization in a flower

Answer:

Distinguish between pollination and fertilization:

- Site of Fertilization: Embryo sac in the ovule of an ovary.

- Product of Fertilization: Zygote, Primary Endosperm nucleus (flowering plants)

Question 20.

- State one drawback of each of the following :

- Oral Contraceptive pills

- Copper T.

- Under which category of contraceptive methods, is the use of condoms kept? In what way its use is better as compared to other methods of contraception?

Answer:

1.

- Oral Pills – Disturb the secretory activity of the pituitary, cause hormonal imbalance, and disturb ovulatory menstrual cycles.

- Copper T – It may irritate the uterus.

2. Condom is a barrier method of contraception. It prevents the passage of sperm in the genital tract of the female. It also prevents the catching up of sexually transmitted diseases.

Question 21. Give reasons :

- The placenta is extremely essential for fetal development

- The uterine lining becomes thick and spongy after fertilization.

Answer:

1. The placenta is the disc-shaped joint structure between the embryo and the uterus. It is essential for fetal development as

- It provides attachment to the embryo

- Develops large surface area for transfer of nutrients from mother to embryo and waste substances from embryo to mother.

2. Uterine lining becomes thick and spongy after fertilization for proper attachment and nutrient support to the embryo.

Question 22.

- In a flower, name the parts where

- Pollen grains are produced and

- Pollen grains are transferred.

- What happens to the ovule and ovary after fertilization?

Answer:

1.

- Pollen grains are produced inside anthers of stamens

- They are transferred to the stigma of the pistil.

2. The ovule matures into seed while the ovary gives rise to fruit.

Question 23. Suggest any two contraceptive methods to control the size of the human population and explain them.

Answer:

Contraceptive methods are used to prevent unwanted pregnancies and thus control the size human population.

The two common contraceptive methods are oral pills and condoms:

- Oral Pills: They are hormone (progesterone) containing pills taken by women to prevent ovulation and hence pregnancy.

- Condom: It is a barrier method, used by men over the penis or women in the vagina that prevents sperm from entering the genital tract of the female

Question 24.

- What is the function of another? How does the fusion of male and female gametes take place in plants?

- Name the most effective contraceptive which prevents the spread of sexually transmitted diseases.

Answer:

1. Function of Anther:

It is the male reproductive part of the flower. Anther produces haploid spores called pollen grains. On germination over the stigma, each pollen grain produces a pollen tube containing two male gametes.

Fusion of Male and Female Gametes:

A pollen tube carrying two male gametes passes through style, reaches ovary, and enters an ovule. It penetrates the embryo sac and bursts open to release the two male gametes. One male gamete fuses with the oosphere and forms a diploid zygote or future embryo. It is known as generative fertilization.

The second male gamete fuses with the central cell having two polar nuclei. It produces a triploid primary endosperm cell. This fusion is called vegetative fertilization or triple fusion. The phenomenon of functioning of both the male gametes brought by a pollen tube by fusing with two different structures of the same embryo sac is called double fertilization.

2. Effective Contraceptive against STDs:

Condoms in males and fern shields/Vaginal diaphragm in females.

Question 25.

- State any three advantages of sexual reproduction over asexual reproduction.

- Explain what happens to the egg once it gets fertilized in the human female.

Answer:

1. Advantages of Sexual Reproduction over Asexual Reproduction:

- Sexual reproduction produces a large number of variations and new combinations of the traits which is not possible in asexual reproduction.

- It hides the harmful traits,

- Sexual reproduction maintains the vigor and vitality of the race,

- It increases the adaptability and competitiveness of the individuals.

2. Egg After Fertilization:

Soon after fertilization, the egg begins to undergo cleavage. It first forms a solid ball or morula and then a hollow structure called a “Blastocyst”.

- Blastocyst reaches the uterus. It comes in contact with the endometrium and develops finger-like outgrowths called villi.

- Villi corrode the endometrium and fixes the blastocyst. The process is called implantation.

- The contact region grows into a disc-shaped spongy and vascular structure called a placenta.

- The blastocyst develops into a fetus. An umbilical cord develops between the fetus and the placenta. The placenta provides nourishment to the fetus.

- It also takes away the waste products of the fetus. A fetus becomes fully developed in about 270 days after fertilization.

- The period of embryonic development is called the gestation period. The fully developed embryo and its placenta develop the ejection r reflex which induces the pituitary to release oxytocin. Oxytocin causes contractions of the uterus to push the baby through the birth canal.

Question 26.

- Categorize the following flowers into bisexual and unisexual: Papaya, Watermelon, Hibiscus,

- Mustard.

- State the function of the urethra in man.

- When does ovulation occur during the menstrual cycle in a normal healthy woman?

- What is menopause?

Answer:

1. Bisexual: Hibiscus, Mustard.

Unisexual: Papaya, Watermelon.

2. Function of Urethra:

It is the pathway for the elimination of urine in both human males and females. In human males, the urethra is also used for the ejection of semen.

3. Ovulation:

Ovulation or liberation of eggs occurs in human females on the 13th or 14th day of the menstruation cycle.

Menopause:

Menopause It is the permanent cessation of menstruation in women that commonly occurs between the age of 45 to 50 years.

Question 27.

- How do the following contraceptives prevent pregnancy :

- Oral pills

- Condom.

- Mention the possible misuse of surgical methods of birth control by some people. How is this method causing harm to the society? State the steps taken by the government to prevent this misuse.

Answer:

1.

- Oral Pills: They contain progesterone which prevents ovulation and hence pregnancy.

- Condom: It is a mechanical barrier that does not allow the sperm to enter the reproductive tract of the female.

2. Misuse ofSurgical Method:

Unwanted pregnancy was previously terminated surgically. It is called abortion. However, as the technique of sex determination became common, abortion was used on a large scale in terminating female fetuses.

- This female foeticide caused a fall in the sex ratio (1000 males to 800 females).

- Such a skewed sex ratio is liable to cause a lot of social tension.

- Therefore, the government has banned the prenatal sex test.

- There is a huge fine and imprisonment for persons indulging in sex determination and female foeticide.

Question 28.

1. Explain what happens when

- Testosterone is released in males

- Pollen grain falls on the stigma of the flower

- Egg fuses with sperm cells.

2. Differentiate between pollen tube and style.

Answer:

1.

- Testosterone: It helps in sperm formation. Puberty changes in boys are due to it. It maintains secondary sexual characters.

- Pollen Grain: After falling on a compatible stigma, the pollen grain absorbs water and germinates. It gives rise to a pollen tube. Firstly, stigma and then style provide nutrients for the growth of pollen tubes.

- Egg Fuses with Sperm Cell: It produces a diploid zygote. The act of fusion of egg with sperm is called fertilization. The diploid zygote later grows to form an embryo.

2. Pollen Tube and Style:

The pollen tube is part of the male gametophyte which develops from a pollen grain for carrying the male gametes to the ovule. Style is the stalk that is meant for lifting the stigma above the level of the ovary to capture the pollen grains.

Question 29.

- Name the organ that produces sperm as well as secretes a hormone in human males. Name the hormone it secretes and write its functions.

- Give an example of each of the unisexual and bisexual flowers.

- Differentiate between two types of pollination that occur in flowers.

Answer:

1. Testes: They produce sperm as well as the hormone testosterone.

Functions of Testosterone:

- Controls the formation of sperm

- Brings about changes in boys at puberty.

- It maintains the secondary sexual characteristics in male individuals.

2. Unisexual Flowers: Cucurbita, Papaya.

Bisexual Flowers: Petunia, Mustard.

3. The two types of pollination are self-pollination and cross-pollination:

Question 30. Write the functions of the following parts in the human female reproductive system :

- Ovary

- Oviduct

- Uterus

Answer:

1. Ovary: Formation of ova, secretion of hormones estrogen and progesterone.

2. Oviduct (Fallopian Tube):

- Collection of ovum

- Site of fertilization

- Providing passage to ovum.

3. Uterus:

Attachment to the fetus, protection to the fetus, nourishment, gaseous exchange, and waste disposal of the fetus.

Question 31. Define pollination. Explain the different types of pollination. List two agents of pollination. How does suitable pollination lead to fertilization?

Answer:

Pollination:

It is the transfer of pollen grains from another to the stigma of a flower.

Types of Pollination: Two types are

- Self-pollination and

- Cross-pollination.

In self pollination pollen grains from the anther of a flower pass to the stigma of the same or genetically similar flower.

In cross-pollination, pollen grains of the anther of a flower are transferred to the stigma of the flower of another (genetically different) plant. Agents. Wind, water, insects, and other animals.

Suitable Pollination:

The compatible pollen grain absorbs water and nutrients from the stigma. It swells up and forms a tube called a pollen tube. Pollen tube comes to have two male gametes. It passes through the style, reaches the ovary, enters an ovule, and pierces the embryo sac. One male gamete fuses with the oosphere to form a zygote while the other fuses with the nucleus of the central cell to form a triploid primary endosperm cell.

Question 32.

- Identify the given diagram. Name the parts 1 to 5

- What is contraception?

Answer:

1. The female reproductive system.

Female reproductive system Parts:

- Fallopian tube/oviduct

- Ovary

- Uterus

- Cervix.

- Vagina.

2. Contraception:

It is the prevention of conception or pregnancy. The mechanisms used to prevent pregnancy are called contraceptive devices.

Question 33. What is sexual reproduction? Explain how this mode of reproduction gives rise to more viable variations than asexual reproduction. How does this affect evolution? Sexual reproduction is a mode of multiplication in which new individuals develop after the process of formation and fusion of gametes.

Answer:

Sexual reproduction:

Sexual reproduction is a mode of multiplication in which new individuals develop after the process of affirmation and fusion of gametes.

In asexual reproduction, variations do not appear except when there is some wrong incorporation to nucleotides during DNA replication.

In sexual reproduction variations develop due to several reasons:

- Random separation of chromosomes during gamete formation.

- Random coming together of chromosomes during the process of fertilization

- Changes in chromosomes due to crossing over

Mixing of variations from two different parents and formation of new variations due to crossing over. Sexual reproduction maintains the vigor and vitality of the individuals.

Its variations also hide the harmful traits. Therefore, variations produced by sexual reproduction provide adaptability and competitiveness to the individuals. On accumulation, they also produce new species and hence cause evolution.

Question 34.

- List three different categories of contraception methods.

- Why has the Government of India prohibited prenatal sex determination by law? State its benefits in the long run.

- Unsafe sexual acts can lead to various infections. Name two bacterial and two viral infections caused due to unsafe sex.

Answer:

1. Contraception Methods:

- Barrier or Mechanical Methods,

- For example: Condom

- Intrauterine Contraceptive Devices

- For example: Copper T

- Hormonal methods

- For example: Oral pills.

2. Prenatal Sex Determination:

It has been banned due to large-scale female foeticide. The child sex ratio declined.

Benefits:

Benefits It shall restore the sex ratio for a healthy society.

3. Unsafe Sexual Act:

- It can result in unwanted pregnancy.

- It may spread sexually transmitted diseases.

Bacterial STDs: Syphilis, Gonorrhoea.

Viral STDs: Warts, HIV-AIDS.

Question 35.

1. What is puberty?

2. Describe in brief the functions of the following parts in the human reproductive system :

- Testes

- Seminal vesicle

- Vas deferens

- Urethra.

3. Why are testes located outside the abdominal cavity?

4. State how sperms move towards the female germ cell.

Answer:

1. Puberty: It is the phase of physical changes by which young persons reach sexual maturity and become adults.

2.

- Testes: Formation of sperm and secretion of hormone testosterone.

- Seminal Vesicle: Secretion of fluid for nourishing and transport of sperms.

- Vas Deferens: Passage of sperms from epididymis to ejaculatory duct in the lower abdomen.

- Urethra: In males, common passage for urine and sperm.

3. In order the provide lower temperature for formation and maturation of sperms.

4. With the help of a vibratile tail.

Question 36. . Based on the given diagram answer the questions given below :

- Label the parts A, B, C and D.

- Name the hormone secreted by the testis and mention its role.

- State the functions of B and C in the process of reproduction.

Answer:

1.

- A-Ureter

- B-Seminal vesicle.

- C-Urethra. D-Vas Deferens.

2. Testosterone: Regulation of sperm formation, appearance and maintenance of male characteristics.

3. The function of B: Its secretion provides nutrition and a medium for the transport of sperm.

4. The function of C: Common passage for urine and sperm.

f

f

Question 36. What are the advantages of sexual reproduction over asexual reproduction?

Answer:

- Due to the coming together of variations from the two parents, chromosome separation, crossing over, and t chance combination of chromosomes during fertilization, sexual reproduction produces a large number of variations. This is not possible in asexual reproduction.

- It hides the harmful traits. The same does not occur in asexual reproduction. ;

- Sexual reproduction maintains the vigor and vitality of the individuals. In asexual reproduction, there is a slow deterioration. !

- It increases the adaptability and competitiveness of the individuals. Asexual reproduction does not help in it.

Question 37. What are the functions performed by testis in human beings?

Answer:

Testis has two functions.

1. Formation of Sperms:

The germinal cells present in the lining of seminiferous tubules produce sperms through meiosis. They are nourished by Sertoli cells.

2. Testosterone:

It is male sex hormone that is secreted by Leydig or interstitial cells of the connective tissue of the testis. Testosterone is essential for sperm formation, the development of male sex organs during puberty, and the maintenance of male sex characteristics.

Question 38. What are the different methods of contraception?

Answer:

Contraception methods are devices that when employed prevent conception. They are of the following types :

1. Mechanical Barriers:

They do not allow the sperm to enter the uterus.

- Condoms: Tubular rubber sheaths worn over the penis at the time of coitus

- Cervical Caps: Rubber nipples fitted over cervix.

- Fern Shields: They are tubular rubber sheaths with flexible metallic rings which are fitted over and inside the vagina at the time of coitus.

2. Intrauterine Contraceptive Devices (IUCD):

They are plastic and metallic devices that are inserted in the uterus to prevent the escape of sperm into the fallopian tubes. IUCDs destroy or debilitate sperms. Common IUCDs are loops, spirals, shields, and Ts. Copper-T is the most common one. It releases ionized copper to immobilize the sperm.

3. Oral Pills:

They are progesterone-containing pills that are taken by women regularly to prevent ovulation.

4. Chemical Methods:

They are creams and jellies which are applied inside the vagina for the killing of sperm.

5. Reversible Sterilization:

They are surgical methods that block the passage of sperm in males and ova in females

- Vasectomy: Both the vasa deferentia are cut in the scrotal region and the cut ends are tied.

- Tubectomy: Both the fallopian tubes are cut midway and the cut ends are tied.

Question 39. How are modes of reproduction different in unicellular and multicellular organisms?

Question 40. How does reproduction help in providing stability to the population of species?

Answer:

In nature, older individuals become senescent and die. The youngsters become adults and the adults become older. Reproduction is regularly adding new young individuals into the population.

This helps the population in

- Perpetuation of species

- Maintaining several individuals in the population

- Stability of the different sections of the population.

Question 41. What could be the reasons for adopting contraceptive methods?

Answer:

- Controlling the size of the population.

- Enjoying tension-free reproductive health.

- Protection from sexually transmitted diseases.

- Having a smaller economically viable family.

- Better health of the women.

- Spacing the birth of children so that they can be properly looked after, educated, and provided with amenities to grow into good citizens.

Question 42.

- Which glands contribute fluid to the semen?

- State two advantages semen offers to sperms.

Answer:

1. Seminal vesicles and prostate gland.

2.

- Medium of transport

- Nourishment of sperms

- Activation of sperms.

Question 43.

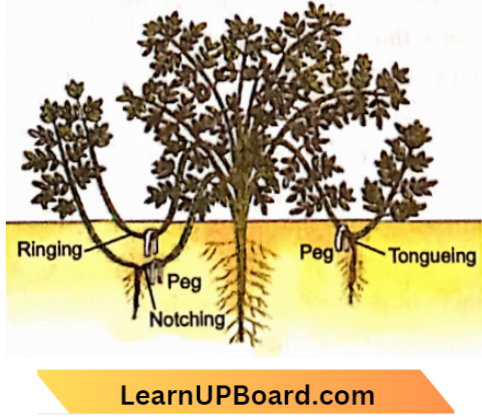

- List two advantages of vegetative propagation.

- In which of the following plants is vegetative propagation practiced Banana, Rice, Tomato, Rose?

Answer:

1. Vegetative propagation Advantages:

- Vegetative propagation is the only method of multiplication in seedless plants

- Good quality of variety can be maintained indefinitely.

2. Banana, Rose.

Question 44.

- Name one organ in the female and male reproductive system that plays the role of endocrine gland along with the production of germ cells. Name one hormone secreted by each of them.

- State two advantages of the development of the embryo in the mother’s womb.

- Where does fertilization occur in the case of a human female and name the place where the fertilized egg gets implanted?

Answer:

1. Male — Testis. Hormone — Testosterone along with producing sperm.

Female — Ovary. Hormone — Oestrogen along with producing ova.

2. Embryo in Mother’s Womb:

- Protection from the outside environment

- Provision for nourishment, exchange of gases, and removal of waste products.

3. Site of Fertilization:

Junction of ampulla and isthmus parts of the fallopian tube.

Implantation: The fertilized egg is implanted in the uterus.

Question 45.

- Give an example of a bisexual flower. What is its female reproductive part known as?

- Pollination may occur without fertilization but fertilization will not take place without pollination. Give reasons.

Answer:

1. Bisexual Flower: Mustard, Petunia, Female Reproductive Part. Pisfil

2. Pollination is the first step while fertilization is the second step. Fertilization can occur only when pollination has occurred and the pollen tube has carried the male gametes into the embryo sac. However, if the latter does not occur, pollination may occur but will be of no consequence.

Question 46. Give reason for the statement — since the ovary releases one egg every month, the uterus also prepares itself every month by making its lining thick and spongy.

Answer:

An egg released once a month can get fertilized and transform itself into an embryo. The embryo requires fixation, nourishment, and oxygen which can be provided by the uterus. Therefore, the uterus prepares itself for that eventuality every month.

Question 47. In a germinating seed which parts are known as future shoot and future root? Mention the functions of cotyledons.

Answer:

Future Shoot: Plumule.

Future Root: Radicle.

The function of Cotyledons:

- Store and supply of food to embryo

- Functioning as the first leaves of the seedling.

Question 48. What is the placenta? Write any two major functions of the placenta.

Answer:

The placenta is a disc-shaped spongy structure that attaches the fetus to the uterine wall through the umbilical cord.

Functions of Placenta:

- Provides attachment to fetus.

- It is the source of nourishment to the fetus.

- The exchange of gases and removal of waste products of the fetus is also carried out by the placenta.

Question 49. In a flowering plant, summarise the events that take place after fertilization.

Answer:

Fertilization produces two structures, a diploid zygote and a triploid primary endosperm cell. The zygote undergoes divisions and produces an embryo. Primary endosperm cell forms a nutritive tissue called endosperm. The endosperm may persist or get consumed. Ovule matures into a seed. It develops a thick seed coat. Ovary matures into fruit. Fruit encloses the seeds.

Question 50.

1.

- Where the block is created surgically to prevent fertilization

- Where Cu-T is inserted

- Inside which condom can be placed.

2. Why do more and more people prefer to use condoms? What is the principle behind the use of condoms?

Answer:

1.

- Block: Both the oviducts or fallopian tubes,

- CuT: Inside the uterus

- Condom: Inside vagina.

2. More people prefer condoms as

- They do not have any side effect

- Condoms are disposable

- They protect against catching sexually transmitted diseases.

Question 51.

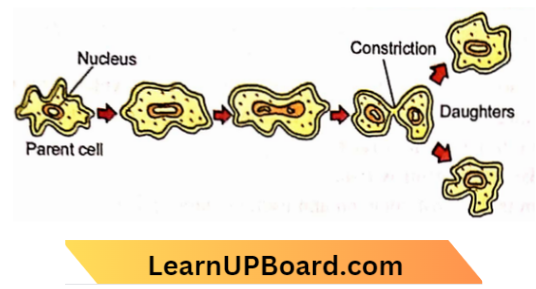

- Describe the various steps involved in the process of binary fission with the help of a diagram.

- Why do multicellular organisms use complex ways of reproduction?

Answer:

1. Binary fission is a mode of asexual reproduction in unicellular organisms in which a mature individual divides into two daughter cells, both of which behave as new individuals.

- For binary fission, there is an enlargement of the parent cell.

- Simultaneously nucleus (or nuclear matter) elongates.

- The nucleus constricts in the middle and divides into two.

- The cell also constricts between the two nuclei,

- There is a division of the parent cell into two daughter cells, each with a nucleus. The parent cell disappears.

2. Multicellular organisms cannot divide and multiply cell by cell. They have organization of specialized cells to form tissues and tissues to form organs. Some organs called reproductive organs become specialized to produce propagules or reproductive cells. Only they take part in reproduction. Therefore, multicellular organisms use complex way of reproduction.

Question 52.

- Describe the role of the prostate gland, seminal vesicles, and testes in human male reproductive systems.

- How is surgical removal of unwanted pregnancies misused?

- Explain the role of oral contraceptive pills to prevent conception.

Answer:

1.

- Prostate Gland: Forms 20-30% of semen plasma. Secretion is essential for the mobility of sperm and ejaculation of semen.

- Seminal Vesicles: Forms 60-70% of semen plasma. The secretion contains nutrients, fibrinogen, and prostaglandins.

- Testes: Secrete testosterone hormone and produce sperm. The hormone brings about changes in the males during puberty and helps maintain male sex characters.

2. Surgical removal of unwanted pregnancies has been misused for female foeticide. Because of it, the sex ratio started declining. Therefore, prenatal sex determination has been banned. Abortions are undertaken only when it is essential in the opinion of doctors.

3. Oral contraceptives contain progesterone which inhibits ovulation. In the absence of ovulation, pregnancy cannot occur.

Question 53. Trace the changes that take place in a flower from gamete formation to fruit formation.

Answer:

- The stamen is the male organ of a flower. In the region of its anther, four pollen sacs develop. They produce pollen grains.

- The pistil is the female organ of a flower. It has a receptive part called the stigma and an ovule-bearing part called the ovary. Each ovule contains a female gametophyte called embryo sac. An embryo sac has a female gamete or oosphere and a diploid central cell.

- In the process of pollination, pollen grains are transferred to the stigma of the pistil. A pollen grain germinates and develops a pollen tube. The pollen tube contains two male germ cells.

- Pollen tube passes through the style, reaches the ovary, and enters an ovule. In the embryo sac region, it bursts open to release the two male germ cells.

- One germ cell fuses with the female germ cell or oosphere to form a zygote. The zygote undergoes repeated divisions and forms an embryo.

- The second germ cell fuses with the central cell to produce the primary endosperm cell. The latter undergoes divisions and forms endosperm.

- The fusion of both the male gametes with two different structures in the same embryo sac is called double fertilization. The fusion of a second male germ cell with the central cell is called triple fusion.

- After fertilization, the ovules develop into seeds. The ovary grows around the seeds and produces fruit.

Question 54.

1. Differentiate between germination and fertilization.

2. Differentiate between pollen and ovule.

3. What happens to the following parts after fertilization :

- Ovum

- Ovary

- Ovule

- Sepals and petals.

Answer:

1. Germination:

Germination is the growth of contents of a propagule or spore as a pollen tube from a pollen grain, seedling from seed, new mycelium from a sporangiospore.

Fertilization:

Fertilization is a fusion of two haploid gametes to form a diploid zygote.

2. Pollen Grain:

It is a haploid spore that is formed by the meiotic division of pollen grain mother cell inside a spore sac or microsporangium. Ovule is integument megasporangium. It develops a single haploid megaspore which grows to form embryo sac or female gametophyte. While pollen grain degenerates after fertilization, the ovule develops into seed after fertilization.

3. After Fertilization:

- Ovum forms a diploid zygote. The embryo develops from the same.

- Ovary matures into fruit,

- Ovule develops into a seed,

- Sepals and Petals.

They shrivel and fall. Sepals persist in the fruits of some plants.

Question 55. Rajesh observed a patch of greenish-black powdery mass on a state piece of bread.

- Name the organism responsible for this and its specific mode of asexual reproduction.

- Name its vegetative and reproductive parts.

Answer:

1. The greenish-black powdery mass found on a piece of bread is due to the growth of bread mold Rhizopus. Its specific mode of asexual reproduction is spore formation or sporulation.

2. Vegetative Parts:

Hyphae. They are thread-like structures lying over and inside the bread.

Reproductive Parts: Blob-like blackish sporangia borne on aerial hyphae called sporangiophores.

Question 56. The diagram depicts pollination. Choose the options that will show a maximum variation in the offspring.

- 1, 2 and 3

- 2 and 4

- 2, 3 and 4

- 1 and 3

Answer: 4. 1 and 3, They involve cross-pollination

Question 57.

- Why is not possible to reconstruct the whole organisms from a fragment in complex multicellular organisms

- Sexual maturation or reproductive tissue and organs are necessary links for reproduction. Elucidate

Answer:

1. A multicellular organism hi not a random collodion ofcclla. II lias well-differentiated eclhi which are organized into limits and tissues into organs, They occur at specific places in Ihc body. A fragment of a complex multicellular organism cannot have differentiated cells for cell-by-cell division. Further regeneration in complex oi gallium is under the control of nerves and hormones,

2. Reproductive tissues and organs become functional only on full sexual maturation. It takes a long time beginning at puberty and is completed at the end of adolescence, Puberty produces immature sex organs which begin to produce hormones Under The influence of hormones when general body growth begins to slow down reproductive tissues and organs begin to mature.

New sets of changes appear in the body like changes in body proportions, menstruation, increase in breast size, and darkening of The skin of the nipples al lips of breasts in girls. In boys (there is a thick growth of hair on the face. ‘Their voice also begins to crack,

Question 58.

- How are variations useful for species if there Is drastic alteration in the niches?

- Explain how the uterus and placenta provide necessary conditions for proper growth and development of the embryo after Implantation.

Answer:

1. A drastic change in niches means that The population of niches will not only lose their habitat but also the emotional areas for obtaining their food. In such a situation the whole population of a niche could be wiped out.

However, this generally does not occur because of the presence of variations in some individuals which are useful in the new niche. These individuals with variations will not only survive but also take part in the multiplication and formation of the population again. Therefore, variations are useful for the survival of species over time.

2. The placenta is a disc-shaped structure formed by the joint activity of the uterus and embryo. It helps in the proper attachment of the fetus inside the uterus.

‘The wall of the uterus thickens and becomes highly vascularised. The embryo part of the placenta develops finger-like outgrowths or villi for proper fixation and absorption. They are surrounded by uterine blood spaces or sinuses. A large surface area develops for the exchange of materials between the mother and fetus. The mother provides glucose and oxygen to the embryo. Waste of embryo and carbon dioxide is picked up by the mother’s blood. As the fetus matures, the uterus undergoes rhythmic contractions to expel the child.

Question 59. From the internet, gather information about the chromosome number of five animals and five plants.

Correlate the number with the size of organisms and answer the following questions :

- Do larger organisms have more number of chromosomes/cells?

- Can organisms with fewer chromosomes reproduce more easily than organisms with more number of chromosomes?

- The more the number of chromosomes/cells greater is the DNA content. Justify.

Answer:

1. No. there is no relationship between the number of chromosomes and the size of the organism. However sized organisms have a larger number of cells as compared to smaller sized organisms.

2. No. The process of reproduction is independent of number of chromosomes.

3. Chromosomes are made of DNA (+ protein). More chromosomes and more number of cells means more