CA Foundation Solutions For Business Laws Registration And Dissolution Of Firm Self-Study Questions And Answers

Question 1. What are the Steps Adopted for the Registration of a Firm?

Answer:

Registration of firm is affected:

- By sending post, or

- By delivering a statement in a prescribed form to the registrar of the area, in which any place of business of the firm is situated or proposed to be situated.

The statement must include:

- Firm’s name

- Principal Place of Business

- Other Places of Business

- Date of joining of each partner

- Partner’s full name and addresses

- Firm’s duration.

The statement should be signed by all the partners

- Registrar on being satisfied, shall record this entry in his register of firms and shall file the statement

- The registrar then issues a certificate of Registration

- An unregistered firm is not an illegal association.

Question 2. How Many Consequences of Non-Registration?

Answer:

As per Section 69:

Indian Partnership Act does not make, registration of Partnerships compulsory nor does it impose any penalty.

However, non-registration gives rise to certain disabilities such as:

- The firm or any person on its behalf cannot bring action against the third party for breach of contract unless the firm is registered and persons suing are shown in the register of firms.

- Neither the firm nor any partner can claim set off if any suit is brought by a third party against the firm.

- Partner of an unregistered firm cannot bring any action against the firm or any partner of such firm.

- Unregistered firms however can bring a suit for enforcing the right arising otherwise than out of contract.

Question 3. How to Suits allowed by the Act?

Answer:

- Dissolution of a firm

- Rendering accounts of a dissolved firm

- Realisation of property of a dissolved firm

- Set off values not exceeding 100

- Proceeding arising incidentally of value not exceeding ₹ 100

- The firm does not have a business place in territories to which this act extends

- Realisation of property of insolvent partner

- Firms having business places in areas exempted from the application of the Indian Partnership Act, of 1932.

Question 4. What is the Condition Apply on Dissolution of Firm?

Answer:

As per Section 39-47

- It takes place when the relationship between all the partners of the firm is so broken to close the business of the firm.

- As a result, the firm’s assets are sold and its liabilities are paid off.

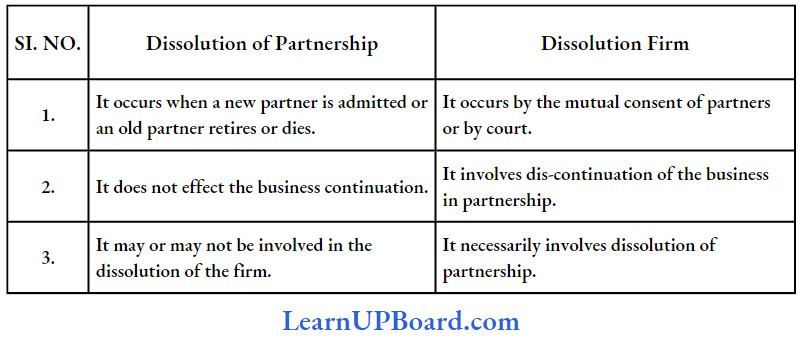

Question 5. Distinguish between the Dissolution’ of the firm and the Dissolution of a partnership.

Answer:

Difference between the Dissolution’ of the firm and the Dissolution of a partnership

Question 6. How Many Modes of Dissolution of Firm?

Answer:

- Section 40 – Result of an agreement between all partners.

- Section 41 (a) – By adjudication of all partners, or declaration of all partners as insolvent except one.

- Section 41 (b) – By firm’s business becoming unlawful. Subject to agreement between parties, on the happening of certain contingent events.

- Section 42 (a) – By the expiry of the fixed term for which the partnership was formed.

- Section 42(b) – By the completion of the venture.

- Section 42 (c) – By death of a partner.

- Section 42 (d) – By insolvency of a partner.

- Section 42 (e) – By retirement of a partner.

- Section 43 – In case of partnership at will, by a partner giving notice of his intention to dissolve the firm. The firm dissolves from the date mentioned in the notice. If no date is mentioned, then from the date of communication of the notice.

- Section 44- By court intervention is a case of:

- A partner becoming unsound mind.

- Permanent in the capacity of partners to perform their duties.

- Misconduct of partners affecting the business.

- Willful or persistent breach of agreement by a partner.

- Transfer or sale of the whole interest of a partner.

- The improbability of business being carried on except at a loss.

- Court being satisfied on other just and equitable grounds.

Question 7. What do you mean by Consequences of Dissolution?

Answer:

Consequences of Dissolution

As per Section 45 – 55:

- Continuing liability until public notice: Partners continue to be liable for any act done by them, done on behalf of the firm until public notice of dissolution is given.

- Right to enforce winding up: Partner or his representative has a right against others, on dissolution:

- Apply the firm’s property in payment of the firm’s debt.

- Distribute surplus amongst all partners.

- Continuing authority of partners: Authority of partner continues:

- So far as necessary to wind up the firm,

- To complete the pending transactions till the dissolution date.

- Settlement of partnership accounts:

- Losses including capital deficiencies:

- Our first paid-out-of-profits

- Then out of capital

- Lastly partners in their profit sharing ratio.

- Assets including the partner’s contribution are applied in the following order:

- In paying debts of third parties.

- In paying the advances of each partner.

- In paying capital of each partner.

- The residue is distributed among partners in their profit-sharing ratio.

- Losses including capital deficiencies:

- If the assets are not sufficient, the partners have to bear the loss in equal shares.

- Personal Profits earned after dissolution: If surviving partners along with the representatives of the deceased partner carry on the firm’s business and earn some personal profits, it must be accounted for by them to other partners.

- Return of premium on premature dissolution: On dissolution of partnership earlier than the fixed period in all cases except

- Death of a partner.

- Misconduct of partner paying a premium.

- Subject to an agreement containing no provision for the return of the premium, the partner paying the premium is entitled to the return of a reasonable part of the premium.

- Rights where the partnership contract is rescinded for fraud or misrepresentation:

- Party is entitled to:

- To a lien on the surplus or assets of the firm remaining after the debts of the firm are paid by him for the purchase of a share in the firm and any capital contributed by him.

- To rank as a creditor of the firm in respect of any payment made by him towards the debts of the firm, and

- To an indemnity for the partners guilty of fraud or misrepresentation against all the debts of the firm.

- Sale of goodwill after dissolution: It can be sold separately or along with other properties of the firm.

Question 8. Describe the Buyer Rights include.

Answer:

tThe Buyer Rights include.

- Representing himself in business continuation.

- Maintaining his exclusive rights of business continuation.

- Soliciting former customers and restraining the seller from it.

Question 9. Describe the Seller’s right.

Answer:

Seller’s right

Vendors can enter into competition with purchasers unless there is an agreement of valid restrictions.

Question 10. How many Mode of Giving Public Notice?

Answer:

Mode of Giving Public Notice

As per Section 72:

- Notice to Registrar of Firms u/s 63

- Publication in the official gazette.

- Publication in one vernacular newspaper circulating in the district of the principal place of business.

CA Foundation Solutions For Business Laws Registration And Dissolution Of Firm Objective Questions And Answers

Question 1. State with reasons whether the following statement is ‘Correct’ or ‘Incorrect’. A third party cannot exercise any right against a non-registered firm.

Answer:

Incorrect: Non-registration of a firm does not affect the right of third parties against the firm or its partners or the power of an official assignee or Receiver of the court.

Therefore, non-registration of a firm will not make the partnership agreement or any transaction between the partners and third parties void (Section 69 of the Partnership Act, 1932).

Question 2. State with reasons in brief whether the following is ‘Correct’ or ‘Incorrect’. A partner making advance of money to the firm, beyond the amount of his agreed capital is entitled to interest on such advanced money.

Answer:

Correct: The general rule is that partners are not considered debtors and creditors among themselves and hence advances made to the firm by a partner cannot be regarded as a loan.

But clause (d) of Section 13 of the Indian Partnership Act, 1932 lays down that a partner who makes any payment or advance of money to the firm beyond the amount of his greed capital is entitled to interest thereon at the rate of six percent per annum, subject to a contract between the partners.

Question 3. State with reasons in brief whether the following is ‘Correct’ or ‘Incorrect’.

Answer:

Correct: Though registration of a firm is not compulsory unregistration creates certain disabilities.

- The general principle under Section 69 of the Indian Partnership Act, 1932 is that an unregistered firm cannot file a suit against a third party to enforce a right arising from a contract.

- But it is an exception to the general rule that an unregistered firm may institute a suit or claim of set-off if the value of the suit does not exceed ₹ 100.

Question 4. State with reasons in brief whether the following is ‘Correct’ or ‘Incorrect’. A partner of an unregistered firm can sue for the dissolution of a firm.

Answer:

Correct: According to Section 69(3)(a) of the Indian Partnership Act, 1932, a partner of an unregistered firm can sue for the dissolution of the firm.

CA Foundation Solutions For Business Laws Distinguish Between Registration And Dissolution Of Firm

Question 1. Distinguish between a Partnership and a Joint Stock Company.

Answer:

Partnership and Joint Stock Company:

- Personality: A firm is not a legal entity whereas a company is a juridical person distinct from its members.

- Agency: In the case of a firm, every partner is an agent of other partners as well as of the firm but in the case of a company, members are not agents of the company.

- Profits: Profits of a firm are among the partners according to the deed of partnership. But in the case of a company, distribution of profit is optional as the company may or may not declare dividends.

- Liability: In a firm, the liability of partners is unlimited but in a company, liability is always limited to the amount of shares or guarantee.

- Property: The property of a firm is the joint estate of all the partners whereas in a company, the property belongs to the company and not to shareholders.

- Transfer of share: In the case of partnership transfer of a partner’s right is not possible without the consent of all the partners, though his interest can be assigned to a third party who has a right to share in profits but has no other right, but in the case of a public company, share is transferable and quoted on stock exchange.

- Management: In partnership, management is by partners, but in a company, the Board of Directors does the management, shareholders only attend general meetings to vote.

- Several members in the partnership is a minimum of 2 and a maximum of 20 (in banking it is 10) but in the case of a private company, the minimum is 2 and. a maximum of 50 excluding past and present employees. In the case of a public company, it is 7, and no restriction on the maximum.

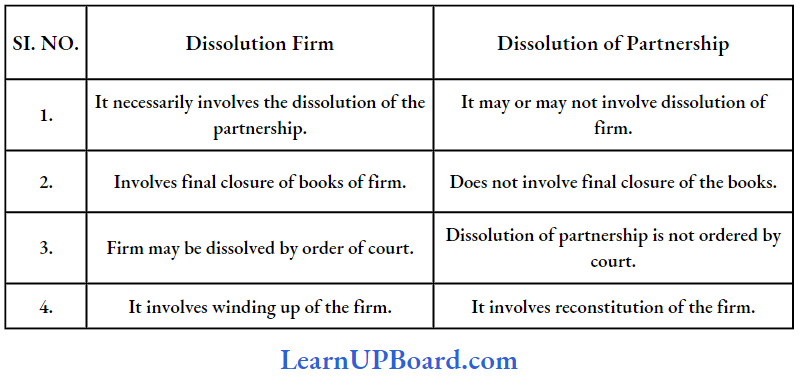

Question 2. Distinguish between ‘Dissolution of firm’ and ‘Dissolution of partnership’.

Answer:

Dissolution of firm Vs. Dissolution of Partnership:

CA Foundation Solutions For Business Laws Registration And Dissolution Of Firm Descriptive Questions And Answers

Question 1. Define ‘Partnership’ and state the procedure for its registration.

Answer:

‘Partnership’

Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all. (Section 4).

The above definition of the Partnership given by the Indian Partnership Act lays down three important elements:

- It must be a result of an agreement between two or more persons;

- The agreement must be to share the profits of the business; and

- The business must be carried on by all or any of them acting for all.

All the above elements must co-exist before a partnership can come into existence. Thus existence of an agreement, a business, sharing of profits, and mutual agency form a core part of the existence of a partnership.

Procedure for Registration: The firm has to file a statement in the prescribed form either in person by post with the prescribed fee, or with the Registrar of the Firms of the area in which the firm is situated or is to be situated.

The Statement is to state the following particulars:

- The firm’s name:

- The principal place of business.

- The name of its other places of business.

- The date of joining of each partner.

- The names in full and the permanent addresses of the partners, and

- The duration of the firm.

When the Registrar is satisfied that the above-mentioned provisions have been complied with, he shall record an entry of this statement in the. register (called the Register of Firms) and shall file the statement.

- The registration shall be completed only when the firm receives a certification of Registration.

- However, registration is deemed to be complete as soon as the application in the prescribed form and with the prescribed fee with necessary details concerning the particulars of the partnership is delivered to the Registrar.

The recording of an entry in the Register of Firms is a routing duty of the Registrar.

Question 2. Explain the meaning of ‘dissolution of a partnership firm’. When does a dissolution of a firm take place?

Answer:

The meaning of ‘dissolution of a partnership firm’

Dissolution of a firm means the discontinuation of the jural relation existing between all the partners of the firm.

- But when only one of the partners retires or becomes incapacitated from acting as a partner due to death, insolvency, or insanity, the partnership, i.e. the relationship between such a partner and others is dissolved, but the rest may decide to continue.

- In such cases, there is in practice no dissolution of the firm. The particular partner goes out, but the remaining partners carry on the business of the firm.

In the case of dissolution of the firm, on the other hand, the whole firm is dissolved. The partnership terminates between each and every partner of the firm.

Section 39 of the Indian Partnership Act, defines it as follows: ‘The dissolution of partnership between all the partners of a firm is called the dissolution of the firm”.

Thus, the business is stopped and the relations between all the partners come to an end.

When does a dissolution of a firm take place?

Dissolution of a firm may take place in the following manner (Sections 39-44):

- As a result of any agreement between all the partners, this is called dissolution by agreement.

- By the adjudication of all the partners, or of all the partners but one, as insolvent, this is known as compulsory dissolution.

- If the business of the firm becomes unlawful, this is known as compulsory dissolution.

- As per the agreement, upon happening of any of the following contingencies:

- Efflux of time;

- Completion of the venture for which it was entered into;

- Death of a partner;

- Insolvency of partner.

- In case of the death of a partner, the number of the partners does not exceed two, the firm is to be dissolved. In case the number of partners is more than two, the firm may continue even after the death of one partner, provided other partners agree to do so.

- By a partner giving notice of his intention to dissolve the firm, in case of partnership at will and the firm being dissolved as from the date mentioned as from the date of the communication of the notice; and

- By the intervention of the court in the case of:

- A partner becoming of unsound mind;

- Permanent incapacity of a partner;

- Misconduct of a partner affecting the business;

- Wilful persistence in breach of agreement by a partner;

- Transfer or sale of the whole interest of the partner;

- The improbability of the business being carried on save at a loss;

- The court was satisfied on other equitable grounds that the firm should be dissolved.

Question 3. What will be the consequences in the relationships partners of a partnership firm resulting from:

- Insolvency of partner, and

- Death of a partner?

Answer:

Consequences of Insolvency and death of a partner:

- Insolvency of a partner (Section 34): When a partner in a firm is adjudicated insolvent. He ceases to be a partner on the date of the order of adjudication whether or not the firm is thereby dissolved.

- His estate (which thereupon vests in the official assignee) ceases to be liable for any act of the firm done after the date of the order

- The firm also is not liable for any act of such a partner after such date(whether or not under a contract between the partners the firm is dissolved by such adjudication).

- Death of a partner (Section 35): Where under a contract between the partners the firm is not dissolved by the death of a partner, the estate of a deceased partner is not liable for any act of the firm done after his death (Section 35).

Ordinarily, the effect of the death of a partner is the dissolution of the partnership, but the rule concerning the dissolution of the partnership by death of a partner is subject to a contract between the parties and the partners are competent to agree.

- The death of one will not have the effect of dissolving the partnership as regards the surviving partners unless the firm consists of only two partners [Commissioner of Income Tax v. G.S Mill, AIR (1966) S.C. 24].

- Section 35 deals with the situation where the firm continues its business without dissolution and lays down that, in such a case, the estate of a deceased partner is not to be held liable for any act of the firm done after his death.

- Proviso to Section 45 lays down an incidental rule applicable to a case where the death of a partner has caused the dissolution of the firm.

So that the estate of a deceased partner may be absolved from liability for the future obligations of the firm, it is not necessary to give any notice either to the public or the person having dealings with the firm.

Question 4. State the matters for which a partner of a partnership firm is required to give ‘Public Notice’ under the provision of the Indian Partnership Act, 1932. State also the consequences for not giving a public notice where it is required to be given under the Partnership Act.

Answer:

Public Notice: As per the requirements of Section 72 of the Indian Partnership Act, 1932 a public notice has to be given:

- On the retirement or expulsion of a partner from a registered firm.

- On the dissolution of a registered firm.

- On the election to become or not to become a partner in a registered firm by a minor on his attaining majority.

Consequences of not giving public notice as required above;

- If a minor admitted to the benefits of partnership under Section 30 fails to give public notice within 6 months of his attaining majority or of his obtaining knowledge that he had been admitted to the benefits of a partnership.

- Whichever date is later, that he has elected to become or not to become a partner in the firm, he shall become a partner in the firm on the expiry of the said 6 months and is liable as a partner of the firm.

- If a retiring partner does not give public notice of the retirement from the firm under Section 32, he and the other partners shall continue to be liable as partners to third parties for any act done by any of them which would have been an act of the firm if done before the retirement.

- If in case of expulsion of a partner from the firm, a public notice is not given, the expelled partner and the other partners shall continue to be liable to third parties dealing with the firm as in the case of a retired partner. (Section 33).

- If public notice is not given on the dissolution of a registered firm, the partners shall be liable to third persons for any act done by any of them which would have been an act of the firm if done before the dissolution (Section 45).

- When public notice is given of the dissolution of a firm, no partner shall have the authority to bind the firm except for certain specific purposes as given in Section 47.

- According to this section, after the dissolution of a firm, the authority of each partner to bind the firm and the mutual rights and obligations of the partners shall continue:

- So far as may be necessary wind up the affairs of the firm; and

- To complete transactions begun but unfinished at the time of the dissolution.

Question 5. Explain briefly the following: Dissolution of partnership may or may not involve the dissolution of the firm.

Answer:

Dissolution of partnership may or may not involve the dissolution of the firm: The Indian Partnership Act, 1 932 makes a distinction between the dissolution of a partnership and the dissolution of a firm.

Section 39 of the Act provides that the dissolution of a partnership between all the partners of a firm is called the dissolution of the firm. Dissolution of a partnership involves change in the relation of partners but it does not end the partnership.

For example, where X, Y, and Z were partners in a firm and X died or retired, the partnership firm would come to an end. If Y and Z agree to continue the business, the partnership between X, Y, and Z will come to an end, although the firm of Y and Z continue in the firm.

- So the dissolution of a partnership may or may not include the dissolution of the firm, but the dissolution of the firm necessarily means the dissolution of the partnership as well.

- On the dissolution of the partnership, the business may be carried on by the remaining constituted firm but on, the dissolution of the firm, all business must be stopped, and the assets of the firm realized and distributed among the partners.

Question 6. Is registration of a partnership firm necessary? Discuss the effects of non-registration of a firm.

Answer:

The registration of a firm is not compulsory. However, an unregistered firm suffers from certain disabilities so registration is necessary.

The effects of non-registration as provided in Section 69 of the Indian Partnership Act, 1932 are:

- In an unregistered firm, a partner cannot file a suit against the firm on any other partner for enforcing his conferred in the act or arising from a contract.

- No suit can be filed on behalf of an unregistered firm against any third party to enforce a right arising from a contract.

- An unregistered firm or any partner thereof cannot claim set off in a suit instituted against the firm by a third party to enforce a right arising from a contract.

But the non-registration of a firm does not attract the following rights:

- The right of a third party to sue the firm or any other partner.

- The right of a partner to sue for dissolution of a firm or for accounts of a dissolved, firm or any right or power to realize the property of a dissolved firm.

- The power of the official assignee or receiver to realize the property of an insolvent partner.

- The rights of firms having no place of business in India.

- A suit for set off not exceeding ₹ 100 in an amount which is of a nature cognizable by Small Causes Court.

Question 7. Answer briefly the following: Mode of effecting registration of a partnership firm.

Answer:

Mode of Effecting Registration of a Partnership Firm: The registration of a partnership firm may be effected, at any time by sending by post or delivering to the Registrar of the area in which any place of business of the firm is situated or proposed to be situated, a statement in the prescribed form.

- The firm doesn’t have to be registered from the very beginning. When the partners so decide they may go for registration of the firm.

- However, the application is to be made by then in the prescribed form as per the provisions of Section 58 of the Indian Partnership Act, of 1832.

The statement must be accompanied by the prescribed fee and must contain the following matters:

- The firm’s name.

- The principal place of business.

- The names of its other places of business.

- The date of joining the firm by each partner.

- The name in full and the permanent addresses of the partners.

- The duration of the firm.

The aforesaid statement is signed by all the partners or by their agents specially authorized on this behalf. Each partner so signing it shall also verify it in the manner prescribed.

- When the Registrar is satisfied that the above-mentioned provisions have been complied with, he shall record an entry of this statement in the register’ (called the Register of Firms) and shall file the statement.

- Subsequent alterations like alterations in the name, place of business, constitution of the firm, etc. may also be registered.

Question 8. You want to form a partnership firm. Would you like to get it registered? If so, why? Also, state the procedure you have to follow for getting the firm registered.

Answer:

Yes, the firm should be registered under the Indian Partnership Act, of 1932 since its non-registration has the following, consequences; (Section 69).

- A person suing as a partner of an unregistered firm cannot sue the firm or any partners of the firm to enforce a right arising from a contract or conferred by the Partnership Act.

- An unregistered firm cannot sue a third party to enforce a right arising from a contract.

- An unregistered firm or any partner thereof cannot claim a set-off in a proceeding instituted against the firm by a third party to enforce a right arising from a contract.

Non-registration, however, does not affect the rights of a firm or of its partners having no place of business in India. It also does not affect the right to any suit or claim of set-off not exceeding ₹ 100.

Procedure; (Sections 58 and 59):

The registration of a firm may be effected at any time by applying the form of a statement and giving the necessary information to the Registrar of Firms of the area. The application shall be accompanied by the prescribed fee. It shall state:

- The name of the firm;

- The place or principal place of business of the firm;

- The names of other places where the firm carried on business.

- The date, when each partner joined the firm;

- The names in full and permanent addresses of the partners;

- The duration of the firm.

The statement shall be signed by all the partners or by their agents specially authorized on this behalf. [Section 58(1)]. It shall also be verified by them in the prescribed manner. [Section 58(2)].

- When the Registrar is satisfied that the above provisions have been duly complied with, he shall record an entry of the statement in the Register of Firms and file the statement. (Section 59).

- He shall then issue under his hand a certificate of registration. Registration is effective from the date when the Registrar files.

- The statement makes entries in the Register of Firms and not from the date of presentation of the statement to him.

Question 9. Explain the following: Dissolution of a Partnership Firm by the intervention of the Court.

Answer:

Dissolution of a firm by the intervention of the Court:

A firm can be dissolved by the intervention of the Court on the following grounds:

- A partner becoming of unsound mind;

- Permanent, incapacity of a partner to perform his duties as such.

- Misconduct of a partner affecting the business.

- Willful or persistent breaches of agreement by a partner.

- Transfer or sale of the whole interest of a partner.

- The improbability of the business being carried on save at a loss.

- The Court was satisfied on other equitable grounds that the firm should be dissolved.

Question 10. What are the consequences of Non-Registration of a Partnership Firm? Discuss.

Answer:

The consequences of Non-Registration of a Partnership Firm

Under the English law, the registration of firms is compulsory. But the Indian Partnership Act does not make the registration of firms compulsory nor does it impose any penalty for non-registration.

- However, under section 69, nonregistration of partnership gives rise to many disabilities.

- Thus, the consequences of non-registration have a persuasive pressure on their registration.

These disabilities are as follows:

- No suit in a civil court by the firm or other co-partners against a third party: The firm or any other partner on its behalf cannot bring an action against a third party for breach of contract entered into by the firm unless the firm is registered and the person suing are or have been shown in the register of firms as partners in the firm.

- No relief to partners for set-off of claim: In an action against the firm by a third party, neither the firm nor the partner can claim any set-off, if the suit is valued at more than ₹ 100.

- Aggrieved partner cannot bring legal action against other partner or the firm: A partner of an unregistered firm is precluded from bringing legal action against the firm or any person alleged to be or to have been a partner in the firm. (But such a person may sue for dissolution of firm).

- A third party can sue the firm: In the case of an unregistered firm, an action can be brought against the firm by a third party.

Question 11. State any four grounds on which the Court may dissolve a partnership firm in case any partner files a suit for the same.

Answer:

The four grounds as mentioned under Section 44 on which the Court can dissolve a partnership firm are:

- Insanity or Unsound mind: Where a partner (not a sleeping partner) has become of unsound mind, the Court may dissolve the firm on a suit of the other partners or by the next friend of the insane partner.

- Permanent incapacity: When a partner other than the partner suing has become in any way permanently incapable of performing his duties as a partner, then the Court may dissolve the firm.

- Misconduct: Where a partner, other than the partner suing, is guilty of conduct which is likely to affect prejudicially the carrying on of business, the Court may order for dissolution of the firm, by giving regard to the nature of business.

- Persistent breach of agreement: Where a partner other than the partner suing, wilfully or persistently commits a breach of agreements relating to the management of the affairs of the firm or the conduct of its business, or otherwise so conducts himself in matters relating to the business that it is not reasonably practicable for other partners to carry on the business in partnership with him.

Question 12. Indian Partnership Act does not make the registration of firms compulsory nor does it impose any penalty for non-registration.” Explain. Discuss the Various disabilities or disadvantages that a nonregistered partnership firm can face in brief.

Answer:

Under the English Law, the registration of firms is compulsory. But the Indian Partnership Act does not make the registration of firms compulsory nor does it impose any penalty for non-registration.

However, section 69, of the Act, gives rise to several disabilities which will attach to an unregistered partnership firm. Although registration of firms is not compulsory, the consequences or disabilities of non-registration have a persuasive pressure for their registration.

These disabilities are as follows:

- No suit in a civil court by the firm or other co-partner against the third party: The firm or any other person on its behalf cannot bring an action against the third party for breach of contract unless the firm is registered.

- No relief to partner for set off of claim: Neither the firm nor the partner can claim any set off if the suit is valued at more than ₹ 100.

- Aggrieved partner cannot bring legal action against the other partner of the firm: A partner of an unregistered firm is precluded from bringing legal action against the firm or any person alleged to be or to have been a partner in the firm.

- A third party can sue the firm: In the case of an unregistered firm, an action can be brought against the firm by a third party.

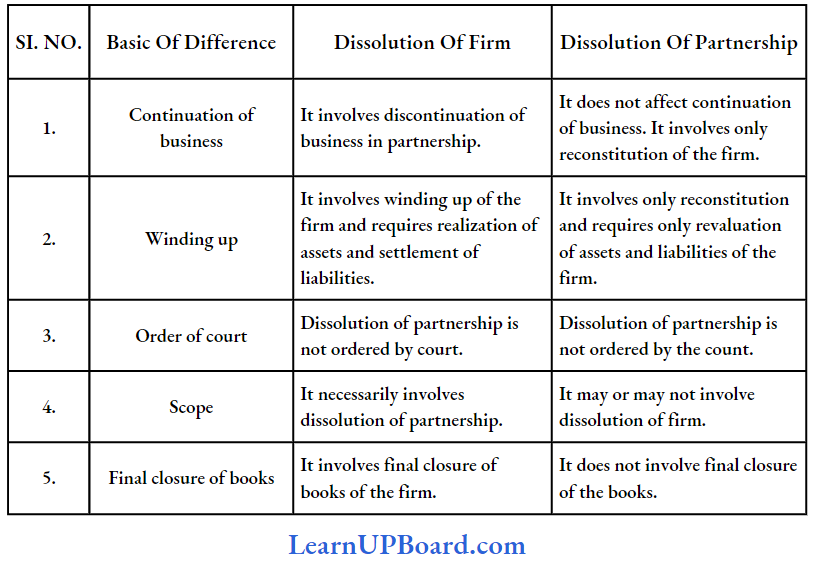

Question 13. Dissolution of a firm is different from dissolution, of Partnership”. Discuss.

Answer:

As per the Indian Partnership Act, of 1932, the dissolution of a partnership between all partners of a firm is called the “dissolution of the firm.” The particular partner goes out, but the remaining partner carries on the business of the firm, it is called dissolution of the partnership.

Dissolution of Firm Vs. Dissolution of Partnership

Question 14. Referring to the Provisions of the Indian Partnership Act, of 1932, answer the following:

- What are the consequences of the Non-Registration of a Partnership firm?

- What are the rights that won’t be affected by the Non-Registration of the Partnership firm?

Answer:

- Consequences of Non-Registration of a Partnership (Section 69) According to the Indian Partnership Act, of 1932 the registration of a partnership firm is optional but it has to face various disabilities:

- No suit in a civil court by a firm or other co-partners against a third party: The firm or any person on its behalf cannot take any legal action against the third party for a breach of a contract entered into by the firm until and unless the firm is registered.

- No relief to partners for set-off of claim: If an action is brought against the firm by a third party then neither the firm nor the partner can claim any set-off if the suit is valued for more than ₹ 100 or pursue other proceedings to enforce the rights arising from any contract.

- Non-registration of a partnership firm, however, affects the following rights:

- The right of a third party to sue the firm or

- The right of partners to sue feel the dissolution of the firm or for the settlements of the accounts of a dissolved firm.

- The power of an official assignee to release the property of the insolvent partner and to bring an action.

- The right to sue or claim a set-off if the value of the suit does not exceed ₹ 100 in value.

Question 15. Subject to agreement by partners, state the rules that should be observed by the partners in settling the accounts of the firm after dissolution under the provisions of The Indian Partnership Act, 1932.

Answer:

Subject to the Contract between the partners, after the distribution of the firm, its accounts must be settled as follows.

- Payment of Losses: Losses including deficiencies of capital are to be paid first out of profits then out of capital and lastly by partners individually in the proportion in which they have contributed capital.

- Application of Assets: The assets of the firm, including any sums contributed by the partners to make up the deficiencies of capital, must be applied in the following manner and order:

- In payment of debt to third parties

- In payment of each partner’s advances

- In payment of each partner’s Surplus Capital i.e. which is over capital ratio.

- The remaining is divided amongst partners in profit sharing ratio.

Question 16. Explain the grounds on which the court may dissolve a partnership firm in case any partner files a suit for the same.

Answer:

The Court may dissolve a firm on any of the following grounds if a partner files a suit

- Insanity or unsound Mind – Where an active partner (not sleeping partner) has become of unsound mind, then the court may dissolve the firm on a suit filed by any other partner or by the next friend of such unsound partner. Although, temporary sickness, is not a ground for the dissolution of the firm.

- Permanent Incapacity – Where an active partner (but not sleeping partner) has become permanently incapable of performing his duties as a partner, then the Court may dissolve the firm on a suit filed by any other partner. Such permanent incapacity may result from physical disablement, illness, etc.

- Misconduct – Where a partner is guilty of misconduct, which is likely to affect prejudicially the carrying on of business, then the Court may order for dissolution of the firm by giving regard to the nature of business upon a suit filed by any other partner. It is not necessary that misconduct must relate to the conduct of the business. If misconduct is adversely affecting the business, then it is a sufficient ground.

- Persistent breach of agreement – Where a partner wilfully or persistently commits a breach of agreements relating to the business and the management of the affairs of the firm, or the conduct of the business, or otherwise so conducts himself in a matter relating to the business in such a way that other partner can’t carry on the business in partnership with him, then the court may order for dissolution of the firm on a suit filed by any other partner.

- Transfer of interest – Where a partner, transfers the whole of his interest in the firm to a third party or allows his share to be charged or sold by the Court, in the recovery of arrears of land revenue due by the partner, then the Court may order for dissolution of the firm on a suit filed by any other partner.

- Continuous or Perpetual losses – Where the business of the firm cannot be carried on except at a loss, then the Court may order for dissolution of the firm. In such a case suit may be filed by any partner of the firm.

- Just and Equitable Grounds – Where the Court considers any other ground to be just and equitable for the dissolution of the firm, then it may dissolve the firm.

Question 17. “Indian Partnership Act does not make the registration of firms compulsory nor does it impose any penalty for non-registration.” In light of the given statement, discuss the consequences of non-registration of the partnership firms in India. Also, explain the rights unaffected due to non-registration of firms.

Answer:

“Indian Partnership Act does not make the registration of firms compulsory nor does it impose any penalty for non-registration.”

- A consequence of non-registration (Section 69): Under the English Laws, the registration of firms is compulsory. Therefore, there is a penalty for non-registration of firms.

- But the Indian Partnership Act does not make the registration of firms compulsory nor does it impose any penalty for non-registration.

- However, under Section 69, non-registration of partnership has given rise to some disabilities which we shall presently discuss.

- Although registration of firms is not compulsory, yet the consequences or disabilities of non-registration have a persuasive pressure for their registration. These disabilities briefly are as follows:

- No suit in a civil court by the firm or other co-partners against a third party: The firm or any after person on its behalf cannot bring an action against the third party for a branch of the contract entered into by the firm unless the firm is registered and the persons suing are or have been shown in the register of firms as partners in the firm.

- In other words, a registered firm can only file a suit against a third party and the persons suing have been in the register; of firms as partners in the firm.

- No relief to partners for set-off of claim: If an action is brought against the firm by a third party, then neither the firm nor the partner can claim any set-off if the suit is valued for more than ₹ 100 or pursue other proceedings to enforce the rights arising from any contract.

- Aggrieved partner cannot bring legal action against other partner or the firm: A partner of an unregistered firm (or any other person on his behalf) is precluded from bringing legal action against the firm or any person alleged to be or to have been a partner in the firm.

- But, such a person may sue for dissolution of the firm dr for accounts arid realization of his share in the firm’s property where the firm is dissolved.

- A third party can sue the firm: In the case of an unregistered firm, an action can be brought against the firm by a third party.

Exception: Non-registration of a firm does not, however, affect the following rights:

- The right of third parties to sue the firm or any partners.

- The right of partners to sue for the dissolution of the firm the settlement of the accounts of a dissolved firm, or the realization of the property of a dissolved firm.

- The power of an official assignee, receiver of the court to release the property of the insolvent partner and to bring an action.

- The right to sue or claim a set-off if the value of the suit does not exceed ₹ 100 in value.

- The right to suit and proceeding instituted by legal representative or heirs of the deceased partner of a firm for accounts of the firm or to realize the property of the firm.

Question 18. Explain about the registration procedure of a partnership firm as prescribed under the Indian Partnership Act, of 1932.

Answer:

Registration procedure of a partnership firm as prescribed under the Indian Partnership Act, of 1932

As per section 58 of the Indian Partnership Act, 1932, following the registration procedure of a partnership firm.

- The registration of a firm may be effected at any time by sending by post or delivering to the registrar of the area in which any places of business of the firm is situated or proposed to be situated.

- A statement in the prescribed form and accompanied by the prescribed fee, stating the firm’s name place or principal place of business firm the names of any other places where the firm carries on business.

The date when each partner joined the firm, the names full and permanent addresses of the partners, and the duration of the firm.

- The statement shall be signed by all the partners, or by their agents specially authorized on this behalf.

- When the Registrar is satisfied that the provisions of section 58 have been duly complied with, he shall record an entry of the statement in a Register called the Register of Firms and shall file the statement.

- The registrar shall then issue a certificate of Registration. However, registration is deemed to be completed as soon as an application in the prescribed form with the prescribed fee and necessary details concerning the particulars of the partnership are delivered to the Registrar.

- If the statement in respect of any firm is not sent or delivered to the Registrar within the time specified in sub-section (1A) of section 58, then the firm may be registered on payment, to the Registrar of a penalty of one hundred rupees per year of delay or a part thereof.

Question 19. M/S XYZ and Associates, a partnership firm with X, Y, and Z as senior partners were engaged in the business of carpet manufacturing and exporting to foreign countries. On 25th Aug. 2016, they inducted Mr. G an expert in the field of carpet manufacturing as their partner. On 10th Jan. 2018, Mr. G was blamed for unauthorized activities and thus expelled from the partnership by the united approval of the rest of the partners.

- Examine whether the action by the partners was justified or not.

- What should be the factors to be kept in mind before expelling a partner from the firm by other partners according to the provisions of the Indian Partnership Act, 1932?

Answer:

A partner may not be expelled from a firm by a majority of partners except in exercise, in good faith of powers conferred by contract between the partners. It is, thus, essential that:

- The power of expulsion must have existed in a contract between the partners.

- The power has been exercised by a majority of the partners, and

- It has been exercised in good faith.

If all these conditions are not present the expulsion is not deemed to be done in bonafide interest of the business of the firm.

If a partner is otherwise expelled, the expulsion is null and void. Thus, the action taken by a partner in expelling partner G is valid.

Question 20. Mr. M is one of the four partners in M/s. XY Enterprises. He owes a sum of 16 crore to his friend Mr. Z which he is unable to pay on due time. So he wants to sell his share in the firm to Mr. Z to settle the amount. In light of the provisions of The Indian Partnership Act, of 1932, discuss each of the following:

- Can Mr. M validity transfer his interest in the firm by way of sale?

- What would be the rights of the transferee (Mr. Z) in case Mr. M wants to retire from the firm after 6 months from the date of transfer?

Answer:

- As per Section 29 of The Indian Partnership Act, of 1932.

- A share in a partnership firm is transferable like any other property.

- But as this relationship is based on confidence,

- The assignee of a partner’s interest by sale, mortgage, or otherwise cannot enjoy the same rights and privileges as the original partner.

- The rights of a transferee on the retirement of the transferring partner are as follows:

- The transferee is entitled to receive the share of the assets of the firm to which the transferring partner was entitled.

- To ascertain his share, he is entitled to access and inspect the accounts of the firm.

Four Partners Conclusion:

In the given case,

- Mr. M can validly transfer his interest in the firm by way of sale.

- Mr. Z is entitled to aforesaid rights after the retirement of Mr. M from the firm.