CA Foundation Economics – National Income Accounting Multiple Choice Questions

Question 1. Which of the following is NOT a component of Gross Domestic Product (GDP)?

- Consumption

- Investment

- Government Spending

- Imports

Answer: 4. Imports

Explanation:

Imports are not included in Gross Domestic Product (GDP) calculations because GDP measures the value of goods and services produced within a country’s borders. Importing goods from other countries is not considered part of a country’s production.

Question 2. Which of the following is the correct formula for calculating Gross Domestic Product (GDP)?

- GDP = Consumption + Investment + Government Spending

- GDP = Consumption + Investment + Government Spending + Exports – Imports

- GDP = Consumption + Investment + Net Exports

- GDP = Consumption + Investment + Government Spending + Exports

Answer: 2. GDP = Consumption + Investment + Government Spending + Exports – Imports

Explanation:

This formula represents the expenditure approach to calculating GDP, taking into account consumption, investment, government spending, and net exports (exports minus imports).

Question 3. Which of the following is a measure of a country’s Gross National Product (GNP)?

- The total value of all goods and services produced within a country’s borders in a specific period.

- The total value of all goods and services produced by a country’s residents, both domestically and abroad, in a specific period.

- The total value of all goods and services sold by a country to other countries in a specific period.

- The total value of all goods and services produced by a country’s domestic companies in a specific period.

Answer: 2. The total value of all goods and services produced by a country’s residents, both domestically and abroad, in a specific period.

Explanation:

Gross National Product (GNP) measures the total value of all goods and services produced by a country’s residents, regardless of whether they are located within the country’s borders or abroad.

Question 4. In national income accounting, “Net Domestic Product (NDP)” is defined as

- The total value of all goods and services produced within a country’s borders in a specific period.

- The total value of all final goods and services produced within a country’s borders in a specific period.

- The total value of all goods and services produced within a country’s borders minus depreciation in a specific period.

- The total value of all goods and services produced by a country’s residents, both domestically and abroad, in a specific period. .

Answer: 3. The total value of all goods and services produced within a country’s borders minus depreciation in a specific period

Explanation:

“Net Domestic Product (NDP)”

Net Domestic Product (NDP) is a measure of a country’s economic output that considers depreciation (wear and tear on capital goods) to account for the difference between Gross Domestic Product (GDP) and the net value of capital goods used in the production process.

Question 5. Which of the following is NOT a component of Gross Domestic Product (GDP)?

- Government Spending.

- Consumption

- Investment

- Imports

Answer: 4. Imports

Explanation:

GDP only considers the value of goods and services produced within a country’s borders (domestic production). Imports represent goods and services produced abroad, and they are not included in GDP calculations.

Question 6. What does GNP stand for in national income accounting?

- Gross National Product

- Gross Net Profit

- Government National Payment

- General National Practice

Answer: 1. Gross National Product

Explanation:

GNP stands for Gross National Product, which measures the total value of goods and services produced by a country’s residents (both domestically and abroad) during a specific period.

Question 7. Which of the following represents the formula for calculating GDP (Gross Domestic Product)?

- GDP = Consumption + Government Spending + Investment + Exports – Imports

- GDP = Consumption + Government Spending – Investment + Exports + Imports

- GDP = Consumption + Government Spending + Investment – Exports – Imports

- GDP = Consumption – Government Spending + Investment + Exports – Imports

Answer: 1. GDP = Consumption + Government Spending + Investment + Exports – Imports

Explanation:

GDP is calculated by summing up the consumption by households, government spending, investments made by businesses, and net exports (exports minus imports).

Question 8. In national income accounting, what does the term “disposable income” refer to?

- The total income earned by a nation’s residents.

- The income that individuals have after paying taxes.

- The total income earned by a nation’s residents minus government spending.

- The income earned from foreign sources.

Answer: 2. The income that individuals have after paying taxes.

Explanation:

Disposable income refers to the income that individuals have at their disposal after paying taxes. It is the money available for personal spending, saving, or investment.

Question 9. Which of the following is NOT included in the calculation of Gross Domestic Product (GDP)?

- Government spending

- Consumer spending

- Imports

- Exports

Answer: 3. Imports

Explanation:

GDP is a measure of the total economic output of a country. It includes consumer spending, government spending, and exports (goods and services produced domestically and sold abroad). However, imports (goods and services produced abroad and sold domestically) are not included in GDP because they are already accounted for in the final sales of domestic goods and services.

Question 10. Which of the following is used to measure the total income earned by a country’s residents, regardless of their location?

- Gross National Product (GNP)

- Gross Domestic Product (GDP)

- Net National Product (NNP)

- Net Domestic Product (NDP)

Answer: 1. Gross National Product (GNP)

Explanation:

GNP measures the total income earned by a country’s residents, including income earned abroad. It includes the income earned domestically and the net income earned from foreign assets and investments. In contrast, GDP measures the total economic output within a country’s borders, regardless of whether the income is earned by residents or foreigners.

Question 11. In National Income Accounting, depreciation of capital refers to

- The decrease in the value of a nation’s currency.

- The decrease in the value of physical assets over time

- The decrease in the government’s budget deficit

- The decrease in consumer spending on durable goods

Answer: 2. The decrease in the value of physical assets over time

Explanation:

Depreciation of capital in National Income Accounting refers to the wear and tear or obsolescence of physical assets (For example, machinery, and buildings) used in the production process. It is also known as “capital consumption” or “capital depreciation.” Depreciation is deducted from the Gross Domestic Product (GDP) to arrive at the Net Domestic Product (NDP) or from the Gross National Product (GNP) to arrive at the Net National Product (NNP).

Question 12. Which of the following is an example of a transfer payment in National Income Accounting?

- Salary of a government employee

- Social Security benefits

- Income earned from selling goods

- Corporate taxes paid to the government

Answer: 2. Social Security benefits

Explanation:

Transfer payments are payments made by the government to individuals or other entities where no goods or services are exchanged. Social Security benefits are an example of transfer payments as they involve direct payments from the government to eligible recipients without any production of goods or services in return.

Question 13. Which of the following is NOT a component of Aggregate Expenditure in National Income Accounting?

- Consumption

- Investment (I)

- Government Spending (G)

- Net Exports (NX)

Answer: 4. Net Exports (NX)

Explanation:

Aggregate Expenditure is the total spending on goods and services in an economy. It comprises four components: Consumption (C), investor (I), Government Spending (G), and Net Exports (NX). Net Exports (NX represents the difference between exports (X) and imports (M) and are not a standalone component of Aggregate Expenditure

Question 14. National income accounting is a method used to

- Calculate the total profits of private companies

- Measure the economic performance of a country

- Determine the total savings of the government

- Assess the inflation rate in the economy

Answer: 2. Measure the economic performance of a country

Question 15. Gross Domestic Product (GDP) is defined as:

- The total value of all goods and services produced within a country’s borders in a specific period

- The total value of all imports and exports of a country

- The total value of all goods and services produced by a country’s citizens, regardless of their location

- The total value of all goods and services produced by a country’s companies, regardless of their ownership

Answer: 1. The total value of all goods and services produced within a country’s borders in a specific period

Question 16. Which of the following is NOT included in GDP calculations?

- Investment spending by businesses

- Government spending on infrastructure

- Social Security payments to retirees

- Consumer spending on durable goods

Answer: 3. Social Security payments to retirees

Question 17. The income approach to calculating GDP

- Adds up all the wages, salaries, and profits earned in an economy

- Only considers the total spending on final goods and services

- Focuses on the net exports of a country

- Includes only the value of intermediate goods and services

Answer: 1. Adds up all the wages, salaries, and profits earned in an economy

Question 18. Real GDP differs from Nominal GDP in that

- Real GDP accounts for inflation, while Nominal GDP does not

- Real GDP includes government spending, while Nominal GDP does not

- Real GDP is measured in current market prices, while Nominal GDP is adjusted for inflation

- Real GDP considers only the value of goods, while Nominal GDP includes services as well

Answer: 1. Real GDP accounts for inflation, while Nominal GDP does not

Question 19. National Income is calculated as

- GDP minus depreciation

- GDP plus net exports

- GDP minus indirect taxes and subsidies

- GDP minus government spending

Answer: 3. GDP minus indirect taxes and subsidies

Question 20. The expenditure approach to calculating GDP

- Adds up all the wages, salaries, and profits earned in an economy

- Focuses on the total spending on final goods and services

- Includes only the value of intermediate goods and services

- Considers the net exports of a country

Answer: 2. Focuses on the total spending on final goods and services

Question 21. Which of the following is a component of Gross Domestic Product (GDP)?

- Money supply in the economy

- Unemployment rate

- Government budget deficit

- Investment spending by businesses

Answer: 4. Investment spending by businesses

Usefulness And Significance Of National Income Estimates

Question 1. National Income estimates are essential for

- Calculating government debt

- Evaluating the overall health of the financial sector

- Measuring the economic growth and development of a country

- Determining the inflation rate

Answer: 3. Measuring the economic growth and development of a country

Explanation:

National Income estimates provide valuable information about the total output and income generated within an economy. By tracking changes in National Income over time, economists and policymakers can assess the economic growth and development of a country. It helps in understanding whether the economy is expanding or contracting and whether living standards are improving.

Question 2. The Gross Domestic Product (GDP) per capita is used to:

- Measure the overall size of the economy

- Determine the average income of a country’s citizens

- Calculate the total value of exports and imports

- Analyze the distribution Of wealth in a nation

Answer: 2. Determine the average income of a country’s citizens

Explanation:

GDP per capita is calculated by dividing the Gross Domestic Product (GDP) of a country by its population. It provides an estimate of the average income earned by each individual in the country. It is commonly used to compare the standard of living and economic well-being of different countries.

Question 3. Which of the following is NOT a usefulness of National Income estimates?

- Facilitating economic planning and formulation of policies

- Assessing the contribution of different sectors to the economy

- Aiding in international trade negotiations

- Estimating the unemployment rate

Answer: 4. Estimating the unemployment rate

Explanation:

National Income estimates provide valuable insights into various aspects of the economy, including economic growth, sectoral contributions, and international trade analysis. However, estimating the unemployment rate is not directly related to National Income accounting. Unemployment rate calculations involve separate labor market data and surveys.

Question 4. National Income estimates help in identifying

- The fiscal deficit of a country

- The sources of economic growth

- The exchange rates of foreign currencies

- The demographic profile of the population.

Answer: 2. The sources of economic growth

Explanation:

National Income estimates break down the total economic output into different sectors like agriculture, manufacturing, services, etc. By analyzing these sectoral contributions, economists can identify the sources of economic growth and determine which sectors are driving the overall expansion of the economy.

Question 5. The difference between Gross National Product (GNP) and Gross Domestic Product (GDP) is mainly due to

- Imports and exports

- Government spending

- Foreign aid received

- Remittances from citizens working abroad

Answer: 1. Imports and exports

Explanation:

The main difference between GNP and GDP lies in the treatment of net foreign income. GNP considers the total income earned by a country’s residents, regardless of their location (both domestic and abroad), while GDP only accounts for the income generated within the country’s borders.

Imports and exports are not included in GDP, but they are considered in the calculation of GNP to account for income earned from foreign trade and income earned by citizens working abroad.

Question 6. Which of the following is the usefulness of National Income estimates in economic planning?

- Estimating the number of people in poverty

- Determining the cost of living for citizens

- Assessing the impact of monetary policy

- Identifying the distribution of wealth in society

Answer: 3. Assessing the impact of monetary policy

Explanation:

National Income estimates are crucial for economic planning and policy formulation. One of the significant uses is in assessing the impact of monetary policy. By analyzing changes in National Income over time, policymakers can evaluate the effectiveness of monetary measures, such as interest rates and money supply, in influencing economic growth, inflation, and employment.

Question 7. Which of the following is NOT a significance of National Income estimates?

- Comparing the economic performance of different countries,

- Guiding businesses in profit maximization strategies

- Formulating fiscal policies and taxation rates

- Predicting short-term fluctuations in the stock market

Answer: 4. Predicting short-term fluctuations in the stock market

Explanation:

National Income estimates provide valuable information for various economic analyses and decision-making processes. However, they are not directly related to predicting short-term fluctuations in the stock market. Stock market movements are influenced by a wide range of factors, including investor sentiment, corporate earnings, geopolitical events, and macroeconomic indicators, but National Income alone is hot used for stock market predictions.

Question 8. The concept of “per capita income” derived from National Income estimates is used to

- Determine the total output of an economy

- Measure the average income of individuals in the country

- Assess the level of government debt

- Calculate the value of imports and exports

Answer: 2. Measure the average income of individuals in the country

Explanation:

“Per capita income” is calculated by dividing the total National Income of a country by its population. It provides an average income figure per person in the country. Per capita income is used to assess the standard of living, compare the economic prosperity of different nations, and understand the distribution of income among the population.

Question 9. National Income estimates help in identifying

- The number of foreign tourists visiting the country

- The contribution of different sectors to the economy

- The literacy rate and educational attainment of citizens

- The availability of natural resources within the country

Answer: 2. The contribution of different sectors to the economy

Explanation:

National Income estimates provide data on the total, output and value-added by different sectors of the economy, such as agriculture, manufacturing, services, etc. This information helps in understanding the relative importance and contribution of each sector to the overall economic activity in the country.

Question 10. National Income estimates are essential for

- Calculating individual income taxes

- Assessing the overall health of an economy

- Measuring inflation and unemployment rates

- Determining exchange rates between currencies

Answer: 2. Assessing the overall health of an economy

Question 11. National Income estimates are essential because they help in

- Calculating the total population of a country

- Measuring the total value of goods and services produced in a country

- Determining the exchange rate of the country’s currency

- Evaluating the literacy rate of the country

Answer: 2. Measuring the total value of goods and services produced in a country

Explanation:

National Income estimates are primarily used to measure the total value of goods and services produced within a country’s borders during a specific period. It is a key indicator of a country’s economic performance and is used to understand the overall economic activity and growth.

Question 12. The significance of National Income estimates lies in

- Assessing the distribution of income among different income groups

- Determining the number of unemployed individuals in the country

- Estimating the total national debt of the country

- Analyzing the birth and death rates in the country

Answer: 1. Assessing the distribution of income among different income groups

Explanation:

National Income estimates provide valuable information about the distribution of income among different sections of the population. It helps economists and policymakers understand the level of income inequality in the country and formulate appropriate policies to address disparities and promote inclusive growth.

Question 13. Which of the following is NOT a usefulness of National Income estimates?

- Assessing the standard of living in a country

- Formulating economic policies

- Calculating the inflation rate

- Comparing the economic performance of different countries

Answer: 3. Calculating the inflation rate

Explanation:

While National Income estimates are essential for various purposes, calculating the inflation rate is not one of them. Inflation is measured using other economic indicators, such as the Consumer Price Index (CPI) or Producer Price Index (PPI).

Question 14. National Income estimates help in international comparisons of countries’ economies because they:

- Provide information about the military strength of the countries

- Show the total exports and imports of the countries

- Indicate the level of technological advancement in the countries

- Offer a common measure to compare economic performance

Answer: 4. Offer a common measure to compare economic performance

Explanation:

National Income estimates provide a standardized measure that allows for meaningful comparisons of economic performance among different countries. GDP or GNP (Gross National Product) per capita is often used for these comparisons to understand the relative economic well-being of nations.

Question 15. Which of the following statements is true regarding the usefulness of National Income estimates?

- It helps in predicting the stock market trends.

- It assists in identifying the environmental challenges faced by a country. .

- It is only relevant for developed countries, not for developing countries.

- It aids in assessing the contribution of different sectors to the economy.

Answer: 4. It aids in assessing the contribution of different sectors to the economy.

Explanation:

National Income estimates help analyze the contributions of various sectors (such as agriculture, manufacturing, and services) to the overall economy. It allows policymakers to identify the strengths and weaknesses of different sectors and formulate strategies to promote balanced economic growth.

National Income estimates provide a comprehensive measure of the economic performance and health of a country. They help policymakers, economists, and analysts understand the level of economic activity, growth, and prosperity. By. analyzing National Income data, one can assess the overall health of an economy and make informed decisions regarding economic policies and development strategies.

Question 16. National income estimates are essential for

- Calculating the profits of individual companies

- Assessing the distribution of wealth in a country

- Determining the exchange rates between currencies

- Monitoring the stock market performance

Answer: 2. Assessing the distribution of wealth in a country

Question 17. The primary use of national income estimates is to

- Measure the overall happiness and well-being of citizens

- Determine the economic growth rate of the country

- Calculate the total value of imports and exports

- Evaluate the effectiveness of foreign aid programs

Answer: 2. Determine the economic growth rate of the country

Question 18. Why is it important to calculate Gross Domestic Product (GDP)?

- To understand the unemployment rate in the country

- To analyze the overall debt of the government

- To determine the total value of all goods and services produced in the economy

- To evaluate the efficiency of the banking sector

Answer: 3. To determine the total value of all goods and services produced in the economy

Question 19. National income estimates help in comparing the economic performance of different countries by

- Converting all currencies to a common unit of measurement

- Focusing solely on the GDP growth rate

- Ignoring the impact of inflation on the economy

- Excluding the service sector from the calculations

Answer: 1. Converting all currencies to a common unit of measurement

Question 20. The per capita income, derived from national income estimates, is useful for

- Understanding the total population of a country

- Analyzing the average income of individuals in the country

- Measuring the total number of employed people

- Evaluating the performance of the agricultural sector

Answer: 2. Analyzing the average income of individuals in the country

Question 21. One of the limitations of using national income estimates is that they

- Cannot account for the underground economy

- Overstate the value of intermediate goods

- Ignore the impact of international on the economy

- Focus excessively on government spending

Answer: 1. Cannot account for the underground economy

Question 22. National income estimates help policymakers make informed decisions about

- The promotion of consumer spending

- The allocation of resources and budget planning

- The reduction of inflation rates

- The regulation of the stock market

Answer: 2. The allocation of resources and budget planning

Question 23. In times of economic downturn, national income estimates can be used to

- Encourage more foreign investments

- Identify the sectors that require government bailouts

- Increase taxes on businesses and individuals

- Decrease government spending on infrastructure

Answer: 2. Identify the sectors that require government bailouts

Different Concepts Of National Income

Question 1. Gross Domestic Product (GDP) measures:

- The total value of goods and services produced within a country’s borders, including net income from abroad.

- The total value of goods and services produced by a country’s

residents, regardless of their location. - The total value of goods and services produced within a country’s borders, excluding net income from abroad.

- The total value of goods and services consumed within a country’s borders.

Answer: 1. The total value of goods and services produced within a country’s borders, including net income from abroad.

Explanation:

GDP measures the total value of all goods and services produced within a country’s borders, including the income earned by foreign residents within the country (net income from abroad).

Question 2. Gross National Product (GNP) is defined as:

- The total value of goods and services produced within a country’s borders, excluding depreciation.

- The total value of goods and services produced by a country’s residents, regardless of their location.

- The total value of goods and services produced within a country’s borders, including indirect taxes.

- The total value of goods and services produced by a country’s residents, excluding net income from abroad.

Answer: 2. The total value of goods and services produced by a country’s residents, regardless of their location

Explanation:

GNP measures the total value of goods and services produced by a country’s residents, regardless of. where they are located. It includes the income earned by the country’s residents both domestically and abroad.

Question 3. Net National Product (NNP) is calculated by

- Deducting depreciation from Gross Domestic Product (GDP).

- Adding depreciation to Gross National Product (GNP).

- Deducting indirect taxes from Gross Domestic Product (GDP).

- Adding indirect taxes to Gross National Product (GNP).

Answer: 1. Deducting depreciation from Gross Domestic Product (GDP).

Explanation:

NNP is derived by subtracting depreciation (capital consumption) from Gross Domestic Product (GDP). Depreciation accounts for the wear and tear or obsolescence of physical assets used in production.

Question 4. National Disposable Income(NDI) is defined as

- The total income earned by a country’s residents, including net income from abroad.

- The total income earned by a country’s residents, excluding net income from abroad and indirect taxes.

- The total income earned by a country’s residents, including indirect

taxes. - The total income earned by a country’s residents,. excluding depreciation.

Answer: 2. The total income earned by a country’s residents, excluding net income from abroad and indirect taxes.

Explanation:

National Disposable Income (NDI) represents the total income earned by a country’s residents after deducting net income from abroad and indirect taxes including government transfer payments.

Question 5. Personal Income (PI) is calculated as

- National Disposable Income (NDI) minus corporate profits and social insurance contributions.

- National Income (Nl) minus indirect taxes.

- Gross Domestic Product (GDP) minus depreciation.

- Gross National Product (GNP) minus net income from abroad.

Answer: 1. National Disposable Income (NDI) minus corporate profits and social insurance contributions.

Explanation:

Personal Income (PI) is derived from National Disposable Income (NDI) by subtracting retained corporate profits and social insurance contributions and adding government transfer payments to individuals.

Question 6. Gross Domestic Product (GDP) is defined as the total

- Income earned by a country’s residents, regardless of their location

- Value of goods and services produced within a country’s borders

- Income earned by foreign residents within the country

- Value of goods and services produced by a country’s residents abroad

Answer: 2. Value of goods and services produced within a country’s borders

Explanation:

GDP measures the total value of all goods and services produced within a country’s borders during a specific period. It includes the value of goods and services produced by both domestic and foreign factors of production operating within the country.

Question 7. Gross National Product (GNP) is calculated as the total

- Value of goods and services produced within a country’s borders

- Income earned by a country’s residents, regardless of their location *

- Income earned by foreign residents within the country

- Value of goods and services produced by a country’s residents abroad

Answer: 4. Value of goods and services produced by a country’s residents abroad

Explanation:

GNP measures the total value of goods and services produced by a country’s residents, whether within the country’s borders or abroad. It includes the income earned by a country’s residents from their productive activities both domestically and overseas.

Question 8. Met National Product (NNP) is derived by deducting=

- Depreciation from GDP

- Depreciation from GNP

- Net indirect taxes from GDP

- Net indirect taxes from GNP

Answer: Depreciation from GNP

Explanation:

Net National Product (NNP) is obtained by subtracting depreciation (capital consumption) from Gross National Product (GNP). Depreciation accounts for the wear and tear or obsolescence of capital goods used in the production process. –

Question 9. National Disposable Income (NDI) is calculated by

- Adding depreciation to NNP

- Adding net indirect taxes to NNP

- Deducting direct taxes from NNP

- Deducting net indirect taxes from NNP

Answer: 3. Deducting direct taxes from NNP

Explanation:

National Disposable Income (NDI) is obtained by deducting direct taxes from Net National Product (NNP). It represents the income available to the residents of a country for consumption and saving after accounting for capital depreciation and direct taxes.

Question 10. Personal Income (PI) is derived from National Income (Nl) by

- Adding transfer payments and deducting undistributed corporate profits.

- Adding corporate profits and deducting net interest and rent

- Deducting direct taxes and adding transfer payments

- Deducting retained earnings and adding social security contributions

Answer: 1. Adding transfer payments and deducting undistributed corporate profits

Explanation:

Personal Income (PI) is obtained from National Income (Nl) by adding transfer payments (For example: Social Security benefits) received by individuals and deducting undistributed corporate profits (profits not distributed as dividends to shareholders).

Question 11. Which concept of National Income includes only the market value of final goods and services produced within a country’s borders during a specific period?

- Gross National Product (GNP)

- Net Domestic Product (NDP)

- Gross Domestic Product (GDP) at market price

- Net National Product (NNP)

Answer: 3. Gross Domestic Product (GDP) at market price

Explanation:

Gross Domestic Product (GDP) at market price is a concept of National Income that measures the total market value of all final goods and services produced within a country’s borders during a particular period. It includes goods and services produced by both domestic and foreign entities.

Question 12. Which concept of National Income deducts depreciation (capital consumption) from Gross Domestic Product (GDP)?

- Net Domestic Product (NDP)

- Net National Product (NNP)

- Gross National Product (GNP)

- Gross Domestic Product (GDP) at factor cost

Answer: 1. Net Domestic Product (NDP)

Explanation:

Net Domestic Product (NDP) is a concept of National Income that is obtained by deducting depreciation (capital consumption) from Gross Domestic Product (GDP). It provides a measure of the net value of domestic output after accounting for the wear and tear or obsolescence of physical assets used in the production process.

Question 13. Which concept of National Income takes into account the net income earned from foreign investments and deducts net income earned by foreigners within the country?

- Gross Domestic Product (GDP) at factor cost

- Net Domestic Product (NDP)

- Gross National Product (GNP)

- Net National Product (NNP)

Answer: 3. Gross National Product (GNP)

Explanation:

Gross National Product (GNP) is a concept of National Income that includes the total market value of all final goods and services produced by the country’s residents (both domestically and abroad) during a specific period.

It takes into account the net income earned from foreign investments (factor income from abroad) and deducts net income earned by foreigners within the country (factor income to foreigners) to arrive at GNP.

Question 14. Which concept of National income includes only the value added at each stage of production and avoids double-counting?

- Gross Domestic Product (GDP) at market price

- Net Domestic Product (NDP)

- Gross Domestic Product (GDP) at factor cost

- Gross Value Added (GVA)

Answer: 4. Gross Value Added (GVA)

Explanation:

Gross Value Added (GVA) is a concept of National Income that includes only the value added at each stage of production. It is the difference between the value of output produced and the value of intermediate consumption. GVA avoids double-counting, which may occur when calculating GDP, as it considers only the value added by each industry or sector.

Question 15. Which concept of National Income measures the total market value of all final goods and services produced within a country’s borders, excluding the value of indirect taxes and subsidies?

- Net Domestic Product (NDP) at factor cost

- Gross Domestic Product (GDP) at factor cost

- Gross Domestic Product (GDP) at market price

- Net National Product (NNP)

Answer: 2. Gross Domestic Product (GDP) at factor cost

Explanation:

Gross Domestic Product (GDP) at factor cost is a concept of National Income that measures the total market value of all final goods and services produced within a country’s borders, excluding the value of indirect taxes but including subsidies. It provides a measure of the income earned by the factors of production (labor and capital) without the distortion of indirect taxes and subsidies.

Question 16. Gross Domestic Product (GDP) is the total value of

- All goods and services produced within a country’s borders in a specific time period

- All goods and services produced by a country’s citizens, regardless of their location

- All goods and services produced by a country’s companies, regardless of their ownership

- All final goods and services produced within a country’s borders in a specific time period

Answer: 1. All goods and services produced within a country’s borders in a specific period

Question 17. Gross National Product (GNP) differs from GDP in that GNP

- Includes only the value of final goods and services

- Excludes the value of exports

- Accounts for depreciation of capital goods

- Includes the value of goods and services produced by a country’s citizens abroad

Answer: 4. Includes the value of goods and services produced by a country’s citizens abroad

Question 18. Net National Product (NNP) is calculated by

- Adding depreciation to GDP

- Subtracting depreciation from GDP

- Adding depreciation to GNP

- Subtracting depreciation from GNP

Answer: 2. Subtracting depreciation from GDP

Question 19. National Income (Nl) is calculated by

- Adding indirect taxes to NNP

- Subtracting indirect taxes from NNP

- Adding net foreign factor income to NNP

- Subtracting net foreign factor income from NNP

Answer: 2. Subtracting indirect taxes from NNP

Question 20. Personal Income (PI) is the total income received by

- Individuals before paying personal taxes

- Individuals after paying personal taxes

- Households before paying personal taxes

- Households after paying personal taxes

Answer: 2. Individuals after paying personal taxes

Question 21. Disposable Income (Dl) is calculated by

- Adding personal taxes to personal income

- Subtracting personal taxes from personal income

- Adding corporate taxes to personal income

- Subtracting corporate taxes from personal income

Answer: 2. Subtracting personal taxes from personal income

Question 22. Which of the following represents the broadest measure of a country’s national income? ‘

- GDP

- GNP

- NNP

- Pl

Answer: 2. GNP

Question 23. Gross National Income (GNI) is defined as:

- The total value of all goods and services produced by a country’s companies, regardless of their ownership

- The total value of all goods and services produced by a country’s citizens, regardless of their location

- The total value of all final goods and services produced within a . country’s borders in a specific period

- The total value of all goods and services produced within a country’s borders, excluding foreign factors of production

Answer: 2. The total value of all goods and services produced by a country’s citizens, regardless of their location

Gross Domestic Product

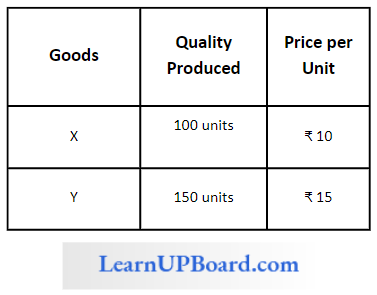

Question 1. The following table shows the production and prices of two goods, X and Y, in a hypothetical economy for the year 2023

Calculate the nominal GDP of the economy for the year 2023.

- ₹ 2,500

- ₹ 3,000

- ₹ 3,500

- ₹ 4,000

Answer: 3. ₹ 3,500

Solution:

To calculate the nominal GDP, we use the formula:

Nominal GDP = I(Quantity Produced × Price per Unit) for all goods.

Nominal GDP = (100 units × ₹ 10) + (150 units × ₹ 15) = ₹ 1,000 + ₹ 2,250 = ₹ 3,250.

The nominal GDP of the economy for the year 2023 is ₹ 3,250.

∴ ₹ 3500

Note: There seems to be a typo in the table provided, as the correct calculation should yield ₹ 3,250, not ₹ 3,500. Please double-check the numbers in the table to ensure accuracy.

Question 2. In a country, the nominal GDP for the year 2022 is ₹ 800 billion, and the GDP deflator for 2022 is 120.0. What is the real GDP for 2022?

- ₹ 480 billion

- ₹ 666.67 billion

- ₹ 666.00 billion

- ₹ 960 billion

Answer: 3. ₹ 666.00 billion

Solution:

In a country, the nominal GDP for the year 2022 is ₹ 800 billion, and the GDP deflator for 2022 is 120.0.

Real GDP can be calculated using the formula:

Real GDP = (Nominal GDP) / (GDP deflator) x 100 Given,

Nominal GDP for 2022 = ₹ 800 billion

GDP deflator for 2022 = 120.0

Real GDP = (800 billion) / (120.0) × 100 5

Real GDP = 666.6667 billion ₹ 666.00 billion (rounded to two decimal places)

So, the real GDP for the year 2022 is approximately ₹ 666.00 billion.

Question 3. The nominal GDP of a country in the base year was ₹ 500 billion, and the real GDP in the same year was ₹450 billion. Calculate the GDP deflator for the base year.

- 90.0

- 100.0

- 110.0

- 125.0

Answer: 2. 100.0

Solution:

The nominal GDP of a country in the base year was ₹ 500 billion, and the real GDP in the same year was ₹450 billion.

The GDP deflator for the base year is calculated as

(Nominal GDP / Real GDP) × 100.

GDP deflator = (500 billion / 450 billion) × 100

GDP deflator =1.1111 × 100 = 100.0

Question 4. In the current year, the nominal GDP of the country is ₹ 600 billion, and the real GDP is ₹ 540 billion. Calculate the GDP deflator for the current year using the base year’s GDP deflator (which is 100.0).

- 90.0

- 100.0

- 110.0

- 125.0

Answer: 3. 110.0

Solution:

In the current year, the nominal GDP of the country is ₹ 600 billion, and the real GDP is ₹ 540 billion.

The GDP deflator for the current year is calculated as (Nominal GDP / Real GDP) × 100.

GDP deflator = (600 billion / 540 billion) × 100

GDP deflator = 1.1111 × 100 = 110.0

Question 5. If the GDP deflator for a particular year is 120.0 what does it indicate about the price level compared to the base year?

- Prices have increased by 20% compared to the base year.

- Prices have decreased by 20% compared to the base year.

- Prices have remained the same as the base year.

- Prices have doubled compared to the base year.

Answer: 1. Prices have increased by 20% compared to the base year.

Solution:

A GDP deflator of 120.0 means that the overall price level has increased by 20% compared to the base year (which has a GDP deflator of 100.0).

Question 6. If the GDP deflator for a particular year is 90.0, what does it indicate about the price level compared to the base year?

- Prices have increased by 10% compared to the base year.

- Prices have decreased by 10% compared to the base year.

- Prices have remained the same as the base year.

- Prices have decreased by 90% compared to the base year.

Answer: 2. Prices have decreased by 10% compared to the base year.

Solution:

A GDP deflator of 90.0 means that the overall price level has decreased by 10% compared to the base year (which has a GDP deflator of 100.0).

Gross National Product (GNP)

Question 1. In a country, the Gross National Product (GNP) for the year 2021 is calculated as follows:

- Gross Domestic Product (GDP) = ₹ 900 billion.

- Net factor income from abroad (NFIA) = ₹ 50 billion (negative value indicates net outflow of income to foreign countries)

Calculate the GNP for the year 2021.

- ₹ 850 billion

- ₹ 950 billion

- ₹ 950 billion (adjusted for net factor income from abroad)

- ₹ 850 billion (adjusted for net factor income from abroad)

Answer: 3. ₹ 950 billion (adjusted for net factor income from abroad)

Solution:

GNP is calculated by adding Net factor income from abroad (NFIA) to GDP.

GNP = GDP + NFIA

GNP = ₹ 900 billion + (- ₹ 50 billion)

GNP = ₹ 950 billion

So, the GNP for the year 2021 is ₹ 950 billion (adjusted for net factor income from abroad).

Question 2. In a country, the Gross National Product (GNP) for the year 2022 is ₹ 1,200 billion, and Net factor income from abroad (NFIA) is ₹ 40 billion (positive value indicates net inflow of income from foreign countries). Calculate the Gross Domestic Product (GDP) for the year 2022.

- ₹ 1,1 60 billion

- ₹ 1,240 billion

- ₹ 1,160 million (adjusted to not factor Incomo from abroad)

- ₹ 1,240 billion (adjusted for not factoring Incomo from abroad)

Answer: 3. 1,160 million (adjusted tor does not factor Incomo from abroad)

Solution:

In a country, the Gross National Product (GNP) for the year 2022 is ₹ 1,200 billion, and Net factor income from abroad (NFIA) is ₹ 40 billion (positive value indicates net inflow of income from foreign countries).

GDP is calculated by subtracting Not factor income from abroad (NFIA) from GNP.

GDP = GNP – NFIA

GDP = ₹ 1,200 billion – ₹40 billion

GDP = ₹ 1,160 billion

So, the Gross Domestic Product (GDP) for the year 2022 is ₹ 1,160 billion (adjusted for net factor income from abroad).

Question 3. In a country, the Gross National Product (GNP) for the year 2023 is ₹ 2,500 billion, and Net factor income from abroad (NFIA) is ₹ 80 billion (positive value indicates net inflow of income from foreign countries). The GDP for the year 2023 is:

- ₹ 2,580 billion

- ₹ 2,420 billion

- ₹ 2,420 billion (adjusted for net factor income from abroad)

- ₹ 2,580 billion (adjusted for net factor income from abroad)

Answer: 3. ₹ 2,420 billion (adjusted for net factor income from abroad)

Solution:

GDP is calculated by subtracting Net factor income from abroad (NFIA) from GNP.

GDP = GNP-NFIA

GDP = ₹ 2,500 billion – ₹ 80 billion

GDP = ₹ 2,420 billion,

So, the Gross Domestic Product (GDP) for the year 2023 is ₹ 2,420 billion (adjusted for net factor income from abroad).

Question 4. In a country, the Gross National Product (GNP) for the year 2022 is calculated as follows: Gross Domestic Product (GDP) = ₹ 900 billion Net factor income from abroad = ₹ 50 billion, What is the Gross National Product (GNP) for the year 2022?

- ₹ 850 billion

- ₹ 860 billion

- ₹ 950 billion

- ₹ 960 billion

Answer: 3. 950 billion

Solution:

In a country, the Gross National Product (GNP) for the year 2022 is calculated as follows: Gross Domestic Product (GDP) = ₹ 900 billion Net factor income from abroad = ₹ 50 billion,

Gross National Product (GNP) is calculated as the Gross Domestic Product (GDP) plus net factor income from abroad.

Given, Gross Domestic Product (GDP) = ₹ 900 billion

Net factor income from abroad = ₹ 50 billion

GNP = GDP + Net factor income from abroad

GNP = ₹ 900 billion + ₹ 50 billion

GNP = ₹ 950 billion

So, the Gross National Product (GNP) for the year 2022 is ₹ 950 billion.

Net National Product At Market Prices (NNPMP)

Question 1. In a country, the Gross National Product (GNP) at Market Prices for the year 2021 is ₹,800 billion. During the same year, depreciation (Capital Consumption Allowance) amounts to ₹100 billion. Calculate the Net National Product at Market Prices (NNPMP) for the year 2021.

- ₹ 900 billion

- ₹ 700 billion

- ₹ 800 billion

- ₹ 600 billion

Answer: 2. ₹ 700 billion

Solution:

In a country, the Gross National Product (GNP) at Market Prices for the year 2021 is ₹,800 billion. During the same year, depreciation (Capital Consumption Allowance) amounts to ₹100 billion.

NNPMP is calculated by subtracting depreciation (Capital Consumption Allowance) from GNP at Market Prices.

NNPMP = GNP at Market Prices – Depreciation

NNPMP = ₹ 800 billion – ₹ 100 billion

NNPMP =₹ 700 billion

So, the Net National Product at Market Prices

(NNPMP) for the year 2021 is ₹ 700 billion.

Question 2. In a country, the Gross National Product (GNP) at Market Prices for the year 2022 is ₹ 1,500 billion. During the same year, depreciation (Capital Consumption Allowance) amounts to ₹ 200 billion. Calculate the Net National Product at Market Prices (NNPMP) for the year 2022.

- ₹ 1,300 billion ‘

- ₹ 1,700 billion

- ₹ 1,300 billion (adjusted for depreciation)

- ₹ 1,700 billion (adjusted for depreciation).

Answer: 1. ₹ 1,300 billion (adjusted for depreciation)

Solution:

In a country, the Gross National Product (GNP) at Market Prices for the year 2022 is ₹ 1,500 billion. During the same year, depreciation (Capital Consumption Allowance) amounts to ₹ 200 billion.

NNPMP is calculated by subtracting depreciation (Capital Consumption Allowance) from GNP at Market Prices.

NNPMP = GNP at Market Prices – Depreciation

NNPMP = ₹ 1,500 billion – ₹ 200 billion

NNPMP = ₹ 1,300 billion

So, the Net National Product at Market Prices

(NNPMP) for the year 2022 is ₹ 1,300 billion (adjusted for depreciation).

Question 3. In a country, the Gross National Product (GNP) at Market Prices for the year 2023 is ₹ 2,000 billion. During the same year, depreciation (Capital Consumption Allowance) amounts to 250 billion. The Net National Product at Market Prices (NNPMP) for the year 2023 is:

- ₹ 2,250 billion

- ₹ 1,750 billion

- ₹ 2,250 billion (adjusted for depreciation) .

- ₹ 1,750 billion (adjusted for depreciation)

Answer: 4. ₹ 1,750 billion (adjusted for depreciation)

Solution:

In a country, the Gross National Product (GNP) at Market Prices for the year 2023 is ₹ 2,000 billion. During the same year, depreciation (Capital Consumption Allowance) amounts to 250 billion.

NNPMP is calculated by subtracting depreciation (Capital Consumption Allowance) from GNP at Market Prices.

NNPMP = GNP at Market Prices – Depreciation

NNPMP = ₹ 2,000 billion – ₹ 250 billion

NNPMP = ₹ 1,750 billion

So, the Net National Product at Market Prices

(NNPMP) for the year 2023 is ₹ 1,750 billion (adjusted for depreciation).

Gross Domestic Product at Factor Cost (GDPFC)

Question 1. In a country, the Gross Domestic Product at Market Prices (GDPMP) for the year.2021 is ₹ 900 billion, and indirect taxes (subsidies) on products are ₹ 50 billion. Calculate the Gross Domestic Product at Factor Cost (GDPFC) for the. year 2021.

- ₹ 850 billion

- ₹ 950 billion

- ₹ 950 billion (adjusted for indirect taxes)

- ₹ 850 billion (adjusted for subsidies)

Answer: 3. ₹ 950 billion (adjusted for indirect taxes)

Solution:

In a country, the Gross Domestic Product at Market Prices (GDPMP) for the year.2021 is ₹ 900 billion, and indirect taxes (subsidies) on products are ₹ 50 billion.

GDPFC is calculated by subtracting indirect taxes (subsidies) on products from GDPMP.

GDPFC = GDPMP – Indirect taxes (subsidies) on products

GDPFC = ₹ 900 billion – ₹ 50 billion

GDPFC = ₹ 950 billion

So, the Gross Domestic Product at Factor Cost

(GDPFC) for the year 2021 is ₹ 950 billion (adjusted for indirect taxes).

Question 2. In a country, the Gross Domestic Product at Market Prices (GDPMP) for the year 2022 is ₹ 1,200 billion, and indirect taxes (subsidies) on products are ₹ 100 billion. Calculate the Gross Domestic Product at Factor Cost (GDPFC) for the year 2022.

- ₹ 1,100 billion

- ₹ 1,300 billion

- ₹ 1,100 billion (adjusted for indirect taxes)

- ₹ 1,300 billion (adjusted for subsidies)

Answer: 3. ₹ 1,100 billion (adjusted for indirect taxes)

Solution:

In a country, the Gross Domestic Product at Market Prices (GDPMP) for the year 2022 is ₹ 1,200 billion, and indirect taxes (subsidies) on products are ₹ 100 billion.

GDPFC is calculated by subtracting indirect taxes (subsidies) on products from GDPMP.

GDPFC = GDPMP – Indirect taxes (subsidies) on products

GDPFC = ₹ 1,200 billion – ₹ 100 billion

GDPFC = ₹ 1,100 billion ‘

So, the Gross Domestic Product at Factor Cost

(GDPFC) for the year 2022 is ₹ 1,100 billion (adjusted for indirect taxes).

Question 3. In a country, the Gross Domestic Product at Market Prices (GDPMP) for the year 2023 is ₹ 2,500 billion, and indirect taxes (subsidies) on products are Rs.200 billion. Calculate the Gross Domestic Product at Factor Cost (GDPFC) for the year 2023.

- ₹ 2,300 billion

- ₹ 2,700 billion

- ₹ 2,300 billion (adjusted for indirect taxes)

- ₹ 2,700 billion (adjusted for subsidies)

Answer: 3. ₹ 2,300 billion (adjusted for indirect taxes)

Solution:

In a country, the Gross Domestic Product at Market Prices (GDPMP) for the year 2023 is ₹ 2,500 billion, and indirect taxes (subsidies) on products are Rs.200 billion.

GDPFC is calculated by subtracting indirect taxes (subsidies) on products from GDPMP.

GDPFC = GDPMP – Indirect taxes (subsidies) on products GDPFC = ₹ 2,500 billion – ₹ 200 billion

GDPFC = ₹ 2,300 billion

So, the Gross Domestic Product at Factor Cost

(GDPFC) for the year 2023 is ₹ 2,300 billion (adjusted for indirect taxes).

Net Domestic Product At Factor Cost (NDPFC)

Question 1. In a country, the Gross Domestic Product at Factor Cost (GDPFC) for the year 2021 is ₹ 800 billion, and depreciation (consumption of fixed capital) is ₹ 100 billion. Calculate the Net Domestic Product at Factor Cost (NDPFC) for the year 2021.

- ₹ 700 billion

- ₹ 900 billion

- ₹ 700 billion (adjusted for depreciation)

- ₹ 900 billion (adjusted for depreciation)

Answer: 3. ₹ 700 billion (adjusted for depreciation)

Solution:

In a country, the Gross Domestic Product at Factor Cost (GDPFC) for the year 2021 is ₹ 800 billion, and depreciation (consumption of fixed capital) is ₹ 100 billion.

NDPFC is calculated by subtracting depreciation from GDPFC.

NDPFC = GDPFC – Depreciation

NDPFC = ₹ 800 billion – ₹ 100 billion

NDPFC = ₹ 700 billion

So, the Net Domestic Product at Factor Cost

(NDPFC) for the year 2021 is ₹ 700 billion (adjusted for depreciation).

Question 2. In a country, the Gross Domestic Product at Factor Cost (GDPFC) for the year 2022 is ₹ 1,200 billion, and depreciation (consumption of fixed ( capital) is ₹150 billion. Calculate the Net Domestic Product at Factor Cost (NDPFC) for the year 2022.

- ₹ 1,050 billion.

- ₹ 1,350 billion.

- ₹ 1,050 billion (adjusted for depreciation)

- ₹ 1,350 billion (adjusted for depreciation)

Answer: 3. ₹ 1,050 billion (adjusted for depreciation)

Solution:

In a country, the Gross Domestic Product at Factor Cost (GDPFC) for the year 2022 is ₹ 1,200 billion, and depreciation (consumption of fixed ( capital) is ₹150 billion.

NDPFC is calculated by subtracting depreciation from GDPFC.

NDPFC = GDPFC – Depreciation

NDPFC = ₹ 1,200 billion – ₹ 150 billion

NDPFC = ₹ 1,050 billion

So, the Net Domestic Product at Factor Cost

(NDPFC) for the year 2022 is ₹ 1,050 billion (adjusted for depreciation).

Question 3. In a country, the Gross Domestic Product at Factor Cost (GDPFC) for the year 2023 is ₹ 2,500 billion, and depreciation (consumption of fixed capital) is ₹ 200 billion. Calculate the Net Domestic Product at Factor Cost (NDPFC) for the year 2023.

- ₹ 2,300 billion

- ₹ 2,700 billion

- ₹ 2,300 billion (adjusted for depreciation)

- ₹ 2,700 billion (adjusted for depreciation)

Answer: 3. ₹ 2,300 billion (adjusted for depreciation

Solution:

In a country, the Gross Domestic Product at Factor Cost (GDPFC) for the year 2023 is ₹ 2,500 billion, and depreciation (consumption of fixed capital) is ₹ 200 billion.

NDPFC is calculated by subtracting depreciation from GDPFC.

NDPFC = GDPFC – Depreciation

NDPFC = ₹ 2,500 billion – ₹ 200 billion

NDPFC = ₹ 2,300 billion

So, the Net Domestic Product at Factor Cost

(NDPFC) for the year 2023 is ₹ 2,300 billion (adjusted for depreciation).

Net National Product At Factor Cost (NNPFC) Or National Income

Question 1. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2021 is ₹ 900 billion, and net indirect taxes (subsidies) on products are ₹ 50 billion. Calculate the Net National Product at Factor Cost (NNPFC) or National Income for the year 2021.

- ₹ 850 billion

- ₹ 950 billion

- ₹ 950 billion, (adjusted for net indirect taxes)

- ₹ 850 billion (adjusted for subsidies)

Answer: 3. ₹ 950 billion (adjusted for net indirect taxes)

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2021 is ₹ 900 billion, and net indirect taxes (subsidies) on products are ₹ 50 billion.

NNPFC or National Income is calculated by subtracting net indirect taxes (subsidies) on products from GNPFC.

NNPFC = GNPFC – Net indirect taxes (subsidies) on products

NNPFC = ₹ 900 billion – ₹ 50 billion

NNPFC = ₹ 950 billion ‘

So, the Net National Product at Factor Cost

(NNPFC) or National Income for the year 2021 is ₹ 950 billion (adjusted for net indirect taxes).

Question 2. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2022 is ₹ 1,200 billion, and net indirect taxes (subsidies) on products are ₹ 100 billion. Calculate the Net National Product at Factor Cost (NNPFC) or National Income for the year 2022.

- ₹ 1,100 billion

- ₹ 1,300 billion

- ₹ 1,100 billion (adjusted for net indirect taxes)

- ₹ 1,300 billion (adjusted for subsidies)

Answer: 3. ₹ 1,100 billion (adjusted for net indirect taxes)

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2022 is ₹ 1,200 billion, and net indirect taxes (subsidies) on products are ₹ 100 billion.

NNPFC or National Income is calculated by subtracting net indirect taxes (subsidies) on products from GNPFC.

NNPFC = GNPFC – Net indirect taxes (subsidies) on products

NNPFC = ₹ 1,200 billion – ₹ 100 billion

NNPFC = ₹ 1,100 billion

So, the Net National Product at Factor Cost

(NNPFC) or National Income forthe year 2022 is ₹ 1,100 billion (adjusted for net indirect taxes).

Question 3. In a country, the Gross National Product at Factor Cost (GNPFC) forthe year 2023 is ₹ 2,500 billion, and net indirect taxes (subsidies) on products are ₹ 200 billion. Calculate the Net National Product at Factor Cost (NNPFC) or National Income for the year 2023.

- ₹ 2,300 billion

- ₹ 2,700 billion

- ₹ 2,300 billion (adjusted for net indirect taxes)

- ₹ 2,700 billion (adjusted for subsidies)

Answer: 3. ₹ 2,300 billion (adjusted for net indirect taxes)

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) forthe year 2023 is ₹ 2,500 billion, and net indirect taxes (subsidies) on products are ₹ 200 billion.

NNPFC or National Income is calculated by subtracting net indirect taxes (subsidies) on products from GNPFC.

NNPFC = GNPFC – Net indirect taxes (subsidies) on products

NNPFC = ₹ 2,500 billion – ₹ 200 billion

NNPFC = ₹ 2,300 billion

So, the Net National Product at Factor Cost

(NNPFC) or National Income for the year 2023 is ₹ 2,300 billion (adjusted for net indirect taxes).

Per Capita Income

Question 1. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2021 is ₹ 800 billion, and the total population is 200 million. Calculate the Per Capita Income for the year 2021.

- ₹ 4,000

- ₹ 4,500

- ₹ 3,500

- ₹ 4,200.

Answer: ₹ 4,000

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2021 is ₹ 800 billion, and the total population is 200 million.

Per Capita Income is calculated by dividing the GNPFC by the total population.

Per Capita Income = GNPFC / total population

Per Capita Income = ₹ 800 billion / 200 million

Per Capita Income = ₹ 4,000

So, the Per Capita Income for the year 2021 is ₹ 4,000.

Question 2. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2022 is ₹ 1,200 billion, and the total population is 250 million. Calculate the Per Capita Income for the year 2022.

- ₹ 4,800

- ₹ 4,000

- ₹ 4,500

- ₹ 5,000

Answer: 3. ₹ 4,500

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2022 is ₹ 1,200 billion, and the total population is 250 million.

Per Capita Income is calculated by dividing the

GNPFC by the total population.

Per Capita Income = GNPFC / Total population

Per Capita Income = ₹ 1,200 billion / 250 million

Per Capita Income = ₹ 4,500

So, the Per Capita Income for the year 2022 is ₹ 4,500.

Question 3. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2023 is ₹ 2,500 billion, and the total population is ₹ 300 million. Calculate the Per Capita Income for the year 2023

- ₹ 8,000

- ₹ 6,000

- ₹ 7,500

- ₹ 5,000

Answer: 2. ₹ 6,000

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2023 is ₹ 2,500 billion, and the total population is ₹ 300 million.

Per Capita Income is calculated by dividing the GNPFC by the total population.

Per Capita Income = GNPFC / Total population

Per Capita Income = ₹ 2,500 billion / ₹ 300 million.

Per Capita Income = ₹ 6,000

So, the Per Capita Income for the year 2023 is ₹ 6,000.

Personal Income

Question 1. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2021 is ₹ 900 billion, depreciation (consumption of fixed capital) is ₹ 100 billion, net indirect taxes (subsidies) on products are ₹ 50 billion, and net current transfers from abroad are ₹ 20 billion. Calculate the Personal Income for the year 2021.

- ₹ 730 billion

- ₹ 830 billion

- ₹ 850 billion

- ₹ 900 billion

Answer: 2. ₹ 830 billion

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2021 is ₹ 900 billion, depreciation (consumption of fixed capital) is ₹ 100 billion, net indirect taxes (subsidies) on products are ₹ 50 billion, and net current transfers from abroad are ₹ 20 billion.

Personal Income is calculated as follows:

Personal Income = GNPFC – Depreciation + Net current transfers from abroad – Net indirect taxes (subsidies) on products

Personal Income = ₹ 900 billion – 100 billion + ₹ 20 billion – ₹ 50 billion

Personal Income = ₹ 770 billion + ₹ 20 billion -₹ 50 billion

Personal Income = ₹ 790 billion – ₹ 50 billion

Personal Income = ₹ 830 billion

So, the Personal Income for the year 2021 is ₹ 830 billion.

Question 2. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2022 is ₹ 1,200 billion, depreciation (consumption of fixed capital) is ₹ 150 billion, net indirect taxes (subsidies) on products are ₹ 80 billion, and net current transfers from abroad are ₹ 30 billion. Calculate the Personal Income for the year 2022.

- ₹ 1,000 billion

- ₹ 1,100 billion

- ₹ 1,020 billion

- ₹ 1,130 billion

Answer: 3. ₹ 1,020 billion

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2022 is ₹ 1,200 billion, depreciation (consumption of fixed capital) is ₹ 150 billion, net indirect taxes (subsidies) on products are ₹ 80 billion, and net current transfers from abroad are ₹ 30 billion.

Personal Income is calculated as follows:

Personal Income = GNPFC – Depreciation + Net current transfers from abroad – Net indirect taxes (subsidies) on products

Personal Income = ₹ 1,200 billion – ₹ 150 billion + ₹ 30 billion – ₹ 80 billion

Personal Income = ₹ 1,050 billion + ₹ 30 billion – ₹ 80 billion

Personal Income = ₹ 1,080 billion – ₹ 80 billion

Personal Income = ₹ 1,020 billion.

So, the Personal Income for the year 2022 is ₹ 1,020 billion.

Question 3. In a country, the Gross National Product at factor Cost (GNPfC) for the year 2023 is ₹ 2,500 billion, desperation (Consumption of fixed capital) is ₹ 200 billion, and net current transfers from abroad are ₹ 40 billion. Calculate the Personal income for the year 2023.

- ₹ 2,240 billion

- ₹ 2,440 billion

- ₹ 2,380 billion

- ₹ 2, 540 billion

Answer: 1. ₹ 2,240 billion

Solution:

In a country, the Gross National Product at factor Cost (GNPfC) for the year 2023 is ₹ 2,500 billion, desperation (Consumption of fixed capital) is ₹ 200 billion, and net current transfers from abroad are ₹ 40 billion.

Personal Income is calculated as follows:

Personal Income = GNPFC – Depreciation + Net current transfers from

abroad – Net indirect taxes (subsidies) on products

Personal Income = ₹ 1,200 billion – ₹ 150 billion + ₹ 30 billion – ₹ 80 billion

Personal Income = ₹ 1,050 billion + ₹ 30 billion – ₹ 80 billion

Personal Income = ₹ 1,080 billion – ₹ 80 billion

Personal Income = ₹ 1,020 billion.

So, the Personal Income for the year 2022 is ₹ 1,020 billion.

Question 4. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2023 is ₹ 2,500 billion, depreciation (consumption of fixed capital) is ₹ 200 billion, net indirect taxes (subsidies) on products are ₹ 100 billion, and net current transfers from abroad are ₹ 40 billion. Calculate the Personal Income for the year 2023.

- ₹ 2,240 billion

- ₹ 2,440 billion

- ₹ 2,380 billion

- ₹ 2,540 billion

Answer: 1. ₹ 2,240 billion

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2023 is ₹ 2,500 billion, depreciation (consumption of fixed capital) is ₹ 200 billion, net indirect taxes (subsidies) on products are ₹ 100 billion, and net current transfers from abroad are ₹ 40 billion.

Personal Income is calculated as follows:

Personal Income = GNPFC – Depreciation + Net current transfers from abroad – Net indirect taxes (subsidies) on products

Personal Income = ₹ 2,500 billion – ₹ 200 billion + ₹ 40 billion – ₹ 100 billion

Personal Income = ₹ 2,300 billion + ₹ 40 billion – ₹ 100 billion

Personal Income = ₹ 2,340 billion – ₹ 100 billion

Personal Income = ₹ 2,240 billion

So, the Personal Income for the year 2023 is ₹ 2,240 billion.

Question 5. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2021 is ₹ 900 billion. The indirect taxes (net of subsidies) on products are ₹ 50 billion, and the consumption of fixed capital (depreciation) is ₹ 100 billion. Calculate the Personal Income for the year 2021, given that there are no other income transfers

- ₹ 750 billion

- ₹ 800 billion

- ₹ 850 billion

- ₹ 900 billion

Answer: 2. ₹ 750 billion

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2021 is ₹ 900 billion. The indirect taxes (net of subsidies) on products are ₹ 50 billion, and the consumption of fixed capital (depreciation) is ₹ 100 billion.

Personal Income is calculated by subtracting indirect taxes (net of subsidies) on products and depreciation from GNPFC.

Personal Income = GNPFC – Indirect taxes (net of subsidies) – Depreciation

Personal Income = ₹ 900 billion – ₹ 50 billion – ₹ 100 billion

Personal Income = ₹ 750 billion

So, the Personal Income for the year 2021 is ₹ 750 billion.

Question 6. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2022 is 1 ₹,200 billion. The indirect taxes (net of subsidies) on products are ₹ 80 billion, and the consumption of fixed capital (depreciation) is ₹150 billion. Calculate the Personal

Income for the year 2022, given that there is no other income transfer

- ₹ 960 billion

- ₹ 970 billion

- ₹ 980 billion

- ₹ 990 billion

Answer: 2. ₹ 970 billion

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2022 is 1 ₹,200 billion. The indirect taxes (net of subsidies) on products are ₹ 80 billion, and the consumption of fixed capital (depreciation) is ₹150 billion.

Personal Income is calculated by subtracting indirect taxes (net of subsidies) on products and depreciation from GNPFC.

Personal Income = GNPFC – Indirect taxes (net of subsidies) – Depreciation

Personal Income = ₹ 1,200 billion – ₹ 80 billion – ₹ 150 billion Personal Income = ₹ 970 billion.

So, the Personal Income for the year 2022 is ₹ 970 billion.

Question 7. In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2023 is ₹ 2,500 billion. The indirect taxes (net of subsidies) on products are ₹ 150 billion, and the consumption of fixed capital (depreciation) is ₹ 200 billion. Calculate the Personal Income for the year 2023, given that there is no other income transfer

- ₹ 2,150 billion

- ₹ 2,150 billion

- ₹ 2,150 billion

- ₹ 2,150 billion

Answer: 2. ₹ 2,150 billion

Solution:

In a country, the Gross National Product at Factor Cost (GNPFC) for the year 2023 is ₹ 2,500 billion. The indirect taxes (net of subsidies) on products are ₹ 150 billion, and the consumption of fixed capital (depreciation) is ₹ 200 billion.

Personal Income is calculated by subtracting indirect taxes (net of subsidies) on products and depreciation from GNPFC.

Personal Income = GNPFC – Indirect taxes (net of subsidies) – Depreciation

Personal Income = ₹ 2,500 billion – ₹ 150 billion – ₹ 200 billion

Personal Income = ₹ 2,150 billion

So, the Personal Income for the year 2023 is ₹ 2,150 billion

Disposable Personal Income (Dl)

Question 1. In a country, the Personal Income (PI) for the year 2021 is ₹ 800 billion. The direct taxes are ₹ 100 billion, and the social security contributions are ₹ 50 billion. Calculate the Disposable Personal Income (Dl) for the year 2021, given that there is no other income transfer

- ₹ 650 billion

- ₹ 750 billion

- ₹ 700 billion

- ₹ 600 billion

Answer: 1. ₹ 650 billion

Solution:

In a country, the Personal Income (PI) for the year 2021 is ₹ 800 billion. The direct taxes are ₹ 100 billion, and the social security contributions are ₹ 50 billion. Calculate the Disposable Personal Income (Dl) for the year 2021

Disposable Personal Income (Dl) is calculated by subtracting direct taxes and social security contributions from Personal Income (PI).

Disposable Personal Income (Dl) = Personal Income (PI) – Direct Taxes – Social Security Contributions

Disposable Personal Income (Dl) = ₹ 800 billion – ₹ 100 billion – ₹ 50 billion

Disposable Personal Income (Dl) = ₹ 650 billion

So, the Disposable Personal Income (Dl) for the year 2021 Is ₹ 650 billion.

Question 2. In a country, the Personal Income (PI) for the year 2022 is ₹ 1,200 billion. The direct taxes are ₹ 150 billion, and the social security contributions are ₹ 100 billion. Calculate the Disposable Personal Income (Dl) for the year 2022, given that there are no other income transfers ₹

- ₹ 950 billion

- ₹ 1,050 billion

- ₹ 1,000 billion

- ₹ 900 billion

Answer: 4. ₹ 900 billion Solution:

In a country, the Personal Income (PI) for the year 2022 is ₹ 1,200 billion. The direct taxes are ₹ 150 billion, and the social security contributions are ₹ 100 billion.

Disposable Personal Income (Dl) is calculated by subtracting direct taxes and social security contributions from Personal Income (PI).

Disposable Personal Income (Dl) = Personal Income (PI) – Direct Taxes – Social Security Contributions

Disposable Personal Income (Dl) = ₹ 1,200 billion – ₹ 150 billion – ₹ 100 billion

Disposable Personal Income (Dl) = ₹ 900 billion

So, the Disposable Personal Income (Dl) for the year 2022 is ₹ 900 billion.

Question 3. In a country, the Personal Income (PI) for the year 2023 is X 2,500 billion. The direct taxes are X 200 billion, and the social security contributions are ^150 billion. Calculate the Disposable Personal Income (Dl) for the year 2023, given that there are no other income transfers ₹.

- ₹ 2,200 billion

- ₹ 2,300 billion

- ₹ 2,350 billion

- ₹ 2,400 billion

Answer: 1. ₹ 2,200 billion

Solution:

In a country, the Personal Income (PI) for the year 2023 is X 2,500 billion. The direct taxes are X 200 billion, and the social security contributions are ^150 billion.

Disposable Personal Income (Dl) is calculated by subtracting direct taxes and social security contributions from Personal Income (PI).

Disposable Personal Income (Dl) = Personal Income (PI) – Direct Taxes – Social Security Contributions

Disposable Personal Income (Dl) = ₹ 2,500 billion – ₹ 200 billion – ₹ 150 billion

Disposable Personal Income (Dl) = ₹ 2,200 billion

So, the Disposable Personal Income (Dl) for the year 2023 is ₹ 2,200 billion.

Question 4. In a country, the Personal Income (PI) for the year 2021 is ₹ 900 billion. Personal taxes for the year 2021 are ₹ 150 billion. Calculate the Disposable Personal Income (Dl) for the year 2021.

- ₹ 750 billion

- ₹ 900 billion

- ₹ 750 billion (adjusted for personal taxes)

- ₹ 1,050 billion

Answer: 3. ₹ 750 billion (adjusted for personal taxes)

Solution:

In a country, the Personal Income (PI) for the year 2021 is ₹ 900 billion. Personal taxes for the year 2021 are ₹ 150 billion.

Disposable Personal Income (Dl) is calculated by subtracting personal taxes from Personal Income (PI).

Dl = PI – Personal taxes Dl = ₹ 900 billion – ₹ 150 billion

Dl = ₹ 750 billion

So, the Disposable Personal Income

(Dl) for the year 2021 is ₹ 750 billion (adjusted for personal taxes).

Question 5. In a country, the Personal Income (PI) for the year 2022 is ₹ 1,200 billion. Personal taxes for the year 2022 are ₹ 180 billion. Calculate the Disposable Personal Income (Dl) for the year 2022.

- ₹ 1,020 billion

- ₹ 1,200 billion

- ₹ 1,020 billion (adjusted for personal taxes)

- ₹ 1,380 billion

Answer: 3. ₹ 1,020 billion (adjusted for personal taxes)

Solution:

In a country, the Personal Income (PI) for the year 2022 is ₹ 1,200 billion. Personal taxes for the year 2022 are ₹ 180 billion.

Disposable Personal Income (Dl) is calculated by subtracting personal taxes from Personal Income (PI).

Dl = PI – Personal taxes

DI = ₹ 1,200 billion – ₹180 billion

Dl = ₹ 1,020 billion

So, the Disposable Personal Income

(Dl) for the year 2022 is ₹ 1,020 billion (adjusted for personal taxes).

Question 6. In a country, the Personal Income (PI) for the year 2023 is ₹ 2,500 billion. Personal taxes for the year 2023 are ₹ 300 billion. Calculate the Disposable Personal Income (Dl) for the year 2023.

- ₹ 2,200 billion

- ₹ 2,800 billion

- ₹ 2,200 billion (adjusted for personal taxes)

- ₹ 2,800 billion (adjusted for personal taxes)

Answer: 3. ₹ 2,200 billion (adjusted for personal taxes

Solution:

In a country, the Personal Income (PI) for the year 2023 is ₹ 2,500 billion. Personal taxes for the year 2023 are ₹ 300 billion.

Disposable Personal Income (Dl) is calculated by subtracting personal taxes from Personal Income (PI).

Dl = PI – Personal taxes

Dl = ₹ 2,500 billion – ₹ 300 billion

Dl = ₹ 2,200 billion

So, the Disposable Personal Income

(Dl) for the year 2023 is 2,200 billion (adjusted for personal taxes).

Private Income

Question 1. In a country, the Personal Income (PI) for the year 2021 is ₹ 900 billion. Current transfers from the government and the rest of the world to individuals for the year 2021 are ₹ 50 billion. Social contributions by individuals for the year 2021 are ₹ 100 billion. Calculate the Private Income for the year 2021.

- ₹ 750 billion

- ₹ 800 billion

- ₹ 850 billion

- ₹ 950 billion

Answer: 2. ₹ 800 billion

Solution:

In a country, the Personal Income (PI) for the year 2021 is ₹ 900 billion. Current transfers from the government and the rest of the world to individuals for the year 2021 are ₹ 50 billion.

Private Income is calculated by subtracting current transfers from the government and the rest of the world to individuals and social contributions by individuals from Personal Income (PI).

Private Income = PI – Current transfers – Social contributions

Private Income = ₹ 900 billion – ₹ 50 billion – ₹ 100 billion

Private Income = ₹ 800 billion

So, the Private Income for the year 2021 is ₹ 800 billion.

Question 2. In a country, the Personal Income (PI) for the year 2022 is ₹ 1,200 billion. Current transfers from the government and the rest of the world to individuals for the year 2022 is ₹ 80 billion. Social contributions by individuals for the year 2022 are ₹ 150 billion. Calculate the Private Income for the year 2022.

- ₹ 950 billion

- ₹ 940 billion

- ₹ 930 billion

- ₹ 970 billion

Answer: 4. ₹ 970 billion.

Solution:

In a country, the Personal Income (PI) for the year 2022 is ₹ 1,200 billion. Current transfers from the government and the rest of the world to individuals for the year 2022 is ₹ 80 billion

Private Income is calculated by subtracting current transfers from the government and the rest of the world to individuals and social contributions by individuals from Personal Income (PI).

Private Income = PI – Current transfers – Social contributions

Private Income = ₹ 1,200 billion – ₹ 80 billion – ₹ 150 billion

Private Income = ₹ 970 billion

So, the Private Income for the year 2022 is ₹ 970 billion.

Question 3. In a country, the Personal Income (PI) for the year 2023 is ₹ 2,500 billion. Current transfers from the government and the rest of the world to individuals for the year 2023 are ₹ 200 billion. Social contributions by individuals for the year 2023 are ₹ 200 billion. Calculate the Private Income for the year 2023.

- ₹ 2,100 billion

- ₹ 2,700 billion

- ₹ 2,500 billion

- ₹ 2,900 billion

Answer: 1. ₹ 2,100 billion

Solution: