CA Foundation Solutions For Business Laws Contract Of Indemnity And Guarantee Multiple Choice Question

Question 1. A contract of indemnity as a contract by which one party promises to save the other party from the loss caused to him by the conduct of the promisor himself or of any other person has been defined

- Under Section 124

- Under Section 123

- Under Section 125

- Under Section 126

Answer: 1. Under Section 124

Question 2. As perSection124 of the Indian Contract Act,1 872, a contract is a contract by which one party promises to save the other party from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person

- Indemnity

- Guarantee

- Specific performance

- Injunction

Answer: 1. Indemnity

Question 3. The person who promises to make a good loss is called as

- Indemnified

- Indemnity holder

- Indemnifier

- Surety

Answer: 3. Indemnifier

Question 4. The person whose loss is to be made good is called as

- Indemnified

- Indemnify holder

- Indemnifier

- (1) or (2)

Answer: 4. (1) or (2)

Question 5. As per Section 125 of the Indian Contract Act, 1872, the Indemnity-holder acting within the scope of.his authority is entitled to recover:

- All damages which he may be compelled to pay in any suit in respect of any matter to which the promise to indemnify applies.

- All costs for defending or bringing any suit if worked as a prudent person.

- All sums which he may have paid under the terms of any compromise of any such suit.

- All of the above.

Answer: 4. All of the above.

Question 6. A and B go into a shop. A says to the shopkeeper, “Let B have the goods, I will see you paid. This is:

- Contract of guarantee

- Contract of Indemnity

- Contract of Specific performance

- Contract of wagering

Answer: 2. Contract of Indemnity

Question 7. A contract of guarantee has been defined

- Under Section 123

- Under Section 124

- Under Section 125

- Under Section 126.

Answer: 4. Under Section 126.

Question 8. Surety is a person

- In respect of whose default the guarantee is given

- Who gives the guarantee

- To whom the guarantee is given.

- None of the above.

Answer: 2. Who gives the guarantee

Question 9. A creditor is a person

- To whom the guarantee is given

- Who gives the guarantee

- In respect of whose default the guarantee is given

- None of the above.

Answer: 1. To whom the guarantee is given

Question 10. A guarantee

- Has to be in writing

- Can be oral

- Can be oral or in writing

- Neither (1) nor (2)

Answer: 3. Can be oral or in writing

Question 11. A valid guarantee can be given

- Only if there is no principal debt

- Only if there is a principal debt

- Irrespective of any debt

- Both (1) and (2)

Answer: 2. Only if there is a principal debt

Question 12. A guarantee to be valid

- Can only be of a present debt

- Can be of past debt if some further debt is incurred after the guarantee

- Can be future debt if some debt is incurred after the guarantee

- All the above.

Answer: 4. All the above.

Question 13. Which of the following is a valid guarantee

- Guarantee of a minor’s debt

- Guarantee of a debt of a company acting ultra vires in obtaining the loan

- Both (1) and (2)

- Neither (1) nor (2)

Answer: 1. Guarantee of a minor’s debt

Question 14. Under a contract of guarantee

- If the principal debtor is not liable, the guarantor is not liable

- If principal debtors are not liable, the guarantor is liable

- If the principal debtor is liable, the guarantor is liable

- All the above.

Answer: 3. If the principal debtor is liable, the guarantor is liable

Question 15. In a contract of guarantee

- There are two parties and one contract

- There are two parties and two contract

- There are three parties and three contracts

- None of the above

Answer: 3. There are three parties and three contracts

Question 16. A contract_______ is a contract to perform the promise made or discharge liability incurred by a third person in case of his default.

- Indemnity

- Guarantee

- Specific performance

- Injunction

Answer: 2. Guarantee

Question 17. The person on whose behalf the guarantee is given is called________.

- Surety

- Principal debtor

- Creditor

- Indemnity holder

Answer: 2. Principal debtor

Question 18. The person who gives the guarantee is called _________

- Surety

- Principal debtor

- Creditor

- Indemnity holder.

Answer: 1. Surety

Question 19. The person to whom the guarantee is given is called as

- Surety

- Principal debtor

- Creditor

- Indemnity holder.

Answer: 3. Creditor

Question 20. A and B go into a shop. A ways to the shopkeeper, “Let B have the goods and if he does not pay, I will. This is _________.

- Contract of guarantee

- Contract of Indemnity

- Contract of Specific performance

- Contract of wagering.

Answer: 1. Contract of guarantee

Question 21. There are ________ to the contract of indemnity while there are ________ to the contract of guarantee.

- Three parties, two parties

- Two parties, three parties

- Two parties, four parties

- Four parties, two parties

Answer: 2. Two parties, three parties

Question 22. The liability of the indemnifier is

- Primary

- Collateral

- Secondary

- 2 or 3

Answer: 1. Primary

Question 23. Liability of the surety is

- Conditional on default

- Independent of default

- Can be conditional and can be independent

- Either (1) or (2)

Answer: 1. Conditional on default

Question 24. The liability of the surety

- Is co-extensive with that of the principal debtor

- Extends to the whole of the amount for which the principal debtor is liable

- Both (1) and (2)

- Neither (1) nor (2).

Answer: 1. Is co-extensive with that of the principal debtor

Question 25. Under the contract of guarantee, the liability of the surety

- Can be limited

- Cannot be limited and has to extend to the whole of the amount due from the principal debtor

- Can be extended to penalties also

- Both (2) and (3).

Answer: 2. Cannot be limited and has to extend to the whole of the amount due from the principal debtor

Question 26. The liability of the surety is

- Primary

- Collateral

- Secondary

- (2) or (3)

Answer: 4. (2) or (3)

Question 27. The liability of the surety is co-extensive with that of the principal debtor unless the contract otherwise provides.

- True

- False

- Partly true

- None of the above

Contract Of Indemnity And Guarantee 1. True

Question 28. A surety is a favored debtor.

- True

- False

- Partly true

- None of the above.

Answer: 1. True

Question 29. On payment of a guaranteed debt surety is subrogated all the rights of _________.

- Creditor

- Principal debtor

- Other co-surety

- None of the above

Answer: 1. Creditor

Question 30. On being sued by the creditor, the surety can rely on any ________ which the debtor has against the creditor.

- Set-off

- Counterclaim

- Set-off or counterclaim

- None of the above

Answer: 3. Set-off or counterclaim

Question 31. A guarantee which extends to a series of transactions under section 129 is called

- A guarantee

- A continuing guarantee

- An invalid guarantee

- A conditional guarantee.

Answer: 2. A continuing guarantee

Question 32. A continuing guarantee applies to

- A specific transaction

- A specific number of transactions

- Any number of transactions

- Reasonable number of transactions.

Answer: 3. Any number of transactions

Question 33. A continuing guarantee under section 130 is

- Revocable absolutely

- Irrevocable absolutely

- Revocable as regards future transaction

- Either (1) or (2).

Answer: 3. Revocable as regards future transaction

Question 34. The liability of the surety on his death under section 131 in case of continuing guarantee

- Is terminated absolutely

- Does not stand terminated as regards past transaction

- Stands terminated as regards the future transaction

- Both (2) and (3).

Answer: 4. Both (2) and (3).

Question 35. When guaranteeing extends to a single transaction it is known as

- Continuing guarantee

- Specific guarantee

- Unlimited guarantee

- Fidelity guarantee.

Answer: 2. Specific guarantee

Question 36. When a guarantee extends to a series of transactions it is called a

- Continuing guarantee

- Specific guarantee

- Unlimited guarantee

- Fidelity guarantee.

Answer: 1. Continuing guarantee

Question 37. A specific guarantee is

- Irrevocable

- Revocable

- (1) or (2)

- None of the above

Answer: 1. Irrevocable

Question 38. A continuing guarantee _______ for the transaction which has already taken place.

- Cannot be revoked

- Can be revoked

- Cannot be performed

- None of the above

Answer: 2. Can be revoked

Question 39. A continuing guarantee may be revoked by the surety at any time, as to ______ by notice to the creditor.

- Future transactions

- Past transactions

- Existing transactions

- None of the above

Answer: 1. Future transactions

Question 40. In which of the following circumstances continuing guarantee can be revoked?

- By notice of revocation by the surety

- By the death of the surety

- Both (1) and (2)

- None of the above

Answer: 3. Both (1) and (2)

Question 41. The surety stands discharged

- By revocation

- By death

- By variance in terms of the contract without his consent

- In (1), (2) and (3) above.

Answer: 4. In (1), (2) and (3) above.

Question 42. Under the contract of guarantee a creditor

- Has to avail his remedies first against the principal debtor

- Can avail his remedies against the principal debtor as well as the surety

- Can avail his remedy against the surety alone

- Both (2) and (3).

Answer: 4. Both (2) and (3).

Question 43. Surety stands discharged

- By an agreement between the creditor and the principal debtor

- By an agreement between the creditor and a third party for not to sue the principal debtor

- Both (1) and (2) above

- Neither (1) nor (2).

Answer: 3. Both (1) and (2) above

Question 44. A surety may be discharged from liability

- By notice of revocation in case of a continuing guarantee as regards, future transaction

- By the death of the surety as regards future transactions, in a continuing guarantee

- Any variation in the terms of the contract between the creditor and the principal debtors without the consent of the surety.

- All of the above.

Answer: 4. All of the above.

Question 45. A surety may be discharged from liability.

- If the creditor releases the principal debtor, acts, or makes an omission that results in the discharge of the principal debtor

- Where the creditor, without the consent of the surety, makes an arrangement with the principal debtor for composition, or promises to give time or not to sue him, the surety will be discharged.

- If the creditor does any act that is against the rights of the surety or omits to do an act that his duty to the surety requires him to do, the eventual remedy of the surety himself against the principal debtor is thereby impaired

- All of the above

Answer: 4. All of the above

Question 46. On payment or performance of the liability the surety

- Is invested with all the rights the creditor had against the principal debtor.

- Is entitled to the very security that the creditor has against the principal debtor.

- Is entitled to be indemnified by the principal debtor

- All of the above

Answer: 4. All of the above

Question 47. A surety is entitled to be indemnified by the principal debtor

- In respect of a sum rightfully paid

- In respect of a sum wrongfully paid

- In respect of a sum paid rightfully or wrongfully

- All of the above.

Answer: 1. In respect of a sum rightfully paid

Question 48. Under Section 146, the co-sureties are liable to contribute

- Equally

- Unequally

- According to their capacity

- Either (1) or (2) or (3)

Answer: 1. Equally

Question 49. If the co-sureties are bound in different sums, they are liable to pay

- Equally subject to the limit of their respective obligation

- Equally without any limit

- Equally irrespective of their obligation but subject to the limit

- Either (2) or (3).

Answer: 1. Equally subject to the limit of their respective obligation

Question 50. Surety on payment or performance of his liability, against the principal debtor

- Has the right of subrogation

- Has rights like creditors have against the principal debtor.

- Both (1) and (2)

- Either (1) or (2).

Answer: 3. Both (1) and (2)

Question 51. Under Section 141 a surety is entitled to the benefit of every security which the creditor has against the principal debtor at the time when the contract of suretyship is entered into whether the surety knows of the existence of such security or not.

- False

- True

- Partly true

- None of the above.

Answer: 2. True

Question 52. After discharging the debt, the surety

- Steps into the shoes of the creditor

- Is subrogated to all the rights of the creditor against the principal debtor

- Both (1) and (2)

- None of the above.

Answer: 2. Is subrogated to all the rights of the creditor against the principal debtor

Question 53. When a surety has paid more than his share of debt to the creditor, he has a right to contribute from the co-securities who are equally bound to pay with him.

- False

- True

- Party true

- None of the above

Answer: 2. True

Question 54. A, B, and C jointly promise to pay D the sum of ₹ 3,000. C is compelled to pay the whole. A is insolvent but his assets are sufficient to pay one-half of his debts. How much is C entitled to receive from A’s estate and how much B?

- C is entitled to receive ₹ 500 from A’s estate and ₹ 1,250 from B.

- C is entitled to receive ₹ 1,250 from A’s estate and ₹ 500 from B.

- C is entitled to receive ₹ 1,000 from A’s estate and ₹ 1,000 from B.

- C is entitled to receive ₹ 500 from A’s estate and ₹ 1,000 from B.

Answer: 1. C is entitled to receive ₹ 500 from A’s estate and ₹ 1,250 from B.

CA Foundation Solutions For Business Laws Contract Of Indemnity And Guarantee Distinguish Between

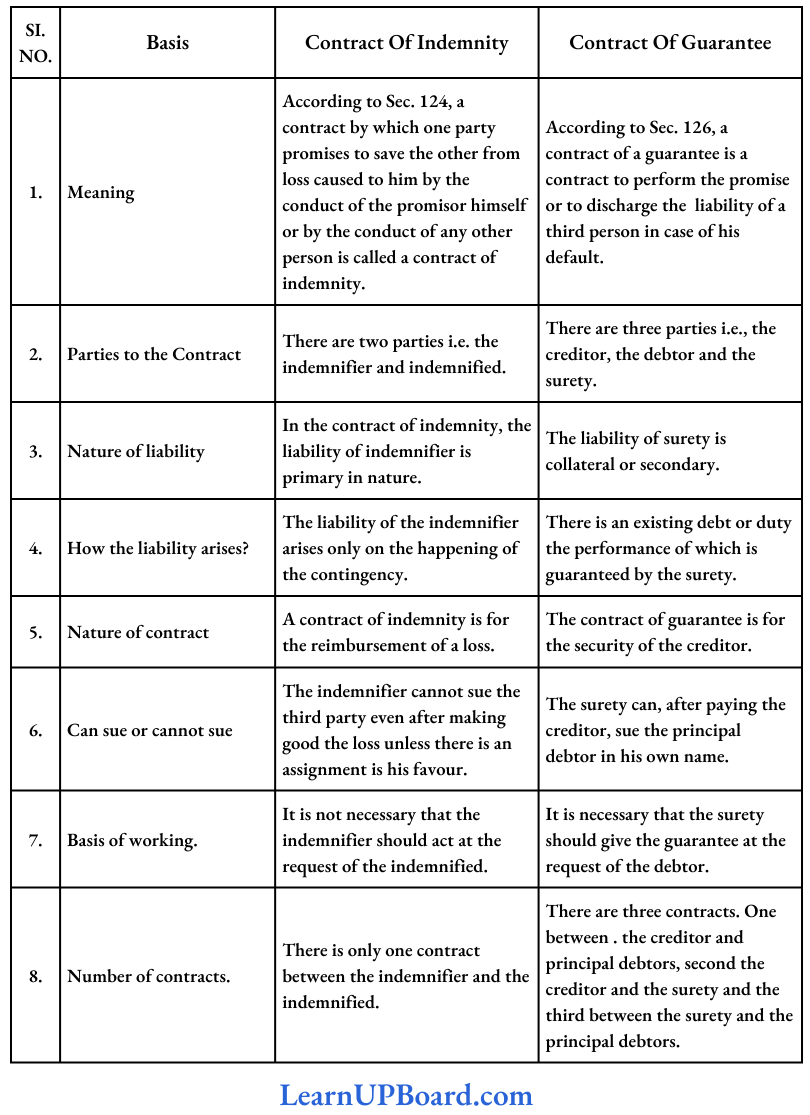

Question 1. Distinguish between ‘Contract of Indemnity’ and ‘Contract of Guarantee’.

Answer:

Difference between ‘Contract of Indemnity’ and ‘Contract of Guarantee’.

CA Foundation Solutions For Business Laws Contract Of Indemnity And Guarantee Descriptive Questions

Question 1. What are the Rights of surety against the Principal debtor and co-sureties?

Answer:

Rights of a surety against the principal debtors :

1. Right of Subrogation [Section 140]: After making a payment and discharging the liability of the principal debtor, the surety takes over all the rights of the creditors, which he can himself exercise against the principal debtors.

This right of surety is called the right of subrogation. In this way, surety steps in the shoes of the creditors. The surety becomes liable to receive all the remedies that the creditors would have enforced not only against the principal debtor but also against all the persons claiming against him.

2. Right of indemnity [Section 141]: There is an implied promise to indemnify the surety between the surety and the principal debtor. This to Section 145, the surety is entitled to recover from the principal debtor whatever sum he has correctly paid under the guarantee.

The surety can recover the actual amount and interest from the creditor. It is so because the surety is entitled to full indemnification.

Right against co-sureties: When two or more sureties are guaranteed for debtors, they are called co-sureties. The rights are.

- Right to share security gained from the creditor

- Act to Sec. 146, the liability of co-sureties to contribute equally if there is no contract to the contrary.

- Liability for equal limit (Sec. 1 47) where different sums are guaranteed by the co-sureties, they have to contribute to the maximum at guarantees by anyone.

Question 2. Examine the validity of the following statements under the provisions of the Indian Contract Act, of 1872. The creditor should proceed with legal action first against the Principal Debtor and later against the surety.

Answer:

This statement is not valid

The creditor has a right to sue the surety directly without first proceeding against the principal debtor.

Question 3. Examine the validity of the following statements under the provisions of the Indian Contract Act, 1 872. A guarantee which extends to a single debt 7 specific transaction is called a continuing Guarantee.

Answer:

This statement is not valid. A guarantee which extends to a single debt or specific transaction is called a specific guarantee.

Question 4. ‘Amit’ stands surety for ‘Bikram’ for any amount which ‘Chander’ may lend to ‘Bikram’ from time to time during the next three months subject to a maximum amount of ₹ 1,00,000 (one lakh only). One month later ‘Amit’ revokes the surety, when ‘Chander’ had already lent to ‘Bikram’ ₹ 10,000 (ten thousand). Referring to the provisions of the Indian. Contract Act, 1872. Decide:

- Whether ‘Amit’ discharged from all the liabilities to ‘Chander’ for any subsequent loan given to ‘Bikram’?

- What would be your answer in case ‘Bikram’ makes a default paying back to ‘Chander’ the already borrowed amount of ₹ 10,000?

Answer:

Amit’ stands surety for ‘Bikram’ for any amount which ‘Chander’ may lend to ‘Bikram’ from time to time during the next three months subject to a maximum amount of ₹ 1,00,000 (one lakh only). One month later ‘Amit’ revokes the surety, when ‘Chander’ had already lent to ‘Bikram’ ₹ 10,000 (ten thousand).

The problem as asked in the question depends on Qn the provisions of the Indian Contract Act, 1872 as contained in Section 130. The section relates to the revocation of continuing guarantees as to future transactions which can be done in any of the two ways :

- By notice: By notice to the creditor, the continuing guarantee can be revoked at any time by the surety as to future transactions.

- By the death of surety: Regarding the future transaction the death of the surety operates, in the absence of any contract to the contrary, as a revocation.

The liability of the surety remains the same for the previous transactions. Thus by using the above rule in the question, A is discharged from all the liabilities to C for any subsequent loan.

In the second case, the answer will change that is A will be liable to C for ₹ 10,000/35,000 on default of B because the loan was taken before the notice of revocation was given to C.

Question 5. ‘A’ gives to ‘M’ a continuing guarantee to the extent of Contract Of Indemnity And Guarantee 8,000 for the fruits to be supplied by ‘M’ to ‘S’ from time to time on credit. Afterward, ‘S’ became embarrassed and without the knowledge of ‘A’, ‘M’, and ‘S’ contract that ‘M’ shall continue to supply ‘S’ with fruits for ready. money and that payments shall be applied to. the then existing debts between ‘S’ and ‘M’. Examining the provision of the Indian Contract Act, of 1872, decide whether ‘A’ is liable for his guarantee given to ‘M’.

Answer:

‘A’ gives to ‘M’ a continuing guarantee to the extent of Contract Of Indemnity And Guarantee 8,000 for the fruits to be supplied by ‘M’ to ‘S’ from time to time on credit. Afterward, ‘S’ became embarrassed and without the knowledge of ‘A’, ‘M’, and ‘S’ contract that ‘M’ shall continue to supply ‘S’ with fruits for ready. money and that payments shall be applied to. the then existing debts between ‘S’ and ‘M’.

Provision:

Variance in terms and composition with Principal Debtor. (Sec. – 133 and Sec. – 135 of the Indian Contract Act, 1872):

Provision:

According to Sec. 133, where there is any variance in the terms of the contract between the principal debtor and creditor without surety’s consent it would discharge the surety in respect of all transactions taking place after such variance. On the other hand.

Sec. 135 provides that, if the creditor makes a settlement with the principal debtor, the surety is discharged if the consent of surety is not obtained.

Present Case:

Hence, in the first instance, since S and M have varied the terms of the ‘ contract, without A’s consent, it has discharged A from all the transactions taking place after such variation under Sec. 133.

- In the second instance, S and M have made a settlement that the further. supply of vegetables will be for cash and the payment shall be applied to the existing debts without the consent of A.

- Hence, A is discharged in respect of all the transactions taking place after the variation in the terms of the contract. However, A will remain liable on his guarantee given to M for the existing debts i.e. if S is unable to settle off the debts existing before the variation, the liability of A will arise.

Question 6. Mr. D was in urgent need of money amounting ₹ 5,00,000. He asked Mr. K for the money. Mr. K lent the money on the sureties of A, B, and N without any contract between them in case of default in repayment of money by D to K. D defaulted in payment. B refused to contribute, examine whether B can escape liability.

Answer:

Co-sureties are liable to contribute equally:

As per Sec. 146 of the Indian Contract Act, 1872, when two or more persons are co-sureties for the same debt or duty either jointly, or severally and whether under the same or different contracts and whether with or without the knowledge of each other.

The co-sureties in the absence of any contract to the contrary, are liable, as between themselves to pay each an equal share of the whole debt, or of that part of it which remains unpaid by the principal debtor.

Present Case:

A, B, and N are co-sureties without any contract between them. D makes a default in payment. B refused to contribute. As per the provision, B can not escape liability and has to pay equally -With A and N.

Question 7. Mr. Chetan was appointed as Site Manager of ABC Constructions Company on a two-year contract at a monthly salary of ₹ 50,000. Mr. Pawan gave a surety in respect of Mr. Chetan’s conduct. After six months the company was not in a position to pay ₹ 50,000 to Mr. Chetan because of financial constraints. Chetan agreed to a lower salary of ₹ 30,000 from the company. This was not communicated to Mr. Pawan. Three months afterwards it was discovered that Chetan had been doing fraud since the time of his appointment. What is the liability of Mr. Pawan during the whole duration of Chetan’s Appointment?

Answer:

Provision:

As per Sec. 133 of the Indian Contract Act, 1872, if the creditor makes any variance (i.e. change in terms) without the consent of the surety, then surety is discharged with as to the transactions after the change.

Present Case:

In the instant case, Mr. Pawan is liable as a surety for the loss suffered by the company due to fraud by Mr. Chetan during the first six months but not for fraud committed after the salary reduction.

- Mr. Pawan will thus be liable as a surety for the act of Mr. Chetan before the change in the terms of the contract i.e., during the first six months.

- Variation in the terms of the contract (as to the reduction of salary) without consent of Mr. Pawan, will discharge Mr. Pawan from all the liabilities towards the act of Mr. Chetan after such variation.

Question 8. Manoj guarantees Ranjan, a retail textile merchant, an amount of ₹ 1,00,000, for which Sharma, the supplier may from time to time supply goods on a credit basis to Ranjan during the next 3 months.

After 1 month, Manoj revoked the guarantee, when Sharma supplied goods on credit for ₹ 40,000. Referring to the provisions of the Indian Contract Act, of 1872, decide whether Manoj is discharged from all the liabilities to Sharma for any subsequent credit supply. What would be your answer in case Ranjan makes a default in paying back Sharma for the goods already supplied on credit i.e. ₹ 40,000?

Answer:

Provision:

As per Sec. 130 of the Indian Contract Act, 1872, the continuing guarantee may at any time be revoked by the surety as to future transactions by notice to the creditors.

Sec. 129 of the Indian Contract Act, 1872, a continuing guarantee means a guarantee which extends to a series of transactions is called a continuing guarantee. The essence of a continuing guarantee is that it applies not to a specific number of transactions but any number of transactions and makes the surety liable for the unpaid balance at the end of the guarantee.

Present Case:

In this case, Manoj guarantees Ranjan, an amount of ₹ 1,00,000 for which Sharma, the supplier may from time to time supply goods on a credit basis to Ranjan during the next 3 months, so as per provision of Section 130, it is a continuing guarantee.

- Further, after 1 month, Manoj revoked the guarantee, when Sharma supplied goods on credit for ₹ 40,000. So as per the above provisions of Section 130 of the Indian Contract Act, 1872, Manoj is discharged from all the liabilities to Sharma for any subsequent credit supply.

- However, if Ranjan makes any defaults in paying back to Sharma for the goods already supplied on credit i.e. ₹ 40,000, Manoj is liable to Sharma for ₹ 40,000.

Question 9. Aarthi is the wife of Naresh. She purchased some sarees on credit from M/s Rainbow Silks, Jaipur. M/s Rainbow Silks, Jaipur demanded the amount from Naresh. Naresh refused. M/s Rainbow Silks, Jaipur filed a suit against Naresh for the said amount. Decide in the light of provisions of the Indian Contract Act, 1872, whether M/s Rainbow Silks, Jaipur would succeed.

Answer:

Provision:

As per the provisions of the Indian Contract Act, 1 872, if a person permits or represents another to act on his behalf so that a reasonable person would infer that the relationship of principal and agent had been created then he will be stopped from denying his agent’s authority and getting himself relieved from his obligation to a third party by proving that no such relationship exist.

However, where, a married woman lives with her husband, there is a presumption that she has the authority to pledge his credit for necessaries.

But the legal presumption can be rebutted in the following cases:

- Where the goods purchased on credit are not necessary.

- Where the wife is given sufficient money for purchasing necessaries.

- Where the wife is forbidden from purchasing anything on credit or contracting debts.

- Where the trader has been expressly warned not to give credit to his wife.

If the wife lives apart for no fault on her part, the wife has the authority to pledge her husband’s credit for necessities. This legal presumption can be rebutted only in cases (3) and (4) above.

In this case, Aarthi, wife of Naresh purchased some Sarees on credit from M/s. Rainbow silks of Jaipur. Upon non-payment of the amount, Naresh will be held personally liable for these dues as per the above provisions. So, the suit was filed by M/s. Rainbow silks against Naresh on the refusal by Naresh for payment would succeed.

Question 10. ‘C’ advances to ‘B’ ₹ 2,00,000 on the guarantee of ‘A’. ‘C’ has also taken further security for the same borrowing by mortgage of B’s furniture worth ₹ 2,00,000 without knowledge of ‘A’. ‘C’ cancels the mortgage. After 6 months ‘B’ becomes insolvent and ‘C’ sues ‘A’ on his guarantee. Decide the liability of ‘A’ if the market value of furniture is worth ₹ 80,000, under the Indian Contract Act, of 1872.

Answer:

‘C’ advances to ‘B’ ₹ 2,00,000 on the guarantee of ‘A’. ‘C’ has also taken further security for the same borrowing by mortgage of B’s furniture worth ₹ 2,00,000 without knowledge of ‘A’. ‘C’ cancels the mortgage. After 6 months ‘B’ becomes insolvent and ‘C’ sues ‘A’ on his guarantee.

As per Section 141 of the Indian Contract Act, 1872, a surety is entitled to the benefit of every security which the creditor has against the principal debtors at the time when the contract of surety-ship is entered into, whether the surety knows of the existence of such security or not; and if the creditor loses, or without the consent of the surety, parts with such security, the surety is discharged to the extent of the value of the security.

Present Case:

In this case, C advances to B ₹ 2,00,000 on the guarantee that A – C has also taken further security for the same borrowing by mortgage of B’s furniture worth ₹ 2,00,000 without knowledge of A – C cancels the mortgage. After 6 months B becomes insolvent and C sues A on his guarantee. So as per the above provisions, A is discharged from his liability to the amount of furniture worth ₹ 80,000 and will remain liable for the balance ₹ 1,20,000.

Question 11.

- Mr. CB was invited to guarantee an employee Mr. BD who was previously dismissed for dishonesty by the same employer. This fact was not told to Mr. CB. Later on, the employee embezzled funds. Whether CB is liable for the financial loss as surety under the provisions of the Indian Contract Act, of 1872?

- Mr. X agreed to give a loan to Mr. Y on the security of four properties. Mr. A gave a guarantee against the loan. Mr. X gave a loan of a smaller amount on the security of three properties. Whether Mr. A liable as surety in case Mr. Y fails to repay the loan?

Answer:

1. Provision:

As per section 143 of the Indian Contract Act, of 1872, any guarantee which the creditor has obtained through keeping silent as to material circumstances, is invalid.

Present Case:

In the given case, Mr. CB was invited to Guarantee an employee Mr. BD who had previously been dismissed for dishonesty by the same employer. This fact was not told to Mr. CB later on the employee embezzled funds. So as per the above-mentioned provision, CB is not liable for the financial loss as a surety.

2. Provision:

As per the provisions of Section 133 of the Indian Contract Act, 1872, any variance, made without the surety’s consent, in the terms of the contract between the principal [the debtor] and the creditor, discharges the surety as to transactions after the variance.

In the given instance, the actual transaction was not in terms of the guarantee given by Mr. A. The loan amount as well as the securities were reduced without the knowledge of the surety. So, accordingly, Mr. A is not liable as a surety in case Y fails to repay the loan.

Question 12. Satya has given his residential property on rent amounting to ₹ 25,000 per month to Tushar. Amit became the surety for payment of rent by Tushar. Subsequently, without Arnif’s consent, Tushar agreed to pay higher rent to Satya. After a few months of this, Tushar defaulted on paying the rent.

- Explain the meaning of contract of guarantee according to the provisions of the Indian Contract Act, 1872.

- State the position of Amit in this regard.

Answer:

1. Contract of guarantee: As per the provisions of section 126 of the Indian Contract Act, 1872, a contract of guarantee is a contract to perform the promise made or discharge the liability, of a third person in case of his default.

These parties are involved in a contract of guarantee:

Surety– a person who gives the guarantee,

Principal debtor– person In respect of whose default the guarantee is given,

Creditor– person to whom the guarantee is given

2. Provision:

According to the provisions of section 133 of the Indian Contract Act, of 1872, where there is any variance in the terms of the contract between the principal debtor and creditor without surety’s consent, it would discharge the surety in respect of all transactions taking place after such variance.

Present Case:

In the instant case, Satya (Creditor) cannot sue Amit (Surety), because Amil is discharged from liability when, without his consent, Tushar (Principal debtor) has changed the terms of his contract with Satya (creditor). It is immaterial whether the variation is beneficial to the surety or does not materially affect the position of the surety.

Question 13. Paul (a minor) purchased a smartphone on credit from a mobile dealer on the surety given by Mr. Jack, (a major). Paul did not pay for the mobile. The mobile dealer demanded payment from Mr. Jack because the contract entered with Paul (minor) was void. Mr. Jack argued that he is not liable to pay the amount since Paul (Principal Debtor) is not liable. Whether the argument is correct under the Indian Contracts Act, of 1872? What will be your answer if Jack and Paul both are minor?

Answer:

- As per the provision of the contract of guarantee, any surety who is not a minor can be a competent party to the contract where the contract for the sale of goods is made with the minor party.

- In this case, Mr. Jack who is a major has given surety for payment of a mobile to the seller, if the buyer who is a minor has failed to make payment.

- In line with the provisions, Mr. Jack’s argument is not correct, he is liable to pay the amount of sale to the mobile dealer.

- If all the parties to the contract are minor, then the agreement of guarantee is void because Mr, Jack who is the surety to the contract is minor.

Question 14. Due to the urgent need for money amounting to ₹ 3,00,000, Pawan approached Raman and asked him for the money. Raman lent the money on the guarantee of Suraj, Tarun, and Usha. However, there is no contract between Suraj, Tarun and Usha. Pawan defaults in payment and Suraj pays the full amount to Raman. Suraj, afterward, claimed contributions from Tarun and Usha. Tarun refused to contribute on the basis that there was no contract between Suraj and him. Examine referring to the provisions of the Indian Contract Act, of 1872, whether Tarun can escape from his liability.

Answer:

Equality of burden is the basis of Co-suretyship. This is contained in section 146 of the Indian Contract Act, 1872, which states that “when two or more persons are co-sureties for the same debt, or duty, either jointly, or severally and whether “under the same or different contracts and whether with or without the knowledge of each other.

- The co-sureties in the absence of any contract to the contrary, are liable, as between themselves, to pay each an equal share of the whole debt, or of that part of it which remains unpaid by the principal debtor”.

- Accordingly, on the default of Pawan in payment, Tarun cannot escape from his liability. All three sureties Suraj, Tarun, and Usha are liable to pay equally, in the absence of any contract between them.

Question 15. Shyam, at the request of Govind, sells goods that were, in the possession of Govind. However, Govind had no right to dispose of such goods. Shyam did not know this and handed over the proceeds of the sale to Govind. Afterward, Manohar, who was the true owner of the goods, sued Shyam and recovered the value of the goods. In light of the provisions of the Indian Contract Act, of 1872, answer the following questions:

- Is Govind liable to indemnify Shyam for his payment to Manohar?

- What will be the liability of Govind if the goods is a prohibited drug?

Answer:

According to Sec. 178 of the Indian Contract Act, of 1872, where a mercantile agent is. with the consent of the owner, in possession of goods or the documents of title to goods, any pledge made by him.

When acting in the ordinary course of business of a mercantile agent, shall be as valid as if he were expressly authorized by the owner of the goods to make the same:

Provided that the pawnee acts in good faith and has not at the time of the pledge notice that the Pawnor has no authority to pledge. it is also to be noted that:

- The possession of goods must be with the consent of the owner. If possession has been obtained dishonestly or by a trick, a valid pledge cannot be effected.

- The pledgee should have no notice of the pledger’s defect of title. If the c edge knows that the pledger has a defective title, the pledge will not be valid.

Present Case:

- Shyam had no notice of the Govind’s defect of title. He acted in the ordinary course of business of a mercantile agent considering Govind as owner of the good and genuinely handed over the proceeds of the sale to him. Therefore, the transaction is invalid. Thus. Govind shall be liable to indemnify Shyam for his payment to Manohar.

- Govind shall not be liable to indemnify Shyam as selling prohibited drugs is a prohibited act and against public policy.

Question 16. Alpha Motor Ltd. agreed to sell a bike to Ashok under a purchase agreement on the guarantee of Abhishek. The Terms were: purchase price ₹ 96,000 payable in 24 monthly Installments of ₹ 8,000 each. Ownership is to be transferred on the payment of the last Installment. State whether Abhishek is discharged in each of the following alternative cases under the provisions of the Indian Contract Act, of 1872:

- Ashok paid 12 installments but failed to pay the next two installments. Alpha Motor Ltd. sued Abhishek for the payment of arrears and Abhishek paid these two installments i.e. 13th and 14th. Abhishek then gave a notice to Alpha Motor Ltd. to revoke his guarantee for the remaining month.

- If after 15th Month, Abhishek died due to COVID-19.

Answer:

According to Sec. 130 of the Indian Contract Act, 1872, the continuing guarantee may at any time be revoked by the surety as to future transactions by notice to the creditors.

Once the guarantee is revoked, the surety is not liable for any future transaction however he is liable for all the transactions that happened before the notice was given. A specific guarantee can be revoked only if liability to the principal debtor has not accrued.

Present Case:

- Ashok paid 12 installments (out of a total of 24 monthly installments) but failed to pay the next two installments. Abhishek (guarantor) paid the 13th and 14th installments but then he revoked the guarantee for the remaining months. Thus, Abhishek is not liable for installments that were made after the notice, but he is liable for installments made before the notice (which he had paid i.e. 13th and 14th installments).

- According to Sec. 131 of the Indian Contract Act, 1872, in the absence of any contract to the contrary, the death of surety operates as a revocation of a continuing guarantee as to the future transactions taking place after the death of surety. However, the surety’s, estate remains liable for the past transactions that have already taken place before the death of the surety.

In the given question, Abhishek (guarantor) died after the 15th month. This will operate as a revocation of a continuing guarantee as to the future transactions taking place after the death of surety (i.e. Abhishek). However, Abhishek’s estate remains liable for the past transactions (i.e. 15th month and before) which have already taken place before the death of the surety.

Question 17. Examine the validity of the following statements under the provisions of the Indian Contract Act, of 1872. Variation which is not material and beneficial to the surety will not discharge him of his liability.

Answer:

This statement is valid

Based on the principle held in the M S Anirudhan v Thomco’s Bank Ltd. AIR 1963 SC 746 that the surety’s liability will not be discharged where the alteration is beneficial to him and is not substantial.

Question 18. Manish, a minor, lost his parents in the COVID-19 pandemic Due to poor financial background Manish was facing difficulties in maintaining his livelihood. He approached Mr Sohel (a grocery shopkeeper) to supply him with grocery items and to wait for some period to receive his dues. Mr. Sohel did not agree with the proposal; but when Mr. Ganesh, a local person, who is a major, agreed to provide a guarantee that he would pay the dues in case Manish failed to pay the amount, Mr. Sohel supplied the required groceries to Manish. After a few months when Manish failed to clear his dues, Mr. Sohel approached Mr. Ganesh and asked him to clear the dues of Manish. Mr. Ganesh refused to pay the amount on two grounds; firstly, that there was no consideration in the contract of guarantee and secondly that Manish is a minor and therefore on both grounds the contract of guarantee is not valid. Referring to the relevant provisions of the Indian Contract Act, 1 872, decide, whether the contention of Mr. Ganesh, (the surety) is tenable. Will your answer differ in case both Manish (the principal debtor) and Mr. Ganesh (the surety) are minors?

Answer:

As per Section 127 of the Indian Contract Act, 1872, consideration received by the principal debtor is sufficient consideration to the surety for giving the guarantee.

- Even if the Principal debtor is incompetent to contract, the guarantee is invalid.

- But, if the surety is incompetent to the contract, the guarantee is void.

Present Case: Manish, a minor lost his parents in the COVID-19 Pandemic. He was facing financial difficulties Manish approached Sohel (a grocery shopkeeper) to supply him with grocery items and to wait for some period to receive his dues.

- Mr. Sohel did not agree. when Mr Ganesh, a major, agreed to provide a guarantee that he would pay the dues in case Manish failed to pay the amount. Mr Sohel supplied the required groceries to Manish.

- After a few months, when Manish failed to clear his dues, Mr Sohel approached Mr Ganesh and asked him to clear the dues Mr Ganesh refused to pay the amount on two grounds.

- Firstly, there was no consideration in the contract of guarantee, and secondly that Manish is a minor therefore, on both grounds, the contract of guarantee is invalid.

Conclusion: In the present case, the contention of Mr Ganesh is not tenable. Mr. Ganesh cannot refuse Mr. Sohel to clear to dues of Manish. Even if Manish (Principal debtor) is a Minor, the contract of guarantee will be valid.

If Manish and Ganesh were both minors, then the contract of Guarantee would be invalid as Mr. Ganesh is a surety, and if a surety is a minor, the contract of guarantee is invalid.