B.Com Stock Market Indices Essay Question And Answers

Questions 1. What is the stock market index? Write the need and purpose of stock market indices.

Answer:

Stock market index:

A stock market index is a statistical source that measures financial market fluctuations. The indices are performance indicators that indicate the performance of a certain market segment or the market as a whole.

- A stock market index is constructed by choosing equities from similar companies or those that match a predetermined set of criteria. These shares are already listed on the exchange and traded. Share market indexes can be built using a range of variables, including industry, segment, or market capitalization.

Need of Share Price Indices: Share price indices serve several important purposes in the world of finance and investing. These indices provide valuable information and insights to market participants, investors, and policymakers.

Following are the reasons for the need for share price indices:

1. Market Performance Measurement: Share price indices serve as benchmarks to assess the overall performance of a stock market, specific sectors, or individual stocks. They provide a standardized way to measure market movements and trends over time.

2. Investment Performance Evaluation: Investors use indices to gauge the performance of their investment portfolios. By comparing the returns of their investments to a relevant index, investors can assess how well their portfolio has performed.

3. Risk Management: Indices help investors and fund managers manage risk by providing a reference point for market movements. Investors can assess the risk-adjusted returns of their portfolios about an appropriate index.

4. Portfolio Diversification: Share price indices enable investors to diversify their portfolios effectively. By investing in index-tracking funds or exchange-traded funds (ETFs), investors can gain exposure to a broad market segment without individually selecting stocks.

5. Market Trends Identification: Indices help in identifying market trends, cycles, and patterns. Analysts and investors use historical index data to identify long-term trends and make informed predictions about future market movements.

6. Sector Analysis: Sector-specific indices provide insights into the performance of particular industries or sectors of the economy. This information is valuable for investors and analysts looking to understand economic trends and sector dynamics.

7. Comparison of Investment Strategies: Investors can compare the performance of various investment strategies against relevant indices. For example, active fund managers can compare their returns to a benchmark index to assess their performance.

8. Economic Indicators: Share price indices can serve as leading indicators of economic health. If a stock market index is rising, it might indicate positive investor sentiment and economic growth.

9. Market Sentiment: The direction of share price indices can reflect market sentiment. Rising indices can indicate optimism while falling indices might suggest investor concerns.

10. Capital Allocation: Investors use index data to allocate capital to different asset classes, regions, or sectors based on their risk appetite and investment goals.

11. Investor Communication: Share price indices provide a common language for investors, analysts, and financial media to communicate about market performance and trends.

12. Policy Decisions: Policymakers and regulators use indices to monitor market stability, assess the impact of policy changes, and make informed decisions about financial regulations.

13. Benchmarking: Companies and investment managers use indices to benchmark their performance against market standards and competitors.

Purpose of Share Price Indices:

Indices are used across the global markets by financial professionals, institutions, and individuals for the following purposes:

- Stock market indices are the most significant and widely studied parameters in the financial market.

- Investors and traders use the stock market index to analyze the market and manage their investment portfolios.

- Financial institutions use the stock market indices to manage the investment portfolio of clients and draw performance comparisons based on the indices.

- The stock indices indicate the mood and sentiment of the market at a given time. Investors can understand the market’s pattern by looking at the indices and placing profitable buying and selling calls.

- The stock index helps identify profitable stocks and indicates how these stocks have performed compared to their peers.

- Along with stocks, stock market indices show the trend prevailing in different sectors.

- Investors can make passive investments by analyzing the stock indices by choosing index funds that simply mimic the performance of an index.

Question 2. What are Stock Market Indices? Explain the uses and limitations of Stock Market Indices.

Answer:

Stock Market Indices

Stock market indices represent a certain group of shares selected based on particular criteria like trading frequency, share size, etc. The stock market uses the sampling technique to represent the market direction and change through an index.

- Stock Market Indices are the barometer of the stock market which mimic. the stock market behavior and help to determine the upward and downward movements in the stock market.

Advantages of Investing in the Stock Market Indices:

Some of the advantages of investing in the stock market index are as follows:

1. Diversification: Stock market indices consist of many stocks, providing investors with diversification across various sectors and industries. This diversification can help reduce overall portfolio risk, as gains in one stock can make up for losses in another one.

2. Low Cost: Investing in a stock market index is typically less expensive than investing in individual stocks. Because index funds and exchange-traded funds (ETFs) have lower fees and expenses. This can help investors keep more of their investment returns.

3. Market Performance: Stock market indices generally reflect the performance of the overall market, which tends to increase over time. As a result, investing in indices can provide investors with exposure to the growth potential of the stock market as a whole, rather than relying on the performance of individual stocks.

4. Benchmarking Performance: Investors and fund managers use stock market indices as benchmarks to assess the performance of their investment portfolios. Comparing the returns of a portfolio to a relevant market index helps gauge how well the investments are performing relative to the broader market.

5. Investment Products: Indices are the basis for various financial products, such as index funds and exchange-traded funds (ETFs). These ‘ investment vehicles replicate the performance of a specific index, allowing investors to gain exposure to a broad market or a specific sector without having to buy individual stocks.

6. Risk Management: Investors use indices to assess the overall risk and volatility of the market. A widely followed index can serve as a proxy for market risk. By understanding the historical volatility of an index, investors can make more informed decisions about the level of risk they are comfortable taking in their portfolios.

7. Sector Analysis: Some indices focus on specific sectors or industries, providing insights into the performance of those particular segments of the market. Investors use sector indices to analyze trends, assess the health of specific industries, and make investment decisions based on sector-specific information.

Disadvantages of Investing in the Stock Market Indices:

1. Limited flexibility: Stock market indices have a pre-determined composition of stocks. Consequently, investors have limited control over the individual stocks in their portfolios. This lack of flexibility can be a disadvantage for investors who prefer a more active approach to investing.

2. Overexposure to certain sectors: Certain sectors may have a larger representation in a particular stock market index. It can lead to overexposure to those sectors. For example, if a particular index has a large weighting towards the technology sector, then investors in that index may get overexposed to the performance of tech companies.

3. Market volatility: Investing in stock market indices can be subject to market volatility and fluctuations. While the long-term trend of the market has historically been upward, short-term fluctuations can be unsettling for investors who are not comfortable with the inherent risk of investing in the stock market.

4. Price-Only Focus: Indices are typically based on stock prices, not total returns. This means they do not account for dividends or other income generated by the stocks in the index. For income-focused investors, this can be a limitation as it does not provide a complete picture of the overall return.

5. Lack of Quality Assessment: Indices often include stocks based on quantitative criteria, such as market capitalization, without a thorough assessment of the quality of the underlying companies. This can lead to the inclusion of overvalued or financially weak companies in the index.

6. Survivorship Bias: Indices are periodically revised to include successful companies and remove struggling ones. This survivorship bias can result in an overestimation of historical performance, as the poor performers are excluded from the index. Investors should be cautious when interpreting long-term historical returns.

Question 3. HOW do interpret share price index numbers?

Answer:

Interpreting share price index numbers involves understanding how the index value changes over time and what it signifies in terms of market performance. Here’s how to interpret share price index numbers:

1. Direction of Change: If the index value increases, it indicates that the overall value of the constituent stocks has risen. This suggests a positive market performance.

- If the index value decreases, it signifies a decline in the overall value of the stocks, indicating a negative market performance.

2. Percentage Change: The percentage change in the index value from one period to another indicates the magnitude of the market’s movement. A higher percentage change indicates a more significant shift in market performance.

3. Relative Performance: Investors often compare the performance of individual stocks or portfolios to the index’s performance. If an investor’s portfolio outperforms the index, it suggests strong performance.

4. Trends and Patterns: Analyzing index values over time can reveal trends, cycles, and patterns in the market’s behavior. This can assist in making informed investment decisions.

5. Sector and Industry Analysis: Sector-specific indices can be used to analyze the performance of specific industries. Positive trends in a sector index might suggest a strong industry outlook.

6. Economic Indicators: A rising index might reflect positive investor sentiment and economic growth, while a declining index could indicate economic concerns.

7. Market Sentiment: Index movements can reflect market sentiment. Bullish sentiment is often associated with rising indices, while bearish sentiment is linked to falling indices.

8. Benchmarking and Risk Assessment: Investors and fund managers compare their portfolios’ performance to index performance to assess their risk-adjusted returns and benchmark their strategies.

Question 4. What do you mean by Stock Market Indices? Write the significance/importance of Stock Market Indices.

Answer:

Stock Market Indices

A stock market index is a method of measuring a section of the stock market. A stock market index (or just “index) is a number that measures the relative value of a group of stocks.

- As the stocks in this group change value, the index also changes value. If an index goes up by 1% then, that means the total value of the securities which make up the index has gone up by 1% in value.

Significance/Importance of Stock Market Indices:

1. Market Representation: Indices provide a snapshot of the overall market or a specific sector by tracking the performance of a selected group of representative stocks. This representation helps investors gauge the general health and direction of the market.

2. Benchmark for Performance: Indices serve as benchmarks for the overall performance of a stock market or specific sectors within it. Investors use these benchmarks to evaluate the performance of their investment portfolios against the broader market.

3. Investment Strategy: Investors and fund managers use indices as a basis for developing and implementing investment strategies. For example, an investor may choose to replicate the performance of a specific index by investing in a basket of stocks that mirrors the index composition.

4. Risk Management: Indices help in assessing market risk and volatility. By tracking the performance of a diversified set of stocks, indices provide a more stable and comprehensive view of market movements, allowing investors to make more informed decisions about risk management.

5. Market Sentiment: Changes in the values of indices often reflect market sentiment. A rising index can indicate optimism and confidence, while a falling index may suggest concerns or a bearish sentiment. Traders and investors use this information to make decisions about buying or selling assets.

6. Asset Allocation: Asset allocators use indices to guide their decisions on how to distribute investments across different asset classes. Indices provide a reference point for balancing portfolios based on factors such as risk tolerance, investment goals, and market conditions.

7. Financial Products: Many financial products, such as index funds and exchange-traded funds (ETFs), are designed to track the performance of specific indices. These products allow investors to gain exposure to a broad market or sector without having to buy individual stocks.

8. Economic Indicators: Movements in stock market indices can serve as indicators of the overall economic health. A rising market may indicate economic growth and confidence, while a declining market might suggest economic challenges.

9. Global Comparison: Investors often compare the performance of different stock markets or regions using indices. This global perspective helps investors make decisions about international diversification and take advantage of opportunities in various markets.

10. Policy and Regulation: Governments and regulatory bodies often use stock market indices to monitor the health of financial markets. Changes in indices can influence economic policies and regulatory decisions.

Question 5. Write the Advantages and disadvantages of the Stock Market Index.

Answer:

A stock market index is a statistical measure that tracks the performance of a group of stocks in a particular market or sector. It provides a snapshot of how a specific set of stocks or the overall market is performing. Stock market indices are usually calculated by taking the weighted average of the prices of a select group of stocks.

Advantages of Stock Market Index:

1. Economic Indicator: Changes in stock indices are often used as indicators of economic health. A rising stock market index is generally associated with economic growth and optimism, while a declining index may suggest economic challenges.

2. Price Discovery Mechanism: The stock market index acts as a price discovery mechanism, reflecting the collective valuation of the included stocks. Investors use this information to make informed decisions about buying or selling.

3. Research Tool: Analysts and researchers use stock market indices to study market trends, conduct economic research, and analyze the performance of various sectors.

4. Investor Confidence: A rising index may boost investor confidence, leading to increased investment and economic activity. Conversely, a falling index may erode confidence and result in more conservative investment behavior.

5. Risk Management: Indices provide a way for investors to manage risk by spreading investments across multiple stocks. This can help reduce the impact of poor-performing stocks on a portfolio.

6. Liquidity: indices often include highly liquid stocks, making it easier for investors to buy and sell shares. This liquidity can be particularly important for institutional investors dealing with large amounts of capital.

7. Basis for Investment Products: Indices are used as the basis for various financial products, such as index funds and exchange-traded funds (ETFs). These investment vehicles allow investors to gain exposure to the entire market or specific sectors without having to buy each stock.

8. Diversification: Indices often include a diverse range of stocks from various sectors. This diversification helps reduce risk because the performance of individual stocks may not have a significant impact on the overall index.

9. Market Trends and Sentiment: Changes in index values can indicate broader market trends. Rising indices may suggest a bullish market, while falling indices may signal a bearish market sentiment.

Disadvantages of Stock Market Index:

1. Market Manipulation: Market manipulation can impact the performance of indices. For example, a few large trades in a heavily weighted stock can disproportionately influence the index. This is a concern, especially in thinly traded markets.

2. Geographical Bias: Global indices may have a bias towards certain geographical regions, potentially neglecting opportunities in other parts of the world. This can limit the global diversification benefits for investors.

3. Dividend Exclusion: Some indices do not account for dividends. Dividends can be a significant component of total returns, and their exclusion may provide an incomplete picture of an investor’s actual performance.

4. No Risk Assessment: Indices do not provide information about the risk associated with individual stocks. Investors need to perform additional analysis to understand the risk profile of the stocks within an index.

5. Past Performance Bias: Indices are backward-looking and reflect historical performance. Just because a stock has performed well in the past doesn’t guarantee future success. Investors should be cautious about assuming that past trends will continue.

6. Limited Diversification: While indices aim to provide diversification, they are still limited by the selection of stocks included. Some sectors or industries may be overrepresented or underrepresented, and certain types of stocks may not be included at all.

Question 6. What is a stock market index? Write the different types of Stock Market Indices in India.

Answer:

stock market index

A stock market index is a statistical source that measures financial market fluctuations. The indices are performance indicators that indicate the performance of a certain market segment or the market as a whole.

- A stock market index is constructed by choosing equities from similar companies or those that match a predetermined set of criteria. These shares are already listed on the exchange and traded. Share market indexes can be built using a range of variables, including industry, segment, or market capitalization.

- Each stock market index tracks the price movement and performance of the stocks that comprise the index.

- This simply means that the success of any stock market index is precisely proportionate to the performance of the index’s constituent stocks. In layman’s words, if the prices of the stocks in an index rise, the index as a whole rises as well.

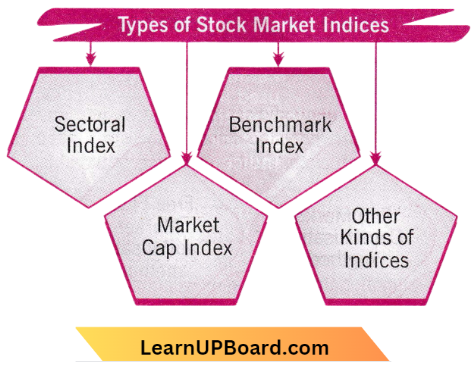

Types of Stock Market Indices:

1. Sectoral Index: Both the BSE and the NSE have some strong indicators that gauge companies in a given sector. Indices like the S&P BSE Healthcare and NSE Pharma are known to be good indicators of changes in the pharmaceutical sector.

- Another notable example is the S&P BSE PSU and Nifty PSU Bank Indices, which are indices of all listed public sector banks. However, neither exchange is required to have equivalent indexes for all industries, yet this is a key cause in general.

2. Benchmark Index: The Nifty 50 index, which consists of the top 50 best-performing equities, and the BSE Sensex index, which consists of the top 30 best-performing stocks, are indicators of the NSE and the Bombay Stock Exchange, respectively.

- This group of equities is known as a benchmark index since they employ the best standards to regulate the companies they select. As a result, they are regarded as the most reliable source of information about how markets work in general.

3. Market Cap Index: A few indices select companies based on their market capitalization. Market capitalization refers to the stock exchange market value of any publicly traded corporation. Indices such as the S&P BSE and NSE small cap 50 are companies with a lower market capitalization as defined by the Securities Exchange Board of India (SEBI).

4. Other Kinds of Indices: Several additional indices, such as the •S&P BSE 500, NSE 100, and S&P BSE 100, are slightly larger and have a greater number of stocks listed on them.

- Investors may have a low-risk appetite, but Sensex stocks may have a high-risk appetite. Investment portfolios are not designed to fulfill all demands. As a result, investors must remain focused and invest in areas where they feel secure.

Question 7. What are the different methods used in the calculation of stock Indices?

Answer:

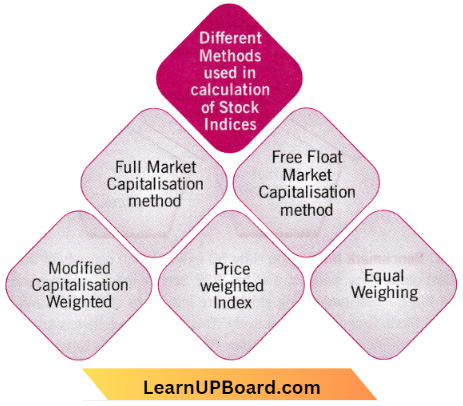

There are various methods for calculating the stock market index.

Some of the major methods to calculate the stock market index are given below:

1. Full Market Capitalisation method: In this method, to determine the scrips weighted in the index, the number of shares outstanding is multiplied by the market price of company shares.

- The share with the highest market capitalization would have a higher weight in the index and would be the most influential in the index. In the end, Market capitalization of all companies will be added and it will be the final value of that index.

- The number of shares outstanding means the total number of shares currently held by all its shareholders, including shares held by institutional investors and restricted shares owned by the company’s officers and insiders. The S&P 500 index in the USA uses this method.

- Full Market Capitalisation = No. of shares outstanding x Market Price of one share

2. Free Float Market Capitalisation method: Free Float is the percentage of shares available in the market for trading. It excludes restricted shares held by the government in the form of strategic investment, shares held by company officers and insiders, shares locked under employee stock option plans,s, etc.

Companies in the index are provided with the free float factors based on their percentage of shares in free float. Free float ranges from 0.05 to 1.0 Value of the index through this method is calculated using the following steps-

- Free float market Capitalisation using the formula = Total number of free float shares x Market price of each share x Free float factor

- Add the Market capitalization of all the companies in the index calculated through step 1.

- Calculate the index value with the help of the following formula.

- Index Value = (Current Free Float Market Capitalisation of index / Base Free Float Market Capitalisation of index) x Base

- The Index Value Free float market capitalization method is used by both BSE and NSE.

3. Modified Capitalisation Weighted: This method seeks to reduce the effect of the largest stock in the index which would otherwise dominate the value of the index. This method sets a limit on the percentage weight of the largest stock in the group of stocks. NASDAQ 100 uses this method.

4. Price-weighted Index: In the price-weighted index calculation method, each stock influences the index in proportion to its price per share. The value of the index is calculated by adding the prices of each stock in the index and dividing them by the total number of stocks.

- Stocks with a higher price are given more weight which has a greater influence on the performance of the index. Dow Jones Industrial Average uses this method.

5. Equal Weighing: In this method, the percentage weight of every stock in the index is equal, so, all the stocks have an equal influence on the index value. Kansas City Board of Trade (KCBT) uses this method.

Question 8. What are Sectoral Indices? Illustrate the Sectoral Indices of the NIFTY.

Answer:

Sectoral Indices

Sectoral indices provide concise, summaries and comparative data for specific sectors or industries. It enables investors to monitor a stock’s performance against specific sectors. Each trading company operates within a particular economic sector, and businesses that share common products or services will be grouped.

- By classifying firms and the economy, investors may conduct in-depth analyses of how the economy as a whole is operating. Energy, services, healthcare, consumer products, industrial, materials, utilities, technology & communications, and financial are all examples of sector indexes.

Sectoral Indices of the NIFTY: The NSE has established a variety of sectoral indices that reflect the performance of the equities included in each index. All sectoral indices are capped following the information provided under ‘Index features.’

1. NIFTY Auto: The index is intended to reflect the behavior and performance of the automobile sector, which includes manufacturers of automobiles and motorcycles, as well as heavy vehicles, auto ancillaries, and tires. The index comprises a maximum of 15 equities and has a January 1, 2004 base date.

2. NIFTY Bank: The index is intended to capture the behavior and performance of large, liquid banks. The index may contain up to 12 stocks and has a base date of January 1, 2000.

3. NIFTY Consumer Durables: The index is designed to track the performance of companies in the Consumer Durables sector. The index consists of a maximum of 15 stocks and has a base value of 1000 points. The index’s base date is April 1, 2005.

4. NIFTY FMCG: The index is intended to reflect the performance and behavior of Fast-Moving Consumer Goods (FMCG). They are commodities and products that are not durable, are intended for mass consumption, and are readily available off the shelf. The index includes a maximum of fifteen companies.

5. NIFTY IT: The index is intended to reflect the behavior of companies involved in information technology infrastructure, information technology education and software training, networking infrastructure, software development, hardware, and information technology support and maintenance, among other activities. The index included twenty companies. The index’s base value was changed from 1000 to 100 on May 28, 2004.

6. NIFTY Media: The NIFTY Media Index is designed to track the behavior and performance of companies in industries such as media, entertainment, printing, and publishing. The index includes a maximum of fifteen companies.

7. NIFTY Metal: The NIFTY Metal Index is intended to reflect the metals sector’s behavior and performance, including mining. The index may have up to fifteen stocks.

8. NIFTY Oil & Gas: The index is designed to track the performance of companies involved in the oil, gas, and petroleum industries. The index consists of a maximum of 15 stocks and has a base value of 1000 points. The index’s base date Is April 1, 2005,

9. NIFTY Pharma: The NIFTY Pharma Index is intended to reflect the behavior and performance of pharmaceutical manufacturers. The index consists of a maximum of 20 stocks as of September 30, 2021.

10. The NIFTY PSU Bank Index: was created to reflect the behaviour and performance of public sector banks. Effective December 27, 2019, all Public Sector Banks traded on the National Stock Exchange (NSE) (listed and traded or not listed but permitted to trade) are eligible for inclusion in the index, subject to meeting other inclusion requirements, including listing history and trading frequency. The index’s base date is January 1, 2004, and its base value is 1000 points.

11. The NIFTY Private Bank Index: It is intended to reflect the behavior and performance of private sector banks. The index consists of ten stocks, and each company’s weight in the index is limited to 25%. (until March 29, 2019).

12. NIFTY Realty: The NIFTY Realty Index is intended to reflect the behavior and performance of enterprises engaged in developing residential and commercial real estate. The index may contain up to ten stocks.

13. NIFTY Financial Services: The index is aimed to reflect the behavior and performance of the Indian financial industry, including banks, financial institutions, housing finance, non-bank financial companies (NBFCs), insurance, and other financial services firms. The index is limited to a maximum of twenty stocks.

14. NIFTY Financial Services 25/50: This is a new capped version of the NIFTY Financial Services index, with 25 denoting the maximum percentage weight of a single stock and 50 denoting the maximum percent weight of all stocks with an individual weight greater than 5%.

NIFTY Healthcare: The index is intended to reflect healthcare companies’ behavior and performance. The index has a maximum of twenty firms and has a base value of 1000 points, and the index’s base date is April 1, 2005.

Question 9. Explain the criteria adopted in the selection of scrips for Sensex.

Answer:

The criteria adopted in the selection of scrips for Sensex

The BSE Sensitive Index has long been known as the barometer of the daily temperature of Indian bourses. In 1978-79 stock market contained only private sector companies and they were mostly geared to commodity production.

- Hence, a sample of 30 was drawn from them. With time more and more companies private as well as public came into the market.

- Even though the number of scrips in the Sensex basket remained the same at 30, representations were given to new industrial sectors such as services, telecom, consumer goods, and 2 and 3-wheeler auto sectors.

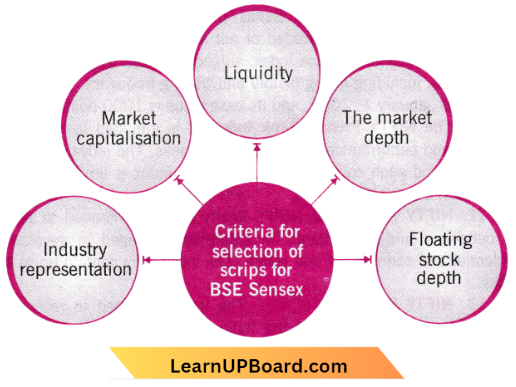

Criteria for selection of scrips for BSE Sensex;

1. Industry representation: The index should be able to capture the macro-industrial situation through price movements of individual scrips. The company’s scrip should reflect the present state of the industry and its prospects. Companies chosen should be representative of the industry. For example, a company like ACC in the Sensex is a representative of the cement industry.

- The logic here is that ACC reflects the fortunes of the cement industry that in turn is discounted by the market in the scrip’s pricing. Care is taken in selecting scrips across all the major industries to make the index act as a real barometer of the economy.

2. Market capitalization: The market capitalization of the stock indicates the true value of the stock, as the outstanding number of shares is multiplied by the price. Price indicates the demand and growth potential for the stock. The outstanding shares depend on the equity base. The selected scrip should have a wide equity base too.

3. Liquidity: The liquidity factor is based on the average number of deals of a scrip. The average number of deals in the two previous years is taken into account. The market fancy for the share can be found out by the trading volumes. The Financial Express Equity Index is weighted by trading volume and not by market capitalization.

4. The market depth: The market depth factor is the average deal as a percentage of the company’s shares outstanding. The market depth depends upon the wide equity base. If the equity base is broad based then the number of deals in the market would increase. For example, Reliance Industries has a wide equity base and a larger number of outstanding shares.

5. Floating stock depth: The floating depth factor is the average number of deals as a percentage of floating stock. Low floating stock may get overpriced because the simple law of demand and supply applies here. For example, MRF with its low floating stock can command a high price.

It’s sound finance and internal generation of funds-led growth may be the reason for the low flotation. Though the public holding is fairly high at around 40 percent due to a small equity of Rs. 4.24 Cr, the free float of the company stock is low.

Trading volumes are directly linked to the public holding in the equity of the company. Wide public holding is a prerequisite for high trading volume. Reliance Industries is a good example. The free float of the company is 45 percent and it has a positive effect on the trading volume.

Question 10. Explain the stock selection criteria adopted in the NSE-Nifty.

Answer:

The stock selection criteria adopted in the NSE-Nifty

The NSE-50 Index is built by India Index Services Product Ltd (IISL) and Credit Rating Information Services of India Ltd.(CRISIL). The NSE-50 index was introduced on April 22, 1996, with the objectives given below:

- Reflecting market movement more accurately

- Providing fund managers with a tool for measuring portfolio returns and market returns.

- Serving as a basis for introducing index-based derivatives.

- Nifty replaced the earlier NSE-100 index, which was established as an interim measure till the time the automated trading system stabilized.

Selection criteria: The selection criteria are the market capitalization and liquidity. The selection criterion for the index was applied to the entire universe of securities admitted to NSE.

- Thus, the sample set covers a large number of industry groups and includes equities of more than 1200 companies.

- The market capitalization of the companies should be Rs. 5 billion (US $ 118 Million) or more. The selected securities are given weights in proportion to their market capitalization.

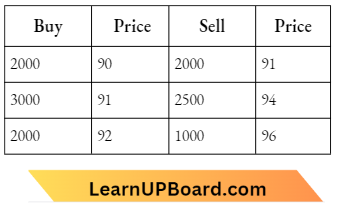

Liquidity (Impact cost): Here liquidity is defined as the cost of executing a transaction in a security in proportion to the weightage of its market capitalization as against the index market capitalization at any point in time.

- This is calculated by finding out the percentage markup suffered while buying/selling the desired quantity of security compared to its ideal price (best buy + best sell)/2

To buy 2500

\(\text { Ideal price }=\frac{90+91}{2}=90.5\)Actual buy price \(=\frac{(2000 \times 91)+(500+94)}{2500}\)

⇒ \(=\frac{1,82,000+47,000}{2500}=91.6\)

Impact cost for 2500 shares \(=\frac{91.6-90.5}{90.5} \times 100=1.21\)

- The impact cost for the selling price also can be calculated. The company scrip should be traded for 85% of the trading days at an impact cost of less than 1.5%

2. Base period: The base period for the S & P. CNX Nifty index is the closing prices on November 3, 1995. The base period is selected to commensurate the completion of one year of operation of NSE in the stock market. The base value of the index is fixed at 1000 with a base capital of Rs. 2.06 trillion. Its unique features are:

- S & P. CNX Nifty provides an effective hedge against risk. The effectiveness of hedging was compared with several portfolios that consist of small-cap, madcap, and large-cap companies and found to be higher.

- The index represents 45 percent of the total market capitalization.

- The impact cost of S & P. NCX Nifty portfolio is less compared with other portfolios.

- The nifty index is chosen for derivative trading.

Question 11. ‘Stock market indices are the barometers of the stock market’- Discuss.

Answer:

‘Stock market indices are the barometers of the stock market’

A stock market index is a barometer of market behavior. It measures overall market sentiment through a set of stocks that are representative of the market. It reflects market direction and indicates day-to-day fluctuations in stock prices.

- An ideal index must represent changes in the prices of securities and reflect price movements of typical shares for better market representation. In the Indian markets the BSE, SENSEX, and NSE, NIFTY are important indices.

- A stock exchange does not indicate the fluctuating prices of all the companies in the country. It only includes best stocks which represent a portion of the overall market. Generally, stocks of a company that performs best in its industry are selected.

- The parameter to select the best company from a particular industry can be the size of the company, market capitalization, performance growth, or some other basis.

- For Example, on the Bombay Stock Exchange, there are two pharmaceutical companies, namely Cipla Ltd. and Dr Reddy’s Laboratories Ltd. These two companies are the best performers in that industry.

- It is not necessarily fixed that once a company is included in a stock index then it can’t be removed. The composition of a stock exchange alters as per the performance of companies. Stock Exchange may remove a bad-performing company and can add a well-performing new company.

1. Representation of Market Performance: Stock market indices are designed to represent the performance of a group of stocks that are listed on a particular exchange. In India, popular indices include the Bombay Stock Exchange (BSE) Sensex and the National Stock Exchange (NSE) Nifty. These indices typically consist of large, well-established companies that are considered representative of the overall market.

2. Indicator of Economic Health: Stock market indices are often seen as indicators of broader economic health. In India, for example, a rising stock market may be interpreted as a positive signal for the economy, suggesting that investors have confidence in the growth prospects of businesses. Conversely, a declining market may indicate concerns about economic challenges.

3. Investor Sentiment: Stock indices reflect the collective sentiment of investors. If the market indices are rising, it may indicate optimism and confidence among investors. On the other hand, a falling index may suggest pessimism and concern. Changes in investor sentiment can impact buying and selling decisions, influencing overall market trends.

4. Benchmark for Investment Performance: Investors and fund managers often use stock market indices as benchmarks to assess the performance of their investments. If a mutual fund or portfolio consistently outperforms the benchmark index, it is considered a positive sign, while underperformance may raise concerns.

5. Liquidity and Market Depth: Stock market indices also provide insights into the liquidity and depth of the market. Higher market capitalization and trading volumes of the constituent stocks contribute to the overall stability and reliability of the index as a barometer.

6. Policy Impact: Changes in government policies, economic reforms, and other macroeconomic factors can influence stock market indices. Investors and analysts closely watch indices for signs of how policy changes might impact various sectors and industries.

7. Global Connectivity: In an era of globalized financial markets, movements in Indian indices are often correlated with global indices. Global events and trends can impact Indian markets, making indices crucial for understanding the interconnectedness of the Indian market with the global economy.

Question 12. Define Derivative. Write the Features of financial derivatives.

Answer:

Derivative

The term “Derivative” indicates that it has no independent value, its value is entirely derived from the value of the underlying asset. The underlying asset can be securities, commodities, bullion, currency, livestock, or anything else.

- In other words, derivative means forward, futures, option, or any other hybrid contract of predetermined fixed duration, linked for contract fulfillment to the value of a specified real or financial asset or an index of securities

Features of financial derivatives:

1. It is a contract: Derivative is defined as the future contract between two parties. It means there must be a contract binding on the underlying parties and the same to be fulfilled in the future. The future period may be short or long depending upon the nature of the contract, for example, short-term interest rate futures and long-term interest rate futures contracts.

2. Derives value from underlying asset: Normally, the derivative instruments have a value that is derived from the values of other underlying assets, such as agricultural commodities, metals, financial assets, intangible assets, etc.

- The value of derivatives depends upon the value of the underlying instrument which changes as per the changes in the underlying assets, and sometimes, it may be nil or zero. Hence, they are closely related.

3. Specified obligation: In general, the counterparties have specified obligations under the derivative contract. The nature of the obligation would be different as per the type of the instrument of a derivative. For example, the obligation of the counterparties, under the different derivatives, such as forward contract, futures contract, option contract, and swap contract would be different.

4. Direct or exchange-traded: The derivatives contracts can be undertaken directly between the two parties or through a particular exchange like financial futures contracts.

- The exchange-traded derivatives are quite liquid and have low transaction costs in comparison to tailor-made contracts. Examples of exchange-traded derivatives are Dow Jones, S&P 500, Nikki 225, NIFTY option, and S&P Junior which are traded on the New York Stock Exchange, Tokyo Stock Exchange, National Stock Exchange, Bombay Stock Exchange, and so on.

5. Related to notional amount: In general, the financial derivatives are carried off-balance sheet. The size of the derivative contract depends upon its notional amount. The notional amount is the amount used to calculate the payoff.

- For instance, in the option contract, the potential loss and potential payoff, both may be different from the value of underlying shares, because the payoff of derivative products differs from the payoff that their notional amount might suggest.

6. Delivery of underlying assets not involved: Usually, in derivatives trading, the taking or making of delivery of underlying assets is not involved, rather underlying transactions are mostly settled by taking offsetting positions in the derivatives themselves. There is, therefore, no effective limit on the quantity of claims, which can be traded in respect of underlying assets.

7. May be used as deferred delivery. Derivatives are also known as deferred delivery or deferred payment instruments. It means that it is easier to take short or long positions in derivatives in comparison to other assets or securities. Further, it is possible to combine them to match specific, i.e., they are more easily amenable to financial engineering.

8. Secondary market instruments: Derivatives are mostly secondary market instruments and have little usefulness in mobilizing fresh capital by the corporate world, however, warrants and convertibles are exceptions in this respect.

9. risk exposure: Although in the market, the standardized, general, and exchange-traded derivatives are being increasingly evolved, however, still there are so many privately negotiated customized, over-the-counter (OTC) traded derivatives in existence. They expose the trading parties to operational risk, counter-party risk, and legal risk. Further, there may also be uncertainty about the regulatory status of such derivatives.

10. Off-balance sheet item: Finally, the derivative instruments, sometimes, because of their off-balance sheet nature, can be used to clear up the balance sheet. For example, a fund manager who is restricted from taking a particular currency can buy a structured note whose coupon is tied to the performance of a particular currency pair.

Question 13. Elucidate the different types of Financial Derivatives.

Answer:

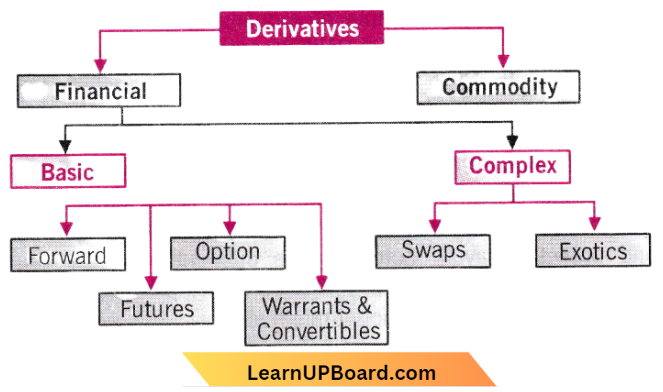

Derivatives are of two types: Financial And Commodities

- One form of classification of derivative instruments is between commodity derivatives and financial derivatives.

- The basic difference between these is the nature of the underlying instrument or asset. In a commodity derivative, the underlying instrument is a commodity which may be wheat, cotton, pepper, sugar, jute, turmeric, corn, soybeans, crude oil, natural gas, gold, silver, copper, and so on.

- In a financial derivative, the underlying instrument may be treasury bills, stocks, bonds, foreign exchange, stock index, gilt-edged securities, cost of living index, etc.

The most commonly used derivatives contracts are forwards, futures, and options:

1. Forwards: A forward contract is a customized contract between two entities, where settlement takes place on a specific date in the future at today’s pre-agreed price.

- For example, an Indian car manufacturer buys auto parts from a Japanese car maker with a payment of one million yen due in 60 days.

- The importer in India is short of yen and supposed the present price of the yen is Rs. 68. Over the next 60 days, the yen may rise to Rs. 70. The importer can hedge this exchange risk by negotiating a 60 days forward contract with a bank for Rs. 70.

- According to a forward contract, in 60 days the bank will give the importer one million yen and the importer will give the bank 70 million rupees to the bank.

2. Futures: A futures contract is an agreement between two parties to buy or sell an asset at a certain time in the future at a certain price. Futures contracts are special types of forward contracts in the sense that the former are standardized exchange-traded contracts.

- A speculator expects an increase in the price of gold from current future prices of Rs. 9000 per 10 gm. The market lot is 1 kg and he buys one lot of future gold (9000 x 100) for Rs. 9,00,000.

- Assuming that there is a 10% margin money requirement and a 10%increase occurs in the price of gold, the value of the transaction will also increase i.e. Rs. 9900 per 10 gm and the total value will be Rs. 9,90,000. In other words, the speculator earns Rs. 90,000.

3. Options: Options are of two types- calls and puts. Calls give the buyer the right but not the obligation to buy a given quantity of the underlying asset, at a given price on or before a given future date. Puts give the buyer the right, but not the obligation to sell a given quantity of the underlying asset at a given price on or before a given date.

4. Warrants: Options generally have lives of up to one year, the majority of options traded on options exchanges have a maximum maturity of nine months. Longer-dated options are called warrants and are generally traded over the counter.

5. Leaps: The acronym LEAPS means long-term equity anticipation securities. These are options having a maturity of up to three years.

6. Baskets: Basket options are options on portfolios of underlying assets. The index options are a form of basket options.

7. Swaps: Swaps are private agreements between two parties to exchange cash flows in the future according to a prearranged formula. They can be regarded as portfolios of forward contracts. The two commonly used swaps are:

8. Interest rate swaps: These entail swapping only the interest-related cash flows between the parties in the same currency

9. Currency Swaps: These entail swapping both principal and interest on different currencies than those in the opposite direction.

10. Swaptions: Swaptions are options to buy or sell a swap that will become operative at the expiry of the options. Thus a swaptions is an option on a forward swap. Rather than have calls and puts, the swaptions market has receiver swaptions and payer swaptions. A receiver swaption is an option to receive fixed and pay floating. A payer swaption is an option to pay fixed and receive floating.

Question 14. What are Derivatives? Describe the uses and limitations of Derivatives.

Answer:

Derivatives

Derivatives are financial instruments whose pay-off is derived from some other underlying asset. Derivatives are designed for hedging, speculation, or arbitrage purposes.

- Derivative securities are the outcome of future and forward markets, where the buying and selling of securities take place in advance but on future dates. This is done to mitigate the risk arising out of the future price movements.

Uses of derivatives:

Derivatives are supposed to provide the following services:

1. Risk aversion tools: One of the most important services provided by the derivatives is to control, avoid, shift, and manage efficiently different types of risks through various strategies like hedging, arbitraging, spreading, etc.

- Derivatives assist the holders to shift or modify suitably the risk characteristics of their portfolios.

- These are specifically useful in highly volatile financial market conditions like erratic trading, highly flexible interest rates, volatile exchange rates, and monetary chaos.

2. Prediction of future prices: Derivatives serve as barometers of the future trends in prices which result in the discovery of new prices both on the spot and futures markets.

- Further, they help in disseminating different information regarding the futures markets trading of various commodities and securities to the society which enables them to discover or form suitable or correct or true equilibrium prices in the markets.

- As a result, they assist in the appropriate and superior allocation of resources in society.

3. Enhance liquidity: In derivatives trading no immediate full amount of the transaction is required since most of them are based on margin trading. As a result, a large number of traders, and speculators arbitrageurs operate in such markets. So, derivatives trading enhances liquidity and reduces transaction costs in the markets for underlying assets

4. Assist investors: The derivatives assist the investors, traders, and managers of large pools of funds to devise such strategies so that they may make proper asset allocation increase their yields, and achieve other investment goals.

5. Integration of price structure: It has been observed from the derivatives trading in the market that the derivatives have smoothed out Price fluctuations, squeezed the price spread, integrated price structure at different points of time, and removed gluts and shortages in the markets.

6. Catalyze growth of financial markets: Derivatives trading encourages competitive trading in the markets and different risk-taking preferences of the market operators like speculators, hedgers, traders, arbitrageurs, etc. resulting in an increase in trading volume in the country. They also attract young investors, professionals, and other experts who will act as catalysts to the growth of financial markets.

7. Brings perfection to the market: Lastly, it is observed that derivatives trading develops the market towards ‘complete markets’. The complete market concept refers to that situation where no particular investors can be better off than others, or patterns of returns of all additional securities are spanned by the already existing securities in it, or there is no further scope of additional security.

Limitations of Derivatives:

1. Risk of Loss: While derivatives can be used to manage risk, they also carry their risks. Leverage inherent in many derivative contracts can amplify losses, potentially leading to significant financial losses.

2. Complexity: Derivatives can be complex financial instruments that require a deep understanding of underlying markets, contract terms, and potential risks. A lack of understanding can lead to costly mistakes.

3. Counterparty Risk: In derivative transactions, there is a risk that one of the parties involved might default on their obligations. This is known as counterparty risk and can lead to financial losses for the other party.

4. Regulatory and Legal Risks: Derivatives are subject to various regulations and legal requirements. Failure to comply with these regulations can result in legal and financial consequences.

5. Market Volatility: Derivative markets can be highly volatile, which can lead to unexpected price movements. Sudden and extreme price fluctuations can result in losses for traders and investors.

6. Market Manipulation: In some cases, derivative markets can be susceptible to manipulation and fraudulent activities, which can distort prices and impact fair market functioning.

7. Overdependence on Derivatives: Relying heavily on derivatives for risk management and speculation can expose individuals and institutions to significant risks if market conditions change unexpectedly

Question 15. Explain the Functions of derivatives markets.

Answer:

The Functions of Derivatives Markets

The derivatives market is a financial market where financial instruments known as derivatives are traded.

- Derivatives derive their value from an underlying asset, index, or rate, and their value is based on the expected future price movements of the underlying asset.

- These instruments are used for various purposes, including hedging against price fluctuations, speculating on future price movements, and achieving portfolio diversification.

Functions of derivatives markets: The following functions are performed by derivative markets:

1. Discovery of price: Prices in an organized derivatives market reflect the perception of market participants about the future and lead the prices of underlying assets to the perceived future level.

- The prices of derivatives converge with the prices of the underlying at the expiration of the derivative contract. Thus derivatives help in the discovery of future as well as current prices.

2. Risk transfer: The derivatives market helps to transfer risks from those who have them but may not like them to those who have an appetite for them.

3. Linked to cash markets: Derivatives, due to their inherent nature, are linked to the underlying cash markets. With the introduction of derivatives, the underlying market witnesses higher trading volumes because of participation by more players who would not otherwise participate for lack of an arrangement to transfer risk.

4. Check on speculation: Speculation traders shift to a more controlled environment of the derivatives market. In the absence of an organized derivatives market, speculators trade in the underlying cash markets. Managing, monitoring and surveillance of the activities of various participants become extremely difficult in these kinds of mixed markets.

5. Encourages entrepreneurship: An important incidental benefit that flows from derivatives trading is that it acts as a catalyst for new entrepreneurial activity. Derivatives have a history of attracting many bright, creative, well-educated people with an entrepreneurial attitude.

- They often energize others to create new businesses, new products, and new employment opportunities, the benefits of which are immense.

6. Increases savings and investments: Derivatives markets help increase savings and investment in the long run. The transfer of risk enables market participants to expand their volume of activity.

Question 16. What are the Factors -responsible for the growth of Financial Derivative markets in India?

Answer:

Factors -responsible for the growth of Financial Derivative markets in India

There are a large number of factors that contribute to the growth of financial derivative markets in India. All such factors may be classified into environmental factors and internal factors.

Environmental factors: Environmental factors contribute to the growth of financial derivative markets in India.

The following are the environmental factors

1. Price volatility: It refers to rapid changes in the prices of assets in the financial markets over a short period.

2. Globalisation of markets: Globalization has increased the size of markets. This has exposed the modern businesses to greater risk. Increased size has also led to greater use of debt in capital structures. This has contributed to an increase in the financial risks of firms.

3. Technological advances: Technological advances have also motivated the financial derivative markets. Technological advances involve computer and internet technologies. These developments encouraged not only the modeling and design of complex financial deals and instruments but also facilitated trading in them on a 24*7 time frame

4. Regulatory changes: Much of the financial derivative market activity in recent years in India has been fostered by an atmosphere of deregulation of the financial sector. Deregulation has increased competition and forced industries to become competitive.

Internal factors: The following are internal factors that have contributed to the growth of financial derivative markets in India.

1. Liquidity needs: Business firms have liquidity needs. Many of the financial innovations pioneered in the recent past have targeted these needs.

2. Risk aversion: Most of the investors would like to avoid risks. Derivative instruments are useful for avoiding risk.

3. Risk executives: increased risk perceptions of corporate organizations promoted to recruit personnel with risk management training. Most big and medium enterprises maintain risk management teams.

Question 17. Explain the Stock market derivatives in India.

Answer:

Stock market derivatives in India

In India, derivatives are traded on organized exchanges as well as on OTC markets. Derivatives in financial securities were introduced in the National Stock Exchange (NSE) AND THE Bombay Stock Exchange (BSE) in 2000.

- Commodity derivatives were introduced in the year 2003 with the establishment of the multi-commodity exchange, the National Multi-commodity Exchange, and the National Commodity and Derivatives Exchange Ltd.

Let us examine the important stock market derivatives in India.

1. Index futures: The first derivative product traded on the BSE and NSE was index futures. This was introduced in 2000.

- Index futures at NSE: NSE is now one of the prominent exchanges amongst all emerging markets, in terms of equity derivatives turnover. The index futures trading at NSE commenced on 12/06/2000 on the S&P CNX Nifty index.

- Index futures at BSE: The index futures trading at BSE commenced on 09/06/2000 on BSE sense over some time (2000-2012) many indices have been made available for index futures trading.

2. Stock futures or Futures on individual securities: Futures on individual securities were introduced in November 2001. These are cash-settled. These do not involve the delivery of the underlying assets. Today, the most preferred product on the exchanges is single stock futures. This accounts for 55% of total volume.

3. Index options: Index options are financial derivatives based on stock indices such as the S&P 500 or the Dow Jones Industrial Average. Index options give the investor the right to buy or sell the underlying stock index for a defined period.

- Since index options are based on a large basket of stocks in the index, investors can easily diversify their portfolios by trading them. Index options are cash settled when exercised, as opposed to options on single stocks where the underlying stock is transferred when exercised.

- Index options at NSE: The index options were allowed for trading on the S&P CNXnifty index on June 4, 2001. Since its inception, index options at NSE have been growing in the overall equity derivative market.

- Index options at BSE: BSE commenced trading in index options on Sensex on June 1, 2001. BSE launched the Chhota (mini) Sensex on June 1, 2008. With a small or mini market lot of 5, it allows, for comparatively lower capital outlay, lower trading cost, more precise hedging, and flexible trading.

4. Stock options or options on individual securities: Options on individual securities were introduced in July 2001. These are cash-settled. These do not involve the physical delivery of the underlying asset. Other derivatives in India

- Apart from the futures and options on stock indices and individual stocks, there are some other derivatives in India.

Such derivatives may be briefly discussed below.

1. Commodity derivatives: The Forward Contract Regulation Act governs commodity derivatives in the country. The FCRA specifically prohibits OTC commodity derivatives, therefore, at present, India trades only exchange-traded commodity futures.

2. Interest rate derivatives: The NSE launched short-term and long-term interest rate futures in June 2003. However, the trading activity in interest rate futures was very thin. The major reason for this low volume of trading in interest rate futures is the existence of a well-developed OTC market for interest rate swaps and forward rate agreements.

3. Currency derivatives: India has been trading forward contracts in currency, for the last several years. Recently, the Reserve Bank of India has also allowed options in the over-the-counter market. The OTC currency market in the country is considerably large and well-developed.

4. Credit derivatives: Since 2003, the RBI has been looking into the introduction of credit derivatives, and on May 17, 2007, it allowed banks to enter into single-entity credit default swaps. Credit derivatives allow lenders to buy protection against default by borrowers. It is the transfer of the credit risk from one party to another without transferring the underlying.

5. Weather derivatives: SEBI is planning to allow trading in weather derivatives. It is a financial instrument to reduce the risk associated with adverse or unexpected weather conditions, For Example in the agriculture sector. Weather derivative was pioneered by Enron in the US in 1997.

Question 18. Define Commodity Market. Write its features and functions.

Answer:

Commodity Market

A commodity market is a marketplace that facilitates the exchange of goods for immediate deliveries between the country’s residents.

- The commodity market is a financial market where people buy and sell commodities like agro-products, metals, energy, and other raw materials.

- Producers and consumers of commodities use commodity markets to control price risk and figure out prices. To put it more simply, it is a place where people can buy and sell goods.

- The physical market and the derivatives market are the two kinds of commodity markets. In the physical market, real goods are traded.

- In the derivatives market, contracts are traded that show a deal to buy or sell a specific good at a certain time in the future.

Features of Commodity Markets: Commodity markets have several features that distinguish them from other financial markets.

Here are some of the key features of commodity markets:

1. Standardization: Commodities traded in the market are standardized. This means that the quality, quantity, and delivery date of the commodity are predetermined and specified in the contract. Standardization enables buyers and sellers to trade transparently and efficiently.

2. Price discovery: Commodity markets facilitate price discovery, which is the process of determining the market value of a commodity. The price of a commodity is determined by the forces of supply and demand in the market. Price discovery helps producers and consumers of commodities to determine the fair value of the commodity.

3. Low transaction costs: Commodity markets have low transaction costs compared to other financial markets. This is because commodities are physical assets that do not require complex financial instruments for trading. As a result, transaction costs such as brokerage fees and commissions are relatively low.

4. Leverage: Commodity markets provide leverage to traders. This means that traders can buy or sell a larger quantity of commodities with a smaller amount of capital. Leverage allows traders to amplify their gains or losses.

5. Volatility: Commodity markets are volatile. The prices of commodities are influenced by a variety of factors such as weather conditions, geopolitical events, and supply and demand dynamics. As a result, commodity prices can fluctuate rapidly and unpredictably.

6. Hedging: Commodity markets provide a mechanism for hedging against price risk. Producers and consumers of commodities can use futures contracts to lock in a price for the commodity and protect themselves against price fluctuations in the physical market.

7. Speculation: Commodity markets also attract speculators who seek to profit from price changes in the market. Speculators are traders who do not have an underlying interest in the physical commodity but trade futures contracts for profit.

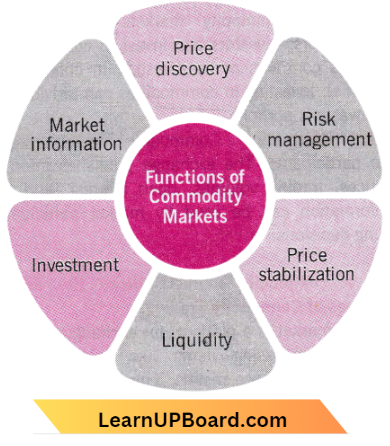

Functions of Commodity Markets: The commodity market serves several functions that are important to the economy and to market participants.

The following are the key functions of commodity markets:

1. Price discovery: One of the primary functions of commodity markets is to facilitate price discovery. Commodity prices are determined by the forces of supply and demand in the market. Through the trading of commodities on the exchange, buyers and sellers can determine the fair value of the commodity.

2. Risk management: Commodity markets provide a mechanism for managing price risk. Producers and consumers of commodities can use futures contracts to lock in a price for the commodity and protect themselves against price fluctuations in the physical market. This is known as hedging and it enables market participants to manage risk and plan their operations more effectively.

3. Price stabilization: Commodity markets can help stabilize commodity prices. By providing a platform for trading commodities, the market can balance the supply and demand of commodities. In periods of excess supply, traders can sell their commodities on the exchange, which can help bring down prices. Similarly, in periods of shortage, traders can buy commodities on the exchange, which can help support prices.

4. Liquidity: Commodity markets provide liquidity to market participants. This means that traders can buy or sell commodities at any time during the trading hours of the exchange. The availability of liquidity helps to ensure that market participants can trade their commodities quickly and easily.

5. Investment: Commodity markets provide an investment opportunity to investors. Investors can invest in commodities by buying and selling futures contracts or by investing in commodity exchange-traded funds (ETFs). Investing in commodities can provide diversification benefits to an investor’s portfolio.

6. Market information: Commodity markets provide market information to participants. The exchange publishes information about commodity prices, trading volumes, open interest, and other market data. This information can be used by market participants to make informed trading decisions.

Question 19. What is a commodity market? Write the advantages and

Answer:

Commodity market

A commodity market is a platform for exchanging primary goods or raw materials, encompassing items like gold, silver, crude oil, agricultural products, and base metals.

- This marketplace facilitates the buying and selling of these commodities through cash or futures contracts.

- Essentially, these markets act as a vital intermediary between commodity producers and consumers. They provide producers with a means to sell their goods and safeguard against price fluctuations, while consumers can acquire the needed products at optimal prices.

Advantages of Commodity Trading:

1. Diversification: Commodities introduce diversification to investment portfolios, reducing overall risk exposure. Their performance often differs from traditional assets like stocks and bonds, acting as a buffer during market volatility.

2. Inflation Hedge: As commodities tend to rise in value during inflation, they serve as a safeguard against currency depreciation. Investors seek commodities to preserve purchasing power.

3. Global Demand Influence: Commodities’ prices can surge due to geopolitical events, natural disasters, or supply disruptions, providing lucrative opportunities for investors.

4. Profit Potential: Trading commodities allows investors to profit from both rising and falling markets, thanks to options like futures and options contracts.

5. Liquidity: Many commodity markets are highly liquid, meaning there is a high volume of trading activity. This liquidity can make it easier for investors to buy or sell commodities without significantly impacting their prices, it also allows for quick entry and exit from positions.

6. Potential Returns: Several factors affect the prices of individual commodities such as supply and demand, inflation, and economy. Due to massive global infrastructure projects, demand has increased in the global infrastructure projects that impact commodity prices. A positive impact on the company stocks affects commodity prices.

7. Transparency in the Process: Trading is a transparent process in commodity futures that allows a fair price that is controlled by large-scale participation. It reflects different perspectives of a large number of people who deal with the commodity.

8. Profitable Returns: Commodities become riskier in the form of investments if the liquidity is high. This means that companies can experience both huge profits and heavy losses.

9. Cushioning against market fluctuations; Money requirement to buy commodity goods if the rupee’ becomes less valuable. During inflation, investors sell off stocks and bonds for investment in commodities. This leads to an increase in the prices of commodity goods. You can only benefit from commodities that act as a hedge against market risks.

10. Trading on Lower Margin: Traders can deposit 5 to 10% of the total contract value as a margin with the broker. This is less in comparison with other asset classes. Low margins allow individuals to invest and take larger positions at lesser capital.

Disadvantages of the Commodity Trading:

1. Price Volatility: Commodities can experience rapid price swings due to external factors, potentially leading to substantial gains or losses for traders.

2. Lack of Income: Unlike dividend-paying stocks or interest¬bearing bonds, commodities do not provide regular income, making them more suitable for capital appreciation.

3. Limited Knowledge: Successful commodity trade demands specialized knowledge of specific markets, often requiring diligent research and analysis.

4. Market Complexity: Derivative trading, such as futures and options, can be intricate and necessitates understanding contract terms and market dynamics.

5. High Risk: Trading in some commodities like crude oil requires a high risk-bearing capacity. The commodity market comes with its own set of risks; therefore it is very important to have a risk profile evaluated before entering the world of commodity trading.

Question 20. What is meant by Currency Market/’Foreign Exchange Market’? What are its Characteristics?

Answer:

Currency Market/’Foreign Exchange Market’

A market for the purchase and sale of foreign currencies is called a ‘foreign exchange market’. The purpose of such a market is to facilitate international trade and investments. The need for a foreign exchange market arises because of the presence of different international currencies such as the US dollar, UK-pound sterling, European, Japanese-Yen, etc., and the need for trading in such currencies.

Definition: According to Kindleberger, a “Foreign exchange market is a place where foreign money is bought and sold”.

Characteristics of Foreign Exchange Market: Some of the important features of a foreign exchange market are as follows:

1. Electronic Market: The Foreign Exchange market is described as the OTC (Over the Counter) market as there is no physical place where the participants meet to execute the deals. It means the foreign exchange market does not have a physical place.

- It is a market whereby trading in foreign currencies takes place through the electronically linked network of banks, foreign exchange brokers, and dealers whose function is to bring together buyers and sellers of foreign exchange.

2. Geographical spreading: A feature of the foreign exchange market is that it is not to be found in one place. The market is vastly dispersed throughout the leading financial centers of the world such as London, New York, Amsterdam, Tokyo, Hong Kong Toronto, and other cities.

3. Transfer of purchasing power: The foreign exchange market aims at permitting the transfer of purchasing power denominated in one currency to another whereby one currency is traded for another currency. For example – an Indian exporter sells software to a U.S. firm for dollars and a U.S. firm sells supercomputers to an Indian Company for rupees.

- In these transactions, firms of respective countries would like to have their payment settled in their currencies i.e. Indian firm in rupees and U.S. firm in U.S. dollars. It is the foreign exchange market, which facilitates such a settlement between countries in their respective currency units.

4. Intermediary: Foreign exchange markets provide a convenient way of converting the currencies earned into currencies wanted by their respective countries. For this purpose, the market acts as an intermediary between buyers and sellers of foreign exchange.

5. Volume: A special feature of the foreign exchange market is that out of the trading transactions that take place in the foreign exchange market, around 95% takes the firm of cross-border purchase and sale of assets, that is, international capital flows. Only around 5% relates to the export and import activities.

6. Provision of credit: A foreign exchange market provides credit through specialized instruments such as bankers’ acceptance and letters of credit. The credit thus provided is of much help to the traders and businessmen in the international market.

7. Minimizing risks: The foreign exchange market helps the importer and exporter in foreign trade to minimize their risks of trade. This is being done through the provision of ‘Hedging’ facilities.

- This enables traders to transact business in the international market to earn a normal business profit without exposure to an expected change in anticipated profit. This is because exchange rates suddenly change.

8. 24-hour Market: The markets are situated throughout the different time zones of the globe in such a way that when one market is closing the other is beginning its operations. Thus at any point in time, one market or the other is open. Therefore, it is stated that the foreign exchange market is functioning 24 hours a day.

9. Currencies Traded: In most markets, the US dollar is the vehicle currency i.e. this currency is used to denominate international transactions.

Question 21. What is the Foreign Exchange Market? Write its functions.

Answer:

Foreign Exchange Market

The foreign exchange market is the market in which foreign currencies are bought and sold. The buyers and sellers include individuals, firms, foreign exchange brokers, commercial banks, and the central bank.

- Like any other market, the foreign exchange market is a system, not a place. The transactions in this market are not confined to only one or a few foreign currencies.

- There are a large number of foreign currencies that are traded, converted, and exchanged in the foreign exchange market.

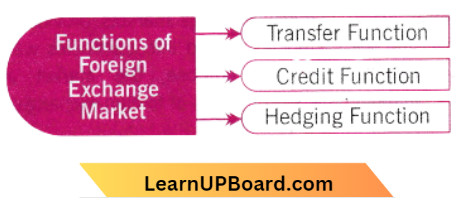

Functions of Foreign Exchange Market: The functions of the foreign exchange market are as follows:

1. Transfer Function: The basic function of any foreign exchange market is to facilitate the conversion of one currency into another, i.e., to accomplish transfers of purchasing power between two countries. This transfer of purchasing power is affected through a variety of credit instruments, such as telegraphic transfers, bank drafts, and foreign bills.

2. Credit Function: Another function of the foreign exchange market is to provide credit, both national and international, to promote foreign trade;, when foreign bills of exchange are used in international payments, a credit for about 3 months, till their maturity, is required.

3. Hedging Function: A third function of the foreign exchange market is to hedge foreign exchange risks. In a free exchange, market when the exchange rate, i.e., the price of one currency in terms of another currency changes, there may be a gain or loss to the party concerned.

- Under this condition, a person or a firm undertakes a great exchange risk if there are huge amounts of net claims or net liabilities that are to be met in foreign money. Exchange risk as such should be avoided or reduced.

- For this, the exchange market provides facilities for hedging anticipated or actual claims or liabilities through forward contracts in exchange.

- A forward contract which is normally for three months is a contract to buy or sell foreign exchange against another currency at some fixed date in the future at a price agreed upon now.

- No money passes at the time of the contract. However, the contract makes it possible to ignore any likely changes in the exchange rate. The existence of a forward market thus makes it possible to hedge an exchange position.

Question 22. Discuss about Types of Market Participants in the Forex Market.

Answer:

The participants of the foreign exchange market are as follows:

1. Corporates: Business houses, international investors, and multinational corporations may operate in the market to meet their genuine trade or investment requirements.

- They may also buy or sell currencies to speculate or trade in currencies to the extent permitted by the exchange control regulations.

- They operate by placing orders with the commercial banks. The deals between banks and their clients form the retail segment of the foreign exchange market.