Relations Of Partners Self Study Questions And Answers

Question 1. What are the Relations of Partners to One Another?

Answer:

The Relations of Partners to One Another

- It arises through an agreement that provides for the rights and duties of partners.

- If articles are silent, rights and duties are governed by the Act.

Question 2. How many Rights of Partners are there?

Answer:

Rights of Partners

- To take part in management

- To express opinion

- To inspect and take out copies of Books of Accounts

- To share profits equally

- To have an interest in capital

- To have an interest in advances

- Right to be indemnified

- To prevent the introduction of the new partner

- Implied Authority

- Right to dissolve

- Profits after retirement or death.

Question 3. What are the Duties and Liabilities of partners?

Answer:

The Duties and Liabilities of partners

- To carry on the business of the firm to the greatest common advantage

- Being diligent and honest

- Being just good faithful

- To render accounts and information

- To indemnify the firm (Section 10)

- Not to make any secret profits

- Not to hold and use the property of the firm.

- Not to start a business in competition with the firm.

- Not to receive any remuneration

- Not to transfer his interest

- To act within the scope of his authority

- To share losses.

Question 4. Describe the Partnership Property.

Answer:

The Partnership Property

As per Section 14:

- It is also known as “property of the firm”, “Partnership assets”, “Joint stock”, “Or joint estate”.

- It represents the property to which all partners and entitled collectively.

Question 5. What conditions are included in Partnership Property?

Answer:

Conditions are included in Partnership Property

- All property, rights, and interests that partners may have brought into the common stock as their contribution.

- All property, rights, and interests which are acquired or purchased by the firm in the course of business.

- Goodwill of the business.

- Every partner is a joint owner of partnership property.

- Every partner is entitled to hold and apply the same exclusively for business purposes.

- A partner’s property being used for a firm’s business does not automatically makes it a firm’s property.

Question 6. Write a short note on Goodwill.

Answer:

Goodwill

- Goodwill is defined as the value of the reputation of a business house concerning profits expected in the future over and above normal profits.

- It is a partnership property.

- In case of dissolution of the firm, every partner has a right according to the deed in the absence of any agreement, to have a share in the goodwill on it being sold.

- It can be sold separately or along with other properties of the firm.

Question 7. Which condition Applies in the Case of Personal Profit Earned by Partners?

Answer:

As per Section 16:

If a partner derives any profits for himself from any business transaction of the firm or use of the property of the firm or carries on a competing business, he must account for and pay all the profits made by him to the firm.

Question 8. Describe the Relation of partners to third parties.

Answer:

The Relation of partners to third parties

- Every partner is the agent of the firm for the purpose of business of the firm.

- Every partner is both the principal and agent.

- The law of partnership is regarded as a breach of the law of agency.

Act of every partner binds the firm and other partners unless:

- The acting partner has no authority to act for the firm in such a matter

- A person with whom he is dealing knows that he has no authority

- Believes such a person to be a partner.

Question 9. Which Conditions Apply for implied authority?

Answer:

- The act must relate to the normal business of the firm.

- Act must be, done in the usual way of carrying on the firm’s business.

- The act must be done in the firm’s name.

Question 10. Which Acts Apply within implied authority?

Answer:

- To buy, sell, and pledge goods on behalf of the firm.

- To raise loans on the security of such assets.

- To receive payments of debts due to the firm.

- To accept, make, and issue bills of exchange, etc on the firm’s behalf.

- To engage servants for the firm’s business.

- To take on lease premises on the firm’s behalf.

Question 11. Which Acts Apply Beyond the Implied Authority?

Answer:

As per Section 19(2):

- Submission of a dispute relating to the business of the firm to arbitration.

- Opening a bank account on the firm’s behalf in his name.

- Comprising of relinquishing any claim or portion of claim against a third party by the firm.

- Withdrawing a suit or proceedings filed on behalf of the firm.

- Admitting any liability in a suit or proceedings against the firm.

- Transferring immovable property of the firm.

- Entering into partnership on the firm’s behalf.

Question 12. What are the Extensions and Restrictions of Partners on Implied Authority?

Answer:

As per Section 20:

- The partners may either extend or restrict the implied authority of any partner by contract between them.

- The third party is not affected by a secret limitation’ of a partner’s implied authority unless he had actual notice of it.

- All partner’s consent is required for it.

Question 13. Describe the Partner’s authority in an Emergency.

Answer:

The Partner’s authority in an Emergency

As per Section 21:

Subject to provisions of section 20, each partner binds the firm by all acts done in the case of emergency, to protect the firm from any loss provided, As he has acted as a man of ordinary prudence.

Question 14. Describe the Liability to third parties.

Answer:

As per Sections 25 to 27:

Section 25: Contractual liability:

Every partner is liable jointly and severally for all acts or omissions binding the firm while he is a partner.

Question 15. What is Section 26: Liabilities for fort or wrongful Act?

Answer:

Liabilities for fort or wrongful Act

(Generally, other partners are not liable for one partner’s fort but where the fort is committed by the authority of other partners then partners are liable).

The firm is liable to the same extent as the partner for any loss or injury caused to the third party by the wrongful act of the partner if they are done by the partner acting:

- In the ordinary course of business

- With the partner’s authority.

Question 16. Which Liabilities arise for misappropriation by a partner?

Answer:

When a partner, acting within his apparent authority, receives money or other property from a third person and applies it, or.

where a firm, in business course, receives money or property from a third party and is misapplied by a partner, while it is in the firm’s custody is liable to make good the loss.

Question 17. What are the Rights of the Transferee of a partner’s interest?

Answer:

The Rights of the Transferee of a partner’s interest

As per Section 29:

- During the continuance of the partnership, if a partner transfers his interest, the transferee will not be entitled to it.

- Interfere with the conduct of business

- Require account, or

- Inspect books of the firm.

- He will only be entitled to share of profits and he is bound to accept the same without challenging the accounts.

- At the time of dissolution or retirement, the transferee is entitled, against other remaining partners:

- To receive the share of assets of the firm to which the transferring partner was entitled, and

- To ascertain the share, he is entitled to an account from the date of dissolution.

Question 18. What are the benefits that arise on the admission of a minor partner in a Partnership Firm?

Answer:

The benefits that arise on the admission of a minor partner in a Partnership Firm

As per Section 30:

- Minor is a person who has not completed 18 years of age and, thus, cannot become a partner as he is not competent to contract.

- As per section 30,’ he can, however, be admitted to the benefits of partnership with the mutual consent of all partners. No partnership firm can be formed only with minors.

- A minor’s agreement is altogether void

- If a minor has to be admitted into the benefits of partnership, there must be at least 2 major partners.

Question 19. What are the Rights of Minorities?

Answer:

Rights of Minorities

- Section 30(2): Share profits of the firm

- Section 30(2): Inspect and copy the book of accounts of the firm.

- Section 30(4): Can file a suit for accounts and his share in the firm but only when severing his connection with the firm.

- Section 30 (5): On attaining majority he may within 6 months either

Question 20. What are the Liabilities of a Minor?

Answer:

Liabilities of a Minor

- Section 30(3): His liability is limited to the extent of his share in the firm.

- Section 30(3): He is liable for all acts of the firm but he is not personally liable.

- Within 6 months of his attaining majority or

- On his obtaining knowledge of had been admitted to the benefits of partnership, whichever is later, he may give a public notice- of not electing to become a partner.

Question 21. What are the Liabilities of an Incoming Partner?

Answer:

Liabilities of an Incoming Partner

As per Section 31(2):

- Liability of the new partner ordinarily commences from the date of his admission.

- He can also agree to be liable for obligations incurred before that date by the firm.

- The new firm constituted, may agree to assume liability for existing debts of the old firm.

- Creditors may agree to accept the new firm as their debtor and discharge the old partners.

- Creditors’ consent is necessary.

Question 22. What are the Agreements that arise between partners in the case of Novation?

Answer:

The Agreements that arise between partners in the case of Novation

- Novation refers to a tripartite agreement between:

- Firm’s creditor

- Partner existing at the time when the debt was incurred.

- Incoming partner.

Question 23. What are the Liabilities of an outgoing or retiring partner?

Answer:

The Liabilities of an outgoing or retiring partner

As per Section 32:

- Liability of such partner continues until a public notice of his retirement has been given.

- He remains liable for the firm’s acts done before his retirement unless there is an agreement made.

- He may be discharged by novation.

Question 24. What do you mean by Insolvency of partner?

Answer:

Insolvency of partner

As per Section 34:

- Such a partner ceases to be a partner on the date of the order of adjudication.

- His estate cases are to be liable for any act of the firm done after that date of order.

- The firm is also not liable for any act of such a partner after such date.

Question 25. Write a short note on the Death of Partner.

Answer:

Death of Partner

As per Section 35:

If the firm is not dissolved, the estate of a deceased partner is not liable for acts of the firm after his death.

Question 26. What are the Rights of Outgoing Partners to Carry on Competing Business?

Answer:

Rights of Outgoing Partners to Carry on Competing Business

As per Section 36:

- An outgoing partner may carry on business competing with that of the firm and he may advertise such business, but subject to contract to the contrary, he may not:

- Use the firm name

- Represent himself as carrying on the business of the firm or

- Solicit the custom of persons who were dealing with the firm before he ceased to be a partner.

- Partner may agree not to carry on a similar business within a specified period or specific local limits and any such agreement will be treated as valid if refractions of restrain are reasonable.

Question 27. What are the Rights of Outgoing Partners in Certain Cases to Share Subsequent Profits?

Answer:

Rights of Outgoing Partners in Certain Cases to Share Subsequent Profits

As per Section 37:

The representatives of the deceased partner would be entitled, at their discretion to interest @ 6% p.a. on the amount due from the date of death to the date of payment or to that portion of profit which is earned by the firm with the amount due to the deceased partner.

Question 28. What do you understand by Revocation of Continuing guarantee by change in the firm?

Answer:

Revocation of Continuing guarantee by change in the firm

As per Section 38:

- A continuing guarantee is given to a firm or third party:

- In respect of a transaction of the firm in the absence of any contrary agreement, “revoked as to future transactions from the date of any change in the constitution of the firm”.

Relations Of Partners Objective Questions And Answers

Question 1. State with reason whether the following statement is Correct or Incorrect. A partner is not entitled to claim remuneration.

Answer:

Correct: The Indian Partnership Act does not allow any remuneration to any partner, unless and until agreed upon by all the partners of the firm. (Section 13(a) Indian Partnership Act).

Question 2. State with reason whether the following statements are Correct or Incorrect.

- A new partner may be introduced in the firm even by any existing partner of the firm.

- The implied authority of a partner empowers him to acquire immovable property on behalf of the firm.

Answer:

- Incorrect: Section 31(1) of the Indian Partnership Act lays down that subject to a contract between the partners and to the provisions regarding minors in a firm, no new partner can be introduced without the consent of all the existing partners.

- Incorrect: According to Section1 9(2)(f), if there is no usage or custom of trade to the contrary, the implied authority of the partner does not empower him to acquire immovable property on behalf of the firm.

Question 3. State with reason whether the following statement is Correct or Incorrect. A transferee of a partner’s interest in a firm accepts a loan on behalf of the firm, for which the other partner was authorized to do so, invest it in the non-partnership business, without the consent of all the partners. The transferee is empowered to accept the loan.

Answer:

Incorrect: Section 29 of the Partnership Act, 1932 lays down that a transferee of a partner’s interest is not entitled, during the continuance of the Partnership to interfere in the conduct of business. Therefore, the acceptance of a loan on behalf of the firm by the transferee of a partner’s interest is not in his purview and he has no right to do so unless the other partners unanimously, agree thereto.

Question 4. State with reason whether the following statements are Correct or Incorrect.

- A partner who has purchased the goodwill of the firm on the dissolution of the partnership firm has the right to make use of the firm’s name to earn profits.

- All partners are not joint owners of the property of the firm unless otherwise provided in the agreement.

Answer:

- Correct: As per the provisions of the Indian Partnership Act, 1 932 as contained in Section 50, where any partner has bought the goodwill of the firm on its dissolution, he has the right to use the firm name and earn profits by its use.

- Incorrect: Section 14 of the Indian Partnership Act, 1 932, states that unless a contrary intention appears, all partners are joint owners of the property of the firm because property acquired with money belonging to the firm is deemed to have been acquired for the firm. If the personal property of the partner is used by the firm the partner must show an intention to make it so.

Question 5. State with reason whether the following statement is Correct or Incorrect. A partner may acquire immovable property on behalf of the firm, in the exercise of his implied authority.

Answer:

Incorrect: Section 19 of the Indian Partnership Act, 1932 says if there is no usage or custom of trade to the contrary, the implied authority of the partner does not empower him to acquire immovable property on behalf of the firm.

Question 6. State with reason whether the following statements are Correct or Incorrect.

- A partner is not an agent of other partners in a partnership firm.

- A minor can be a partner in a partnership firm.

Answer:

- Incorrect: The basis of the partnership is mutual agency, hence a partner is an agent of all other partners.

- A minor cannot contract, he can not be a partner in a firm. However, he can be admitted to the benefits of the partnership with the consent of all the partners.

Question 7. State with reason whether the following statements are Correct or Incorrect.

- The transferee of a partner’s interest is entitled to inspect the books of the firm during the continuance of the firm.

- The goodwill of the firm cannot be regarded as an asset of the firm.

Answer:

- Incorrect: A transfer by a partner of his interest in the firm does not entitle the transferee, during the continuance of the firm to interfere in the conduct of the business, to require accounts, or to inspect the books of accounts of the firm [Section 29 (1) of the Indian partnership Act, 1932].

- Correct: Section 25 of the Indian Partnership Act, 1932 declares that “every partner is liable, jointly with all the partners and also severally, for the acts of the firm done while he is a partner. The liability of the partner is dependent on two things

- It should be an act of the firm and

- The act should have been done by the firm while he was a partner.

Question 8. State with reason whether the following statements are Correct or Incorrect.

- In a partnership firm where a partner is entitled to get interest on the capital subscribed by him, such interest can be paid to him out of the capital of the firm.

- A partner carrying on a business,’ which is similar and competing with that of the firm is bound to pay to the firm, all the profits earned by him, even when there is no such agreement among the partners.

Answer:

- Incorrect: In a partnership firm where a partner is entitled to get interest on his capital subscribed by him in terms of the partnership agreement, he can be paid such interest only out of the profits of the firm and not out of the capital of the firm. (Section 13(c): Indian Partnership Act, 1932).

- Correct: According to Section 16(b) of the Indian Partnership Act, 1932, subject to a contract between the partners if a partner carries on any business of the same nature as and competing with that of the firm, he shall account for and pay to the firm, all profits made by him in that business.

Question 9. State with reason whether the following statement is Correct or Incorrect. A partner making advance of money to the firm, beyond the amount of his agreed capital is entitled to interest on such advanced money.

Answer:

Correct: The general rule is that partners are not considered as debtors and creditors among themselves and hence advances made to the firm by a partner cannot be regarded as a loan.

But clause (d) of Section 13 of the Indian Partnership Act, 1932 lays down that a partner who makes any payment or advance of money to the firm beyond the amount of his greed capital is entitled to interest thereon at the rate of six percent per annum, subject to a contract between the partners.

Relations Of Partners Short Notes

Question 1. Write a short note on the following: Liability of an incoming partner.

Answer:

Liability of an incoming partner

An incoming partner is not liable for any act of the firm done before his admission as a partner. This is because the old partners were not the agents of the new partners at the time when they acted.

- By a mutual agreement, the new partners may agree with the old partners to be liable for the past liabilities of the firm.

- However, the creditors of the firm cannot sue the new partners for their past debts because there is no privity of contract between the creditors and the new partner.

- Similarly, the acts of the old partner can not be ratified by the new partner because he was not in existence as a principal at the time when the acts were done.

He is liable for the acts of the old firm only if the new firm assumes the liabilities of the old firm and the creditors accept the new firm as their debtor and discharge the old firm from his liability.

Question 2. Write a short note on the following: Right to remuneration of a partner.

Answer:

Right to remuneration of partner:

The general rule is: No partner is entitled to receive any remuneration in addition to his share in the profits of the firm for taking part in the business of the firm.

- But this rule can always the varied by an express agreement, or by a cause of dealings, in which event the partner will be entitled to remuneration.

- Thus a partner can claim remuneration even in the absence of a contract, when such remuneration is payable under the contained usage of the firm.

Similarly, a partner on whom the whole conduct of the business has been cast because of the other partner’s wilful neglect of the business to which the latter ought to attend can claim compensation for the undue labor and trouble being imposed upon him] (Krishnamachriar vs. Sankara Saha 91920).

Question 3. Write a short note on the following: Minor in partnership.

Answer:

Minor in partnership

Minor in Partnership: A minor cannot become a partner, as he is not competent to contract. But if all the partners agree, he can be admitted to the benefits of a partnership.

- Such a minor has a right to his agreed share of the profits; he cannot take part in the management, and he can have access to inspect and copy the accounts of a firm but not to book the firm.

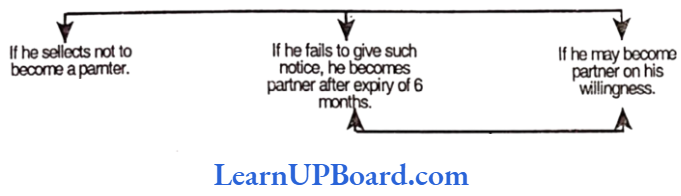

- On attaining majority, he has to elect whether he wants to continue as a partner or not within 6 months of his attaining majority.

- If he fails to give such notice he shall become a partner in the firm on the expiry of the said six months.

If the minor becomes a partner of his willingness, his position is as follows:

- His rights and liabilities as a minor will continue up to the date on which he becomes a partner.

- He becomes personally liable to third parties for all acts of the firm done since he was admitted to the benefits of a partnership.

- His share in the property and profits of the firm remains the same as to which he was entitled as a minor.

Question 4. Write a short note on the following: Explain the duties of a Partner in Partnership.

Answer:

Duties of Partner [Indian Partnership Act, 1932]:

- To work for the greatest common advantage. [Section 9]

- To be just and faithful [Section 9]

- To render true accounts. [Section 9]

- To give full information. [Section 9]

- To indemnity for frauds [Section 1 0]

- To indemnity for wilful neglect. [Section 13 (f)j

- To share losses. [Section 13 (b)]

- To attend diligently without remuneration. [Sections 12 (b) and 13 (a)]

- To hold and use the property of the firm exclusively for business. [Section 15]

- To account for private profits from .transactions of firms etc. and competing businesses [Section 16]

- To act within the authority.

- Not to assign his rights [Section 29]

- To be liable jointly and severally. [Section 25]

Relations Of Partners Descriptive Questions And Answers

Question 1. Comment on the following: “The relationship arises from an agreement and not from status.”

Answer:

“The relationship arises from an agreement and not from status.”

A partnership is the result of a contract and cannot arise by status is sufficiently emphasized by Section 4 of the Indian Partnership Act itself by the use of the word “partnership is the relation between the persons who have agreed to share the profits of a business”.

- It is clear from the definition that the partnership is contractual.

- It springs from an agreement. The same point is further stressed by the opening words Of Section 5 that the relation of partnership arises from contract and not from status.

- Unlike in the case of sole proprietorship and joint Hindu Family business, the legal heirs do not automatically become partners on the death of a partner. A fresh agreement will have to be made.

Thus from the above, it is clear that partnership always arises out of a contract and not from status.

Question 2. Answer in brief the following: What is meant by the term, ‘property of a partnership firm’?

Answer:

‘Property of a partnership firm’

Normally, the partners by an agreement are free ‘to determine as to what shall be the property of the firm and what shall be treated as a separate property of one or more of the partners.

But when there is no such agreement and to know whether a certain property is the property of the firm or not it has to be ascertained from the source from which the property has been acquired the purpose for which it was acquired.

And how it has been dealt with According to Section 14 of the Partnership Act, when there is no contract to the contrary, the property of the firm includes:

- All properties, rights-and-interests originally brought to the stock of the firm.

- The property acquired by purchase or otherwise by or for the firm.

- The property was acquired with the money belonging to the firm.

- The goodwill of the business of the firm.

However, if a partner’s property is used for the purchase of the business of the firm, it does not automatically become the property of the firm.

- It can become to property of the firm if the partners have an intention to manage it so.

- For example, a piece of land that has been bought in the name of one partner but is paid for any the firm shall be deemed to be the property of the firm unless there is an intention to the contrary.

Question 3. Comment on the following: Notice to an acting partner is the notice to the firm.

Answer:

Notice to an acting partner is the notice to the firm.:

Section 24 of the Partnership Act, 1932 lays down that the notice to a partner, who habitually acts in the business of the firm of any matter relating to the affairs of the firm operates as notice to the firm, except in the case of a fraud on the firm committed by or with the consent of that partner.

- The rule embodied in this section is an instance of the application of the general principles of agency to the partnership.

- Accordingly, the notice to one is equivalent to the notice to the rest of the partners of the firm, just as a notice and not to an agent is a notice to his principal. This notice must be actual and not constructive.

- It must be received by a working partner and not by a dormant or sleeping partner. It must further relate to the firm’s business. Only then it would constitute a notice to the firm.

Notice to a clerk or agent of the firm operates as notice to the firm. However, the provisions of this section would not lie in the case of fraud, whether active or tacit.

- Thus the knowledge of a partner as to a particular defect in the goods which he is buying for the firm will be knowledge of the firm, although the other partners are, in fact, not aware of the defect.

- The only exception is in the case of fraud. If, therefore, the purchasing partner, in collusion with the seller, has conspired to conceal the existence of the defect from the other partners.

- The rule will not operate and the other partners would be entitled on the defect being discovered by them, to reject the goods.

Question 4. Answer the following: What are the rights and duties of a partner after a change in the constitution of the firm?

Answer:

Rights and duties of partners after a change in the constitution of the firm (Section 17):

A change in the constitution of the firm may be in one of the four ways, namely:

- Where a new partner or partners come in;

- Where one partner or partners go out;

- Where the partnership concerned carries on business other than the business of the firm;

- Where the partnership business is carried on after the expiry of the term fixed for the purpose.

This section lays down the following provisions as regards to rights and duties after the change in the constitution of the firm:

- Change in the constitution of the firm: Where a change occurs in the constitution of a firm, the mutual rights and duties of the partners in the reconstituted firm remain the same as they were immediately before the change, as far as may be.

- Business continued after expiration of the term: Where a firm constituted for a fixed term continues to carry on business after the expiry of that term, the mutual rights and duties of the partners remain the same as they, were before the expiry, so far as they may. be consistent with the incidents of Partnership at will; and

- In case of additional undertaking: Where a firm constituted to carry out one or more adventures or undertakings carries out other adventures or undertakings the mutual rights and duties of the partners in respect of the other adventures or undertakings are the same as those in respect of the original adventures or undertakings. But the above provisions are however subject to the contract between the partners.

Question 5. Comment on the following: “The power to expel a partner must be exercised in good faith”.

Answer:

The power to expel a partner must be exercised in good faith: A partner may not be expelled from a firm by a majority of partners except in exercise, in good faith, of powers conferred by the contract between the partners. It is thus, essential that:

- The power of expulsion must have existed in a contract between the partners:

- The power has been exercised by. a majority of the partners; and

- It has been exercised in good faith.

If all these considerations are not present, the expulsion is not deemed to be in the bonafide interest of the business of the firm.

The test of good faith as required under section 33(1) includes three things:

- That the expulsion must be in the interest of the partnership.

- That the partner to be expelled is served with a notice.

- That he is allowed to be heard. If a partner is otherwise expelled, the expulsion is null and void. The only remedy, when a partner misconducts in the business of the firm is to seek judicial dissolution.

The provisions of Section 32 regarding the retirement of a partner also apply to an expelled partner as if he were a retired partner [Section 22(2)].

Question 6. What are the mutual duties of partners in a partnership firm to regulate the relations between the partners?

Answer:

Duties of Partners: The following duties should be observed by the partners to regulate the relations between the partners:

- To observe good faith: A partnership contract is a contract of absolute good faith and therefore Section 3 of the Partnership Act, 1932 lays down that partners are bound

- To carry on the business of the firm to the greatest common advantage;

- To be just and faithful, to each other and

- To render to any partner or his legal representative a time account and full information of all things affecting the firm.

- To attend to his duties diligently [Sections 12(b) and 13 (a)]: Every partner is bound to attend diligently to his duties in conducting the business of the firm. He has no right to receive any remuneration for taking part in the conduct of the business.

- To indemnify for fraud (Section 10): A partner shall be held liable to make good any loss caused to the firm by his fraud in the conduct of the business. It is an absolute provision and is not subject to the terms of the contract between the partners. A clause in the deed of partnership exempting a particular partner from liability to the firm for loss caused by his fraud shall be invalid and unenforceable.

- To indemnify for willful Neglect [Section 13 (f)]: Every partner is liable to the firm for any loss caused to it by his wilful neglect in the conduct of the business. The partners can contract themselves out of this liability except in case of fraud.

- To share losses [Section 13(b)]: Each partner is liable to contribute to the firm’s losses equally in the absence of any contract to the contrary.

- To hold and use the property for the firm (Section 13): The property of the firm is the property of all the partners, and therefore, each partner should hold and use the property of the firm exclusively for the firm.

- To account for private profits [Section 16 (a)]: A partner shall be liable to account for and pay to the firm any private profits derived from the transactions of the firm or the use of the property or goodwill of the firm.

- To account for the profits of a competing business [Section 16 (b)]: If a partner carries on a business of the same nature as and competes with that of the firm, then he must account for and pay to the firm all profits made by him in the business. The firm will not be liable for any loss.

- To act within authority: A partner is bound to act within the scope of his actual or apparent authority. In case, he exceeds his authority and the other partners do not ratify his unauthorized acts, he will be liable to the other partners for the loss that they may suffer on account of his such acts.

- Not to assign his rights (Section 29): A partner cannot assign his rights or interest in a partnership firm to an outsider, to make the outsider a partner in the firm’s business without the consent of other partners.

- In case such an assignment has been made the assignee cannot during the continuance of the firm, interface in the conduct of the business, or require accounts or inspect the books of the firm.

- The transferee will be only entitled to receive the share of profits of the transferring partner, and the transferee shall accept the accounts of profits agreed to by the partners.

- To the liable jointly and severally (Section 25): Every partner is liable, jointly with all the other partners, and also severally for all the acts of the firm done while he is a partner. A retired partner continues to be liable for the debts of the firm incurred till he gets public notice of his retirement.

- Duties after a change in the firm (Section 17): Rights and duties of v the partners of a firm, unless otherwise agreed upon shall remain the same as they were in the beginning even after a change in the constitution of the firm or on the expiry of the term of the firm or even when the firm has taken up additional ventures after the complete of the work for which the firm was constituted.

Question 7. Explain clearly the meaning of implied authority of a partner in a partnership firm. State the matters for which a partner does not have implied authority.

Answer:

Meaning of Implied Authority of a Partner: The authority of a partner means the capacity of a partner to bind the firm by his act. This authority may be express or implied.

- Where the authority to a partner to act is expressly conferred by an agreement, it is called express authority.

- But where there is no partnership agreement or where the agreement is silent, the act of a partner is done to carry on, in the usual way.

Business of the kind carried on by the firm, bind the firm’. [Section 19(1) Indian Partnership Act, 1932].

The authority of a partner to bind the firm by his acts is called implied authority. It is subject to the following conditions:

- The act done by the partner must relate to the normal business of the firm.

- The act must be such as is done within the scope of the business of the firm in the usual way.

- The act must be done in the name of the firm, or any other manner expressing or implying an intention to bind the firm (Section 22).

Matters for which no Implied Authority is available to a Partner:

- To submit a dispute relating to the business of the firm to arbitration.

- To open a bank account on behalf of the firm in his name.

- Compromise or relinquish any claim or portion of a claim by the firm.

- Withdraw a suit or proceeding filed on behalf of the firm.

- Admit any liability in an audit or proceeding against the firm.

- Acquire immovable property on behalf of the firm.

- Transfer immovable property belonging to the firm, or

- Enter into a partnership on behalf of the firm (Section 1 9(2)).

Question 8. Answer the following: Describe the position of a minor, who has been admitted to the benefits of partnership, on attaining majority.

Answer:

Position of a Minor in Partnership: Under Section 11 of the Indian Contract Act, 1 872, a minor’s agreement is void. Given this, a minor and a major cannot agree partnership.

- Thus, a minor person may not be a partner in a firm but under Section 30 of the Indian Partnership.

- Act, 1 932, he may be admitted to the benefits of partnership with the consent of all the partners for the time being.

Section 30 of the Indian Partnership Act provides that the minor who has been admitted to the benefits of partnership has to decide whether he shall remain a partner or leave.

- The firm and this decision is to be taken by him within six months of his attaining majority, or his obtaining knowledge that he had been admitted to the benefits of partnership, whichever date is later.

- If he decides to sever his connection with the firm, he must give a public notice of his intention. If he does not give such public notice, it must be presumed that he has opted to become a partner in the firm.

If the minor becomes a partner of his willingness or by his failure to give the public notice within a specified time, his rights and liabilities are as follows:

- He becomes personally liable to third parties for all acts of the firm done from the date when he was admitted to the benefits of the firm.

- His share in the property and the profits of the firm remains the same to which he was entitled as a minor.

If the minor decides to sever his connection with the firm, his rights and liabilities shall be as follows:

- His rights and liabilities continue to be those of a minor up to the date of giving public notice.

- His share shall not be liable for any acts of the firm done after the date of the notice.

- He shall be entitled to sue the partners for his share of the property and profits.

Question 9. Explain the following: Explain the position of a person who had been admitted to the benefits of partnership as a minor, after attaining majority.

Answer:

Position of a minor in partnership after attaining majority: A partnership is a relation resulting from a contract, and a minor’s agreement is altogether void. A minor, being incompetent to contract, cannot become a partner.

- But he can be admitted to the benefits of an already existing partnership if all the partners agree to admit him. Such a minor is not personally liable nor his separate property and profits will be liable.

- Within six months of his attaining majority or when he comes to know of his being so admitted, whichever date is later, he has to elect whether he wants to continue his relationship and become a full-fledged partner or sever his connection with the firm.

- He may give a public notice of his election to continue or discontinue, but if he fails to give any public notice within this, period, he will be deemed to have elected to become a partner in the firm.

- A minor who thus becomes a partner will become personally liable for all debts and obligations of the firm incurred since the date of his admission to the benefits of the partnership.

Question 10. Briefly answer the following: Transferee of a partner’s interest cannot exercise the rights of the transferring partner.

Answer:

Section 29 of the Indian Partnership Act, of 1932, states the rights of transferee of a partner’s share. A share in a partnership is transferable like any other property, but the partnership relation is based upon confidence.

- The assignee of a partner’s interest by sale, mortgage, or otherwise cannot enjoy the same rights and privileges as the original partner.

- The Supreme Court in Narayanappa v. Krishnappa has held that the assignee will enjoy only the rights to receive the share of the profits of the assignor and account of profits agreed to by other partners.

The rights of such a transferee are:

- During the continuance of the partnership, such transferee is not entitled to:

- Interfere with the conduct of the business;

- Require accounts or

- Inspect books of the firm.

- He is only entitled to receive a share of the profits of the transferring partner and he is bound, to accept the profits as agreed to by the partners, i.e. he cannot challenge the accounts.

- On the dissolution of the firm or the retirement of the transferring partner, the transferee will be entitled, against the remaining partners:

- To receive the share of the assets of the firm to which the transferring partner was entitled, and

- To ascertain the share,.to an account as from the date of the dissolution.

Thus, the transferee of a partner’s interest cannot exercise the rights of the transferring partner.

Question 11. Discuss the rights of a Partner in a Partnership Firm.

Answer:

Discuss the rights of a Partner in a Partnership Firm:

Where there is no specific agreement or where the agreement is silent on a certain, the relations of partners to one another as regards their rights are governed by the provisions of the Indian Partnership Act, 1932 as contained in Sections 9 to 17.

There are:

- Right to take part in business: Subject to any contract between the partners, every partner has the right to take part in the conduct of the business of the firm. [Section 12 (a)]

- Right to be consulted: Every partner has an inherent right to be consulted in all matters affecting the business of the partnership before any decision is taken by the partners. Where there is any difference of opinion among the partners as to ordinary matters connected with the business, it may be settled, subject to contract between the partners, by a majority of the partners. [Section 12 (c)].

- Right of access to account: Subject to the contract between the partners, every partner has a right to have access to and inspect and copy any of the books of the firm. [Section 12 (d)].

- Right to share in profit: In the absence of any agreement, the partners are entitled to share equally in the profits earned and are liable to contribute equally to the losses sustained by the firm. [Section 13 (b)]

- Right to interest on capital: The partnership may contain a clause as to the right of the partners to claim interest on capital at a certain rate. Such interest, subject to a contract between the partners, is payable only out of profits, if any, earned by the firm. [Section 13 (c)]

- Right to interest on advances: Where a partner makes, for the business of the firm any advance beyond the amount of capital, he is entitled to interest on each advance at the rate of 6 percent per annum. [Section 13 (d)]

- Right to be indemnified: Where a partner incurs any liability in the ordinary course of the partnership business, or an emergency, to protect the firm from loss, the firm must indemnify such partner. [Sections 13 (e) and 21]

- Right to the use of partnership property: Subject to the contract between the partners, the property of the firm must be held and used by the partners exclusively for the business of the firm. No partner has the right to treat it as his individual property. [Section 15]

- Right of partner as agent of the firm: Every partner for the business of the firm is the agent of the firm And subject to the provisions of the Indian Partnership Act, the act of a partner which is done to carry on, in the usual way, the business of the kind carried on by the firm, binds the firm. [Sections 18 and 19]

- No new partner to be introduced: Every partner has a right to prevent the introduction of a new partner unless the consents to that or unless there is an expression in the contract permits such introduction [Section 31 (1)]

- No liability before joining: A person who is introduced as a partner into the firm is not liable for any act of the firm done before he became a partner [Section 31 (2)]

- Right to retire: A partner has a right to retire with the consent of all the other partners or per an expression agreement between the partners, or where the partnership is at will, by giving notice to all the other partners of his intention to retire. [Section 32 (1)].

- Right not to be expelled: A partner has a right not to be expelled from the firm by any majority of the partners, save in the exercise; in good faith of powers conferred by the contract between the partners. [Section 33(1)] .

- An outgoing partner can claim subsequent profits or interest of 66% per annum till final accounts are settled.

Question 12. Briefly answer the following: What are the liabilities of an outgoing Partner?

Answer:

The liabilities of an outgoing Partner

An outgoing partner or a retiring partner continues to be liable to a third party for acts of the firm after his retirement until public notice of his retirement has been given either by himself or by any other partner.

- However, the retired partner will not be liable to any third party if the letter deals with the firm without knowing that the former was a partner. [Sections 32 (3) and (4) Indian Partnership Act, 1932].

- The liability of a retired or outgoing partner to the third parties continues until public notice of his retirement has been given.

- Regarding his liability for the acts of the firm done before his retirement, he remains liable for the same, unless there is an agreement made by him with the third party concerned and the partners of the reconstituted firm.

Such an agreement may be implied by the course of dealings between the third party and the reconstituted firm after he knew the retirement [Section 32(2)].

Question 13. Briefly answer the following: What are the legal provisions relating to the expulsion of a partner under the Indian Partnership Act?

Answer:

The legal provisions relating to the expulsion of a partner under the Indian Partnership Act

According to Section 33 of the Indian Partnership Act, of 1932, a partner may be expelled from a partnership subject to the following three conditions:

- The power of expulsion of a partner should be conferred by the contract between the partners.

- The power should be exercised by a majority of the partners.

- The power should be exercised in good faith.

If all these conditions are present, the expulsion is not deemed to be in the bonafide interest of the business of the firm.

The test of good faith is:

- That the expulsion must be in the interest of the partnership.

- That the partner to be expelled is served with a notice.

- That he is allowed to be heard.,

Irregular expulsion: Where the expulsion of a partner takes place without the satisfaction of the conditions given above, the expulsion is irregular. The expelled partner may in such a case either

- Claim reimbursement as a partner or

- Sue for the refund of his share of capital and profits in the firm.

An irregular expulsion is wholly ineffectual and inoperative. The expelled partner, in such a case, does not cease to be a partner.

Regular expulsion: Where a partner is expelled subject to the satisfaction of the conditions as above, his expulsion would be regular. The rights and liabilities of an expelled partner are the same as those of a retiring partner [Section 33 (2)].

Question 14. Answer the following: What constitutes Partnership property or Property of the firm?

Answer:

Partnership property consists of the following:

- All property and rights and interests in a property originally brought into the stock of the firm or acquired by purchase or otherwise, by or for the firm, or for the purpose and in the course of the business of the firm; and includes also the goodwill of the business. (Section 14).

- The property and rights and interests on property acquired with many belonging to the firm and deemed to have been acquired for the firm. (Section 14).

- The property of the firm is held and used by the partners exclusively for the -purpose of the firm’s business. (Section 15 Indian Partnership Act, 1832).

Question 15. Explain clearly the meaning of the term “Authority of a partner”. State the acts which fall within the ‘Implied Authority’ of a partner.

Answer:

Meaning: The Authority of a partner means the capacity of a partner to bind the firm by his acts. This authority may be express or implied. Where the authority to a partner to act is expressly conferred by an agreement, it is called express authority.

But where there is no partnership agreement or where the agreement is silent; the authority conferred on a partner by the provision ‘is silent, the authority conferred on a partner by the provisions of Section 19 of the Indian Partnership Act is called implied authority.

Implied authority covers those acts of partners that fulfill the following conditions:

- The act done by the partner must relate to the normal business of the firm. [Section 19(1)].

- The act must be such as is done within the scope of the business of the firm in the usual way.

- The act must be done in the name of the firm, or any other manner expressing or implying an intention to bind the firm. (Section 22).

Acts falling within the implied authority of a partner: In a trading firm, i.e., a firm that depends for its existence on the buying and selling of goods, the implied authority of a partner has been held to include.

- Purchasing goods, on behalf of the firm, in which the firm deals or which are employed in the firm’s business.

- Selling goods of the firm.

- Receiving payment of the debt due to the firm and giving receipts for them.

- Settling accounts with the persons dealing with the firm.

- Engaging servants for the partnership business.

- Borrowing money on the credit of the firm.

- Drawing, accepting, and endorsing bills and other negotiable instruments in the name of the firm.

- Pledging any goods of the firm to borrow money.

- Employing a solicitor to defend an action against the firm for goods supplied.

Question 16. Briefly answer the following: What is the position of a minor in a partnership firm before he attains the age of majority?

Answer:

The position of a minor in a partnership before attaining the age of majority (Indian Partnership Act, 1932):

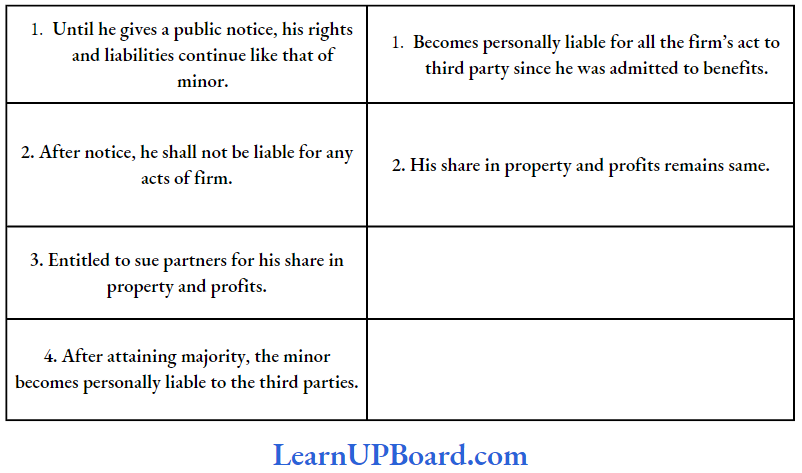

Rights:

- A minor has a right to such share of the property and of profits of the firm as may have been agreed upon.

- He has a right to have access to and inspect and copy any of the accounts, but not the books of the firm. [Section 30(2))].

- When he is not given his due share of profit, he has the right to file a suit for his share of the property of the firm. But he can do so only if he wants to sever his connection with the firm. [Section 30(4)].

Liabilities:

- The liability of a minor partner is confined only to the extent of his share in the profits and property of the firm. Over and above this, he is either personally liable or his private estate liable. [Section 30(3)].

- A minor cannot be declared insolvent, but if the firm is declared insolvent his share in the firm vests in the Officials Receiver or Official Assignee.

Question 17. Briefly answer the following: The liability of a retired partner to third parties continuing after his retirement.

Answer:

Goods forming subject matter of the contract of sale may be classified as under:

- Existing Goods

- Specific goods

- Unascertained goods.

- Ascertained goods.

- Future Goods

- Contingent Goods.

Existing Goods are those goods which are in actual existence at the time of contract of sale.

The seller is the owner of goods or he has the possession of such goods.

Existing goods may be of the following three types:

- Specific goods: Goods that have either been identified or agreed upon by the parties at the time of the contract of sale.

- Unascertained goods: are those not specifically identified at the time of contract of sale. They are described by the description or sample only.

- Ascertained goods: are those identified only after the formation of a contract of sale. When unascertained goods are identified and agreed upon by the parties, the goods.are called Ascertained goods.

- Future goods: are those in existence at the time of contract of sale. These goods are, to be acquired or produced by the seller after the contract of sale is made. It is an agreement to sell and not sell.

- Contingent goods are like future goods. The acquisition of the goods by the seller depends upon the uncertain contingencies which may or may not happen, For Example. goods will be supplied if the ship arrives.

Question 18. Subject to an agreement between the Partnership, state the rights of Partners.

Answer:

The mutual rights and duties of the partners of a firm may be determined by the contract between the partners, and such contract may be expressed or implied by a course of dealing.

In the absence of any express agreement among partners, their rights and duties are governed by the Partnership Act.

The rights of the partners in a partnership firm are discussed hereunder:

- Participation in management [Section 12 (a)]: Every partner has a right to take part in the conduct of the business.

- Right to be consulted: Any difference arising in connection with the business may be decided by a majority of the partners and every partner has a right to express his opinion before the matter is decided.

- Access to books [Section 12 (d)]: A partner has a right to have access to and inspect and copy any of the books of the firm.

- Sharing of profits [Section 13 (b)]: Partners are entitled to share equally in the profit earned.

- Interest on capital [Section 13 (c)]: A partner is entitled to interest on advance made by him over and above his capital at the rate of 6% per annum. However, where the partnership agreement provides for the payment of interest at a certain rate such interest shall be payable only out of profits if any, earned, by the firm.

- Making use of Partnership property [Section 15]: Every partner is entitled to use the property of the firm exclusively for the purpose of the business of the firm.

- Indemnification [Section 13 (c)]: A partner is entitled to be indemnified by the firm in respect of payments made and liabilities incurred by him under certain circumstances.

- Agent of the firm [Sections 18 and 19]: Because of the agency relationship every partner has implied authority to bind the firm by his act in the conduct of the business of the firm.

- Dissolution of the firm [Sections 43, 44, and 46]: A partner is entitled to dissolve the firm under certain conditions. A partner has a right to have the business wound up after dissolution.

- Authority in emergency [Section 21]: A partner has authority in an emergency to do all such acts as required to protect the firm from loss.

- Retirement [Section 32]: Every partner has a right to retire from the partnership firm subject to the nature of the partnership.

- Not to be expelled [Section 33 (1)]: Every partner has a right to continuance in the partnership. No partner can be expelled except in good faith.

- No new partner to be introduced [Section 31 (1)]: Every partner has a right to prevent admission of a new partner to the firm.

- Carrying on competing business [Section 36]: Unless otherwise agreed, an outgoing partner may carry on a business competing with that of the firm and may advertise such business. However, he can not use the name and representation of the firm.

- Sharing profits by outgoing partner [Section 37]: An outgoing partner can claim subsequent profits or interest at the rate of 6% p.a. If final accounts have not been settled.

- Share in the partnership property: On the dissolution of the firm, every partner or his representative has a right to have the property applied in the payment of debts and liabilities of the firm and to have a surplus distributed among the partners.

Question 19.

1. “Though a minor cannot be a partner in a firm, he can nonetheless be admitted to the benefits of partnership.”

- Referring to the provisions of the Indian Partnership Act, of 1932, state the rights that can be enjoyed by a minor partner.

- State the liabilities of a minor partner in both:

- Before attaining the majority and

- After attaining the majority.

OR

2. State the legal position of a minor partner after attaining majority:

- When he opts to become a partner of the same firm.

- When he decides not to become a partner

Answer:

- The rights enjoyed by a minor partner are:

- A minor partner has a right to his agreed share of the profits and of the firm.

- He can have access to, inspect, and copy the accounts of the firm.

- He can sue the partners for accounts or payment of his share but only when severing his connection with the firm and not otherwise.

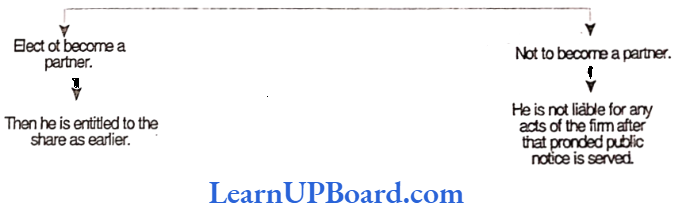

- On attaining majority he may within 6 months elect to become a partner or not to become a partner. If he elects to become a partner, then he is entitled to the share to which he was entitled as a minor.

- If he does not, then his share is not liable for any acts of the firm after the date of the public notice served to that effect.

- The liabilities of a minor partner:

- Before attaining majority:

- The liability of the minor is confined only to the extent of his share in the profits and the property of the firm.

- Minor has no personal liability for the debts of the firm incurred during his minority.

- Minor cannot be declared insolvent but if the firm is declared insolvent his share in the firm vests in the Official Receiver or Assignee.

- After attaining majority:

- Before attaining majority:

Within 6 months of his attaining majority or on his obtaining knowledge that he had been admitted to the benefits of partnership whichever date is later, the minor partner has to decide whether he shall remain a partner or leave the firm.

OR

2. The legal position of a minor partner after attaining majority:

- When he opts to become a partner of the same firm. If the minor becomes a partner on his willingness or by his failure to give the public notice within a specified time, his rights and liabilities as given in section 30(7) are as follows:

- He becomes personally liable to third parties for all acts of the firm done since he was admitted to the benefits of a partnership.

- His share in the property and the profits of the firm remains the same to which he was entitled as a minor.

- When he does not become a partner:

- His rights and liabilities continue to be those of a minor up to the date of giving public notice.

- His share shall not be liable for any acts of the firm done after the date of the notice.

- He shall be entitled to sue the partners for his share of the property and profits. It may be noted that such a minor shall give notice to the registrar that he has or has not become a partner.

Question 20. What is the provision related to the effect of notice to an acting partner, of the firm as per the Indian Partnership Act 1932?

Answer:

The provision related to the effect of notice to an acting partner, of the firm as per the Indian Partnership Act 1932

The notice to a partner, who habitually acts in the business of the firm, on matters relating to the affairs of the firm, operates as a notice to the firm except in the case of fraud on the firm committed by or with the consent of that partner.

- Thus, the notice to one is equivalent to the notice to the rest of the partners of the firm, just as a notice to an agent is a notice to his principal.

- The notice must be actual and not constructive. It must be received by the working partner and not by the sleeping partner.

It must further relate to the firm’s business. Only then it would constitute a notice to the firm.

Question 21. Discuss the provisions regarding personal profits earned by a partner under the Indian Partnership Act 1932.

Answer:

According to the Indian Partnership Act, of 1932, subject to a contract between the partner:

- If a partner derives any profit for himself from any transaction of the firm, or from the sale of the property or business connection of the firm or the firm name, heÿhall accounts for that profit and pays it to the firm.

- If a partner carries on any business of the same nature as and competing with that of the firm, he shall account for and pay to the firm all profits made by him in that business.

Question 22. When the continuing guarantee can be revoked under the Indian Partnership Act, of 1932?

Answer:

- According to Section 38, a continuing guarantee given to a firm or a third party in respect of the transaction of a firm is, in the absence of an agreement to the contrary, revoked as to future transactions from the date of any change in the constitution of the firm.

- In other words, mere changes in the constitution of the firm operate to revoke the guarantee as to all future transactions. Such change may occur by the death, or retirement of a partner, or by introduction of a new partner.

Question 23. What do you mean by Goodwill as per the provisions of the Indian Partnership Act, of 1932?

Answer:

Goodwill as per the provisions of the Indian Partnership Act, of 1932

Section 14, specifically states that the goodwill of a business is subject to a contract between the partners, to be regarded as “property” of the “firm”.

- It may be defined as the value of the reputation of a business house in respect of profits expected in the future over and above.

- The normal level of profits earned by undertaking belonging to the same class of business. Goodwill is a part of the property of the firm.

Question 24. The provisions of the Indian Partnership Act, 1932 explain the various effects of insolvency of a partner.

Answer:

As per the provisions of the Indian Partnership Act, of 1932, the effects of the insolvency of a partner will be as follows:

- The insolvent partner cannot be continued as a partner.

- He will cease to be a partner from the very date on which the order of adjudication is made.

- The estate of the insolvent partner is not liable for the acts of the firm done after the date of order of adjudication. . .

- The firm is also not liable for any act of the insolvent partner after the date of the order of adjudication.

- Ordinarily, the insolvency of a partner would result in the dissolution of the firm but the remaining partners may agree to carry it on.

Question 25. Comment on ‘the right to expel partner must be exercised in good faith’ under the Indian Partnership Act, 1932.

Answer:

Expulsion of a partner (Section 33):

A partner may not be expelled from a firm by any majority of partners save an exercise in good faith of powers conferred by a contract between the parties.

The following are the conditions:

- The powers of expulsion must have existed in a contract between the partners.

- The power must have been exercised by a majority of the partners.

- It has been exercised in good faith.

The test of good faith as required under is as follows:

- The expulsion must be in the interest of the partnership

- The partner to be expelled is served with a notice

- He is given an opportunity to be heard

Question 26. Explain in detail the circumstances that lead to the liability of the firm for misapplication by partners as per provisions of the Indian Partnership Act, 1932.

Answer:

Liability of firm for Misapplication by Partners (Section 27) of the Indian Partnership Act, 1932:

It may be observed that the workings of the two clauses of section 27 are designed to bring out an important point of distinction between the two categories of such cases of misapplication of money by partners.

Clause (1): Covers the case where a partner acts within his authority and due to his authority as a partner, he receives money or property belonging to a third party and misapplies that money to all property.

For this provision for the attracted, the money doesn’t need to have come into the custody of the firm.

On the Other hand the provision of Clause (2): Would be attracted when such money or property has come into the custody of the firm and it is misapplied by any of the partners. The firm would be liable in both cases.

If receipt of money by one partner is not within the scope of his apparent authority, his receipt cannot be regarded as a receipt by the firm and other partners will not be liable, unless the money received comes into their possession all under their control.

Example: A, B, and C are partners of a place for car parking. P stands his car in the parking place but A sold out the car to a stranger. For this liability, the firm is liable for the acts of A.

Question 27. Discuss the liability of a partner for the act of the firm and the liability of the firm for the act of a partner to third parties as per the Indian Partnership Act, 1932.

Answer:

Liability to Third Party (Section 25-27 of Indian Partnership Act 1932):

The partners are jointly and severally responsible to third parties for all acts which come under the scope of their express or implied authority.

- This is because all the acts done within the scope of authority are the acts done towards the business of the firm.

- The question of liability of partners to third parties may be considered under different heads.

These are as follows:

1. Contractual liability or Liability of a partner for acts of the firm:

- Every partner is liable jointly with other partners and also severally for the acts of the firm done while he is a partner.

- The expression “act of firm” connotes any act or omission by all the partners or by any partner or agent of the firm, which gives rise to a right enforceable by or against the firm.

Example: Thus, where certain persons were found to have been partners in a firm when the acts constituting an infringement of a trademark by the firm took place.

It was held that they were liable for damages arising out of the alleged infringement, it being immaterial that the damages arose after the dissolution of the firm.

2. Liability for tort or wrongful Act: A firm is liable for the loss or injury caused to a third party by the wrongful acts of a partner if they are done by the partner while acting

- In the ordinary course of the business of the firm

- With the authority of the partners.

Example: One of the two partners in the coal mine acted as a manager was guilty of personal negligence in omitting to have the shaft of the mine properly fenced. As a result thereof, an injury was caused to a workman. The other partner was held responsible for the same.

3. Liability for misappropriation by a partner: A firm is liable:

- When a partner, acting within his apparent authority receives money or other property from a third person and misapplies it.

- Where a firm, in the course of its business, received money or property from a third person, and the same is misapplied by a partner while it is in the custody of the firm.

Example: A, B, and C are partners of a place for the car. parking. P stands his car in the parking place but A sold out the car to a stranger. For this liability, the firm is liable for the acts of A.

Note: If receipt of money by one partner is not within the scope of his apparent authority, his receipt cannot be regarded as a receipt by the firm and the other partners will not be liable, unless the money received comes into their possession or under their control.

Question 28. Define Implied Authority. In the absence of any usage or custom of trade to the contrary, the implied authority of a partner does not’ empower him to do certain acts. State the acts that are beyond the implied authority of a partner under the provisions of The Indian Partnership Act, of 1932.

Answer:

Implied Authority

The authority conferred on a partner under the provisions of the Indian Partnership Act, of 1932 is known as the Implied authority of a partner.

It is the authority conferred to act in a general way for the business of the partnership firm and if a partner acts this way he binds all the other partners by his acts.

However, there are certain acts which are beyond the implied authority of a partner.

They are as follows:

- Submit a dispute relating to the business of the firm to arbitration.

- Open a bank account in name his name on behalf of the firm.,

- Compromise or relinquish any claim or portion of any claim by the firm.

- Withdraw a suit or proceeding filed on behalf of the firm

- Admit any liability in a suit or proceedings against the firm.

- Acquire immovable property on behalf of the firm.

- Transfer immovable property belonging to the firm.

- Enter into a partnership on behalf of the firm.

Question 29. Can a minor become a partner in a partnership firm? Justify your answer and also explain the rights of a minor in a partnership firm.

Answer:

As per the Indian Contract Act, 1872, “ A minor is incompetent to enter into the contract and any agreement made with or by minor is void-ab-initio.”

- Therefore, a minor cannot be admitted to a partnership firm as a partner as this relationship emerges out of contract.

- Although Minor cannot become a partner in the firm, nonetheless, he can be admitted to the benefits of a partnership firm.

- He may validly have a share in the profits of the firm, but this can be done only with the consent of all the partners of the firm.

Rights of minors in the partnership firm

- He can access inspect and copy accounts of the firm.

- He will have a right to an agreed share of property and profits of the firm.

- At the time of his discontinuation, he can sue other partners for statements of his accounts, and payment thereof.

- On attaining majority, he may within 6 months elects to become a partner or not to become a partner. If he elects to become a partner then he is entitled to the share to which he was entitled as a minor.

If he does not, then his share is not liable for any acts of the firm, after the date of the public notice served to that effect.

Question 30. Can a partner be expelled? If so, how? Which factors should be kept in mind before expelling a partner from the firm by. the other partners according to the provision of the Indian Partnership Act, 1932?

Answer:

Expulsion of a partner (Section 33):

- A partner may not be expelled from a firm by any majority of the partners, same in the exercise in good faith of powers conferred by contract between the partners.

- The provisions of sub-section (2), (3)’ and (4) of Section 32 shall apply to an expelled partner as if he were a retired partner.

Analysis of Section 33.

- The power of expulsion must have existed in a contract between the partners.

- The power has been exercised by a majority of the partners; and

- It has been exercised in good faith. If all these conditions are not present, the expulsion is not deemed to be in the bona fide interest of the business of the firm.

The test of good faith as required under Section 33(1) includes three things:

- The expulsion must be in the interest of the partnership.

- The partner to be expelled is served with a notice.

- He is given an opportunity to be heard. If a partner is otherwise expelled, the expulsion is null and void.

It is important to note that under the Act, the expulsion of partners does not necessarily result in the dissolution of the firm.

The invalid expulsion of a partner does not put an end to the partnership even if the partnership is at will and it will be deemed to continue as before.

Question 31. What are the rights of partners for the conduct of the business of a firm as prescribed under the Indian Partnership Act, of 1932?

Answer:

The rights of partners for the conduct of the business of a firm as prescribed under the Indian Partnership Act, of 1932

As per Section 12 of the Indian Partnership Act, of 1932, the following are the rights of the partners concerning the conduct of the business of the firms:

- Right to take part in the conduct of business (Section 12(a)): Every partner has the right to take part in the business of the firm. This is because a partnership business is a business of the partners and the management powers are generally co-extensive.

- Right to be consulted (Section 12(c): Where any difference arises between the partners about the business of the firm, it shall be determined by the views of the majority of there, and every partner shall have the right to express his opinion before the matter is decided.

- Right to access to books (Section 12(d)): Every partner whether active or sleeping is entitled to have access to any of the books of the firms and to inspect and take out of copy thereof. The right must, however, be exercised bonafide.

- Right of legal heirs and representatives and their duly authorized agents: (Section (2(e)) In the event of the death of the partner, his legal heirs of legal representatives or their duly authorized agents shall have a right of access to and to inspect and copy any of the books of the firms.

Question 32. X, Y, and Z are partners in a Partnership Firm. They have been carrying their business successfully for the past several years. Spouses of X and Y fought in the ladies’ club on their issue and X’s wife was hurt badly. X got angry about the incident and he convinced Z to expel Y from their partnership firm. Y was expelled from the partnership without any notice from X and Z. Considering the provisions of the Indian Partnership Act, 1932, state whether they can expel a partner from the firm. What are the criteria for the test of good faith in such circumstances?

Answer:

A partner may not be expelled from a firm by any majority of the partners, except in exercise of good faith of power conferred by contract between the partners.

If all these conditions are not present, the expulsion is not deemed to be in the bonafide interest of the business of the firm.

The test of good faith as required includes three things:

- The expulsion must be in the interest of the partnership.

- The partner to be expelled is served with a notice.

- He is given an opportunity to be heard.

If a partner is otherwise expelled, the expulsion is null and void. Having regard to the above we can say that the expulsion of partner ‘Y’ by X and Z is not under the provision of indian contract act and thus not valid.

Question 33. Mr. A, Mr. B, and Mr. C were partners in a partnership firm M/s ABC and Co., which is engaged in the business of trading branded furniture. The name of the partners was written along with the firm name in front of the head office of the firm as well as on the letterhead of the firm. On 1st October 2018, Mr. C passed away. His name was neither removed from the list of partners as stated in front of the head office nor from the letterheads of the firm. As per the terms of the partnership, the firm continued its operations with Mr. A and Mr. B. as partners. The accounts of the firm were settled and the amount due to the legal heirs of Mr. C was also determined on 10th, October 2018. But the same was not paid to the legal heirs of Mr. C. On 16th October 2018, Mr. X, a supplier supplied furniture worth ₹ 20,00,000 to M/s ABC and Co. M/s ABC and Co. could not repay the amount due to heavy losses. Mr. X wants to recover the amount not only from M/s ABC and Co. but also from the legal heirs of Mr. C. Analyse the above situation in terms of the provisions of the Indian Partnership Act, 1932, and decide whether the legal heirs of Mr. C can also. be held liable for the dues towards Mr. X.

Answer:

According to the facts of this case, the situation existent indicates the application of Section 37 of the Indian Partnership Act, 1932 according to which where any member of a firm has died or otherwise ceased to be a partner and

- The surviving or continuing partners carry on the business of the firm without any final settlement of the accounts as between them and the outgoing partner of his estate, then in the absence of a contract to the contrary.

- The outgoing partner or his estate is entitled at the option of himself or his representatives to such a share of the profits made.

- Since he ceased to be a partner as may be attributable to the use of his share of the property of the firm or to interest at the rate of six percent per annum on the amount of his share in the property of the firm.