CA Foundation Solutions For Business Laws General Nature Of A Partnership

Indian Partnership Act, 1932

Section 1: Short title

Section 2: Definitions

Section 3: Application of provision of Act, 9 of 1 872

Section 4: Definition of Partnership

Section 5: Partnership not created by status

Section 6: Mode of determining the existence of the partnership

Section 7: Partnership at will

Section 8: Particular Partnership

Section 9: General Duties of Partners

Section 10: Duty to indemnify for loss caused by fraud.

Section 11: Determination of rights and liabilities

Section 12: The conduct of the business

Section 13: Mutual rights and liabilities

Section 14: The property of the firm

Section 15: Application of the property

Section 16: Personal Profits Earned by Partners

Section 17: Rights and duties of partners after a change in the firm

Section 18: Partner to be an agent of the firm

Section 19: Implied Authority of Partner

Section 20: Extension and restriction of Partner’s implied authority

Section 21: Partner’s Authority in an emergency

Section 22: Mode of doing the act to bind the firm

Section 23: Effect of admission by a partner

Section 24: Effect of notice to acting partner

Section 25: Liability of a partner for acts of the firm

Section 26: Liability of the firm for wrongful acts by a partner

Section 27: Liability of firm for misapplication by partners

Section 28: Holding out

Section 29: Rights of transferee of a partner’s interest

Section 30: Minors admitted to the benefits of partnership

Section 31: Introduction of a partner

Section 32: Retirement of a partner

Section 33: Expulsion of a partner

Section 34: Insolvency of a partner

Section 35: Rights of outgoing partner to carry on competing business

Section 36: Same

Section 37: Rights of outgoing partner in certain cases

Section 38: Revocation of continuing guarantee by change in firm

Section 39: Dissolution of a firm

Section 40: Dissolution by agreement

Section 41: Compulsory dissolution

Section 42: Dissolution on the happening of certain events

Section 43: Dissolution by notice of partnership at will

Section 44: Dissolution by Court

Section 45: Liability for acts of partners done after dissolution

Section 46: Rights of partners to have business wound up after dissolution

Section 47: The continuing authority of partners to wind up

Section 48: Mode of settlements of accounts

Section 49: Payment of firm debts and separate debts

Section 50: Personal profits earned after dissolution

Section 51: Return of premium

Section 52: Rights where partnership contract is rescinded for fraud or misrepresentation

Section 53: Rights to restraint from use of the firm name

Section 54: Agreements in restraint of trade

Section 55: Sale of goodwill after dissolution

Section 56: Power to exempt from the application of this chapter

Section 57: Appointment of registrars

Section 58: Application for registration

Section 59: Registration

Section 60: Recording of alterations in the firm name

Section 61: Nothing of closing and opening of branches

Section 62: Nothing of change in names and addresses of partners

Section 63: Recording of changes in and dissolution of a firm

Section 64: Rectifications of mistakes

Section 65: Amendment of registers by order of Court

Section 66: Inspection of Register

Section 67: Grant of copies

Section 68: Rules of evidence

Section 69: Effect of non-registration

Section 70: Reality for furnishing false particulars

Section 71: Power to make rules

Section 72: Mode of giving public notice

Section 73: Repeals

Section 74: Savings.

CA Foundation Solutions For Business Laws General Nature Of A Partnership Self-Study Questions And Answers

Question 1. Define ‘Partnership’, ‘Partner’, ‘Firm’, and ‘Firm name’ as per the Indian Partnership Act, 1932.

Answer:

‘Partnership’, ‘Partner’, ‘Firm’, and ‘Firm name’ as per the Indian Partnership Act, 1932

As per Section 4:

- As per Section 4, “partnership is the relation between persons who have agreed to share the profits of a business-carried on by all or any of them acting for all”.

- The person who enters into partnership with one another is individually called partners and collectively called firms.

- The name under which the business is carried on is “Firm Name”.

- The firm cannot use the words “limited” in its name.

Question 2. How many Elements of Partnership are there?

Answer:

Elements of Partnership

- It must be a result of an agreement between two or more persons to do business.

- It is voluntary.

- The agreement must be to share the profits of the business.

- Business must be carried on by all or any of them acting for all.

- All the above essentials must co-exist before any partnership comes into existence.

- The relation of partnership arises from contract and not from status.

- Agreement may be expressed or implied.

- As per Section 2 (b), “Business including every trade, occupation and profession”.

- Profit means the excess of return over advances.

- Sharing of profit includes sharing of losses.

- Sharing of profit is prima facie evidence of the existence of a partnership, this is not the conclusive test of the same.

Question 3. What do you understand by the True test of Partnership?

Answer:

True test of Partnership

- Mutual agency is the basis and most essential thing for partnership.

- The sharing of profit also involves the sharing of losses.

- Sharing of profits is not a conclusive test of the existence of a partnership.

- Even a partner is a principal and agent for himself and others.

- An agency relationship is the most important test of partnership.

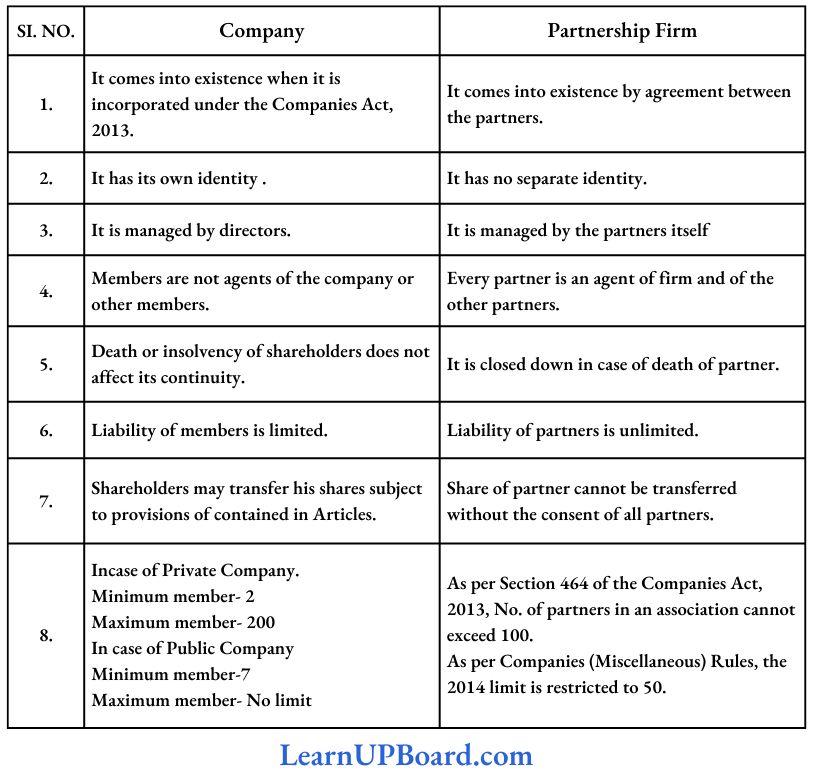

Question 4. Briefly explain and distinguish between a Partnership and a Joint Stock Company.

Answer:

Distinguish between a Partnership and a Joint Stock Company

Question 5. How many kinds of Partnership are there?

Answer:

There are four kinds of Partnerships

- Partnership at will:

- Here no provision is made in the agreement regarding the duration of the partnership.

- Any partner can terminate the agreement anytime by giving the notice.

- Such a type of partnership is usually formed for any particular project.

- Partnership for a fixed period:

- The agreement of partnership contains the provision as to the duration of the partnership.

- At the expiry of the specified period, the partnership comes to an end.

- Particular Partnership:

- Partnership agreement formed to carry out a particular business or for a particular period.

- After the completion of the business, for which it was constituted, the partnership comes to an end.

- General Partnership:

- Partnership constituted the business in general.

Question 6. What do you understand by a Partnership Deed?

Answer:

Partnership Deed

- It constitutes the mutual rights and obligations of partners in a written form.

- It is also known as a partnership agreement, constitution of partnership articles of partnership, etc.

- It must be drafted and stamped as per the provisions of the Indian Stamp Act.

Question 7. What are the contents of Partnership?

Answer:

The partnership deed must contain the following particulars:

- Name of partnership firm

- Particulars of partners

- Place and nature of business

- Date of commencement of the partnership

- Duration or Terms and conditions

- Capital Contribution

- Profit sharing ratio

- Rules regarding admission, retirement, etc.

- Provisions for transactions and settlement of accounts

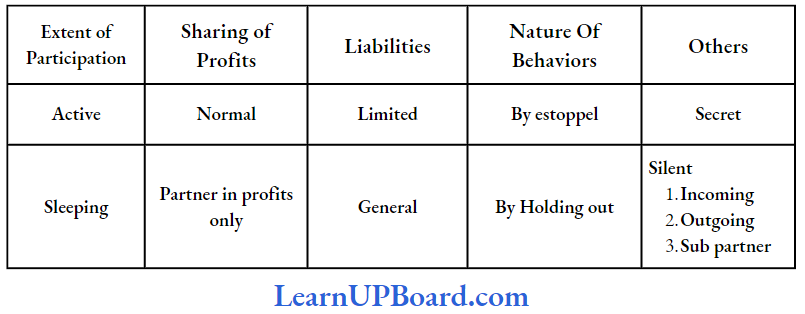

Question 8. How many Types of Partner?

Answer:

Types of Partner

Question 9. Describe the Active or Actual or Ostensible or Working Partners.

Answer:

The Active or Actual or Ostensible or Working Partners

- He is not only contributing capital but also taking an active part in the conduct of the firm’s business.

- He shares its profits and losses.

- He had to give public notice of his retirement if he had to free himself from all liabilities.

Question 10. Describe the Sleeping or Dormant Partners.

Answer:

The Sleeping or Dormant Partners

- He only contributes capital and shares profit or loss without taking an active part in the firm’s business.

- He has unlimited liability.

- He can retire from the firm without giving any public notice.

- He is entitled to access books and accounts of the firm, even though he performs no duty.

Question 11. Describe the Nominal or quasi-partners.

Answer:

The Nominal or quasi-partners

- He only lends his name and reputation for the firm’s benefit without sharing any profit or loss.

- He is known to outsiders as a partner but actually, he is not.

- He is liable to a third party for all his acts.

- He is required to give public notice of requirements.

Question 12. Which condition Applies to Partner in profits only?

Answer:

- He gets a share in profits but does not share any losses of the firm.

- He has to bear all the liabilities to a third party.

Question 13. Describe the Partner by estoppel.

Answer:

Partner by estoppel

- He is not a partner of the firm but conducts himself in such a way that leads third parties to believe that he is a partner.

- He is liable for all the debts to such third party.

Question 14. Describe the Partner by holding out.

Answer:

The Partner by holding out

- He is declared by others as a partner of the firm but does not contradict it immediately and remains silent.

- He is liable to a third party who is entering into contracts with the firm on the belief that he is the partner.

- Holding out means to reprint.

- It is based on the doctrine of estoppel of the Indian Evidence Act.

Question 15. What do you understand by an Incoming Partner?

Answer:

Incoming Partner

- The person being admitted as a partner in an existing partnership firm.

- He will not be liable for any act of the firm done before the date of admission.

Question 16. Describe the Outgoing Partner.

Answer:

Outgoing Partner

- The person leaving the partnership firm.

- He is liable to a third party unless he gives a public notice of his retirement sub-partner.

- He is a third person with whom a partner shares his profits.

- He has no rights or duties towards the firm.

CA Foundation Solutions For Business Laws General Nature Of A Partnership Objective Questions And Answers

Question 1. State with reason whether the following statement is correct or incorrect: Sharing of profits is conclusive evidence of partnership.

Answer:

Incorrect: Although sharing of profit is a .prima facie evidence of the establishment of partnership, it is not conclusive proof. The existence of an agreement, business, and mutual agency is also required along with the sharing of profits for the determination of partnership.

Question 2. State with reason whether the following statements are correct or incorrect:

- Where two persons jointly run a coach and share the profits derived from running such business constitute a partnership business?

- A partnership may be formed with two partnership firms as partners.

Answer:

- Incorrect: It is not a partnership but a co-ownership. The sharing of ‘ profits or gross returns accruing from property by persons holding joint or common interest in a property would not by itself make such persons partners because there is no mutual agency.

- Incorrect: According to Section 4 of the Indian Partnership Act, the term ‘person does not include a firm. This is because a firm is not a separate legal entity. Therefore, two partnership firms cannot enter into a partnership.

Question 3. State with reason whether the following statement is correct or incorrect: The test of the existence of a partnership is the element of ‘sharing of profits’ rather than ‘mutual agency’.

Answer:

Incorrect: Sharing of profits is an essential element to constitute a partnership. But it is only prima facie evidence and not conclusive evidence in that regard. The existence of mutual agency is the cardinal principle of partnership law.

Each partner carrying on the business is the principal as well as an agent of other partners. So, the act of one partner done on behalf of the firm binds all the partners (Section 6, Indian Partnership Act, 1932).

CA Foundation Solutions For Business Laws General Nature Of A Partnership Short Notes

Question 1. Write a short note on Partnership at will.

Answer:

Partnership at will: The definition of partnership at will has been given under Section 7 of the Partnership Act, 1932. It lays down that where no provision is made by contract between the partners for the duration of their partnership, or for the determination of their partnership, the partnership is “Partnership at will”.

Accordingly, a partnership is deemed to be a partnership at will when:

- No fixed period has been agreed upon for the duration of the partnership, and

- There is no provision made as to the determination of the partnership in any other way. Such partnership has no fixed date of termination therefore death or retirement of a partner does not affect the existence of such partnership.

Section 43(1) provides that “where the partnership is at will, the firm may be dissolved by any partner giving notice in writing to all the other partners of his intention to dissolve the firm”. The firm is dissolved from the date of notice or the date of communication of the notice.

However, if the freedom to dissolve the firm at will is curtailed by agreement, say, if the agreement provides that the partnership can be dissolved by the mutual consent of all the partners only, it will not constitute a ‘partnership at will’.

Question 2. Write a short note on the actual partner and sub-partner.

Answer:

Actual partner and sub-partner: A person who becomes a partner, by an agreement and is actively engaged in the conduct of the business of the partnership is known as the actual partner.

- He is the agent of the other partner in the ordinary course of the business of the firm.

- He binds himself and the other partners, so far as third parties are concerned, for all the acts which he does in the ordinary course of the business and the name of the firm.

- Whereas when a partner agrees to share his profits derived from the firm with a third person, that third person is known as a sub-partner.

A sub-partner is in no way connected with the firm and cannot represent himself as a partner of the firm. He has no rights against the firm nor is he liable for the acts of the firm.

Question 3. Write a short note on Partnership at Will.

Answer:

Partnership at will: The definition of partnership at will has been given under Section 7 of the Partnership Act, 1932. It lays down that where no provision is made by contract between the partners for the duration of their partnership, or for the determination of their partnership, the partnership is “Partnership at will”. Accordingly, a partnership is deemed to be a partnership at will when:

- No fixed period has been agreed upon for the duration of the partnership, and

- There is no provision made as to the determination of the partnership in any other way. Such partnership has no fixed date of termination therefore, death or retirement of a partner does not affect the existence of such partnership.

Section 43(1) provides that “where the partnership is at will, the firm may be” dissolved by any partner giving notice in writing to all the other partners of his intention to dissolve the firm”. The firm is dissolved from the date of notice or the date of communication of the notice.

However, if the freedom to dissolve the firm at will is curtailed by agreement, say, if the agreement provides that the partnership can be dissolved by the mutual consent of all the partners only, it will not constitute a ‘partnership at will’.

Question 4. Write a short note on Partner by estoppel.

Answer:

Partner by estoppel: Under Section 28 of the Indian Partnership Act, 1932, when a person represents himself or knowingly permits himself to be represented as a partner in a firm (when in fact he is not) he is liable, like a partner in the firm to anyone who on the faith of such representation has given credit to the firm.

It may be noted that where a retiring partner does not give public notice of his retirement and the continuing partners still use his name as a partner on letter-heads and bills etc., he will be personally liable, on the ground of holding out, to third parties who give credit to the firm on the faith that he is still a partner.

CA Foundation Solutions For Business Laws Distinguish Between General Nature Of A Partnership

Question 1. Briefly explain the difference” between a Partnership and an Association.

Answer:

The distinction between a Partnership and an Association: The two terms can be distinguished on the following basis:

- Meaning: Partnership means and involves setting up relation of agency between two or more persons who have entered into a business for gains, to share the profits of such a business.

- An association is a body of persons who have come together for mutual benefit such as a resident’s association of a particular area or for rendering service to the society such as a charitable or religious society say a dispensary or a temple etc.

- Sharing of profits: A partnership is set up to share the profits of a business, while an association is not set up for sharing the profits. The intention of the association is not to carry on a business by the members of the association to earn profits.

- Mutual Agency Trust: A partnership is based on mutual trust and is carried on by mutual agency, which is not so in the case of an association.

- Dissolution: Retirement or death of a particular may dissolve a firm but retirement or death of a member of an association does not dissolve the association.

Question 2. Briefly explain the difference between a Partnership and a Joint Stock Company.

Answer:

Partnership and Joint Stock Company:

- Personality: A firm is not a legal entity whereas a company is a juridical person distinct from its members.

- Agency: In the case of a firm, every partner is an agent of other partners as well as of the firm but in the case of a company, members are not agents of the company.

- Profits: Profits of a firm are distributed among the partners according to the deed of partnership. But in the case of a company, distribution of profit is optional as the company may or may not declare dividends.

- Liability: In a firm, the liability of partners is unlimited but in a company, liability is always limited to the amount of shares or guarantee.

- Property: The property of a firm is the joint estate of all the partners whereas in a company, the property belongs to the company and not to shareholders.

- Transfer of share: In the case of partnership transfer of a partner’s right is not possible without the consent of all the partners, though his interest can be assigned to a third party who has a right to share in profits but has no other rights, but in the case of a public company, share is transferable and quoted on the stock exchange.

- Management: In partnership, management is by partners, but in a company, the Board of Directors does the management, and shareholders only attend general meetings to vote.

- The number of members in a partnership is a minimum of two and a maximum of 20 (in banking it is 10) but in the case of a private company, the minimum is two and a maximum of 50 excluding past and present employees. In the case of a public company, it is 7 arid with no restriction on the maximum.

Question 3. Briefly explain the difference between a Partnership and a Hindu undivided family.

Answer:

The difference between a Partnership and a Hindu undivided family

Following are the differences between a Partnership and a Joint Hindu Family:

- Creation: The relation of partnership is created necessarily by an agreement, whereas a Joint Hindu Family is established by law. A person becomes a member of a Joint Hindu Family by birth.

- Death: The death of a partner brings about the dissolution of the partnership. The death of a member of a Joint Hindu Family does not give rise to the dissolution of the family business.

- Management: In a Joint Hindu family, only karta has the right to manage the business. In a partnership, all the partners have the right to take part in the management of the firm.

- Liability: The liability of partners in a partnership concern is unlimited, joint, and several. The liability of members of a Joint Hindu Family except the Karta is limited only to the extent of their share in the business of the family.

- Calling for accounts: On the partition of a joint Hindu Family a member is not entitled to ask for the accounts of the family business. However, a partner can bring a suit against the firm for accounts on the acquisition of the firm.

- Governing Law: A partnership is governed by the Indian Partnership Act, of 1932, while a Joint Hindu Family is governed by Hindu Law.

- Minor’s Position: A minor can be a member of a Hindu Joint Family, but a minor can not be a partner in a firm. However, he can be admitted to the benefits of partnership with the consent of all the partners.

Question 4. Briefly explain the difference between a Sleeping partner and a nominal partner.

Answer:

Sleeping Partner and Nominal Partner: A sleeping partner is neither an active partner nor known to outsiders. In reality, he is a partner in the firm.

- He contributes his share of capital and gets his share of profits, but he does not take an active part in the conduct of the business of the firm. He is liable to the third parties for all the acts of the firm.

- whether his existence is known to the third parties at the time of making the contract. A Nominal Partner has no real interest in the business of the firm.

- He is not entitled to share the profits and also does not contribute any capital. He also does not take part in the conduct of the business of the firm.

He lends his name only and his name is used in the firm like an actual partner and is liable for all acts of the firm.

CA Foundation Solutions For Business Laws General Nature Of A Partnership Descriptive Questions And Answers

Question 1. The law of partnership is an extension of the law of agency:

Answer:

The law of partnership is an extension of the law of agency: The concluding portion of the definition of partnership as given in Section 4 of the Act is very important for this quotation as it says that the business may be carried on “by all or any of them for all”.

- Thus, it is clear that the Act does require that the business should be carried on by all or it may be carried on by any of them on behalf of all of them.

- This establishes the implied agency, the partner who is conducting the affairs of the business is considered an agent of the remaining partners. The relationship between partners is governed by the law of agency.

- Section 18 of the Partnership Act provided, “Subject to the provisions of this Act, a partner is the agent of the firm for the business of the firm”.

In carrying on the business of the firm, partners act as agents as well as principals. While the relation between the partners inter se is that of principals, they are agents of one another concerning third parties for purposes of the business of the firm.

- Every partner has a two-fold character, he is an agent of the other partners (because other partners are bound by his acts) and also he is the principal (because he is bound by the acts of other partners).

- The liability of one partner for the acts of his co-partners is in truth the liability of a principal for the acts of his agent. This concept of mutual agency is, in fact, the true test of the existence of partnership.

- This relationship of principal and agent distinguishes a partnership business from co-ownership, a Joint Hindu family business as well as an agreement to share profits of the business.

From the above, we can conclude that the law of partnership is an extension of the law of principal and agent.

Question 2. Who may be a partner of a firm?

Answer:

Partner of a firm

Section 4 of the Indian Partnership Act, defines a partnership. This definition lays-stress on an agreement between persons.

These persons should be those, who are competent to contract as per provisions of S. No. 11 of the Indian Contract Act i.e., these persons must have the capacity to contract, meaning they are capable of entering into a valid contract.

Section 11 defines capacity to contract as follows:

“Every person is competent to contract who is of the age of majority according to the law to which he is subject, and who is of sound mind, and is not disqualified from contracting by any law to which he is subject.

” Those who cannot contract can not be a partner. However, a minor under Section 30 of the Indian Partnership Act can be admitted to the benefits of the partnership firm with the consent of all the partners.

Thus to be a partner, a person must be

- A major,

- Of sound mind, and

- Should not be, disqualified from contracting by any law.

Question 3. The true test of partnership is mutual agency.

Answer:

According to Section 4 of the Indian Partnership Act, of 1932, three elements of the firm appear from the definition of the partnership.

They are

- There must be an agreement entered into by all the persons concerned

- The agreement must be to share the profits of a business; and

- The business must be carried on by all or any of the persons concerned, acting for all, All these elements must be present before a group of persons can be held to be partners.

The third element shows that the business must be carried on by the partners or some of them acting for all. This element very clearly brings out the fundamental principle of partners.

- When carrying on the business of the firm are agents as well as principals; an implied agency flows from their relationship with the result that every partner who conducts the business of the firm is in doing so deemed in law to be the agent of all the partners.

- The essence of a partnership is that each of the partners is the agent of the others to carry on the partnership business. This test is known as the test of mutual agency and is the most distinctive test of partnership.

- Failure by one partner to take part in the management of the business does not have the result that he is not carrying on business as a partner.

- Thus sharing the profits of a business though an essential element, would not be in itself sufficient to constitute a partnership, Besides sharing the profits of a business it is also necessary to show that the business was conducted on his behalf.

Therefore, the true test of partnership is mutual agency rather than sharing profits. If this element is lacking there will be no partnership.

Question 4. Explain the Partnership by holding out.

Answer:

Partnership by holding out (Section 28 Indian Partnership Act, 1932):

When a person represents himself or knowingly permits himself to be represented as a partner in a firm when in fact he is not, he is liable like a partner in the firm to anyone who on the faith of such representation has given credit to the firm.

In the case of partnership holding out some affirmative conduct by the principal is necessary.

Question 5. The true test of partnership is “mutual” agency between the partners.

Answer:

The true test of partnership is mutual agency rather than sharing of profits. If this element of mutual agency is absent then there will be no partnership. The prima facie evidence of partnership is mutual agency.

- Every partner carrying on the business is the principal as well as an agent of other partners. So, the act of one partner done on behalf of the firm binds all the partners.

- Section 4 of the Indian Partnership Act, 1932 says is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.

- Thus an implied agency flows from their relationship as partners with the result that every person who conducts the business of the firm is in doing so, deemed in law to be the agent of all the partners. (Section 18).

Question 6. Partnership is an association of persons, who have agreed to share the profits of a business carried on by all or any one of them acting for all.

Answer:

This statement deals with the definition of partnership as laid down by Section 4 of the Indian Partnership Act, of 1932. The definition lays down the essential elements which must be fulfilled for making a partnership.

Accordingly,

- There must be an agreement between the persons associating to form a firm.

- The agreement must be to carry on a business i.e. there must be a business.

- The agreement must be to share the profits of the business, equally or in agreed proportion.

- However, sharing of profits is only a prima facie test of partnership since. there may be persons who share profits and yet may not be termed as partners For Example. a widow of a deceased partner or a loan creditor getting a share of profits over and above the interest charged by him.

- The business must be carried in by all or it may be carried by one of them on behalf of all. This element establishes a relationship of mutual agency between the persons known to be partners of the business firm.

It is the agency relationship that binds all the partners to each other. A partnership is primarily an extension of the law of agency.

Question 7. The true test of partnership is the existence of mutual agency among the partners and not the sharing of profits.

Answer:

True Test of Partnership: To determine whether there exists a partnership among the partners, the definition given in Section 4 of the Indian Partnership Act, 1932 is used as a test, i.e. one must look to the agreement between them.

- If the agreement is to share the profits of a business, and the business is carried on by all or any of them acting for all, there is a partnership, otherwise not.

- In determining whether a group of persons is or is not a firm or whether a person is or is not a partner in a firm, regard shall be had to the real relation between the parties, as shown by all relevant facts taken together.

- The difficulty arises when there is no specific agreement constituting partnership among the partners, or the agreement is such as does not specifically speak of partnership.

In such a case one has to determine the real relation’ between the partners as shown by all relevant facts taken together (Section 6) such as written or verbal agreement, real intimation and conduct of the partners, other surrounding circumstances, etc.

- The sharing of profits is prima facie a powerful evidence of partnership but the fact that there is a sharing of profit between some persons will not automatically make them partners.

- Therefore, receipt by a person of a share of the profits of a business or a payment contingent upon the earning of profits or varying with the profits earned by a business does not of itself make him a partner with the persons carrying on the business.

- Thus there is no partnership based on the sharing of profits only. The true test of partnership as laid down in the leading case of Cox vs. Hickman is mutual agency.

- Each partner carrying on the business is the principal as well as an agent of other partners, so the out-of-one partner done on behalf of the firm binds all the partners.

If the element of mutual agency relationship exists between the parties constituting a group formed to earn profits by running a business, it can be said that there is a partnership.

Question 8. Partner by Holding out?

Answer:

Partner by Holding Out: Section 28 of the Indian Partnership Act, 1932 provides for the meaning of the term, ‘Partner by Holding Out’. It states:

- Anyone who by words spoken or written or by conduct represents himself, or knowingly permits himself to be represented, to a partner in a firm, is liable as a partner in that firm, to anyone who has on the faith of any such representation given credit to the firm, whether the person representing himself or represented to be a partner does or does not know that the representation has reached the person so giving credit.

- Where after a partner’s death the business is continued in the old firm name, the continued use of that name or the deceased partner’s name as a part thereof shall not of itself make his legal representative or his estate liable for any act of the firm done after his death.

Thus, holding out means holding responsible a person who is not a partner in the real sense in a firm, but has represented himself as a partner, or has knowingly permitted himself to be represented, is to be treated as a partner of the firm to anyone.

- Who on the faith of such representation has given credit to the fire? He shall also be liable to such creditors for payment.

- The representation referred to above may be expressed or implied. It may be written or maybe even by conduct. The form of representation is immaterial for such a purpose.

Question 9. What is the conclusive evidence of partnership? State the circumstances when the partnership is not considered between two or more parties.

Answer:

Conclusive evidence of partnership

The business must be carried on by all the partners or by anyone or more of the partners acting for all. This is the cardinal principle of the ‘partnership law. An act of one partner in the course of the business of the firm is an act of all partners.

- It may be noted that the true test of partnership is mutual agency rather than sharing of profits.

- If the element of mutual agency is absent, then there will be no partnership.

Sharing of profits is an essential element to constitute a partnership, but it is only prima facie evidence and not conclusive evidence.

Conclusive evidence of the existence of a partnership is only mutual agency.

The receipt of profit share by one person of a business, does not itself make him a partner with the persons carrying on the business. Such cases are:

- By a servant or agent as remuneration.

- By a widow or child of a deceased partner, as an annuity.

- By a lender of money to persons engaged or about to engage in any business.

- By a previous owner or part owner of the business.

Question 10. Whether a group of persons is or is not a firm, or whether a person is or not a partner in a firm.,” Explain the mode of determining existence of a partnership as per The Indian Partnership Act 1932.

Answer:

Mode of Determining Existence of Partnership:

In determining whether a group of persons is or is not a firm, or whether a person is or is not a partner in a firm regard shall be had to the real relation between the parties, as shown by all relevant facts taken together.

To determine the existence of a partnership, it must be proved:

- There was an agreement between all the persons concerned.

- The agreement was to share the profits of a business, and

- The business was carried on by all or any of them acting for all.

- Agreement: Partnership is created by agreement and not by status.

- Sharing of Profits: Sharing of profit is an essential element to constitute a partnership. But, it is only prima facie evidence not conclusive evidence. Although the right to participate in profits is a strong test of partnership, whether the relationship is there or not, depends upon the whole contract between the parties.

- Agency: The existence of mutual agency is the cardinal principle of partnership law, and is very much helpful in concluding in this regard. Each partner carrying on the business is the principal as well as an agent of other partners. So, the act of one partner done on behalf of the firm binds all the partners.

If the elements of a mutual agency relationship exist between the parties constituting a group formed to earn profits by running a business, a partnership may be deemed to exist.

Question 11. What do you mean by ‘Partnership at will’ as per the Indian Partnership Act, 1932?

Answer:

‘Partnership at will’ as per the Indian Partnership Act, 1932

Partnership at will (Section 7) of the Indian Partnership Act, 1 932 which says that partnership at will is a partnership when:

- No fixed period has been agreed upon for the duration

- There is no provision made as to the determination of partnership.

Question 12. What do you mean by “Particular Partnership” under the Indian Partnership Act, of 1932?

Answer:

Particular Partnership:

A partnership may be organized for the prosecution of a single adventure as well as for the conduct of a continuous business.

- Where a person becomes a partner with another person in any particular adventure or undertaking the partnership is called a ‘particular partnership’.

- A partnership, constituted for a single adventure or undertaking is, subject to any agreement, dissolved by the completion of the adventure or undertaking.

Question 13. Who is a nominal partner under the Indian Partnership Act, of 1932? What are his liabilities?

Answer:

Nominal Partner:

A person who lends his name to the firm, without having any real interest in it, is called a nominal partner.

- He is not entitled to share the profits of the firm. Neither did he invest in the firm nor take part in the conduct of the business.

- He is, however, liable to third parties for all acts of the firm.

Question 14. “Business carried on by all or any of them acting for all.” Discuss the statement under the Indian Partnership Act, of 1932.

Answer:

Mutual Agency:

The existence of a Mutual Agency which is the cardinal principle of partnership law, is very much helpful in concluding in this regard.

- Each partner carrying on the business is the principal as well as an agent of other partners.

- So, the act of one partner done on behalf of the firm binds all the partners.

If the elements of a mutual agency relationship exist between the parties constituting a group formed to earn profits by running a business, a partnership may be deemed to exist.

Question 15. Define partnership and name the essential elements for the existence of a partnership as per the Indian Partnership Act,1932. Explain any two such elements in detail.

Answer:

Definition of ‘Partnership’ (Section 4)

As per the Partnership Act, 1932 mentioned in section 4 ‘Partnership’ is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.

Elements of Partnership:

The definition of a partnership contains the following five elements which must co-exist before a partnership can come into existence.

- Partnership is an association of two or more persons.

- The partnership must be a result of. an agreement entered into by all persons concerned.

- The partnership is organized to carry on some business.

- The agreement must be to share the profits of the business.

- The business must be carried on by all or any of them acting for all.

Explanations of any two elements in detail are as follows.

- Association of two or more persons: A partnership is an association of 2 or more persons. Again, only persons recognized by law can agree partnership.

- Therefore, a firm since it is not a person recognized in the eyes of law cannot be a partner.

- Again, a minor cannot be a partner in a firm, but with the consent of all the partners, may be admitted to the benefits of partnership.

- The Partnership Act is silent about the maximum number of partners but section 464 of the Companies Act, 2013 has now put a limit of 50 partners in any association or partnership firm.

- Agreement: It may be observed that a partnership must be the result of an agreement between two or more persons. There must be an agreement entered into by all the persons concerned.

- This element relates to the voluntary contractual nature of the partnership. Thus the nature of the partnership is voluntary and contractual.

- An agreement from which a relationship of partnership arises may be expressed.

- It may also be implied from the act done by partners and from a consistent Course of conduct being followed, showing mutual understanding between them. It may be oral or in writing.

Question 16. Sharing in the profits is not conclusive evidence in the creation of partnership”. Comment.

Answer:

Evidence of partnership: Partnership, generally is an agreement between two or more competent persons to carry on some business and distribute or share the profits of such business.

- Section 6 of the Indian Partnership Act prescribes the test to determine the existence of a partnership.

- To determine whether a group of persons is a firm and its members are partners or not, their relation must be determined based on relevant facts.

- The parties to a partnership contract do not become partners simply on the basis that they have been described, in the deed, as partners.

Sharing in the profits of the firm is prima facie evidence of the establishment of the partnership but it is not conclusive proof.

- As per the provision of section 4 of the Indian Partnership Act, the sharing of profits is not the sole determining factor. Other tests are also required to be applied.

- A person may, in many ways share in the profits of a business without being a partner. Explanation 2 of section 6 of the Indian Partnership Act also makes it clear that a creditor is not a partner.

- Similarly, a servant, an agent, a widow, or a child of the deceased partner may receive a share in the profits. But they do not become a partner.

Thus, the real thing to be seen in such cases is whether they are participating in the business of the firm in the capacity of partners and representing each other in the said capacity.

Question 17. What do you mean by ‘Partnership for a fixed Period’ as per the Indian Partnership Act, 1932?

Answer:

A partnership for a fixed period is a partnership where

- A provision is made by a contract between the partners for the duration of the partnership, the partnership is called a ‘partnership for a fixed period.’

- It is a partnership created for a particular period. “

- Such a partnership comes to an end on the expiry of the fixed period.

Question 18. State whether the following are partnerships:

- A and B jointly own a car which they use personally on Sundays and holidays and let it on hired as a taxi on other days and equally divide the earnings.

- Two firms each having 12 partners combine by an agreement into one firm.

- A and B, co-owners, agree to conduct the business in common for profit.

- Some individuals form an association to which each individual contributes ₹ 500 annually. The objective of the association is to produce clothes and distribute the clothes free to the war widows.

- A and B, co-owners share between themselves the rent derived from a piece of land.

- A and B buy commodity X and agree to sell the commodity while sharing the profits equally.

Answer:

The definition of a partnership contains the following five elements that must co-exist before a partnership can come into existence:

- Partnership is an association of two or more persons.

- The partnership must be a. result of an agreement entered into by all persons concerned.

- The partnership is organized to carry on some business.

- The agreement must be to share the profits of the business.

- The business must be carried on by all or any of them acting for all.

- In the given situations if they satisfy any of the following conditions then they will be called as a partnership. Also if ‘they’ satisfy the true test of partnership condition i.e., Agreement, sharing of profit, and Agency.

- A and B jointly own a car which they use personally on Sundays and holidays and let it on hired as a taxi on other days and equally divide the earnings creating an agreement between them for sharing of profits and mutual agency. Hence, it is a partnership.

- Two firms each having 12 partners combined by an agreement into one firm is a partnership as they satisfy the above-mentioned basic conditions.

- A and B, co-owners agree to conduct the business in common for profit is a partnership as it satisfies the basic conditions to form a partnership.

- Some individuals who form an association with an object of charity do not amount to a partnership as they have created a not-for-profit organization that does not carry the basic requirements of agreement between them, sharing of profits, and mutual agency. Hence, it is not a partnership.

- A and B, co-owners share between themselves the rent derived from a piece of land is not a partnership as it lacks the mutual agreement between them.

- A and B brought commodity X without an agreement only to share profits equally does not amount to a partnership.