Stock Exchanges Essay Questions

Question 1. What is BSE? What are the Features of the Bombay Stock Exchange

Answer:

BSE

The Bombay Stock Exchange is the first and oldest stock exchange in India which was founded in 1875 as the Naive Share and Stock Brokers Association.

- The BSE is located in Mumbai, India, and lists more than 5000 companies with a total market capitalization of $3.5 trillion.

- The Bombay Stock Exchange played a vital role in the development of India’s capital market, including the retail debt market, and providing the Indian corporate sector with an efficient platform to raise investment capital.

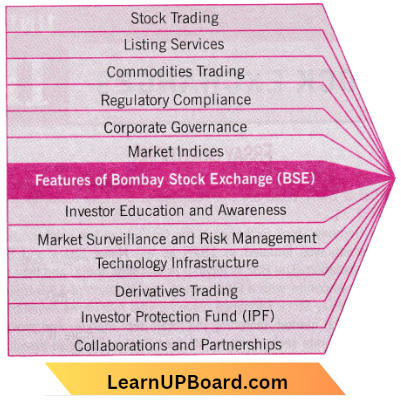

Features of the Bombay Stock Exchange (BSE):

The following are a few prominent characteristics of the Bombay Stock Exchange (BSE):

1. Stock Trading: The Bombay Stock Exchange (BSE) serves as a key marketplace for the exchange of equities, namely stocks and shares, belonging to publicly listed corporations inside India. Investors can engage in the purchase and- sale of these securities within the specified trading hours.

2. Listing Services: Through initial public offerings (IPOs) and follow-on public offerings (FPOs), the BSE helps companies get listed in the stock market. Companies can get money by selling shares to the public and getting listed on an exchange.

3. Commodities Trading: BSE also has a place where buyers can buy and sell derivatives of commodities like gold, silver, and agricultural goods.

4. Regulatory Compliance: The BSE makes sure that listed companies follow the rules set by the Securities and Exchange Board of India (SEBI) and other important bodies about disclosure and other rules.

5. Corporate Governance: The exchange encourages good corporate governance and openness among businesses that are listed, which is important for maintaining investor trust.

6. Market Indices: BSE manages and publishes various market indices, with the BSE Sensex being the most notable. These indices serve as benchmarks to gauge the overall performance of the stock market and specific sectors.

7. Investor Education and Awareness: BSE is involved in initiatives to educate and create awareness among investors. This includes providing information about financial markets, investment strategies, and risk management to enhance investor knowledge.

8. Market Surveillance and Risk Management: BSE employs advanced technology for market surveillance to detect any irregularities or unusual trading patterns. Additionally, the exchange has robust risk management systems in place to ensure the stability and integrity of the market.

9. Technology Infrastructure: BSE continually invests in upgrading its technology infrastructure to provide a seamless and efficient trading experience. The exchange has adopted advanced trading platforms and systems to keep pace with global standards.

10. Derivatives Trading: BSE offers a platform for trading in derivatives, including futures and options contracts. Derivatives provide investors with tools for hedging and speculation on the future price movements of various financial instruments.

11. Investor Protection Fund (IPF): BSE has established the Investor Protection Fund to compensate investors in case of financial losses resulting from fraudulent activities by trading members or other market participants.

12. Collaborations and Partnerships: BSE collaborates with other financial institutions, both domestically and internationally, to foster cooperation and enhance the efficiency of financial markets.

Question 2. Write the objectives and importance of BSE.

Answer:

The Bombay Stock Exchange is the first and oldest stock exchange in India as well as Asia. It was founded by Premchand Roychand in 1875 and is currently managed by S.S. Mundra, serving as the chairman of BSE.

- The BSE is located in Mumbai, India, and lists more than 5000 companies with a total market capitalization of $3.5 Trillion. Also, BSE is one of the largest stock exchanges in the world, along with the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange Group, and Japan Exchange Group.

Objectives of BSE:

The objectives of the Bombay Stock Exchange (BSE) are:-

- To provide an efficient and transparent market for trading in equity, debt instruments, derivatives, and. mutual funds.

- To provide a trading platform for equities of small and medium enterprises.

- To ensure active trading and safeguard market integrity through an electronically-driven exchange.

- To provide other services to capital market participants, like risk management, clearing, settlement, market data, and education.

- To conform to international standards.

Importance of the Bombay Stock Exchange (BSE):

1. Liquidity and Investment Opportunities: The BSE facilitates the purchase and sale of equities and other financial instruments, providing a liquid market for investors to exchange their investments. This liquidity facilitates the purchase and sale of assets by investors.

2. Economic Indicator: The performance of the BSE is frequently viewed as a barometer of the Indian economy as a whole. When the stock market performs well, it may indicate economic growth and stability.

3. Financial Inclusion: The BSE has introduced several initiatives aimed at encouraging financial inclusion, making it possible for a broader segment of the population to invest in the stock market and thus participate in wealth creation and economic development.

4. Market Benchmark: BSE’s primary index, the S&P BSE Sensex, is widely regarded as an indicator of the Indian stock market’s performance. Investors, analysts, and fund managers use it to evaluate market trends and performance.

5. Corporate Governance and Transparency: Listed companies on the BSE are subject to stringent regulatory and reporting requirements that encourage transparency and corporate governance. This is essential for establishing investor confidence.

6. Global Integration: The BSE is part of the global financial system, and its performance and activities are closely monitored by international investors and financial institutions. This integration provides Indian companies with access to global capital and allows international investors to participate in the Indian economic growth story.

7. Facilitates Price Discovery: The BSE serves as a platform where the prices of securities are determined through the forces of supply and demand. This price discovery mechanism helps in establishing fair market values for stocks, enabling investors to make informed decisions.

8. Job Creation and Economic Growth: A vibrant stock exchange contributes to overall economic growth by fostering entrepreneurship and job creation. As companies raise capital on the BSE, they can expand their operations, leading to increased employment opportunities and economic prosperity.

Question 3. What is the Bombay Stock Exchange? Write the Functions of BSE.

Answer:

Bombay Stock Exchange Sensex:

The BSE is the oldest stock exchange in Asia; it was established in 1875 as the Native Shares and Stock Broker’s Association. It was the first exchange in India recognized as the exchange in 1957 under the Securities Contract (Regulation) Act by the government.

- The BSE Sensex, comprising 30 of the largest and most actively traded stocks on the BSE, is India’s benchmark stock market index. The BSE has a significant impact on the Indian economy and is considered a barometer of the country’s economic performance.

Functions of BSE

1. Facilitating Trading: BSE provides a marketplace where buyers and sellers can come together to trade a wide range of financial instruments. It offers a platform for both spot trading of equities and trading in derivative contracts.

2. Listing and Disclosure: BSE provides a platform for companies to list their shares. It establishes listing requirements and standards that companies must meet to become publicly traded entities. Listed companies are also required to adhere to continuous disclosure norms, providing timely and accurate information to investors.

3. Price Discovery: BSE plays a crucial role in price discovery by providing a transparent and efficient marketplace where the prices of securities are determined based on the interactions of buyers and sellers.

4. Market Surveillance: BSE monitors trading activities to detect any unusual or suspicious activities that could potentially harm market integrity. It employs advanced surveillance tools to identify market manipulation, insider trading, and other irregularities.

5. Regulation: BSE operates within the regulatory framework set by the Securities and Exchange Board of India (SEBI). It ensures that trading participants, listed companies, and other stakeholders adhere to SEBI’s rules and guidelines.

6. Market Indices: BSE calculates and publishes several market indices, including the Sensex and the BSE 500 Index. These indices serve as benchmarks to gauge the overall performance of the stock market and specific sectors.

7. Trading Platforms: BSE provides various trading platforms for different types of securities, including equities, bonds, and derivatives. The exchange offers electronic trading platforms for efficient and transparent order execution.

8. Investor Education: BSE undertakes initiatives to educate and inform investors about various aspects of investing, trading, and financial literacy. This helps investors make informed decisions and understand market dynamics.

9. Technology Infrastructure: BSE continuously invests in technological advancements to ensure the smooth functioning of trading systems, order matching, and data dissemination.

10. Market Data and Research: BSE provides real-time market data, historical price charts, and research reports to traders, investors, and analysts for making informed decisions.

11. Corporate Governance: BSE promotes good corporate governance practices among listed companies, enhancing transparency and accountability.

12. Listing Compliance: BSE monitors listed companies’ compliance with various listing requirements, corporate governance norms, and disclosure norms to maintain market integrity.

13. Investor Protection: BSE works to protect the interests of investors by ensuring fair and transparent trading practices, timely dissemination of information, and adherence to regulatory guidelines.

14. Market Development: BSE plays a role in developing new financial products and services, expanding trading opportunities, and contributing to the growth of India’s financial markets.

Question 4. Explain the advantages and disadvantages of investing in BSE.

Answer:

The Bombay Stock Exchange is one of the largest securities markets. It is located on Dalai Street, Mumbai, and lists over 6000 companies. BSE has contributed significantly to developing and shaping India’s capital markets.

- It also offers capital market trading services that include investor education, risk management, clearing, settlement, and many more.

Advantages of BSE:

1. Capital Infusion: Listing on the BSE provides companies with an avenue to raise capital by issuing shares to the public through initial public offerings (IPOs) or follow-on public offerings (FPOs). This capital can be utilized for expansion, investment in new projects, debt repayment, or other strategic initiatives.

2. Liquidity for Shareholders: Shareholders of BSE-listed companies benefit from the liquidity of their investments. The ability to buy and sell shares on the stock exchange provides shareholders with a market where they can easily trade their holdings, offering liquidity and flexibility.

3. Enhanced Profile and Reputation: Being listed on a prestigious stock exchange like BSE can enhance a company’s profile and reputation. It signals to the market that the company has met certain standards and governance requirements, potentially attracting new customers, partners, and investors.

4. Access to a Diverse Investor Base: BSE provides access to a broad and diverse investor base, including domestic and international investors. This can lead to increased demand for the company’s shares and potentially lower the cost of capital.

5. Regulatory Compliance and Transparency: Listing on the BSE requires companies to adhere to regulatory and disclosure requirements set by SEBI and other regulatory bodies. This ensures a higher level of transparency and accountability, building trust among investors and stakeholders.

6. Market Recognition: Being listed on a prominent stock exchange like the BSE provides market recognition and can instill confidence in investors, customers, and business partners.

7. Legal Supervision: Investors can skim through fraudulent companies if they choose to invest in organizations listed with BSE.

- Several rules and regulations are mandated by SEBI to monitor the actions of registered companies, minimizing the chances of investors incurring a loss due to illicit activities of a business.

8. Adequate Pricing Rules: The price of securities trading in the BSE share market is determined by the demand and supply of the same currently prevailing. This reflects the real value of a share, affecting a company’s market capitalization and ease of procurement of funds.

9. Timely Information Display: Adequate information about total revenue generation and reinvestment patterns has to be published annually by all companies listed under the BSE stock exchange.

- Total dividend disbursed, bonus and transfer issues, book-to-closure facility, etc., have to be displayed as per SEBI regulations.

10. Collateral Guarantee: Securities issued by a company act as a collateral guarantee at the time of availing loans. Most financial institutions accept equity shares listed in BSE as leverage against which funds can be obtained.

Disadvantages of BSE:

1. Market Volatility: Stock markets, including the BSE, can be highly volatile. Prices of stocks can fluctuate rapidly based on various factors such as economic conditions, geopolitical events, and company-specific news. This volatility can lead to significant financial losses for investors.

2. Market Risks: Investing in stocks always carries inherent risks. Factors such as economic downturns, industry-specific challenges, or global events can impact stock prices negatively.

3. Lack of Control: Shareholders in publicly traded companies have limited control over the day-to-day operations and management decisions of the company. Decisions are typically made by the company’s management and board of directors.

4. Market Manipulation: Despite regulatory measures, there is always a risk of market manipulation, including insider trading and fraudulent activities. Such practices can harm the interests of small investors.

5. Liquidity Risks: While liquidity is generally an advantage, it can also pose risks. In times of market stress or for smaller stocks, liquidity may dry up, making it challenging to buy or sell shares at desired prices.

6. Regulatory Changes: Regulatory changes in financial markets can impact the trading environment and affect market participants. Changes in tax regulations or listing requirements can have implications for companies and investors.

Question 5. Describe the role of BSE in the Indian Stock Market.

Answer:

The Bombay Stock Exchange (BSE) plays a crucial role in the Indian stock market, serving as one of the major stock exchanges in the country. Its role encompasses various functions that contribute to the efficient functioning of the Indian capital market.

The following points highlight the role of BSE in the Indian stock market:

1. Primary Capital Raising: The BSE provides a platform for companies to raise capital by issuing shares to the public through Initial Public Offerings (IPOs). This process allows companies to raise funds for expansion, investment, or other corporate purposes.

2. Secondary Market Trading: The BSE facilitates the trading of listed securities in the secondary market. Investors, including institutional and retail investors, can buy and sell shares of publicly listed companies, providing liquidity to market participants.

3. Benchmark Index: The BSE’s flagship index, SENSEX, serves as a benchmark for the Indian stock market. It reflects the overall performance of a select group of large-cap companies and is widely followed by investors, analysts, and the media to gauge market trends.

4. Market Regulation: The BSE operates within the regulatory framework established by the Securities and Exchange Board of India (SEBI). It enforces listing requirements, trading rules, and other regulations to ensure fair and transparent market practices.

5. Listing Platform: Companies seeking to go public can list their shares on the BSE. The listing process involves meeting regulatory compliance standards and disclosure requirements, which enhances transparency for investors.

6. Market Surveillance: The BSE employs surveillance mechanisms to detect and prevent market manipulation, fraud, and other irregularities. This helps maintain the integrity of the market and protects investors.

7. Investor Education: The BSE plays a role in educating investors about the functioning of the stock market, investment opportunities, and risk management. This is crucial for fostering investor confidence and participation.

8. Derivatives Trading: The BSE offers a platform for the trading of equity derivatives, including futures and options. This allows investors to hedge their portfolios, speculate on price movements, and manage risk.

9. Technology Infrastructure: The BSE invests in technology infrastructure to ensure efficient and secure trading. The adoption of advanced trading platforms, settlement systems, and risk management tools contributes to the smooth operation of the exchange.

10. Market Development: The BSE actively contributes to the development of the Indian capital market by introducing new financial instruments, promoting corporate governance practices, and aligning with global best practices.

11. International Integration: The BSE engages in initiatives to integrate with international markets, attracting foreign investors and promoting cross-border investment opportunities.

Question 6. What is NSE? Write the salient features of NSE.

Answer:

NSE

The National Stock Exchange (NSE) is the leading stock exchange in India, headquartered in Mumbai, Maharashtra. It was incorporated in the year 1992 as the first dematerialized electronic stock exchange in the country.

- In 1994, NSE commenced its operations on the order of the Indian government to bring transparency to the capital market. By 2015, NSE became the fourth largest stock exchange in the world by its trading volume.

- NSE allows investors to invest in domestic and global securities. The total number of companies listed on the NSE is approximately 1741, with a total market capitalization of $3.4 trillion.

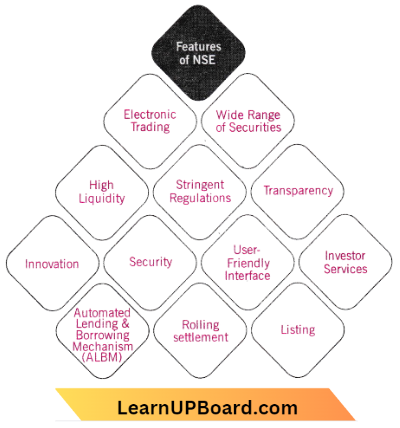

Salient features of NSE:

1. Electronic Trading: One of the most significant features of the National Stock Exchange is its fully automated electronic trading system. This pioneering move in India was replacing the open outcry system and making trading more transparent and efficient.

2. Wide Range of Securities: From equities and bonds to derivatives and currency futures, NSE offers diversified trading options, making it a one-stop shop for investors.

3. High Liquidity: With high trading volumes and many market participants, the NSE offers excellent liquidity, making it easier for investors to buy and sell securities.

4. Stringent Regulations: The National Stock Exchange operates under strict regulatory oversight, ensuring that all market participants adhere to the laws, thereby protecting investor interests.

5. Transparency: Advanced technology and real-time data dissemination make NSE one of the most transparent stock exchanges in the world.

6. Innovation: Whether introducing new indices or launching new financial products, NSE has always been at the forefront of innovation.

7. Security: With state-of-the-art security measures, the National Stock Exchange ensures that trading activities are secure from fraud.

8. User-Friendly Interface: The trading platform of NSE is designed to be user-friendly, facilitating ease of use for novice and experienced investors.

9. Investor Services: Beyond trading, NSE offers a range of services like market analytics, data services, and investor education programs to improve market participation and financial literacy.

10. Automated Lending and Borrowing Mechanism (ALBM): To carry on an orderly system, NSE Promoted lending in securities called ALBM.

11. Rolling settlement: Initially NSE introduced weekly settlements every Thursday, for the transactions taking place between the previous Wednesday to the settlement day. However, fixed settlement day is unjust as it gives different lengths of time for settlement.

12. Listing: A company should have a minimum, paid-up capital of Rs – 10 crore. Only large and medium-sized companies’ securities are allowed for listing on the NSE apart from the securities of public sector undertakings.

Question 7. Elucidate the objectives am importance of NSE.

Answer:

The National Stock Exchange of India was incorporated in the yearl992. It was recognized as a Stock Exchange in 1993 and started operations in 1994. It was established by leading banks, financial institutions, insurance companies, and financial intermediaries.

Objectives of NSE:

- NSE was established with the following objectives.

- Establishing a nationwide trading facility for all types of securities.

- Ensuring equal access to investors all over the country through an appropriate communication network.

- Providing a fair, efficient, and transparent securities market using an electronic trading system.

- Enabling shorter settlement cycles and book entry settlements.

- Meeting international benchmarks and standards.

- Provide traders with a fair, efficient, and transparent securities market through an electronic trading system.

Importance of NSE:

1. Financial Inclusion: NSE contributes to financial inclusion by providing a platform for a diverse range of investors, including retail investors, institutional investors, and foreign investors, to participate in the capital markets.

2. Economic Indicator: The performance of the stock market, as reflected by indices like Nifty, is often considered an indicator of the overall economic health of the country. Movements in the stock market can influence investor confidence and economic sentiment.

3. Investor Protection: NSE plays a key role in regulating and overseeing market activities to ensure fair and transparent trading. It establishes rules and regulations to protect investors and maintain market integrity.

4. Technology and Innovation: NSE has been at the forefront of adopting technology and implementing innovative solutions in its trading platforms. The use of advanced technology has contributed to improved market efficiency, transparency, and reduced settlement times.

5. Market Benchmark: NSE’s Nifty 50 index is one of the most widely followed equity indices in India. It serves as a benchmark for the performance of the Indian stock market and is used by investors, fund managers, and analysts to assess market trends and make investment decisions.

6. Liquidity and Market Efficiency: The NSE is one of the largest stock exchanges in India, providing a platform for trading a wide range of financial instruments such as equities, derivatives, and debt securities. The presence of a liquid and efficient market is essential for investors to buy and sell securities easily.

7. Market Research and Information: NSE disseminates a wealth of market information, research reports, and data. This information is valuable for investors, analysts, and financial institutions in making informed investment decisions and conducting market analysis.

8. Risk Management: The exchange provides robust risk management mechanisms, including margin trading systems and settlement processes, to mitigate risks associated with market volatility. This helps maintain the stability and integrity of the financial system.

9. Regulatory Compliance: NSE operates under the regulatory framework of the Securities and Exchange Board of India (SEBI). Adherence to SEBI regulations ensures that market participants follow standardized practices, promoting transparency and protecting the interests of investors.

Question 8. Describe the functions of NSE.

Answer:

Founded in the year 1992, the National Stock Exchange, or the NSE, is the leading stock exchange in India and the second largest in the world. It is also known to be the first dematerialized stock exchange in India with a fully automated, screen-based electronic trading system.

Functions of NSE:

1. Market Making: NSE acts as a marketplace where buyers and sellers can trade various securities, such as equities, bonds, derivatives, and other financial instruments.

2. Price Discovery: Through its advanced electronic trading system, the National Stock Exchange helps in the fair and transparent discovery of prices, ensuring that every security is traded at its true market value.

3. Liquidity Provider: With many listed companies and high trading volumes, NSE provides ample liquidity to market participants, making entering or exiting positions easier.

4. Clearing and Settlement: NSE has a clearing house that ensures all trades are settled efficiently and on time. This significantly reduces the risk of default.

5. Indices Management: The National Stock Exchange is renowned for its market indices like NIFTY 50, which serve as benchmarks for the Indian economy and various investment products.

6. Risk Management: Through stringent regulations and real-time monitoring, NSE minimizes market risk and ensures a level playing field for all investors.

7. Investor Education: NSE takes upon itself to educate investors through various programs, aiming to improve financial literacy among the masses.

8. Data Services: The National Stock Exchange provides market data and analytics crucial for individual and institutional investors to make informed decisions.

9. Regulatory Functions: NSE operates under the regulation of the Securities and Exchange Board of India (SEBI), and it plays a key role in ensuring that market participants adhere to the laws.

10. Technology Upgradation: The National Stock Exchange has implemented cutting-edge technology to make trading more efficient, secure, and accessible.

Question 9. Explain the benefits and limitations of NSE.

Answer:

The National Stock Exchange of India Ltd. was set up with the primary idea of facilitating computerized trading in Debt Market Instruments.

- This was incorporated in November 1992 by the Industrial Development Bank of India and other India Financial Institutions and recognized as a Stock Exchange from April 26, 1993, to provide Nationwide Stock Trading facilities.

- The National Stock Exchange has a fully automated screen-based trading system and operates on the principles of an order-driven market. National Stock Exchange is the outcome of the recommendations of the Shri M.J. Pherwani Committee.

Benefits of Listing with NSE:

1. Enhanced Visibility: Companies listed on NSE gain immense market visibility due to their reputation and reach, attracting more investors.

2. Access to Capital: Listing on NSE gives companies easier access to capital for their growth and expansion plans.

3. Credibility Boost: The stringent regulatory norms for listing enhance the company’s credibility, making it more appealing to investors.

4. Liquidity: The National Stock Exchange’s large trading volume ensures high liquidity for listed securities, enabling easier buying and selling.

5. Transparency: The advanced electronic trading system ensures transparent price discovery and trade execution.

6. Global Reach: NSE’s alliances with international exchanges expose companies to global investors.

7. Investor Trust: Being listed on a prestigious platform like NSE builds investor confidence, which can benefit the company in the long run.

8. Effective Communication: Listed companies can effectively communicate corporate actions like dividends, bonus issues, and rights issues through the National Stock Exchange platform, ensuring that shareholders are well-informed.

9. Regulatory Compliance: NSE ensures that listed companies comply with all regulatory norms, safeguarding the interests of investors.

10. Market Analytics: Companies get access to valuable market data and analytics, which can guide their future strategies.

Limitations:

1. Market Volatility: The stock market, including NSE, can be subject to volatility. Companies listed on the exchange may experience fluctuations in their stock prices, which could impact investor confidence and the company’s market capitalization.

2. Costs of Compliance: Compliance with NSE’s regulations and reporting requirements involves certain costs. Companies need to allocate resources for legal, accounting, and regulatory compliance, which can be a burden for smaller companies.

3. Liquidity Concerns: Smaller companies may face challenges in maintaining liquidity in their stocks, illiquid stocks can experience higher volatility and may not be as attractive to institutional investors.

4. Listing Requirements: NSE has stringent listing requirements that companies must meet. These criteria include financial performance, minimum public shareholding, and corporate governance standards. Companies that do not meet these requirements may face challenges in getting listed.

5. Cost of Initial Public Offering (IPO): Conducting an Initial Public Offering (IPO) to get listed on NSE involves substantial costs. Expenses related to underwriting fees, legal expenses, marketing, and compliance can be significant, particularly for smaller companies.

6. Market Manipulation Risks: Companies listed on the NSE are vulnerable to market manipulation risks, such as price rigging or insider trading. Regulatory bodies actively monitor and investigate such activities, but the risk still exists, potentially impacting the market value of listed companies.

Question 11. Describe the organizational structure and management of NSE.

Answer:

The National Stock Exchange of India Limited (NSE) is the largest financial exchange in the Indian market. It was established in 1992 on the recommendation of the High-Powered Study Group, which was founded by the Indian government to provide solutions to simplify participation in the stock market and make it more accessible to all interested parties. In 1994, the NSE introduced electronic trading in the Indian stock exchange market.

Organization and management of NSE:

The organization and management of NSE involve several key aspects:

1. Governance and Structure: NSE operates under the regulatory framework of the Securities and Exchange Board of India (SEBi). It has a board of directors responsible for the overall governance and strategic decision-making. The board includes representatives from various stakeholders, including public institutions, financial institutions, and market participants.

2. Management Team: NSE is headed by a Managing Director and Chief Executive Officer (CEO) who oversees the day-to-day operations of the exchange. The management team comprises professionals from diverse backgrounds, including finance, technology, and legal, who manage various departments and functions.

3. Market Segments and Products: NSE offers various market segments and products. The key segments include Equity Cash, Equity Derivatives, Currency Derivatives, and Debt. The exchange also offers mutual fund distribution and other investment-related services.

4. Technology Infrastructure: NSE is known for its robust and advanced technology infrastructure that facilitates seamless trading and settlement processes. Its trading platform relies on high-speed and low-latency systems to ensure efficient order matching and execution.

5. Market Regulation; NSE, like other exchanges, adheres to strict market regulations set by SEBI. It enforces rules and regulations to maintain market integrity, transparency, and investor protection. NSE monitors trading activities, investigates unusual market movements, and takes appropriate actions to maintain market stability.

6. Listing and Membership: Companies interested in being listed on NSE need to fulfill specific listing requirements and comply with ongoing disclosure norms. NSE also regulates its members (brokers) who trade on the exchange by setting membership criteria and monitoring their activities.

7. Investor Education; NSE plays an active role in educating investors about various investment opportunities, financial literacy, and market-related concepts. It conducts workshops, seminars, and awareness programs to empower investors with knowledge.

8. Research and Development: NSE invests in research and development to enhance its services, improve trading systems, and introduce new products. Innovation is crucial to staying competitive and adapting to changing market dynamics.

9. International Relations; NSE maintains collaborations with other international stock exchanges and financial institutions to promote cross-border investments and knowledge sharing.

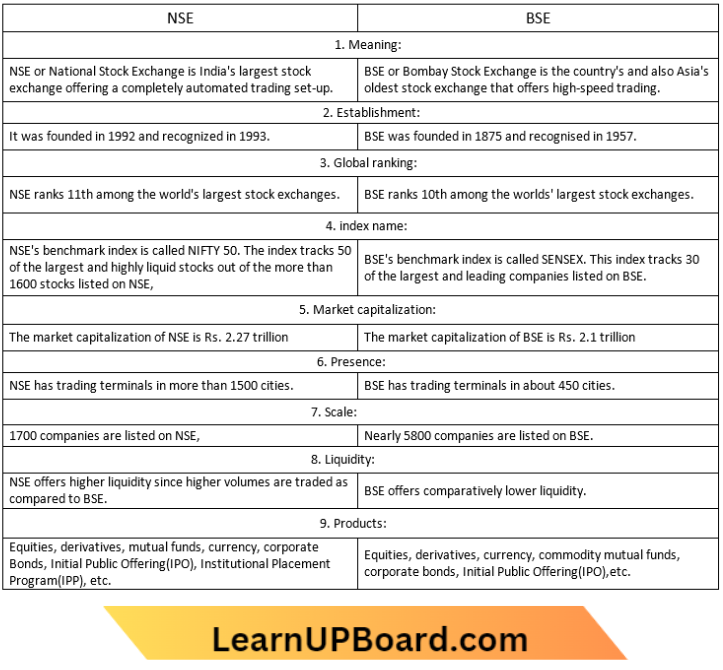

Question 11. Explain the Difference between NSE and BSE.

Answer:

The table below highlights the main differences between NSE and BSE:

Question 12. IM What is MCX: Write its features and advantages.

Answer:

MCX:

The full form of MCX is the Multi Commodity Exchange of India Limited. MCX is India’s first commodity derivatives exchange facilitating online trading of commodity derivatives transactions. Commencing operations in 2003, MCX operates under the purview of the Securities and Exchange Board of India (SEBI).

Features of Trading in MCX:

1. Reputation and Standards: MCX is known for its good reputation in the Indian market, attributed to high-quality standards, transparent trading systems, and well-organized operations.

2. Vision and Purpose: MCX was formed with a vision to provide a robust and transparent platform for trading and clearing commodities in India.

3. Advanced Commodity Exchange: MCX is considered one of the most advanced commodity exchanges in the country, offering a technologically advanced platform for commodity trading.

4. Derivative Contracts: MCX is at the forefront of offering derivative contracts in commodities in India. It provides various types of contracts such as futures, options, swaps, and forwards, catering to different trading needs and strategies.

5. Infrastructure Development: MCX is committed to building a state-of-the-art infrastructure, aiming to set a benchmark for other exchanges in the region. This emphasis on infrastructure can contribute to the efficiency and reliability of the trading platform.

6. Regulation and Control: The derivatives market in India, including commodity trading, has faced challenges related to manipulation. Regulators, including the Securities and Exchange Board of India (SEBi}. have taken measures to control manipulative practices. This includes the closure of illegal trading activities to protect the interests of small-level traders.

Benefits of Trading in MCX:

1. Potential Returns: Several factors affect the prices of individual commodities such as supply and demand, inflation, and economy. Due to massive global infrastructure projects, demand has increased in the global infrastructure projects that impact commodity prices. A positive impact on the company stocks affects commodity prices.

2. Potential Hedge Against Inflation: Inflation can cause a hike in prices for commodities. During high inflation, commodities show strong performance, commodities are more volatile in comparison with other types of investments.

3. Diversified Investment Portfolio: A diversified investment portfolio refers to an ideal asset allocation plan. Commodities help in diversifying the investment portfolio. An investor can invest in raw materials in case you want to invest in stocks and bonds.

4. Transparency in the Process: Trading is a transparent process in. commodity futures that allows a fair price that is controlled by large-scale participation. It reflects different perspectives of a large number of people who deal with the commodity.

5. Profitable Returns: Commodities become riskier in the form of investments if the liquidity is high. This means that companies can experience both huge profits and heavy losses.

6. Cushioning against market fluctuations: Money requirement to buy commodity goods if the rupee becomes less valuable. During inflation, investors sell off stocks and bonds for investment in commodities. This leads to an increase in the prices of commodity goods.

7. Trading on Lower Margin: Traders can deposit 5 to 10% of the total contract value as a margin with the broker. This is less in comparison with other asset classes. Low margins allow individuals to invest and take larger positions at lesser capital.

Question 13. What is MCX? What are the Factors Influencing Commodity Prices in MCX?

Answer:

MCX:

The MCX was established in 2003 -g-Rd is headquartered in Mumbai. The exchange offers contracts for future delivery of a wide range of products, including:

1. Agricultural Products: Rice, Wheat, Soybean Oil, Soybean Meal, Cotton, Natural Gas, Crude Oil and Gold.

2. Metals; Aluminum, Copper, and Nickel.

3. Energy: Crude Oil and Natural Gas.

4. Currencies: South African Rand, Brazilian Real, and Mexican peso.

5. Softs: Coffee and Sugar.

Factors Influencing Commodity Prices: Commodity prices in MCX Trading, as well as other commodity markets, are subject to various influences. Here’s a simplified breakdown of the primary drivers:

1. Supply and Demand: At the core, it’s about balance. When demand for a commodity surpasses its supply, prices ascend. Conversely, when supply outpaces demand, prices decline. Think of it as the equilibrium of supply and demand in everyday life.

2. Weather Conditions: Nature wields significant influence, particularly in agricultural sectors. Droughts, floods, hurricanes, and other weather events can significantly impact crop yields. A prolonged drought, for instance, can devastate wheat crops, resulting in scarcity and higher wheat prices.

3. Geopolitical Events: Political instability and geopolitical conflicts in regions that produce commodities can disrupt supply chains. For instance, a civil war in a major oil-producing country can lead to reduced oil production and subsequent price hikes. Trade tensions between nations can also culminate in tariffs and restrictions affecting commodity flows.

4. Currency Movements: Commodities are often priced in currencies like the US dollar. Fluctuations in exchange rates can directly influence commodity prices. If the dollar strengthens against other currencies, it can elevate commodity costs for international buyers, potentially diminishing demand and causing price dips.

5. Economic Indicators: The broader economic landscape holds significance. A robust economy typically spurs demand for commodities as industries expand. Conversely, high inflation can erode currency values, rendering hard assets like commodities more appealing.

6. Technological Advancements: Technological progress can sway commodity prices. Innovations in production techniques can bolster supply. For instance, enhanced oil drilling methods can increase oil production, possibly prompting oil price reductions. Conversely, breakthroughs in renewable energy technologies can affect fossil fuel demand.

7. Speculation: Speculators and significant investors occasionally influence commodity prices through their trading activities. Their actions can generate short-term price swings when they anticipate impending price shifts.

Question 14. Define Trading. Write the Different Types of Trading.

Answer:

Trading

In simple terms, trading refers to the buying and selling of stocks, bonds, commodities, currencies, or other financial securities for a short period to earn profits. The main difference between trading and traditional investing is the former’s short-term approach compared to the long-term horizon of the latter.

- Trading is mostly prevalent in the stock market as numerous people buy and sell shares of listed entities. The price of these shares changes every second and a trader can pick a favourable direction to make a gain.

Types of stock trading: There are eight primary types of trading.

1. Day trading: It involves buying and selling stocks in a single day. If the trader buys shares for intraday trading, they should also sell those at the end of the trading session. Day trading is famous for capitalizing on small movements of the stock’s NAV value. Intraday trading is a relatively low risk since the trader holds the position for a short time. However, the risk can increase if the trade uses too much margin money.

2. Scalping: It is also called micro-trading because of the time involved in the trade. The trader will make several short-duration trades to reap small profits. The number of scalp trading can go from a few dozen to a hundred daily. Similar to day trading, scalp trading requires an understanding of technical analysis, market knowledge, proficiency, and awareness of price trends.

3. Swing trading: Swing traders capitalize on short-term market trends and patterns. In swing trading, a trade can last for a few days – from one day to seven days. It involves analyzing the short-term trends to gauge market patterns to execute the transaction.

4. Momentum trading: In the case of momentum trading, traders capitalize on the stock’s momentum; and select scrips that are either breaking out or will break out. Traders will base their trading decisions on the direction of the trend. For example, the trader will sell for a higher profit if the ongoing momentum is upward. Conversely, when the movement is downward, the trading strategy is to buy stocks at a lower price.

5. Delivery trading: it is the most prevalent trading style in the stock market and one of the most secure ways of investing. Delivery trading is a form of long-term trading where the investors buy stocks intending to hold onto them for some time. Delivery trading doesn’t allow the usage of margin. This type of trading requires investors to pay the total amount to acquire the stocks. Particular types of stock trading

6. Positional trading: Positional trading is a form of delivery trading called the buy-and-hold strategy. It requires traders to maintain their position for an extended period and ignore the slightest market movements. Positional trading yields profit when the trade waits for a significant period before selling off.

7. Fundamental trading: Traders use fundamental analysis of the company to find stocks. They pay special attention to events related to the company and its financial details. Fundamental traders hold their positions sufficiently long to allow the stock price to move significantly. The trading style is quite close to stock investment.

8. Technical trading: Unlike fundamental traders, technical trading focuses on price trend analysis. They use charts and data to time the market. The risk involved in technical trading is higher than positional or fundamental trading. Traders should have market knowledge and the ability to study charts and graphs for insights.

9. Arbitrage Trading: Arbitrage trading is a style that takes advantage of price differences in. two or more markets or exchanges. This is reserved only for prime trading firms with a huge network as this doesn’t need many analytical skills but needs more network speed.

Question 15. Write about Different Trading Systems prevailing in the Indian Stock Market.

Answer:

In the past, the trading on stock exchanges in India was based on an open outcry system. Under the system, brokers assemble at a central location usually the exchange trading ring, and trade with each other.

- This was time-consuming, and inefficient and imposed limits on trading volumes and trading hours. To provide efficiency, liquidity, and transparency, NSE introduced a nationwide online, fully automated screen-based trading system (SBTS).

Screen Based Trading System (SBTS):

- Under this system a trading member can punch into the computer, the number of securities and the prices at which he would like to transact. The transaction is executed as soon as it finds a matching sell or buy order from a counterparty.

- This system was readily accepted by market participants and in the very first year of its operation, NSE became the leading stock exchange in the country.

- Technology has been used to carry the trading platform from the trading hall of stock exchanges to the premises of brokers. NSE carried the trading platform further to the PCs at the residence of investors through the Internet. This made a huge difference in terms of equal access to investors in a geographically vast country like India.

- The trading system operates on a strict price-time priority. All orders received on the system are sorted with the best-priced order getting the priority for matching i.e., the best-buy orders match with the best-sell order. Similarly priced orders are sorted on a time priority basis, i.e. the one that came in early gets priority over the later one.

- Orders are matched automatically by the computer keeping the system transparent, objective, and fair. Where an order does not find a match, it remains in the system and is displayed to the whole market, til! a fresh order comes in or the earlier order is canceled or modified. The trading system provides tremendous flexibility to the users in terms of the kinds of orders that can be placed on the system.

- The trading system also provides complete market information online. The market screen at any point in time provides complete information on total order depth in a security, the five best buys and sells available in the market, the quantity traded during the day in that security, the high and the low, the last traded price, etc.

- Investors can also know the fate of the orders almost as soon as they are placed with the trading members. Thus, the National Exchange for Automated Trading (NEAT) system provides an Open Electronic Consolidated Limit Order Book (OECLOB).

- Limit orders are orders to buy or sell shares at a stated quantity and price. If the price-quantity conditions do not match, the limit order will not be executed. The term ‘limit order book’ refers to the fact that only limit orders are stored in the book and all market orders are crossed against the limit orders sitting in the book. Since the order book is visible to all market participants, it is termed as an ‘Open Book’.

- Advantages of the Screen-Based Trading System (SBTS): x It electronically matches orders on a strict price/time priority and hence cuts down on time, cost, and risk of error, as well as on fraud resulting in improved operational efficiency.

- It allows faster incorporation of price-sensitive information into prevailing prices, thus increasing the informational efficiency of markets.

- It enables market participants, irrespective of their geographical locations, to trade with one another simultaneously, improving the depth and liquidity of the market.

- It provides full anonymity by accepting orders, big or small, from members without revealing their identity, thus providing equal access to everybody.

- It also provides a perfect audit trail, which helps to resolve disputes by logging in the trade execution process in its entirety.

NEAT System:

- NSE is the first exchange in the world to use satellite communication technology for trading. Its trading system, called National Exchange for Automated Trading (NEAT), is a state-of-the-art client server-based application.

- At the server end, all trading information is stored in an in-memory database to achieve minimum response time and maximum system availability for users.

- It has an uptime record of 99.7%. For all trades entered into the NEAT system, there is uniform response time of less than one second. The NEAT system supports an order-driven market, wherein orders match based on time and price priority.

- All quantity fields are in units and prices are quoted in Indian Rupees. The regular lot size and tick size for various securities traded are notified by the Exchange from time to time.

Question 16. Explain about the Screen-based trading system.

Answer:

Screen-based trading system

Screen-based trading refers to the method of buying and selling financial instruments, such as stocks or derivatives, using computer screens and electronic trading platforms. This form of trading has largely replaced traditional open outcry or floor trading where traders physically gathered on a trading floor to conduct transactions.

Screen-Based Trading Process: Screen-based trading, also known as electronic trading, involves the use of electronic platforms to facilitate the buying and selling of financial instruments. Here’s a general overview of the process:

1. Order Placement: Traders log in to their trading accounts on an electronic trading platform provided by a brokerage or exchange. They enter details of the trade, such as the instrument, quantity, price, and order type (market, limit, etc.)

2. Order Routing: The trading platform receives the order and electronically routes it to the appropriate exchange or market where the instrument is listed.

3. Order Matching: At the exchange, the order is matched with opposing orders based on price and other parameters. This is typically done through an order book that displays the buy and sell orders in real-time.

4. Trade Execution: When a buy and a sell order match, a trade is executed. The exchange confirms the trade and updates the relevant parties’ accounts.

5. Confirmation: Traders receive electronic trade confirmations that provide details about the executed trade, including the price, quantity, and execution time.

6. Market Data: Traders have access to real-time market data, including bid and ask prices, historical price charts, -and. order book information. This data helps inform trading decisions.

7. Account Updates: The trader’s account balance, holdings, and trade history are automatically updated in real-time based on executed trades.

Merits of Screen-Based Trading:

1. Efficiency: Screen-based trading is faster and more efficient than traditional open outcry methods. Orders can be placed and executed quickly, reducing the time it takes to complete a trade.

2. Accessibility: Traders can participate from anywhere with an internet connection, democratizing access to financial markets. This eliminates the need for physical presence on trading floors.

3. Transparency: The electronic platform provides real-time access to market data and trade executions. This transparency allows traders to make informed decisions based on current market conditions.

4. Reduced Costs: Electronic trading often has lower transaction costs compared to traditional methods. Fewer intermediaries are involved, leading to reduced brokerage fees and other charges.

5. Global Reach: Traders can access various markets and exchanges around the world from a single platform, enabling diversification and the ability to trade different financial instruments.

6. Automation: Screen-based trading enables the use of algorithmic trading strategies and automated systems. Traders can program rules for order execution and risk management.

7. Reduced Errors: Automation minimizes the potential for human errors that can occur in manual trading, leading to more accurate order placements and executions.

8. Market Data and Analysis: Electronic platforms offer advanced tools for market analysis, charting, technical indicators, and research, aiding informed decision-making.

9. Flexibility: Traders can place orders and manage portfolios at any time, including outside regular trading hours, accommodating different schedules.

10. Scalability: Online trading systems can handle a large number of orders simultaneously, allowing traders to scale up their activities efficiently.

11. Reduced Market Impact: Electronic trading can help reduce the market impact of large trades, as orders can be executed more discreetly through algorithms.

12. Quick Information Access: Traders can quickly access news, announcements, and relevant information that may impact their trading decisions, facilitating timely responses.

Question 17. Elucidate the Internet-Based Trading System.

Answer:

The Internet-Based Trading System

Internet-based trading systems in stock exchanges refer to platforms that allow investors to trade stocks and other financial instruments online through the Internet.

- These systems have revolutionized the way investors participate in the stock market by providing them with convenient access to trading and market information.

- In India, various stock exchanges, such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), offer internet-based trading platforms through registered brokers. These platforms allow investors to buy and sell stocks and other financial instruments online.

Key Steps in Internet-Based Stock Trading in India:

1. Opening an Account: Investors need to open a trading and demat account with a registered stockbroker. The trading account enables trading, while the Demat account holds securities in electronic form.

2. Access to Trading Platform: Once the account is opened and verified, investors are provided with login credentials to access the online trading platform provided by their chosen broker.

3. Placing Orders: Investors log in to the trading platform and enter their buy or sell orders. They specify the stock, quantity, price, and order type.

4. Order Execution: The trading platform sends the order to the stock exchange’s electronic trading system. The order is matched with existing orders on the exchange, and if conditions are met, the trade is executed.

5. Real-Time Information: Investors have access to real-time market data, stock prices, bid-ask spreads, historical charts, and news updates through the trading platform.

6. Confirmation and Settlement: After a trade is executed, investors receive immediate electronic trade confirmations. Settlement of funds and transfer of shares occurs through the demat and trading accounts.

7. Portfolio Management: investors can monitor their investment portfolios, review trade history, and track overall performance through the trading platform.

8. Research and Analysis: Many online trading platforms provide research tools, technical analysis, and market reports to aid investors in making informed decisions.

9. Security Measures: Security features such as two-factor authentication, encryption, and secure login protocols are commonly implemented to protect investors’ accounts and data.

10. Market Alerts and Notifications: Investors can set up alerts and notifications to receive updates on price movements, news, and other market events.

11. Customer Support: Online brokers offer customer support to assist investors with technical issues, trading-related inquiries, and account management.

12. Regulatory Compliance: Internet-based stock trading in India is regulated by the Securities and Exchange Board of India (SEBI), ensuring that brokers and platforms adhere to established rules and regulations.

Question 18. What is Dematerialisation? Write its process, benefits, and problems.

Answer:

Dematerialisation:

Dematerialisation is a process through which physical securities such as share certificates and other documents are converted into electronic format and held in a Demat Account.

Process of dematerialization:

- Dematerialization starts with opening a Demat account. For Demat account opening, you need to shortlist a Depository Participant (DP) that offers Demat services

- To convert the physical shares into an electronic/Demat form, a Dematerialization Request Form (DRF), which is available with the Depository Participant (DP), has to be filled in and deposited along with share certificates. On each share certificate, ‘Surrendered for Dematerialization’ needs to be mentioned

- The DP needs to process this request along with the share certificates to the company and simultaneously to registrars and transfer agents through the depository

- Once the request is approved, the share certificates in the physical form will be destroyed and confirmation of dematerialization will be sent to the depository

- The depository will then confirm the dematerialization of shares to the DP. Once this is done, a credit in the holding of shares will be reflected in the investor’s account electronically

- This cycle takes about 15 to 30 days from the submission of the dematerialization request

- Dematerialization is possible only with a Demat account, therefore it is essential to learn how to open a Demat account to understand dematerialization

Benefits of dematerialization: There is a wide range of benefits of the dematerialization of securities. Some of them are as follows:

1. Reduction of Paperwork: Dematerialization eliminates the need for physical certificates, reducing the paperwork associated with traditional securities trading. This streamlines administrative processes, making them efficient and cost-effective.

2. Risk Reduction: Physical securities are susceptible to loss, theft, or damage. Dematerialization eliminates these risks as securities exist in electronic form, stored in a central depository, reducing the chances of fraud or mishandling.

3. Faster Settlement: Electronic trading and dematerialization facilitate quicker settlement of transactions. The settlement process is expedited as there is no physical movement of certificates, reducing the time required for the transfer of ownership.

4. Cost Savings: Dematerialization leads to cost savings for both investors and issuers. It reduces the expenses associated with printing, handling, and transporting physical certificates. Additionally, the overall transaction costs are lowered due to increased efficiency.

5. Increased Liquidity: Electronic trading platforms and dematerialization enhance market liquidity by providing a faster and more accessible means of buying and selling securities. This can attract more investors and contribute to a more dynamic market.

6. Easy Accessibility: Investors can access their dematerialized securities portfolio easily through online platforms. This accessibility enhances transparency and allows investors to manage their holdings more efficiently.

7. Automatic Corporate Actions: Dematerialization facilitates the automatic processing of corporate actions such as dividends, bonus issues, and rights offerings. This ensures that investors receive their entitlements in a timely and accurate manner.

8. Global Accessibility: Dematerialization allows investors to access and trade securities from anywhere in the world through electronic trading platforms, promoting global investment opportunities and diversification.

9. Efficient Record Keeping: Electronic records in dematerialized form are easier to maintain and retrieve. This enhances the accuracy and efficiency of record-keeping for both investors and financial institutions.

10. Reduced Frauds: The electronic nature of dematerialized securities reduces the risk of fraud and unauthorized activities. The secure systems and processes implemented in electronic trading platforms and depositories enhance the overall security of transactions.

Problems with dematerialization:

1. Technological Risks: Dematerialization relies heavily on technology. Any glitches, system failures, or cyber-attacks on the electronic infrastructure could disrupt the functioning of the dematerialization process, leading to potential risks for investors.

2. Dependence on Internet Connectivity: The accessibility and management of Demat accounts are dependent on Internet connectivity. In regions with unreliable or limited internet access, investors may face difficulties in executing transactions or accessing their accounts.

3. Costs for Small investors: While dematerialization reduces overall costs, small investors might find the charges associated with maintaining a Demat account and transaction fees relatively high compared to the value of their investments.

4. Lack of Awareness: Some investors, particularly in less developed or rural areas, may lack awareness or understanding of dematerialization. This can result in resistance to the transition from physical to electronic securities.

5. Physical Certificates for Unlisted Securities: In some cases, unlisted or privately issued securities may still be in physical form. Investors holding such securities may face challenges in dematerializing them, as the process is more straightforward for securities listed on recognized stock exchanges.

6. Risk of Unauthorized Access: Given the electronic nature of Demat accounts, there is a potential, risk of unauthorized access or hacking. Investors and service providers need to implement robust security measures to protect sensitive financial information.

Question 19. What do you mean by Demat Account? Write the features and Benefits of the Demat Account.

Answer:

Demat Account

The Demat full form stands for a Dematerialised Account. Demat is a form of an online portfolio that holds a customer’s shares and other securities.

- A Demat account is used to hold shares and securities in an electronic (dematerialized) format. These accounts can also be used to create a portfolio of one’s bonds, ETFs, mutual funds, and similar stock market assets.

- Demat trading was first introduced in India in 1996 for NSE transactions. As per SEBI regulations, all shares and debentures of listed companies have to be dematerialized to carry out transactions in any stock exchange from 31st March 2019.

Features of Demat Account:

1. Easy Share Transfers: When buying or selling shares, investors can transfer their holdings quickly using an electronic Delivery Instruction Slip (e-DIS). Users can include all the information necessary for a transaction to go smoothly on these slips.

2. Freezing Demat Accounts: Owners of Demat accounts have the option, if necessary, to temporarily freeze their accounts. If one wants to stop unauthorized debits or credits from being made to a Demat account, this option may be helpful. The option to freeze securities held in the account up to a certain amount is also accessible.

3. Pledging Facility To Avail Loan: Several brokers offer loans secured by securities that the borrowers have in their Demat accounts. The account holders utilize these holdings as security when applying for loans.

4. Speed E-Facility; Users can send instruction slips electronically through the National Securities Depository Limited rather than handing them in to the DP. As a result, the process is quicker and more convenient.

5. Multiple Accessing Options: Demat accounts can be accessed in a variety of ways because they are managed electronically. Using a computer, smartphone, or other smart device connected to the Internet, User can access these accounts.

6. Corporate Benefits & Actions: The owners of Demat accounts are automatically eligible for any dividends, credits, or interest that the corporations offer to their investors. Additionally, all shareholders’ Demat accounts are automatically updated with information regarding company actions such as bonus issuance, right shares, or stock splits.

Benefits of Demat Account:

1. Easy Holding: Physical share certificate maintenance is a laborious task. Additionally, monitoring their performance is an additional duty. Holders of Demat accounts often find it easier to hold and manage all of their investments in a single account.

2. Lower Risks: Due to losses, thefts, or damages, trading physical certificates is dangerous. Additional dangers include phony securities and faulty deliveries. By establishing a Demat account, holders have the option of keeping all of their investments in electronic form, eliminating these dangers.

3. Reduced Costs: Physical certificates came with several extra expenditures, including stamp duty, handling fees, and other such charges. These extra charges are nullified with a Demat account.

4. Odd Lots: Before Dematerialisation, buying and selling of only fixed quantities was allowed. This presented a problem of odd lots. Demat accounts have resolved this problem.

5. Reduced Time: The time needed to complete a transaction has decreased as a result of the absence of documentation. The account holder can buy and sell securities more quickly and effectively thanks to Demat accounts.

Question 20. Discuss about clearing and settlement process prevailing in the Indian Stock Market.

Answer:

The clearing process involves the determination of what the counterparties owe, and which counterparties are due to receive on the settlement date, following which the obligations are discharged by settlement.

- The clearing and settlement process involves three main activities clearing, settlement, and risk management.

The core processes involved in clearing and settlement include:

1. Trade Recording: The key details about the trades are recorded to provide the basis for settlement. These details are automatically recorded in the electronic trading system of the exchanges.

2. Trade Confirmation: Trades that are meant for settlement by the custodians are indicated with a custodian participant code, and the same is subject to confirmation by the respective custodian. The custodian is required to confirm the settlement of these trades on T+l day by the cut-off time of 1:00 pm.

3. Determination of Obligation: The next step is the determination of what the counterparties owe, and what the counterparties are due to receive on the settlement date.

- The NSCCL interposes itself as a central counterparty between the counterparties to trade and net the positions so that a member has a security-wise net obligation to receive or deliver a security, and has to either pay or receive funds.

- The settlement process begins as soon as the members’ obligations are determined through the clearing process. The settlement process is carried out by the clearing corporation with the help of clearing banks and depositories. The clearing corporation provides a major link between the clearing banks and the depositories.

- This link ensures the actual movement of funds as well as securities on the prescribed pay-in and pay-out day.

4. Pay-in of Funds and Securities: This requires the members to bring in their funds/securities to the clearing corporation. The CMs make the securities available in the designated accounts with the two depositories (the CM pool account in the case of the NSDL, and the designated settlement accounts in the case of CDSL).

- The depositories move the securities available in the poo! accounts to the pool account of the clearing corporation. Likewise, the CMs with funds obligations make the funds available in the designated accounts with the clearing banks.

- The clearing corporation sends electronic instructions to the clearing banks to debit the designated CMs’ accounts to the extent of the payment obligations.

- The banks process these instructions, debit the accounts of the CMs, and credit the accounts of the clearing corporation. This constitutes the pay-in of funds and securities.

5. Pay-out of Funds and Securities: After processing for shortages of funds/securities and arranging for the movement of funds from surplus banks to deficit banks through RBI clearing, the clearing corporation sends electronic instructions to the depositories/clearing banks to release the pay-out of securities/funds.

- The depositories and clearing banks debit the accounts of the clearing corporation and credit the accounts of CMs. This constitutes the payout of funds and securities.

Question 21. Write about Different Types of Settlements in the Security Market.

Answer:

Trade settlement is a two-way process that comes in the final stage of the transaction. Once the buyer receives the securities and the seller gets the payment for the same, the trade is said to be settled.

- While the official deal happens on the transaction date, the settlement date is when the final ownership is transferred.

- The transaction date never changes and is represented with the letter T. The final settlement does not necessarily occur on the same day. The settlement day is generally T+2.

Different types of Settlements: There are types of settlements in the stock market. Settlement is the final stage related to a trade order and can be categorized as follows:

- Spot Settlement; A spot settlement allows for a trade settlement immediately following the T+2 rolling settlement principal.

- Forward Settlement: A forward settlement might be used to settle a trade in the future on T+5 or T+7.

Rolling settlement: A rolling settlement is one in which the settlement is made in the successive days of the trade. In a rolling settlement, trades are settled on T+l day, which means deals are settled by the second working day.

- This excludes Saturdays and Sundays, bank holidays, and exchange holidays. So, if a trade is conducted on a Wednesday, it will be settled by Friday.

- The settlement day is essential for those investors who are looking to earn dividends. If the buyer wishes to receive a dividend from the company, then he must settle the trade before the record date for a profit.

Rolling settlement rules in BSE:

- In the Bombay Stock Exchange (BSE), securities in the equity segment are all settled in T+2 days.

- Government securities and fixed-income securities for retail investors are also settled in T+2 days.

- Pay-in and pay-out of monies and securities need to be completed on the same day.

- The delivery of securities and payment by the client has to be done within one working day after the BSE completes the payout of the funds and securities. the accounts of the clearing corporation and credit the accounts of CMs. This constitutes the payout of funds and securities.

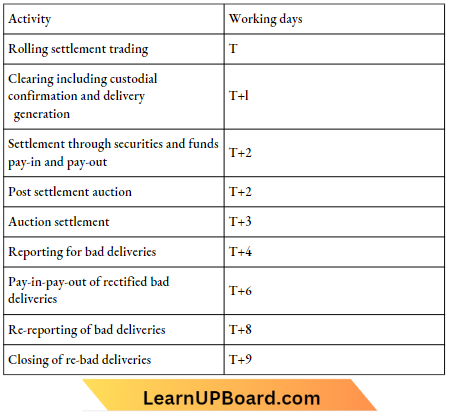

Settlement cycle on the NSE: The cycle for rolling settlements on the National Stok Exchange (NSE) is given below

Question 22. What is an auction? How it is initiated?

Answer:

Auction:

Auctions are initiated by the Exchange on behalf of trading members for settlement-related reasons. The main reasons are Shortages, Bad Deliveries, and Objections. There are three types of participants in the auction market.

- Initiator: The party who initiates the auction process is called an initiator.

- Competitor: The party who enters on the same side as the initiator is called a competitor.

- Solicitor: The party who enters on the opposite side as of the initiator is called a solicitor.

- The trading members can participate in the exchange-initiated auctions by entering orders as a solicitors. For Example. If the Exchange conducts a Buy-In auction, the trading members entering sell orders are called solicitors.

- When the auction starts, the competitor period for that auction also starts. Competitor period is the period during which competitor order entries are allowed.

- Competitor orders are the orders which compete with the initiator’s order i.e. if the initiator’s order is a buy order, then all the buy orders for that auction other than the initiator’s order are competitor orders.

- And if the initiator order is a sell order then all the sell orders for that auction other than the initiators order are competitor orders.

- After the competitor period ends, the solicitor period for that auction starts. The solicitor period is the period during which solicitor order entries are allowed. Solicitor orders are the orders which are opposite to the initiator order i.e. if the initiator order is a buy order, then all the sell orders for that auction are solicitor orders and if the initiator order is a sell order, then all the buy orders for that auction are solicitor orders.

- After the solicitor period, order matching takes place. The system calculates trading price for the auction and all possible trades for the auction are generated at the calculated trading price. After this, the auction is said to be complete. The competitor period and solicitor period for any auction are set by the Exchange.

- Auction Market (AU) Orders: The term AU stands for Auction in which orders are entered for Auction Market. Auctions are initiated by the Exchange on behalf of trading members for settlement-related reasons. The main reasons are Shortages, Bad Deliveries, and Objections.

- The auction period is initiated from 12:00 P.M. to 12:30 P.M. The matching process for auction orders in this book is initiated only at the end of the auction period. The auction ending period is between 12:30 P.M. and 1:00 P.M.

- Entering Auction Orders: Auction order entry allows the user to enter orders into auctions that are currently running. To view the information about currently running auctions invoke the ‘Auction Enquiry’ screen.

- The user can do an auction order entry by entering ‘AU’ in the book type of the order entry screen. Symbol and Series that are currently selected in any of the market information windows (i.e. MW) provides the defaults in the auction order entry screen.

- Auction Order Modification: The user is not allowed to modify any auction orders.

- Auction Order Cancellation: The user can cancel any solicitor order placed by him in any auction provided the solicitor period for that auction is not over.

- The order cancellation procedure is similar to that of the normal market. The user can also use the quick order cancellation key to cancel his outstanding auction orders.

- Auction Order Matching: When the ‘solicitor period’ for an auction is over, auction order matching, starts for that auction. During this process, the system calculates the trading price for the auction based on the initiator order and the orders entered during the competitor and the solicitor period.

- At present for exchange-initiated auctions, the matching takes place at the respective solicitor order prices.

- Example: Auction is held in XYZ for 5,000 shares. The closing price of XYZ on that day was RS. 155. The last traded price of XYZ on that day was Rs.150.

- The price of XYZ last Friday was RS. 151. The previous day’s close price of XYZ was RS. 160. What is the maximum allowable price at which the member can put a sell order in the auction for XYZ? (The price band applicable for the auction market is +/- 20%)

- Maximum price applicable in auction = Previous day’s close price x (100+price band) = RS. 160×1.20 = RS. 192

- Minimum price applicable in auction = Previous day’s close price x (100-price band)

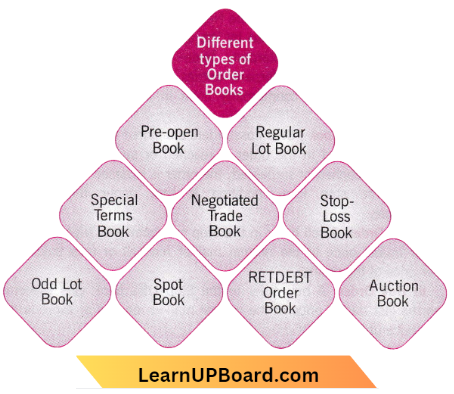

Question 23. Write about different types of Order Books.

Answer:

As and when valid orders are entered or received by the trading system, they are first numbered, time-stamped, and then scanned for a potential match.

- This means that each order has a distinctive order number and a unique time stamp on it. If a match is not found, then the orders are stored in the books as per the price/time priority.

- Price priority means that if two orders are entered into the system, the order having the best price gets the higher priority.

- Time priority means if two orders having the same price are entered, the order that is entered first gets the higher priority. The best price for a sell order is the lowest price and for a buy order, it is the highest price.

The different order books in the NEAT system are as detailed below:

1. Pre-open Book: An order during the Preopen session has to be a Preopen (PO) order. All the Preopen orders are stacked in the system till the Preopen phase. At the end of the Pre-open phase, the matching of Pre-open orders takes place at the Final Opening Price.

- By default, the Preopen (PO) book appears in the order entry screen when the Normal Market is in Preopen and the security is eligible for Preopen Session. Order entry in open book type is allowed only during market status is in pre-open.

2. Regular Lot Book: An order that has no special condition associated with it is a Regular Lot order. When a dealer places this order, the system looks for a corresponding Regular Lot order existing in that market (Passive orders).

- If it does not find a match at the time it enters the system, the order is stacked in the Regular Lot book as a passive order. By default, the Regular Lot book appears in the order entry screen in the normal market. The Regular Lot Book contains all regular lot orders that have none of the following attributes attached to them.

- All or None (AON)

- Minimum Fill (MF)

- Stop Loss (SL)

3. Special Terms Book: Orders that have a special term attribute attached to them are known as special terms orders. When a special term order enters the system, it scans the orders existing in the Regular Lot book as well as the Special Terms Book. Currently, this facility is not available in the trading system. The Special Terms book contains all orders that have either of the following terms attached:

- All or None (AON)

- Minimum Fill (MF)

4. Negotiated Trade Book: The Negotiated. The trade book contains all negotiated order entries captured by the system before they have been matched against their counterparty trade entries. These entries are matched with identical counterparty entries only. It is to be noted that these entries contain a counterparty code in addition to other order details.