B.Com Stock Market Essay Questions And Answers

Question 1. What are Securities markets? Write the features of Securities markets.

Answer:

Securities markets

Securities markets are markets in financial assets or instruments and these are represented as I.O.Us (I owe you) in financial form. These are issued by business organizations, corporate units, and the Governments, Central or State. Public sector undertakings also issue these securities. These securities are used to finance their investment and current expenditures. These are thus sources of funds for the issues.

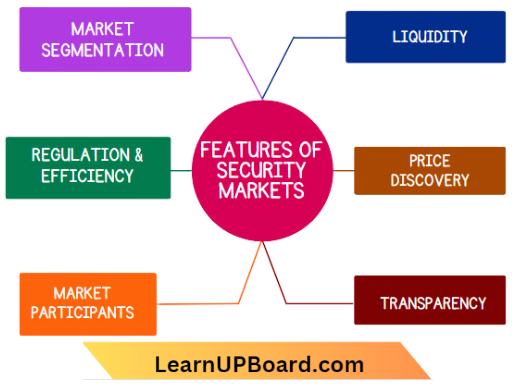

Features Of Securities Markets:

These are thus sources of funds to the issuers. Features of Securities Markets:

1. Liquidity: Security markets offer varying degrees of liquidity, indicating how easily an asset can be bought or sold without significantly affecting its price. Highly liquid markets have many participants and tight bid-ask spreads, making it easier to execute trades quickly.

2. Price Discovery: Security markets provide a mechanism for determining the fair market price of assets. Prices are determined by the interactions of buyers and sellers based on supply and demand dynamics, as well as other market-related information.

3. Transparency: Modern security markets emphasize transparency by providing real-time pricing information, trading volumes, and other relevant data to market participants. This transparency ensures that investors have access to the information needed to make informed decisions.

4. Efficiency: Efficient markets quickly and accurately reflect all available information in asset prices. Efficient markets react rapidly to new information, making it difficult for participants to consistently outperform the market through trading strategies that rely solely on public information.

5. Market Participants: Security markets include a diverse array of participants, including individual investors, institutional investors (such as mutual funds and pension funds), traders, market makers, and speculators. Each participant type has distinct objectives and strategies.

6. Regulation: Security markets are often subject to government regulations and oversight to ensure fair practices, prevent fraud, and maintain market integrity. Regulatory bodies enforce rules that govern market operations, disclosure, and investor protection.

7. Market Segmentation: Security markets can be categorized based on factors like asset type, location (domestic or international), and trading platform (exchange-traded markets or over-the-counter markets). This segmentation allows investors to access markets that align with their investment preferences.

8. Risk and Return: Security markets are inherently tied to the concept of risk and return. Different types of securities offer varying levels of risk and potential returns, influencing investor decisions based on their risk tolerance and investment goals.

Question 2. What is a Capital Market? Describe the different types of Capital Markets.

Answer:

Capital Market Definition

A Capital Market may be defined as a market dealing in medium and long-term funds. It is an institutional arrangement for borrowing medium and long-term funds and provides facilities for marketing and trading of securities.

- So it constitutes all long-term borrowings from banks and financial institutions, borrowings from foreign markets, and raising of capital by issuing various securities such as shares debentures, bonds, etc.

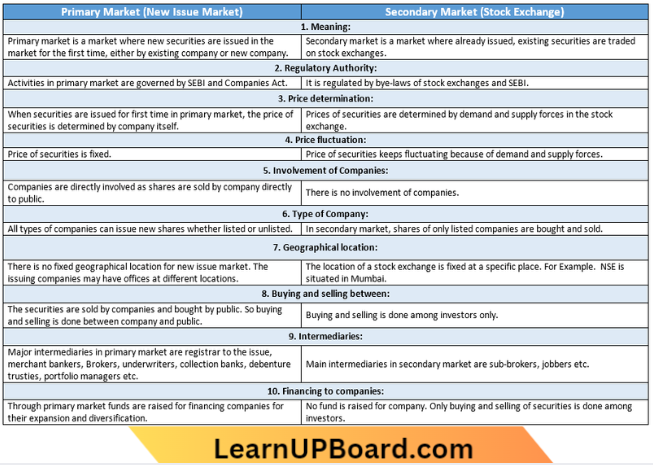

- The market where securities are traded is known as the Securities market. It consists of two different segments namely primary and secondary market. The primary market deals with new or fresh issues of securities and is, therefore, also known as a new issue market; whereas the secondary market provides a place for the purchase and sale of existing securities and is often termed a stock market or stock exchange.

Types of Capital Market

1. Primary Market: The primary market is also known as the new issue market. In this market, securities are sold for the first time i.e. new securities are issued from the company. Primary market companies go directly to investors and utilize these funds for investment in buildings, plants machinery, etc.

- The primary market does not include finance in the form of loans from financial institutions because when the loan is issued from financial institutions it implies converting private capital into public capital and this process is called going public.

- The common securities issued in the primary market are equity shares, debentures, bonds, preference shares, and other innovative securities.

2. Secondary Market (Stock Exchange): The secondary market is the market for the sale and purchase of previously issued or second-hand securities. In the secondary market, securities are not directly issued by the company to investors. The securities are sold by existing investors to other investors.

- In the secondary market companies get additional capital as securities are bought and sold between investors only so directly there is no capital formation but the secondary market indirectly contributes to capital formation by providing liquidity to the securities of the company.

Question 3. Explain the role (OR) Significance of the Capital Market in economic development.

Answer:

The role (OR) Significance of the Capital Market in economic development

The capital market has a crucial significance to capital formation. Adequate capital formation is indispensable for speedy economic development.

- The main function of the capital market is the collection of savings and their distribution for industrial development. This stimulates capital formation and hence, accelerates the process of economic development.

- A sound and efficient capital market facilitates the process of capital formation and thus contributes to economic development. The significance of the capital market in economic development is explained below.

1. Mobilisation of Savings: The capital market is an organized institutional network of financial organizations, which not only mobilizes savings through various instruments but also channelizes them into productive avenues. By making available various types of financial assets, the capital market encourages savings.

- By providing liquidity to these financial assets through the secondary markets capital market can mobilize large amounts of savings from various sections of the people such as individuals, families, and associations.

- Thus, the capital market mobilizes these savings and makes the same available for meeting the large capital needs of industry, trade, and business.

2. Channelization of Funds into Investments: The capital market plays a crucial role in economic development by channelizing funds by development priorities. The financial intermediaries in the capital market are better placed than individuals to channel the funds into investments that are more favorable for economic development.

3. Industrial Development: The capital market contributes to industrial development in the following ways:

- It provides adequate, cheap, and diversified finance to the industrial sector for various purposes.

- It provides funds for diversified purposes such as expansion, modernization, upgradation of technology, establishment of new units, etc.

- It provides a variety of services to entrepreneurs such as provision of underwriting facilities, participating in equity capital, credit rating, consultancy services, etc. This helps to stimulate industrial entrepreneurship.

4. Modernization and Rehabilitation of Industries: The capital market can contribute towards modernization, rationalization, and rehabilitation of industries. For example, the setting up of development financial institutions in India such as IFCI, ICICI, IDBI, and so on has helped the existing industries in the country to adopt modernization and replacement of obsolete machinery by providing adequate finance.

5. Technical Assistance: An important bottleneck faced by entrepreneurs in developing countries is technical assistance. By offering advisory services relating to the preparation of feasibility reports, identifying growth potential, and training entrepreneurs in project management, the financial intermediaries in the capital market play an important role in stimulating industrial entrepreneurship. This helps to stimulate industrial investment and thus promotes economic development.

6. Encourage Investors to Invest in Industrial Securities: Secondary markets in securities encourage investors to invest in industrial securities by making them liquid. It provides facilities for continuous, regular, and ready buying and selling of securities. Thus, industries can raise substantial amounts of funds from various segments of the economy.

7. Reliable Guide to Performance: The capital market serves as a reliable guide to the performance and financial position of corporations, and thereby promotes efficiency. It values companies accurately and toes up manager compensation to stock values. This gives incentives to managers to maximize the value of companies. This stimulates efficient resource allocation and growth.

Question 4. Define Primary Market. Write its features and functions.

Answer:

Primary Market

The primary market is a segment of the capital market’ where entities such as companies, governments, and other institutions obtain funds through the sale of debt and equity-based securities.

- When a company decides to go public for the first time by raising an Initial Public Offering (IPO), it is done in the primary market. Since the securities are sold for the first time here, a primary market is also known as the New Issue Market (NIM).

Features of Primary Market:

- It is a new source of procuring long-term capital.

- Securities are brought for the first time in the market.

- Also termed as the New Issue Market (NIM).

- The investors directly deal with new securities.

- Investors are issued the security certificates after the trading takes place.

- Securities are issued by the new companies or the existing ones looking for their expansion.

- The economy experiences capital formation.

- Fixed assets are purchased from the procured funds in this market.

- Those loans from financial institutions that are of a long-term nature are not considered in this market.

- Under this, the private capital is converted into public capital.

Functions of the primary market:

Some of the main functions of the primary market are:

1. New issue offer: The primary market facilitates a new issue offer that has not previously been traded on any stock exchange. So it is called a new issue market. However, a new issue offer is not an easy task. It involves a complete evaluation of a project’s feasibility.

- For instance, financial arrangements must include liquidity ratio, debt-equity ratio, promoters equity, and foreign exchange demand.

2. Underwriting services: Underwriting is critical for a company which is launching a new issue offer where the underwriter must purchase all unsold shares if the company cannot sell the requisite shares to the public.

- Many financial institutions play the role of underwriters and earn commissions. Investors fall back on underwriters to determine if taking up the risk is worth the return. Sometimes underwriters buy the entire IPO issue and then sell it to the investors.

3. Distribution of New Issue: The primary market has another vital function. The distribution process is initiated through a new prospectus issue. Moreover, the general public is invited to purchase the new issue, and thorough information is given about the company, the issue, and the underwriters.

Question 5. Explain the advantages and disadvantages of the Primary Market.

Answer:

The primary market is the place where securities are created. Companies float (in finance lingo) new stocks and bonds in this market for the first time.

Advantages of Primary Market:

A few of the major advantages of the primary market are as follows:

1. Raising of Funds: A company can easily raise funds from this segment of the market. The new issues are most of the time capable of raising funds from the dull market if they are priced adequately. Investment in the equity component leads to the economic development of the nation.

2. Safety: There is not much manipulation of the prices. So investing in the primary market is considered a safe option.

3. Attractive Scheme: No taxes like service tax, securities transaction tax, and stamp duty are leviable in the primary market, thereby making it attractive.

4. Opportunity for Existing and New Companies: A company can either set up a new business or diversify the existing one. Both companies have the opportunity to raise funds from the market by new issues. Voluntary investors transfer their savings to the companies that need the funds.

5. Long-Term Requirements: The long-term requirements of the companies are satisfied by raising money from prospective investors.

6. Good Returns: Apart from the routine investment opportunities, the investors are provided with new options with better returns in terms of dividends and long-term appreciation.

7. Attracting Small Investors: It does not necessarily require big corporate investors. The savings of the small investors can be mobilized.

8. Setting up New Business: Those entities who are the new entrants also find the primary market quite attractive to raise funds and satisfy their requirements.

Disadvantages of the Primary Market:

The following are the disadvantages of the primary market:

1. Slackness in the Economy: The general depression in the market in the late nineties did not encourage fresh issues much. The main reason behind the economic slowdown was the poor performance of the industry. Investors feel reluctant if there is a poor response in the economy.

2. Reduced Fund Requirement: The reduction in demand for funds by the industries also hampers the confidence of the investors. A substantial reduction is noticed in the number of IPOs that are being offered to the public. As a result, the public has already made its own alternatives.

3. Sluggish Capital Market: Whenever the market faces depression, the growth of the market is likely to be affected. This also influences the poor response of the investors towards primary market investments.

4. Private Placement: Reduction in the issue cost and other allied costs took the company towards offering the shares by way of private placement. The majority of the time, the investors were unaware of any new issue coming and that led to ignorance in this type of market.

5. Re-Structuring of Business: Cases of amalgamations and mergers were constantly reported as a result of globalization that took place in the nineties. That further boosted the concept of re-structuring among the corporates and they began to reorganize their businesses.

Question 6. Elucidate the Intermediaries in the New Issue Market/ Primary Market.

Answer:

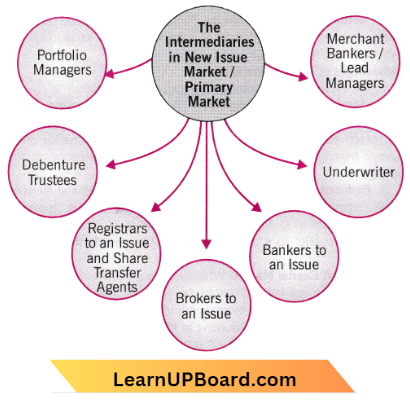

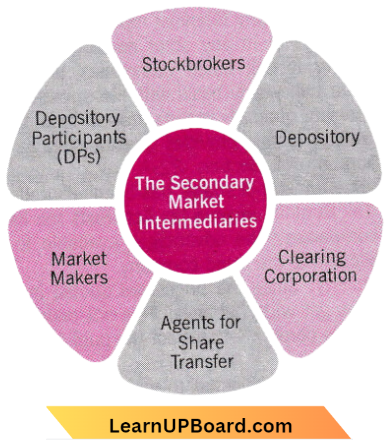

Several intermediaries carry out activities of different natures in the new issue market. The intermediaries include:

1. Merchant Bankers/Lead Managers: The intermediaries in the stock market who are responsible for public issues management are known as ‘merchant bankers’ or lead managers.

Merchant bankers require compulsory registration with the SEBI to carry out their activities. Previously there were four categories of merchant bankers, depending on their activities. Now, since Dec. 1997, there is only one category of registered merchant banker and they perform all activities.

2. Underwriter: A set all institutions and agencies that provide a commitment to take up the issue of securities in the event of a failure of the issue to get full subscription from the public, are known as ‘underwriters’.

- They are compensated for their services by payment of commission as agreed upon between the issuing company and the underwriters and subject to the ceiling under the Companies Act. Brokers, Investment companies, Commercial Banks, and term lending institutions provide underwriting services.

- To act as an underwriter, a certificate of registration must be obtained from SEBI. On application, registration is granted to eligible body corporations with adequate infrastructure to support the business and with a net worth of not less than Rs. 20 lakhs.

3. Bankers to an Issue: Bankers who are engaged in the function of acceptance of applications for shares and debentures along with application money from investors in respect of the issue of securities and also a refund of application money to the applicants to whom securities could not be allotted, are called ‘bankers to an issue’. They play an important role in the working of the primary market.

- To carry on the activity as a banker, a person must obtain a certificate of registration from the SEBI. The applicant should be a scheduled bank. Every banker to an issue had to pay the SEBI annually! free for Rs. 5 lakh and a renewal fee of Rs. 2.5 lakh every three years from the fourth year from the date of initial registration. Nonpayment of the prescribed fee may lead to the suspension of the registration certificate.

4. Brokers to an Issue: Intermediaries that are responsible for procuring the subscription to the issue from the prospective investors are called ‘brokers to the issue’. They provide a vital connecting link between the prospective investors and the issuer. They assist in the speedy subscription of issues by the public. Appointment of brokers is however not compulsory.

- The brokerage applicable to all types of public issues of industrial securities is fixed at 1.5%, whether the issue is underwritten or not. The. listed companies are allowed to pay a brokerage on private placement of capital at a maximum rate of 0.5%.

5. Registrars to an Issue and Share Transfer Agents: Registrar and transfer agent are the two categories of intermediaries who actively participate in the new issue activity of a company.

- The Registrar performs the functions of collecting applications from prospective investors, keeping a record of the applications and money received from the investors, assisting the issuing company in the determination of the basis of allotment of securities, processing, and dispatching of allotment letters and refund orders, share and debenture certificates and other documents related to the issue and acting as Depository Participants (DPs).

- Transfer Agent, on the other hand, carries out the activities, such as maintaining the records of holders of securities of the company for and on behalf of the company, handling all matters relating to the transfer and redemption of securities of the company, and acting as Depository Participants (DPs).

6. Debenture Trustees: Trustees who are appointed to safeguard the interests of debenture holders are called ‘debenture trustees’. They are to be appointed before the issue of debentures by a company. No person can act as a debenture trustee unless a certificate of registration has been obtained from SEBI for the purpose.

7. Portfolio Managers: Portfolio managers are defined as persons who in pursuance of a contract with clients, advise, direct, and undertake on their behalf the management/ administration of a portfolio of securities/ funds of clients. The term portfolio means the total securities belonging to any person. Portfolio management can be

- Non-discretionary. The first type of portfolio management permits the exercise of discretion regarding the investment/management of the portfolio of securities/funds.

- To carry on portfolio services, a certificate of registration from SEBI is mandatory. The certificate of registration for portfolio management services is granted to eligible applicants on payment of Rs.5 lakh as a registration fee. Renewal may be granted by SEBI on payment of Rs. 2.5 lakh as renewal fee (every three years).

Question 7. Explain the Role of Primary Market.

Answer:

The primary market is also known as the new issues market. It deals with new securities being issued for the first time.

- The essential function of a primary market is to facilitate the transfer of investible funds from savers to entrepreneurs seeking to establish new enterprises or to expand existing ones through the issue of securities for the first time.

- The investors in this market are banks, financial institutions, insurance companies, mutual funds, and individuals.

- A company can raise capital through the primary market in the form of equity shares, preference shares, debentures, loans, and deposits. Funds raised may be for setting up new projects, expansion, diversification, modernization of existing projects, mergers and takeovers, etc.

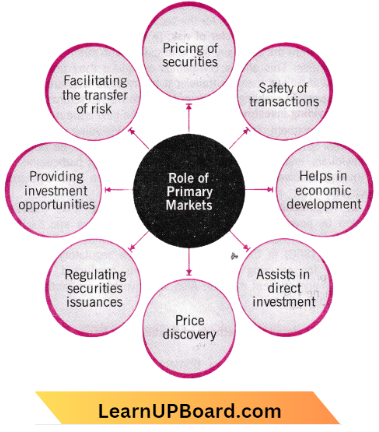

Role of Primary Markets:

- The key function of the primary market is to facilitate capital growth by enabling individuals to convert savings into investments.

- It facilitates companies to issue new stocks to raise money directly from households for business expansion or to meet financial obligations, it provides a channel for the government to raise funds from the public to finance public sector projects.

- Unlike the secondary market, such as the stock market which trades listed shares between buyers and sellers, the primary market exists for the issuance of new securities by corporations and the government directly to investors.

1. Pricing of securities: The primary market determines the price of the security being issued, which is typically based on the company’s financials, its business model, market conditions, and investor sentiment.

2. Safety of transactions: As transactions in the primary market are overseen by regulatory bodies like SEBI, it ensures the safety and transparency of the transactions.

3. Helps in economic development: The primary market indirectly contributes to the country’s economic development by enabling companies to raise capital for their business operations.

4. Assists in direct investment: The primary market provides an avenue for investors to invest in the securities of a company directly. This allows them to participate in the company’s growth and potentially share in its profits,

5. Price discovery: The primary market helps to establish the fair market value of newly issued securities by setting the initial price through the IPO or other mechanisms. This process helps to ensure that investors are paying a fair price for the securities they are buying.

6. Facilitating the transfer of risk: In the primary market, the risk is transferred from the company to the investors who purchase the newly issued securities. This allows companies to reduce their financial risk. Additionally, it allows them to transfer it to investors who are willing to take on that risk in exchange for the potential for higher returns.

7. Providing investment opportunities: The new issue market offers a range of investment opportunities to investors, including equity shares, bonds, and other debt instruments. These securities can be purchased by individuals, institutional investors, and other market participants who are looking to diversify their portfolios and achieve their investment objectives.

8. Regulating securities issuances: The new issue market is regulated by government bodies such as the Securities and Exchange Board of India (SEBI) in India and the Securities and Exchange Commission (SEC) in the United States.

- These regulatory bodies are responsible for ensuring that issuances are conducted in a fair, transparent, and efficient manner. Also, the investors are protected from fraud and other abuses.

Question 8. Explain in detail the methods of floating new issues in the primary market.

Answer:

The New Issue Market or primary market deals with the new securities that were not previously available to the investing public, i.e. the securities that are offered to the investing public for the first time.

- A new issue market provides an opportunity for issuers of securities, the Government as well as corporations, to raise resources to meet their requirements of investment and/or discharge some obligation.

Methods of Floating New Issues:

The methods by which new issues of shares are floated in the primary market in India are:

1. Public Issue: Public Issue The most popular method for floating the issues in the new issue market is through a “prospectus” which is viewed as a legal document. A common method followed by corporate enterprises to raise capital through the issue of securities is employing a prospectus inviting subscriptions from the public.

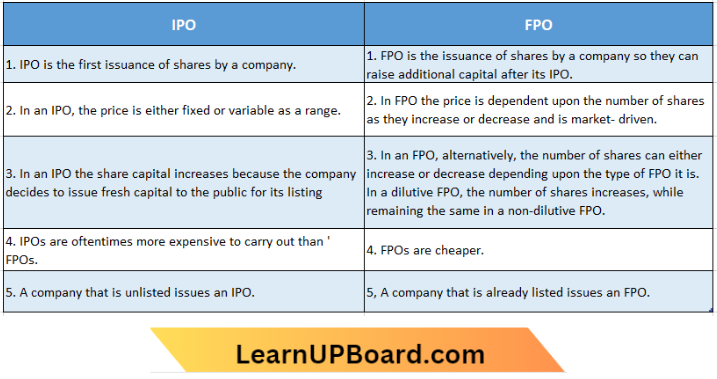

- Under this method, the issuing companies themselves offer directly to the general public a fixed number of shares at a stated price known as the face value of the securities. Public issues can be further classified into Initial Public Offerings (IPOs) and Further Public Offerings (FPOs).

2. Offer for Sale: Institutional investors like business enterprise funds, private equity funds, etc., invest in an unlisted company when it is very small or at an early stage. Under this method, securities are not issued directly to the public but are offered for sale through ‘ intermediaries like issuing houses or stock brokers.

3. Private Placement: A private placement is the allotment of securities by a company to institutional investors and some selected individuals. Public offers are an exclusive concern. The subsidiary cost of IPOs lean to be very high. This is why some companies favor not to go down this route.

- It helps to raise capital more quickly than a public issue. They offer investment opportunities to a select few individuals. The private placement is contradictory to a public issue, in which securities are made accessible for sale on the open market.

4. Rights Issue: It means an issue of capital to be offered by the company to its existing shareholders through a letter of offer, under section 62 of the Companies Act 2013.

- A listed company issues fresh securities to its existing shareholders only. The rights are offered in a specified ratio to several securities held before the issue by the shareholder. The ratio is fixed based on the capital requirement of the company.

5. e-IPOs: It stands for Electronic Initial Public Offer. A company proposing to issue capital to the public through the online system of the stock exchange has to agree with the stock exchange. When a company wants to offer its shares to the public it can now also do so online.

- This is called an Initial Public Offer (IPO). An agreement is signed between the company and the related stock exchange known as the e-IPO. The issuing company is also required to assign a registrar to have electronic connectivity with the exchange.

6. Issue of Indian Depository Receipts (IDR): A foreign company that is listed on the stock exchange abroad can raise money from Indian investors by selling (issuing) shares.

- These shares are held in trust by a foreign custodian bank against which a domestic custodian bank issues an instrument called Indian depository receipts (IDR), denominated in ‘.

- IDR can be traded in the stock exchange like any other shares and the holder is entitled to rights of ownership including receiving dividend

Question 9. What is an IPO? Write its types, advantages, and disadvantages.

Answer:

IPO:

An initial public offering (IPO), otherwise known as a stock market launch, is a public offering in which shares of a company are sold to investors.

- Initial public offerings can be used to raise new capital for companies- to gain more funding to monetize the investments of shareholders.

Types of IPOs:

Generally, there are two types of IPOs. A company gets a boost when people start buying their equities. The two basic types of IPOs are

1. Fixed Price Issue: In a Fixed Price Issue, the price of the offerings is evaluated by the company along with their underwriters. They evaluate the company’s assets, liabilities, and every financial aspect. They then work on these figures and fix a price for their offerings. The price is fixed after considering all the qualitative and quantitative factors.

- In a fixed price issue, the fixed price may be undervalued during the company’s IPO. The price is mostly lower than the market value. As a result, investors are always very interested in fixed price issues and ultimately revalue the company positively.

2. Book Building Issue: A book-building issue is a comparatively new concept in India compared to other parts of the world. In a book-building issue, there is no fixed price, but a price band or range.

- The lowest and the highest price is called ‘floor price’ and ‘cap price’ respectively. You can bid for the shares with the desired price you would like to pay. Thereafter the price of the stock is fixed after evaluating the bids. The demand for the share is known after each day as the book is built.

Advantages:

- Increasing and diversifying the equity base

- Cheaper avenues for raising capital

- More exposure, prestige, and enhanced public image

- Ability to attract and hire better employees and the management to oversee them through liquidity participation

- To enable acquisitions

- Creating multiple financing opportunities through equity, convertible debt, etc

Disadvantages:

- Rise in marketing and accounting costs that will mount as time goes on

- It is necessary to disclose sensitive financial and business information.

- More effort and attention are required of the management to ensure an IPO goes smoothly.

- Chances of additional funding might not be acquired in case the company does not perform well

- Public disclosure of information might be exploited by competitors or even customers

- The initial shareholders may lose independence as new ones will come in through the ability to buy new shares.

- The company will be exposed to the risk of litigation, private securities, and other forms of derivative actions.

Question 10. What is an IPO? Write the SEBI Guidelines for IPOs.

Answer:

IPO:

IPO stands for Initial Public Offering. Initial Public Offering (IPO) can be defined as the process by which a private company or corporation can become public by selling a portion of its stake to the investors.

- An IPO is generally initiated to infuse the new equity capital.to the firm, to facilitate easy trading of the existing assets, to raise capital for the future, or to monetize the investments made by existing stakeholders.

SEBI Guidelines for IPOs:

The salient features of these guidelines are given below:

- Promoters should contribute a minimum of 20% of the total issued capital if the company is an unlisted one. The promoter’s contribution is subject to a lock-in period of 3 years.

- Net Offer to the General Public has to be at least 25% of the Total Issue size for listing on a Stock Exchange.

- A minimum of 50% of the Net offer to the Public has to be reserved for Investors applying for 10 or less than 10 marketable lots of shares.

- In an Issue of more than Rs. 100 crores the issuer is allowed to place the whole issue by book-building.

- 5. There should be at least 5 investors for every 1 lakh of equity offered.

- Allotment has to be made within 30 days of the closure of the Public Issue and 42 days in case of a Rights Issue. All the listing formalities for a Public Issue have to be completed within 70 days from the date of closure of the subscription list.

- Indian Development Financial Institutions and Mutual Funds can be allotted securities up to 75% of the Issue Amount.

- Allotment to categories of Fll’s and NRI’s/OCB is up to a maximum of 24% which can be further extended to 30% by an application to the RBI – supported by a resolution passed in the General Meeting.

- 10% individual ceiling for each category a) Permanent employees b) Shareholding of the promoting companies

- Securities issued to the promoter, and his group companies by way of firm allotment and reservation have a lock-in period of 3 years. However, shares allotted to Fll’s and certain Indian and Multilateral Development Financial Institutions and Indian Mutual Funds are not subject to Lock-in periods.

- The minimum period for which a Public Issue has to be kept open is 3 working days and the maximum for which it can be kept open is 10 working days. The minimum period for a Rights Issue is 15 working days and the maximum is 60 working days.

- A public issue is effected if the issue can procure 90% of the Total issue size within 60 days from the date of earliest closure of the Public Issue. In case of over-subscription, the company may have the right to retain the excess application money and allot shares more than the proposed Issue which is referred to as the ‘green-shoe’ option.

- A Rights Issue has to procure a 90% subscription within 60 days of the opening of the Issue.

Question 11. Write the Principal steps of a Public Issue.

Answer:

A draft prospectus is prepared giving out details of the Company, promoter background, Management, terms of the issue, project details, modes of financing, past financial performance, projected profitability, and others. Additionally, a Venture Capital Firm has to file the details of the terms subject to which funds are to be raised in the proposed issue in a document called the placement memorandum”.

Some of the steps involved in a public issue are

1. Appointment of underwriters: The underwriters are appointed who commit to shoulder the liability and subscribe to the shortfall in case the issue is undersubscribed. For this commitment, they are entitled to a commission up to a maximum of 2.5% on the amount underwritten.

2. Appointment of Bankers: Bankers along with their branch network act as the collecting agencies and process the funds procured during the public issue. The Banks provide temporary loans for the period between the issue date and the date the issue proceeds become available after allotment, which is referred to as a ‘bridge loan’.

3. Appointment of Registrars: Registrars process the application forms, tabulate the amounts collected during the Issue, and initiate the allotment procedures.

4. Appointment of the Brokers to the Issue: Recognized members of the Stock exchanges are appointed as brokers to the Issue for marketing the Issue. They are eligible for a maximum brokerage of 1.5%.

5. Filing of the prospectus with the Registrar of Companies: The draft prospectus along with the copies of the agreements entered into with the Lead Manager, Underwriters, Bankers, Registrars, and Brokers to the issue is filed with the Registrar of Companies of the state where the registered office of the company is located

6. Printing and dispatch of Application forms: The prospectus and application forms are printed and dispatched to all the merchant bankers, underwriters, and brokers to the issue.

7. Filing of the initial listing application: A letter is sent to the Stock exchanges where the issue is proposed to be listed giving the details and stating the intent of getting the shares listed on the Exchange.

8. Statutory announcement: An abridged version of the prospectus and the Issue start and close dates are published in major English dailies and vernacular newspapers.

9. Processing of applications: After the close of the Public Issue all the application forms are scrutinized, and tabulated, and then shares are allotted against these applications.

10. Establishing the liability of the underwriter: In case the Issue is not fully subscribed to, then the liability for the subscription falls on the underwriters who have to subscribe to the shortfall, in case they have not procured the amount committed by them as per the Underwriting agreement.

11. Allotment of shares: After the Issue is subscribed to the minimum level, the allotment procedure as prescribed by SERI is initiated.

12. Listing of the Issue: The shares after having been allotted have to be listed compulsorily in the regional stock exchange and optionally at the other stock exchanges.

Question 12. Write about the recent trends in the Primary Market.

Answer:

The recent trends in the Primary Market

Many improvements and reforms over the last few years have been made in the field of capital markets. It has increased the transparency, integrity, and efficiency of the operation of trading. Stock exchanges have increased the quality of price discovery and decreased the cost of transactions.

NSE’s and BSE’s trading terminals provide services in each part of the country. Computer-based transaction systems and depositories have reduced risks. Some recent changes in capital markets are as under:

1. Various Amendments in Securities Exchange Board of India Act, 1992; SEBI Act has been amended by making the following changes:

- Empowering SEBI with powers of search and seizure,

- Impose penalty on the violator.

2. Solution of UTI Problems: The Unit Trust of India (Transfer of Undertaking and Repeal) Act, 2002 was passed by repealing the Unit Trust of India Act, 1963 so that a one-time solution to the problem can be sought.

3. Encourage Retail Trading in Government Securities: Retail trading is encouraged in gilt-edged securities. Due to this all classes of investors can contribute to it.

4. Training Arrangement: The Securities and Exchange Board of India has made arrangements to provide training to take part in the security market and to encourage research.

5. Development of Debts Market: Indian Clearance Corporation has started functioning for the clearance and settlement of transactions.

6. Takeover Regulation: SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997 makes provisions for disinvestments of public sector undertakings, additional disclosure requirements, etc. The Securities and Exchange Board of India announced an amnesty scheme.

7. Self-Regulatory Organisation: Now, all market intermediaries can become members of one or more self-regulatory organizations.

8. Other Recent Trends: In addition to the above following are some other trends in the capital market:

- A Commencement of trading in stock index futures, stock index options and stock options,

- Beginning of electronic data and information filling and retrieval system (Its object is to make electronic filing by the listed companies),

- Beginning of online inter-depository transfer,

- Demutualization of stock exchanges,

- Beginning of rolling settlement for all scrips on all stock markets,

- Issuance of SEBI (Sweat Equity) Regulation, 2002, .

- Compulsory Benchmarking of debt-oriented and balance fund.

- The Indian capital market has witnessed significant growth over the past few decades, driven by various factors, including economic liberalization, privatization, and globalization.

- The market has also been buoyed by a growing middle class with a greater propensity to invest in financial assets, increasing investor awareness and education, and the development of technology-enabled platforms for trading and investing.

- The equity market is the largest segment of the Indian capital market, with the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) being the major exchanges. The Indian equity market has seen a surge in activity, with the number of listed companies increasing from around 5,000 in the early 2000s to over 7,000 in recent years.

- The market capitalization of Indian companies listed on the stock exchanges has also grown significantly, from around $200 billion in 2000 to over $4 trillion as of 2023.

Question 13. What do you mean by stock exchange/Secondary Market? Give its characteristics.

Answer:

Stock exchange/Secondary Market

A stock exchange is an organized market for buying and selling corporate and other securities. Here, securities are purchased and sold out as per certain well-defined rules and regulations. It provides a convenient and secure mechanism or platform for transactions in different securities.

- Such securities include shares and debentures issued by public companies which are duly listed on the stock exchange, and bonds and debentures issued by government, public corporations, and municipal and port trust bodies.

Definition:

The Indian Securities Contracts (Regulation) Act of 1956, defines the Stock Exchange as, “An association, organization or body of individuals, whether incorporated or not, established to assist, regulate and controlling business in buying, selling and dealing in securities.”

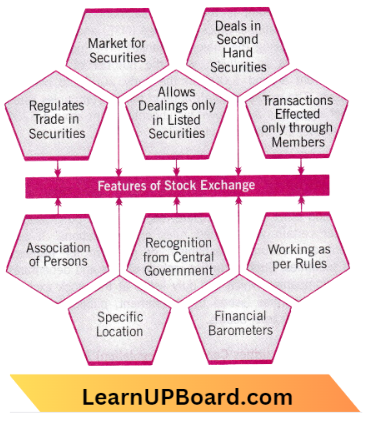

Features of Stock Exchange:

These are various qualities of a Stock Exchange. Such qualities are enumerated below:

1. Market for Securities: A stock exchange is a market, where securities of corporate bodies, government, and semi-government bodies are bought and sold.

2. Deals in Second Hand Securities: It deals with shares, debentures bonds, and such securities already issued by the companies. In short, it deals with existing or second-hand securities and hence it is called a secondary market.

3. Regulates Trade in Securities: The stock exchange does not buy or sell any securities on its account. It merely provides the necessary infrastructure and facilities for trade in securities to its members and brokers who trade in securities. It regulates the trade activities to ensure free and fair trade.

4. Allows Dealings only in Listed Securities:– In fact, stock exchanges maintain an official list of securities that could be purchased and sold on its floor. Securities that do not figure in the official list of the stock exchange are called unlisted securities. Such unlisted securities cannot be traded on the stock exchange.

5. Transactions Effected only through Members: All the transactions in securities at the stock exchange are effected only through those allowed to enter the trading circles of the stock exchange. Investors have to buy or sell the securities at the stock exchange through authorized brokers only.

6. Association of Persons: A stock exchange is an association of persons or bodies of individuals which may be registered or unregistered.

7. Recognition from Central Government: The stock exchange is an organized market. It requires recognition from the Central Government.

8. Working as per Rules: Buying and selling transactions in securities at the stock exchange are governed by the rules and regulations of the stock exchange as well as SEBI Guidelines. No deviation from the rules and guidelines is allowed in any case.

9. Specific Location: A stock exchange is a particular marketplace where authorized brokers come together daily (i.e. on working days) on the floor of the market called trading circles and conduct trading activities.

- The prices of different securities traded are shown on electronic boards. After the working hours market is closed. All the working of stock exchanges is conducted and controlled through computers and electronic systems.

10. Financial Barometers: Stock exchanges are the financial barometers and development indicators of the national economy of the country. Industrial growth and stability are reflected in the index of the stock exchange.

Question 14. What is meant by the Secondary Market / Stock Exchange? Discuss its functions and objectives.

Answer:

Secondary Market / Stock Exchange

A stock exchange is a marketplace where financial instruments (shares, stocks, bonds, etc.) are bought and sold. It acts as a platform where investors (buyers and sellers) come together to trade financial instruments.

Definition:

According to Hastings, “Stock exchange or securities market comprises all the places where buyers and sellers of stocks and bonds or their representatives undertake transactions involving the sale of securities.”

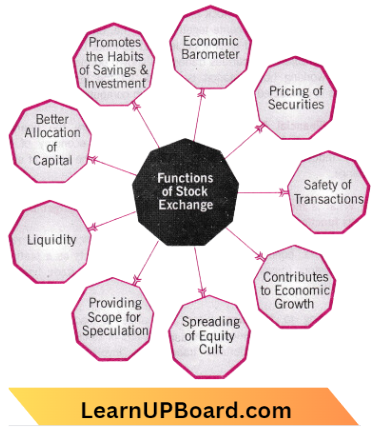

Functions of Stock Exchange:

Some of the Important Functions of the Stock Exchange/Secondary Market are listed below:

1. Economic Barometer: A stock exchange is a reliable barometer to measure the economic condition of a country. Every major change in the country and economy is reflected in the prices of shares. The rise or fall in the share prices indicates the boom or recession cycle of the economy. Stock exchange is also known as a pulse of economy or economic mirror which reflects the economic conditions of a country.

2. Pricing of Securities: The stock market helps to value the securities based on demand and supply factors. The securities of profitable and growth-oriented companies are valued higher as there is more demand for such securities.

- The valuation of securities is useful for investors, government, and creditors. The investors can know the value of their investment, the creditors can value the creditworthiness, and the government can impose taxes on the value of securities.

3. Safety of Transactions: In the stock market only the listed securities are traded and stock exchange authorities include the company’s names in the trade list only after verifying the soundness of the company. The companies that are listed also have to operate within strict rules and regulations. This ensures the safety of dealing through the stock exchange.

4. Contributes to Economic Growth: In the stock exchange securities of various companies are bought and sold. This process of disinvestment and reinvestment helps to invest in the most productive investment proposal and this leads to capital formation and economic growth.

5. Spreading of Equity Cult: The Stock exchange encourages people to invest in ownership securities by regulating new issues, better trading practices, and educating the public about investment.

6. Providing Scope for Speculation: To ensure liquidity and demand of supply of securities the stock exchange permits healthy speculation of securities.

7. Liquidity: The main function of the stock market is to provide a ready market for the sale and purchase of securities. The presence of the stock exchange market gives assurance to investors that their investments can be converted into cash whenever they want. Investors can invest in long-term investment projects without any hesitation, as because of the stock exchange they can convert long-term investments into short-term and medium-term.

8. Better Allocation of Capital: The shares of profit-making companies are quoted at higher prices and are actively traded so such companies can easily raise fresh capital from the stock market. The general public hesitates to invest in securities of loss-making companies. So stock exchange facilitates the allocation of investor’s funds to profitable channels.

9. Promotes the Habits of Savings and Investment: The stock market offers attractive opportunities for investment in various securities. These attractive opportunities encourage people to save more and invest in securities of the corporate sector rather than investing in unproductive assets such as gold, silver, etc.

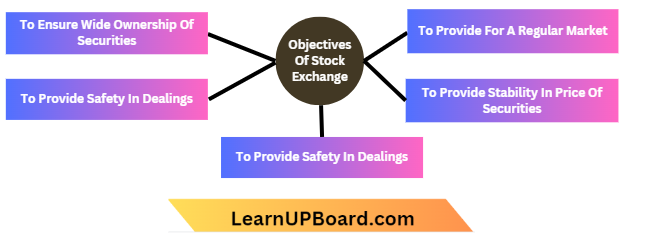

Objectives of Stock Exchange:

The primary objectives of a secondary market are to provide marketability to existing securities and to facilitate the acquisition of capita! by corporate enterprises. To accomplish these objectives, the secondary market performs the following functions:

1. To provide for a regular market: The secondary market provides for a ready and continuous market where those desiring to deal in securities assemble to buy and sell securities during business hours. This enables investors to liquidate their investments quickly and with the least possible loss.

2. To provide stability in the prices of securities: Through the mechanism of regular purchase and sale of securities, the secondary market ensures continuity and stability in share price which is an essential requirement of liquidity.

3. Regular valuation of securities: A well-developed secondary market disseminates full information about listed companies to attract a large number of informed buyers and sellers from all walks of life and to arouse keen competition among them resulting in the establishment of the fairest possible price.

4. To provide safety in dealings: A well-organized and regulated secondary market ensures a greater measure of safety and fair dealings to the average investors because transactions are made publicly under well-defined rules, regulations, and by-laws of the exchange.

5. To ensure wide ownership of securities: A secondary- market ensures wider distribution of securities. If a company’s securities are listed in different stock markets of the country, its securities will be bought and sold by persons spread across the country, and ownership of securities is widely diffused.

Question 15. Write the benefits and limitations of the Stock Exchange.

Answer:

A stock exchange is an organized market, where second-hand securities that have been listed thereon, may be bought and sold, in a safe, quick, and convenient manner.

Definition: According to Husband and Dockerary, “Stock exchanges are privately organized markets which are used to facilitate trading in securities.”

Benefits of Stock Exchange: The Benefits of the Stock Exchange are classified into Benefits to the Community, Company, and Investors.

Benefits to the Community:

1. Economic Development: It accelerates economic development by ensuring a steady flow of savings for productive purposes.

2. Fund Raising Platform: It enables well-managed, profit¬making companies to raise limitless funds by fresh issue of shares from time to time.

3. Tools to Divert Resources: Scarce resources are thus diverted to efficiently run enterprises for better utilization.

4. Capital Formation: It encourages capital formation.

5. Fund Raiser for Government: It enables the Government to raise funds for undertaking projects through the sale of securities on the stock exchange. Thus stock exchange serves as a platform for raising public debt.

Benefits to the Company:

1. Enhances Goodwill or Reputation: Companies whose shares are quoted on a stock exchange enjoy greater goodwill and credit standing.

2. Wide Market: There is a wide and ready market for such securities.

3. Raises huge funds: The Stock Exchange can raise huge funds easily by issuing shares and debentures.

4. Increases bargaining strength: Companies whose shares rise in the stock exchange command higher bargaining power in the event of further expansion, merger, or amalgamation.

Benefits to Investors:

1. Liquidity: Stock exchange helps investors to convert their shares into cash quickly and thus increases the liquidity of their investments.

2. Adding collateral value of security: The fact that a security is dealt with on a stock exchange makes it a good collateral security for obtaining loans from banks.

3. Investor protection: The stock exchange safeguards, the investor’s interest and ensures fair dealing by strictly enforcing its rules and regulations.

4. Assessing the real worth of security: An investor can easily assess the real worth of securities in his hands, as market quotations are published daily in the newspapers and websites.

5. Mechanism to trade security: The Stock Exchange provides a mechanism by which the purchase and sale of listed securities take place in a matter of few minutes.

Limitations of Stock Exchange:

The limitations of the stock exchange are as follows:

- Lack of uniformity and control of stock exchanges

- Absence of restriction on the membership of stock exchanges

- Failure to control unhealthy speculation

- Allowing more than one charge in the place

- Non-insistence of margin requirement in stock exchange or in the case of produce exchanges

- No proper regulation of listing of securities on the stock exchange

Question 16. Discuss the role of stock exchanges in India.

Answer:

Stock exchanges play an important role in the economic development of a country. Thus, the growth of a country depends on its performance.

The role of the stock exchange in the economic development of a country is as under:

1. Raising Capital for Businesses: Stock exchange enables the corporate sector to raise capital from the market by selling the shares of a company to the investing public.

2. Mobilizing Savings for Investment: The stock exchange helps the public to mobilize their savings and invest in the sectors that can yield high returns to them. Such investment provides higher yield to the individuals as well as to the country.

3. Facilitating Company Expansion: Stock exchange facilitates companies to grow and expand through acquisitions or fusion.

4. Profit Sharing: The Stock market facilitates investors to receive their share in the wealth of businesses that are earning huge profits.

5. Corporate Governance: The companies need to comply with different regulations to get listed on the stock exchange. Thus, they have a better record of management as compared to private companies.

6. Creating Investment Opportunities for Small Investors: Stock exchange provides equal investment opportunities to small investors. Small integrated investments enable larger companies to grow and lead to economic development.

7. Government Capital Rising for Development Projects: The stock market is equally helpful in raising capital for the development projects undertaken by the government through the issue of bonds. An investor investing in such securities would get fixed returns and tax advantages.

8. Barometer of Economy: The stock exchange is also responsible for maintaining the stock indices. Such stock indices are the indicators of trends prevailing in the economy. It is equally responsible for regulating the variations in stock price.

Question 17. Write about the evolution and growth of Stock Exchanges in India.

Answer:

The evolution and growth of Stock Exchanges in India

The history of security trading in India takes us to the 18th century when the East India Company began trading in loan securities.

- In the 1830s corporate shares were started in trading along with cotton presses. It was a very simple and kind of informal beginning for the stock exchange in India as it started under a banyan tree in Bombay (Mumbai) with only 22 stock brokers. A decade later it shifted to Meadows Street

- Junction and the shift continued to take place as the number of stockbrokers increased and settled in Daial Street. This was known as the Native Share and Stockbrokers Association and in 1875, it was renamed the Bombay Stock Exchange. It is the oldest in Asia and is also the first one which get permanent recognition by the Securities Contract Regulation Act of 1956.

- After BSE, the Ahmedabad Stock Exchange was founded in 1894 which mainly focused on the trading of shares of textile mills. Then, the Calcutta Stock Exchange began operations ini908 and it focused on the trading of shares of plantations and jute mills.

- After independence, the volume of trading was dominated by the BSE.

- However, there was a high need for market regulators because the BSE being the sole body had a very low level of transparency and undependable clearing systems and other important factors. This was when The Securities and Exchange Board of India (SEBI) was founded in the year 1988 as a non-statutory body and it was made statutory in the year 1992.

- After the Harshad Mehta Scam in the year 1992, it was realized that there was a need for another stock exchange that was large enough to compete with the BSE and that could bring clarity and transparency to the stock market.

- This gave rise to the National Stock Exchange (NSE) in 1992. It was recognized as a stock exchange in the year 1993 and thereafter trading began in 1994. NSE was the first stock exchange to perform trading electronically. In response to this initiative, BSE also introduced an electronic trading system, and it was called BSE On-Line Trading (BOLT) in the year 1995.

- The Sensex was first introduced in 1986 by the Bombay Stock Exchange as the sensitivity index and it had an index of 30 companies. It measured the overall performance of the exchange. Equity Derivatives was launched in the year 2000 and Index as well as stock options in 2001. Also, India’s first free float index, BSE Teck was launched in the same year 2001.

- The National Stock Exchange introduced its exchange milestone as the CNX Nifty, which is now known as the Nifty 50, in 1996. NSE has 50 stocks registered and it functions as the overall performance measure of the exchange.

- The BSE and the NSE are not the only stock exchanges in our country. After the independence, there were about 23 stock exchanges registered but at present, there are only 7 stock exchanges that are recognized by SEBI. Apart from NSE and BSE, there are Calcutta Stock Exchange Ltd, Magadh Stock Exchange of India Ltd, Metropolitan Stock

- Exchange of India Ltd, India International Exchange (India INX), and NSE IFSC Ltd. All the others that were once functioning were granted exit by SEBI.

- There were differences in the pattern of investments in the pre-independence and post-independence eras. Before independence, the management system in the country was not so reliable and transparent in its actions. There were a limited number of companies and the Britishers were mostly interested in the growth of companies in London.

- There was also no guiding agency for the common mass that would have helped in promoting investments. The public was more interested in investing in gold and ornaments than any company securities. After independence, the Indian government took measures to promote investments.

- Two important acts were passed- the Indian Companies Act 1956 and the Securities Contract and Regulations Act 1956. Hence there was a steady growth in the Indian capital market. The risk of the investors was also safeguarded through the acts.

Question 18. What are the major stock exchanges in India?

Answer:

A Stock Exchange is a place where traders buy and sell securities. A stock exchange is often the most important component of a stock market. The auction of securities is done systematically, i.e. abiding by certain rules and regulations.

Major Stock Exchanges in India:

The major stock exchanges in India are stated below:

1. Bombay Stock Exchange (BSE): Bombay Stock Exchange was formed in 1875 and is one of the two principal large stock exchanges in India. The major objective of BSE is to provide an efficient and transparent market for trading currencies, equities, mutual funds, etc.

- It is also the world’s fastest exchange with a median trade speed of six microseconds. The Indian government recognized it officially as per the Securities Contracts Regulation Act in August 1957. Approximately 5000 companies are listed in BSE.

2. National Stock Exchange (NSE): National Stock Exchange is the leading stock exchange in India. It was established in the year 1992 as the first dematerialized electronic exchange in the country.

- It was the first exchange to provide a fully automated screen-based trading system to the investors to facilitate easy trading. In the year 1993, NSE registered itself as a stock exchange under the Securities Contract Regulations Act.

- The benchmark index of NSE, Nifty 50 is used extensively by investors around the world to keep track of the Indian capital market. NSE also played an important role in the creation of the National Securities Depository Limited.

3. Calcutta Stock Exchange (CSE): Calcutta Stock Exchange is the second oldest stock exchange in Southeast Asia and was incorporated in the year 1908 with 150 members. Presently, CSE is located at the Lyons Range.

- It was granted recognition under the relevant provisions of the Securities Contract (Regulation) Act, of 1956, and was replaced by the screen-based trading system only in the year 1997. The matter about the exit of the Calcutta stock exchange by SEBI is pending before the Calcutta High Court.

4. Metropolitan Stock Exchange (MSE): The Metropolitan Stock Exchange was recognized as a “notified stock exchange” in the year 2012 by SEBI. MSE offers an electronic and hi-tech trading platform in Capital Markets, Debt Markets, Futures & Options.

5. India International Exchange (India INX): India International Exchange Limited is India’s first International Financial Services Centre located in Gujarat. Their operations started in 2017 and are a subsidiary of BSE Limited.

- The exchange offers a single-segment approach for all asset classes such as equities, currencies, commodities, etc. The exchange uses an advanced technology platform and is the fastest in the world with a turn-around time of 4 microseconds.

6. NSE IFSC Limited: On November 26th, 2016, NSE IFSC Limited (NSE International Exchange) was incorporated by the Registrar of Companies, Gujarat. It is a fully owned subsidiary company of the National Stock Exchange of India Limited (NSE).

To increase access to financial markets, the NSE International Exchange has been launched to grow the financial market as well as to bring capital into India. Furthermore, Stock exchanges operating in the GIFT IFSC are permitted to offer trading in securities in any currency other than the Indian rupee.

Question 19. Write about the recent developments in Indian Stock Exchanges.

Answer:

The structure of the stock market in India has undergone a vast change due to the liberalization process initiated by the Government. Several new structures have been added to the existing structure of the Indian stock exchange.

A brief description of these structures in the Indian stock market system is presented below:

1. Economic Liberalization due to the Indian Capital Market: Economic liberalization has led to more deregulation, liberalization, and privatization of some of the public sector undertakings in Asia. This has resulted in the shares of some of the public sector undertakings being made available to the Public.

2. Promoting more private sector banks: Opening of more private sector banks has resulted in the public contributing to the shares of these banks in the Indian capital Market. Recently, the government has announced 74% equity participation by foreigners in private sector banks in India.

3. Promotion of Mutual Funds: The promotion of mutual funds by nationalized as well as non-nationalized banks has also improved the Indian capital market. They were helpful to the public by way of tax-saving schemes. Example: UTI’s monthly income scheme.

4. Regulation of NRI Investments: The Amendment of the Foreign Exchange Regulation Act (FERA) into the Foreign Exchange Management Act (FEMA) has given more encouragement to non-resident investors. The percentage of NRI investment in Indian companies has increased from 5% to 24%.

5. Direct Foreign Investment: The Foreign Investment Promotion Board, consisting of the Secretaries of Industries, finance, and foreign affairs, has allowed more direct foreign investment in the core sector, especially in the power sector.

6. FERA Companies: Under the Foreign Exchange Regulation Act, a FERA company has 40% equity participation by foreigners. This limit has been removed and now even foreign companies are allowed to have 51% equity participation. For example, Colgate Palmolive has increased its foreign equity participation from 40 to 51%.

7. Online Trading in Indian Capital Market: Some of the leading stock markets in India have introduced computer systems for their trading activities. The brokers can get hooked up and do their trading on an online basis. The computer terminals will enable the public and the brokers to know the price prevailing in the market at any time. This will prevent speculation activities.

8. Transparency through online trading: Online trading through a computer has brought transparency to the transactions in the market. People can know prices prevailing in the market at any time and as such the brokers cannot deprive their clients of their profits. The manipulation of the opening and closing prices of shares by the brokers in the market is no longer possible.

9. National Stock Exchange: A new stock market called the National Stock Exchange has been created and a large number of companies have been listed. It is a big competitor to the Bombay Stock Exchange and it can even influence the Bombay Stock Exchange. The National Stock Exchange deals in shares of companies throughout India and the prices prevailing in the market is a benchmark for stock prices.

10. Sensitivity Index in Indian Capital Market: The calculation of the index number has also changed. A sensitivity index has been introduced which represents important 30 companies whose volume and value of shares determine the market condition. The sensitivity index is an indication of the conditions prevailing in the market and the conditions that are likely to be encountered by the market.

11. Demating of shares in the Indian Capital Market: The introduction of demating has resulted in improving transactions further. Demating is a system under which the physical delivery of shares is no more adopted. It is called “scripless trade”.

12. Securities and Exchange Board of India: The creation of the Securities and Exchange Board of India (SEBI) is an important development in the Indian capital market of India. SEBI has not only replaced the Controller of Capital issues but has brought uniformity in the transactions in all stock exchanges.

13. Renewal of Registration: All the brokers and sub-brokers have to register afresh with SEBI and any complaints against them will be inquired and if found guilty, punishment is given.

14. Over The Counter Exchange of India (OTCEI): For newly promoted companies, another stock exchange with a lesser degree of conditions has been promoted and it is called Over The Counter Exchange of India (OTCEI). It may not be possible for all the new companies to list their shares with the existing stock exchanges.

The share capital of these companies will be low and hence there should be an arrangement for listing such companies’ shares. The creation of Over The Counter Exchange of India (OTCEI) is helpful to these newly promoted companies.

15. Non-Banking Financial Companies: The role of non-financial companies has also been controlled. RBI has introduced new conditions, restricting their activities. New norms about the capital of non banking financial companies have been introduced. For chit funds, a separate Act has been passed and it restricts the maximum bidding to 40%.

16. Government Securities Market: After the stock scam, the Central Government has de-linked Government securities from trading along with company securities. In other words, there will be a separate market for Government securities and they will not be dealt along with company securities in the stock market. The measure was taken by Dr. Manmohan Singh when he was the Finance Minister.

Question20. What is SEBI? Discuss the orga objectives, powers, and functions of SEBi. (OR) Write the regulatory framework of Indian Stock Exchanges.

Answer:

SEBI Definition:

SEBI stands for Securities and Exchange Board of India. It is a statutory regulatory body that was established by the Government of India in 1992 to protect the interests of investors investing in securities along with regulating the securities market. SEBI also regulates how the stock market and mutual funds function.

The main purpose of SEBI is to safeguard the rights and interests of the investor, reduce malpractices related to the stock exchange, establish a code of conduct, and promote the healthy functioning of the stock exchange.

Organizational Structure:

The SEBI Board consists of nine members:

- One Chairman appointed by the Government of India

- Two members are officers from the Union Finance Ministry

- One member from the Reserve Bank of India

- Five members appointed by the Union Government of India Objectives of SEBI:

The fundamental objective of SEBI is to safeguard the interests of all the parties involved in trading. It also regulates the functioning of the stock market. SEBI’s objectives are: x To monitor the activities of the stock exchange x To safeguard the rights of the investors

To curb fraudulent practices by maintaining a balance between statutory regulations and self-regulation x To define the code of conduct for the brokers, underwriters, and other intermediaries Powers of SEBI:

SEBI has been vested with the following powers:

- Power to call periodical returns from recognized stock exchanges.

- Power to call any information or explanation from recognized stock exchanges or their members.

- Power to direct inquiries to be made about affairs of stock exchanges or their members.

- Power to approve by-laws of recognized stock exchanges.

- Power to make or amend by-laws of recognized stock exchanges.

- Power to compel listing of securities by public companies.

- Power to control and regulate stock exchanges.

- Power to grant registration to market intermediaries.

- Power to levy fees or other charges for carrying out the purpose of regulation

- Power to declare applicability of Section 17 of the Securities Contract (Regulation) Act is any state or area to grant licenses to dealers in securities

Functions of SEBI:

The SEBI performs some functions to meet its objectives and they are:

1. Protective Functions: In the protective functions, the SEBI tries to protect the interest of the investor and provide them the safety towards their investment. Below are the points that are initiated in the protective functions by the SEBI:

- It prohibits Insider Trading. x It checks the price rigging.

- It also prohibits fraudulent and unfair trade practices.

- SEBI always promotes the code of conduct in the security market and fair practices.

- SEBI also takes the steps to make the investor educated about the market so that they make themselves able to evaluate the securities of the various companies and select the most profitable for them.

2. Developmental Functions: These developmental functions are performed by the SEBI to promote and develop the activities in the stock exchange and to increase the business in the stock exchange. For this, the main pointers that the developmental functions are working on are:

- SEBI gives and promotes the training of the intermediaries of the security market.

- SEBI makes the steps to adopt the flexible approach for increment in the activities of the stock market.

3. Regulatory Functions: In the regulatory functions, the SEBI tries to regulate the business in the stock exchange. To regulate the activities of the stock market the regulatory functions include,

- SEBI has framed rules and regulations and a code of conduct to regulate the intermediaries.

- These intermediaries have been brought by the regulatory purview and the private placement that has been more restrictive eventually.

- SEBI regulates the working of Mutual Funds.

- SEBI regulates the takeover of companies.

- SEBI also conducts inquiries and audits of the stock exchange.

Question 21. Examine the Role / Significance of SEBI.

Answer:

Significance of SEBI:

SEBI was established as a non-statutory board in 1988 and in January 1992, it was accorded statutory status. The regulatory powers of SEBI were increased in January 1995.

- It has now become a very important constituent of the financial regulatory framework in India. The SEBI is under the overall control of the Finance Ministry.

1. Promotion and Development of Capital Market: One of the important roles of SEBI is the promotion and development of the capital market. It protects the rights and interests of investors, especially the individual investors. It prevents trading malpractices. Its regulatory measures are meant for the healthy development of capital markets.

2. Regulatory Role: Another important role of SEBI is the regulation of the security markets in India. The SEBI can frame or issue rules, regulations, directives, guidelines, and norms concerning primary and secondary markets.

3. Protection of Interest of Investors: An important role of SEBI is the protection interest of investors in securities. SEBI has introduced various measures to protect the interests of investors. To ensure no malpractice takes place in the allotment of shares, a representative of SEBI supervises the allotment process.

4. Investor’s Education: SEBI has a role in educating investors about the securities market. It issues advertisements from time to time to enlighten investors on various issues related to the securities market and their rights and remedies.

5. Investor’s Grievances Redressal: SEBI plays another role in redressing the investor’s grievances. SEBI has introduced an automated complaint-handling system to deal with investor complaints. The Investor Grievances Redressal and Guidance Division of SEBI assists investors who want to make complaints to SEBI against listed companies.

6. Primary Market Policy: SEBI looks after all the policy matters and regulatory issues concerning the primary market. It is responsible for vetting all the prospectuses and letters of offer for public and right issues, for coordinating with the primary market policy, and for registration, regulation, and monitoring of issue-related intermediaries.

7. Secondary Market Policy: SEBI is responsible for all policy and regulatory issues for the secondary market and new investment products. It is also responsible for the registration and monitoring of members of stock exchanges, administration of some of the stock exchanges, and monitoring of price movements and insider trading.

8. Institutional Investment Policy: SEBI looks after institutional investment policy with respect to domestic mutual funds and Foreign Institutional Investors (Fils). It also looks after the registration, regulation, and monitoring of Fils and domestic mutual funds.

9. Facilitates Mobilisation of Resources: The SEBI plays an important role in facilitating an efficient mobilization and allocation of resources through the securities market, stimulating competition, and encouraging innovations.

Question 22. What do you mean by Listing of Securities? Bring out the guidelines of SEBI for listing in stock exchanges

Answer:

Listing of Securities:

Listing means that the securities have been included in the list of securities that may be traded at a stock exchange. The securities may be of any public limited company, Central or State Government, quasi-governmental and other financial institutions/corporations, municipalities, etc.

- According to Regulation 4(2) of SEBI (Issue of Capital and Disclosure Requirements) Regulations 2009, no issuer shall make a public issue or rights issue of securities unless they make an application to one or more recognized stock exchanges and have chosen one of them as a designated stock exchange.

- In the case of an Initial Public offer, it is required for the issuer to make an application for Shares Listing in at least one recognized stock exchange having nationwide trading terminals.

Listing Conditions and Requirements:

- The company has to follow specified conditions before Shares are listed on the stock exchange:

- Shares of a company shall be offered to the public through the prospectus, and 25% of securities must be offered.

- The date of opening of the subscription, receipt of the application, and other details should be mentioned in the prospectus.

- The capital structure of the company should be wide and the securities of the company should be in public interest.

- The requirement for the Minimum issued is Rs. 3 Crores out of which 1.8 Crore must be offered to the public.

- There is a requirement of at least 5 public shareholders in respect of every Rs. 1 Lakh of fresh issue of capital and 10 shareholders for every Rs.l lakh of the offer of existing capital.

- In the case of excess application money, the company has to pay interest within the range of 4% to 15% in case there is a delay in the refund and the delay should not be more than 10 weeks from the date of closure of the subscription list.

- The company has paid up share capital of more than Rs. 5 crores and should get itself registered in the recognized stock exchange and compulsorily on the regional stock exchange.

- The auditor or secretary of the company has to declare that the share certificate has been stamped for listing so that shares belonging to the promoter’s quota cannot be sold or transferred for 5 years.

- Letter of allotment, Letter of regret, and letter of a right shall be issued. Receipts for all securities deposited either by way of registration or split.

- Consolidation and renewal certificates will be issued for a certificate of the division, letter of allotment, transfer, letter of rights, etc. The company has to notify the stock exchange regarding the board meeting, the change in the composition of the board of directors, and the case of the new issue of securities in place of a reissue of forfeited shares.

- Due notice should be given to the stock exchange, for closing transfer books for a declaration of dividend, rights issue, or bonus issue.

- After the annual general meeting, the annual return is required to be filed.

- The company is required to comply with the conditions imposed by the stock exchange for the listing of security.

- Documents Required For Listing of Securities In Stock Exchange:

The following documents must be filed with the stock exchanges to get the securities listed:

- Memorandum of association and Articles of association

- Copies of all prospectus and statements instead of prospectus.

- Copies of balance sheets, audited accounts, agreements with promoters, underwriters, brokers, etc.

- Letters of consent from the controller of capital issuer, are now replaced with SEBI.