CA Foundation Solutions For Business Laws The Companies Act 2013 Self-Study Notes

1. Introduction:

- Companies Act, 201 3 was notified on 30th August, 201 3.

- It consists of 470 sections (covered in 29 chapters) and 7 Schedules

- Companies under Company law (existing and previous).

- Insurance Company (except in so far as the said provisions are inconsistent with the provisions of the Insurance Act, 1938, IRDA Act, 1999).

- Banking Company (except in so far as the said provisions are inconsistent with the provisions of the Banking Regulation Act, 1949).

- Power Company (except in so far as the said provisions are inconsistent with the provisions of the Electricity Act, 2003).

- Other companies governed by any special Act for the time being in force, except in so far as the said provisions are inconsistent with the provisions of such special Act.

- Body corporate, incorporated by any Act for the time being in force as the CG may, by notification, specify on this behalf, subject to such exceptions, modifications, or adaptations, as may be specified in the notification.

2. Company: Meaning and its features:

As per Section 2 (20) of the Companies Act, 201 3 “Company” means a company incorporated under the Companies Act, 2013 or under any previous company law.

Features of a Company:

- Corporate Personality or Separate Legal Entity:

- A company is a separate legal entity district from individuals who are its members.

- It is known by its name.

- It has its seal (common seal i.e. official signature of the company).

- Its members are its owner but they can be its creditors simultaneously.

- It is capable of owing property, incurring debts, borrowing money, having a bank account, employing people, entering into contracts, and suing or being sued in the same manner as an individual.

- A shareholder can be held liable for the company’s Act even if he holds virtually the company’s entire share capital.

- Shareholders are not the company’s agent and so they cannot bind it by their acts.

- The company does not hold its property as an agent or trustee for its members and it cannot sue to enforce its rights nor can it be sued in respect of its liabilities.

- Members do not even have an insurable interest in the company’s property.

- Relevant Case Law:

- Macaura V/s Northern Assurance Co. Ltd.

- Macaura was the holder of all shares (except one).

- He was also the major creditor of the company.

- He insured the company’s timber in his name instead of the name of the company.

- A fire broke and timber was destroyed, Macauro claimed compensation from an insurance company.

- Held, the Insurance company is not liable to pay him, since, the shareholder has no right to the property owner by the company, for he has no legal or equitable interest in them.

- Perpetual succession:

- Death, insolvency, insanity, etc. of any member does not affect the continuity legal existence, and identity of the company.

- Members may come and go, but the company goes on forever.

- It can be dissolved only under law through a winding-up procedure.

- Limited Liability:

- Members of a company cannot be held liable for its debts.

- In the case limited company, the liability of members is limited to the extent of the unpaid value of shares held by them.

- In the case of a company limited by guarantee members are liable to the extent of the amount guaranteed by them.

- The guaranteed amount can be called only at the time of the company’s liquidation winding up.

- Artificial Legal Person:

- A company is purely a creation of law, it is invisible, intangible, and exists only in the eyes of law.

- It has no soul, nobody, but has a position to enter or exit into a contract, to appoint people as its employees.

- Common Seal:

- It is the official signature of the company.

- The company’s name is engraved on it.

- A document not bearing the common seal of the company is not authentic and has no legal force behind it.

- A rubber stamp does not serve the purpose.

3. Corporate Veil Theory:

- Due to law’s fiction; a company is seen as an entity distinct from its members, but a company is an association of persons who are the beneficial owners of company property.

- No member can be held, liable for the company’s Act even if he holds virtually the entire share capital of the company.

- Lifting of corporate veil means ignoring the company’s separate legal identity. It involves disregarding the corporate personality and looking behind the corporate entity, at the controlling persons, and may make them liable for debts and obligations of the company.

- It is permissible only when it is permitted by the statute.

Relevant Case Law:

- Saloman V/s Saloman and Co.

- Mr. Saloman was carrying on the business of leather merchant and boot manufacturing as a sole proprietor.

- He formed a limited company to take over his business.

- The company’s nominal capital was £ 40,000 in £ 1 shares.

- Payment of the total purchase consideration of £ 38,782 was in the following form:

- Fully paid shares of £ each issued to Salomon – £ 20,000

- Secured debentures issued to Salomon – £ 10,000

- Cash Paid – £ 8, 782

- The other 6 members of his family were issued 1 share each.

- Solomon held virtually the entire share capital of the company.

- Hence, the company was called a ‘one-man company’.

- Due to the trade depression, the company went into liquidation.

- The company’s liabilities were £ 10,000 secured by debentures and its assets realised £ 6,050.

- Unsecured creditors owing £ 8,000 claimed that Salomon was carrying on business in the name of the company. Thus, the company was a mere agent of Salomon.

- They claimed that one man cannot owe money to himself.

- The court held that:

- Salomon and Co. was a real company fulfilling all the legal requirements.

- It had an identity separate from its members.

- Thus, secured debentures even though held by Salomon, were to be paid in priority to unsecured creditors.

- This case established the legality of a “one-man company” and the principle of limited liability.

Lifting of the corporate veil is permitted in the following cases:

- If the company is formed for the commission of

- Fraud and improper conduct.

- To defraud creditors.

- To avoid legal obligations.

- Relevant Case Laws:

- Gilford Motor Co. V/s Harne.

- Jones V/s Lipman.

- To determine whether the company is an enemy company or not.

- Relevant Case Law:

- Daimler Co. Ltd. V/s Continental Tyre and Rubber Co.

- To prevent evasion of taxes and duties.

- Relevant Case Laws:

- CIT V/s Meenakshi Mills Ltd.

- Sir Dinshaw Manakjee Petit.

- Relevant Case Laws:

- If the purpose of a company’s formation is to avoid welfare legislation For Example. reducing its liability of bonus payable under the Bonus Act.

- Relevant Case Law:

- The workers employed in Associated Rubber Industries Ltd. Bhavnagar V/s The Associated Rubber Industries Ltd. Bhavnagar and other, A.I.R. 1986 SCI.

- Relevant Case Law:

- To protect the public policy and thus, prevent the transaction contrary to public policy.

- Relevant Case Law:

- Connors Bros. V/s Connors.

- Relevant Case Law:

- If the holding company has incorporated the subsidiary company for the sole purpose of using it as an agent.

- Relevant Case Law:

- Re, R.G. Films Ltd.

- Relevant Case Law:

Various statutory provisions for lifting the corporate veil are as follows:

- Reduction in membership below the statutory minimum.

- Misdescription of name.

- Presentation of group accounts of holding and subsidiary companies.

- Fraudulent Trading.

- Payment of Arrears of tax.

- Ultra-vires acts.

- Misrepresentation in the prospectus.

4. Classes of Companies under the Act:

1. Based on liability:

- Company limited by shares:

- It is a registered company where public or private company.

- Liability of members is limited to the unpaid amount on the shares held by them.

- This should be stated in the MOA of such a company.

- It arises when a valid call is made by the company.

- Company limited by Guarantee:

- It is a registered company whether public or private company.

- The liability of members is limited to the amount that he has guaranteed to pay to the company.

- Liability arises only in the event of the winding up of the company.

- Its MOA should state the amount guaranteed given by members.

- Examples: Clubs, trade associations, etc.

- Unlimited Company:

- Its memorandum does not in any way limit the liability of its members.

- Every member is liable to contribute to the company’s assets until all its debts are paid in full.

- Not common in India.

- Members are not, however, liable directly to the company’s creditors.

- The liquidator asks the members to contribute in the event of the company’s winding up.

- It may be subsequently converted into a limited company, subject to certain conditions.

- The liability is extended to the personal property of the member

2. Based on members:

- One Person Company:

- It means a company that has only one person as a member.

- The MOA of such company is required to indicate, the name of other people, with his prior consent in the prescribed form, who shall, in the event of the subscriber’s death or his incapacity to contract become a member of the company and the written consent of such person shall be filed with ROC at the time of its incorporation along with MOA and AOA.

- Only a natural person who is an Indian citizen and resident in India is eligible to incorporate OPC and be its nominee.

- “Resident in India” means a person who has stayed in India for not less than 182 days during the immediately preceding calendar year.

- It is considered a private company.

- It has been granted many relaxations in compliance and procedural aspects.

- No person shall be eligible to incorporate more than one OPC or become a nominee in more than one OPC.

- No minor shall become a member or nominee of OPC or hold shares with beneficial, interest.

- It cannot be incorporated or converted into a Section 8 company.

- It cannot carry out Non-Banking Financial -Investment Activities including investment in securities of any Body corporate.

- It cannot convert voluntarily into a private company unless two years have expired from the date of its incorporation, except if its paid-up capital is increased beyond ₹ 50 lakh or its average annual turnover exceeds ₹ 2 crore.

- Private Company [Section 2 (68)]:

- A company which has the following features is a private company

- Restricts the right to transfer its shares.

- Except in the case of OPC, a private company should have a minimum of 2 members and a maximum of 200 members.

- Prohibits any invitation to the public to subscribe to any securities of the company.

- The company can only accept deposits for its members, directors, or their relatives.

- Joint shareholders are counted as one member.

- It must add the words, ‘Private Limited’ at the end of its name.

- They are granted certain privileges and exemptions under the Companies Act, 2013 because not much public interest is involved in private companies.

- The company is required to file its annual accounts and returns to ROC (Registrar of Company) which can be accessed by any person by paying fees.

- A company which has the following features is a private company

- Small Company:

- Section 2(85) of the Companies Act, 2013 defines “Small company” means a company, other than a public company.

- Paid-up share capital of which does not exceed fifty lakh rupees or such higher amount as may be prescribed which shall not be more than ten crore rupees; and

- Turnover of which as per its last profit and loss account for the immediately preceding financial year does not exceed two crore rupees or such higher amount as may be prescribed which shall not be more than a hundred crore rupees:

- Provided that nothing in this clause should apply to:

- A holding company or a subsidiary company

- A company registered under Section 8

- A company or body corporate governed by any special Act

- However, nothing applies to:

- Holding company or subsidiary company.

- Company registered under Section 8.

- Company or body corporate governed by any special Act.

- Public Company [Section 2 (71)]:

- A public Company is a company that:

- Is not a private company.

- Has a minimum paid-up share capital of ₹ 5 lakh or such higher paid-up capital as may be prescribed.

- A subsidiary of a company, not a private company, shall be deemed to be a public company for this act and a subsidiary of a public Co. is also treated to be a public company.

- Should have a minimum of seven members and have no limit for maximum members.

- It requires a minimum of 7 members for its formation.

- Any member of the public can acquire its shares or debentures.

- Its shares are capable of being dealt with on the stock exchange.

- A public Company is a company that:

Amendment made by Companies (Amendment) Act, 2015: Provides that in Clause (71) the words “of ₹ 5 lakhs or higher paid-up share capital” shall be omitted.

3. Based on control:

- Holding and subsidiary companies:

- When a company:

- Controls the composition of the board of directors, or

- Exercises or controls more than one-half of the total share per capital either as its own or together with one or more of its subsidiary companies then, it is known as the holding company and the other company is the subsidiary company.

- Total share capital for this purpose means the aggregate of:

- Paid-up equity share capital and

- Convertible Preference share capital.

- The holding company shall not have layers of subsidiaries beyond the prescribed limit.

- The expression “company” includes any body corporate.

- The word control includes:

- The right to appoint the majority of the directors or

- To control the management or

- The policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly including by their shareholding or

- Management rights or shareholders agreements voting agreements or in any other manner.

- When a company:

- Associate Company:

- As per Section 2(6) “associate company” about another company, means a company in which that other company has a significant influence.

- However, it is not a subsidiary company of the company having such influence and includes a joint venture company.

- Significant influence means control of at least 20% of total share capital or business decisions under an agreement.

4. Based on access to capital:

- Listed Company:

- The company is listed on any of the recognized stock exchanges.

- It is a company whose shares are traded on the recognized stock exchange.

- Unlisted Company:

- Companies except those listed on the stock exchange i.e. companies other than listed companies.

5. Other Companies:

- Government Company [Section 2 (45)]:

- It is a company

- In which not less than 51% of the paid-up share capital is held by

- CG (Central Government)

- SG (State Government)

- Partially by CG and partially by SG

- Which is a subsidiary of a Government Company.

- Its auditor is appointed by the Comptroller and Auditor General of India (C and AG).

- In which not less than 51% of the paid-up share capital is held by

- It is a company

- Foreign Company [Section 2 (42)]:

- Foreign company means any company or body corporate incorporated outside India that:

- Has a place of business in India, whether by itself or through an agent, physically or through electronic mode, and;

- Conduct any business activity in India in any other manner. Thus, the companies doing business through electronic mode are also termed as foreign companies and need to comply with specified provisions.

- Formation of Companies with charitable objects, etc. (Section 8 company):

- License may be granted by CG if the following conditions are satisfied:

- The company’s object is to promote art, commerce, science, religion, charity, or any other useful object.

- The company applies its income to promoting its objectives.

- The company prohibits the payment of any dividend to its members.

- It is not required to use the words ‘Limited’ or ‘Private Limited’ at the end of its name even though it is a limited company.

- It shall enjoy all privileges and be subject to all obligations of a limited company.

- A firm may become its member.

- The company can alter its object clause as MOA or AOA only by obtaining the previous approval of CG in writing.

- It can convert itself into a company of any kind only after complying with the prescribed conditions.

- Conditions for revoking licence by CG:

- Company contravenes any of the requirements or any of the conditions subject to which a license was issued.

- Its affairs are conducted fraudulently.

- Its affairs are conducted in a manner violative of the company’s objects, or

- Prejudicial to public interest.

- On revocation, CG may also direct the company:

- To wound up, or

- Amalgamate with another company registered u/s 8 if it is in the public interest.

- On revocation of licence by CG:

- Limited’ or ‘Private Limited’ shall be inserted at the end of the company’s name.

- Company shall cease to enjoy exemptions granted by CG u/s 8.

- Before revocation, CG shall be allowed to be heard by the company.

- License may be granted by CG if the following conditions are satisfied:

- Dormant Company (Section 455):

- It is a company that is registered under the Companies Act for future projects or to hold an asset or intellectual property and has no significant accounting transactions, and

- It can make an application to the Registrar in the manner prescribed and obtain the status of a dormant company.

- Significant accounting transactions are the transactions other than those mentioned below:

- Payment of fees to Registrar.

- Payment under this Act or any other Act.

- Allotment of shares in compliance with this Act.

- Payment for office and record maintenance.

- Nidhi Company:

- The main object of Nidhi Company is to cultivate the habit of cost-cutting and saving among members.

- Receiving deposits from, and lending to its members for their mutual benefit in compliance with rules as prescribed by CG.

- Public Financial Institution:

- It is the institution

- Established or constituted by or under any Central or State Act or

- At least 50% of paid-up-share capital is held or controlled by CG or by SG or partly by CG and SG or by one or more SG.

- It includes

- LIC was established under the Life Insurance Corporation Act, of 1956.

- Infrastructure Development Finance Company Ltd.

- Institution notified by CG u/s 465.

- Any other institution as notified by CG in consultation with RBI.

5. Mode of Registration or Incorporation of Company: Promoters – It means a person:

- Who has been named as such in the prospectus or is identified by the company in the annual return referred to in Section 92;

- Who has control over the affairs of the company, directly or indirectly whether as a shareholder, director, or otherwise, or

- Under whose advice, directions, or instructions the Board of Directors of the company is accustomed to Act.

Provided that Sub-clause (c) shall not apply to a person who is acting merely in a professional capacity.

- A director officer or employee who has control over the affairs of the company, directly or indirectly whether as a shareholder, director, or otherwise is considered as promoted.

- However, a director officer, or employee of the issuer or a person, if acting as such merely in his professional capacity, shall not be treated as a promoter.

Formation of Company:

Certain legal requirements to be fulfilled:

- There must be an association of persons.

- A minimum of 2 people are required in the case of a private company, (one in the case of OPC) and 7 persons in the case of a public company.

- The company must have a common object.

- Formalities of incorporation must be complied with.

Incorporation of Company:

- Filing a necessary document with the Registrar of Companies. These include:

- MOA and AOA signed by all subscribers.

- Affidavit from each subscriber and person’s names as first directors.

- Proof of place of registered office.

- Particulars of all subscribers.

- Particulars of Directors along with Director Identification Number.

- Issued of Certificate of Incorporation by Registrar of Companies containing Corporate Identity Number (CIN).

- Preparation and maintenance of documents and information at the registered office of the company for the period prescribed usually till the lifetime of the company.

- If at the time of registration, any person knowingly furnished any false or incorrect particulars which are material, then such person shall be liable for fraud u/s 447.

- If the company has been incorporated based on false documents or suppression of material facts, the person named as the first director of the company and the person making the declaration shall be liable for fraud u/s 447.

- If the company is incorporated in the manner as stated in Point No. 5, the Tribunal may, on an application made to it, on being satisfied that the situation so warrants:

- Pass such order, as it may think fit, for regulation of the management of the company in the public interest or interest of the company and its members, creditors.

- Direct the liability of members to be unlimited.

- Remove the name of the company from the register of companies.

- Pass such other order as it may deem fit; after providing a reasonable opportunity of being heard and taking into consideration the transactions entered into by the company.

Simplified Proforma for Incorporating Company Electronically [SPICE]:

- A significant step was taken by MCA by introducing the SPICE scheme vide MCA notification dated 01-10-2016.

- SPICE form is also introduced with a function to prepare e-MOA and e-AOA via this attribute there is no opportunity to prepare manual MOA and AOA.

- Form INC 32 under the SPICE scheme is a single window form that can be used for multiple purposes such as:

- Application of DIN.

- Application of Name Availability.

- No need to file a separate form for the first director.

- Address of Registered Office of the proposed company.

- PAN or TAN application.

Effects of Registration:

- The company becomes a body corporate.

- It acquires legal recognition.

- It gets a name in which it will carry on its business.

- Its objects are laid down.

- Subscribers become the members of the company.

- The Incorporation Certificate issued by the Registrar of Companies is the conclusive evidence that:

- All the requirements of the act have been complied with in respect of registration and matters precedent and incidental thereto.

- An association is a company authorized to be registered.

- The association has been duly registered under the Companies Act.

Relevant Case Laws:

- Hari Nagar Sugar Mills Ltd. V/s SS Jhunjhunwala.

- State Trade Corporation of India V/s Commercial tax officer.

- Spencer and Co. Ltd. Madras V/s CWT Madras (if the company purchases all shares of another company it will not put an and on the corporate character of such other company).

- Heavy Electrical Union V/s State of Bihar:

- If the entire share capital of the company is contributed by CG and all shares are held by the President of India, it does not make a company an agent either of the President or for CG.

6. Classification of Capital:

- Authorized (Nominal) Capital: It is the maximum amount of capital mentioned in the MOA of the company, which it can raise during its lifetime. It is also known as the registered capital to increase the limit of authorized capital, the memorandum of company should be altered.

- Issued Capital: It refers to that portion of authorized capital that has been offered to the public for subscription.

- Subscribed Share Capital: It refers to the part of the issued share capital that has been subscribed by the public. It also includes the issue of shares for consideration other than cash.

- Called-up Share Capital: It is that portion of subscribed capital that the shareholders are called upon to pay. The amount remaining to be called up is called the uncalled capital.

- Paid-up Capital: It is that portion of called-up capital that is paid by the shareholders. The amount that is not paid is known as the calls in arrears. This is the actual capital of the company that is included in the Balance Sheet.

7. Shares:

- Shares mean shares in the share capital of the company.

- It can be said as “an existing bundle of rights and Liabilities”.

- Share into which the total share capital is divided.

- Every person who contributes capital to the company gets a share in the company which represents his capital in the company.

Kinds of Share Capital:

Shares all of two types:

- Preference Shares – preference shareholders following 2 rights.

- Preferential right as to payment of dividend – in the case where a dividend is declared by the company.

- Preferential right as to repayment of capital – in the event of winding up of the company.

- Equity Shares – These are the shares other than preference shares. These can be:

- With voting rights or

- With differential rights as to dividend voting or otherwise under prescribed rules.

8. Memorandum of Association:

- It contains the constitution of the company.

- It is the first step in the company’s formation.

- As per Section 2 (56), “memorandum” means the memorandum of association of a company as originally framed and altered from time to time in pursuance of any private company law or this Act.

- It not only shows the objects of formation but also determines the scope of its operations beyond which its actions cannot go.

- According to Palmer, “MOA is a document of great importance with the proposed company”.

- It is the charter of the company.

- It is the premise on which the whole foundations of the company stand.

- Forms of Memorandum are drawn as

Table A – Memorandum of company limited by shares.

Table B – Memorandum of a company limited by guarantee and not having a share capital.

Table C – Memorandum of the company limited by guarantee and having a share capital.

Table D – Memorandum of Unlimited Company.

Table E – Memorandum of unlimited company and having a share capital.

It contains six clauses which are known as the ‘conditions of memorandum’.

- Name Clause:

- Contains the name of the proposed company.

- The name should not be undesirable.

- It should not be identical to the name of another company.

- It should not be prohibited.

- It should end with the words limited or Private Limited.

- It must be approved by ROC.

- Registered Office Clause:

- It contains the name of the state in which the registered office is situated.

- Object Clause:

- It contains the objects to be pursued by the proposed company and other incidental and ancillary objects.

- Liability Clause:

- It is required by limited companies.

- It contains whether the liability of members is limited by shares, guarantees, or both.

- Capital Clause:

- It is mandatory for every company.

- It states:

- Number of Shares.

- Nominal value of each share.

- Total capital with which the company is to be registered.

- Association or Subscription Clause:

- MOA must be subscribed by at least 7 persons in case of public company at least 2 persons in case of private company and 1 in case of OPC.

- Every subscriber shall take at least one share in case of company is limited by shares. The MOA should be signed by each subscriber also stating his address, description, and occupation.

- Particulars of every subscriber shall be witnessed.

- In the case of OPC, the name of the person who is in the event of the death of the subscriber shall become a member of the company.

- A company being a legal person can through its agent, subscribe to the memorandum.

- Minor- cannot be a signatory to the memorandum as he is incompetent to contract. The guardian of a minor, who subscribes to the memorandum on his behalf, will be deemed to have subscribed in a personal capacity.

9. Doctrine of Ultra Vires:

- It means beyond (their) powers.

- If any Act is done, that is legal but is not authorized by the object clause of the MOA of the company or by the statute, it is said to be ultra vires the company and thus null and void.

- An ultra Act vires the company, cannot be ratified even by the unanimous consent of all the shareholders of the company.

- An Act that is ultra vires the directors can be ratified by the members by passing a resolution at general meeting.

- An ultra Act vires the Articles of Association, can be ratified by amending the Articles after passing a special Resolution at a general meeting.

- An ultra vires contract can never be made binding on the company. It cannot become Infra vires because of estoppel, acquiescence, lapse of time, delay, or ratification.

Relevant Case Law:

- Ashbury Railway Carriage and Iron Company Limited V/s Riche.

- The main objects of the company were:

- To make, sell or lend on hire, railway carriages and wagons;

- To carry on the business of mechanical engineers and general contractors.

- To purchase, lease, sell, and work mines.

- To purchase and sell as merchants or agents, coal, timber, metals, etc.

- Directors of the company entered into a contract for financing the construction of a railway line.

- The company ratified this act of directors by passing SR but however repudiated the contract being ultra vires.

- The other party brought an action for damages for breach of contract. The contract was null and void.

10. Articles of Association:

- As per Section 2(5) “AOA” means the articles of association of a company as originally framed or as altered from time to time or applied in pursuance of any previous company law or Act.

- It contains the regulations relating to the internal management of the company.

- These rules and regulations are framed by the company for its governance.

- It is also called as regulations or bylaws of the company.

- It is subordinate to and is controlled by MOA.

- In case of contradiction with AOA, MOA prevails.

- Public companies limited by shares need not have their articles. It can adopt Table F of Schedule I.

- Private companies must register their articles.

- Some of the important clauses are as follows:

- Share capital and variation of rights, lien on shares, forfeiture of shares, directors, their appointment, accounts and audit, general meeting, share certificate, etc.

- Forms of the article include:

Table F – Articles of Company limited by shares.

Table H – Articles of Company limited by guarantee.

Table G– Articles of a company limited by guarantee having a share capital.

Table I – Articles of an unlimited company having a share capital.

Table J – Articles of an unlimited company not having a share capital.

- The articles play a part that is subsidiary to the memorandum of association.

- The articles govern how the object of the company is to be carried out and can be framed and altered by the members.

- It must be within the limits marked out by the memorandum and the Companies Act.

- It must be printed, divided into paragraphs, numbered consecutively stamped adequately, signed by each subscriber to the memorandum, and duly witnessed and filed along with the memorandum.

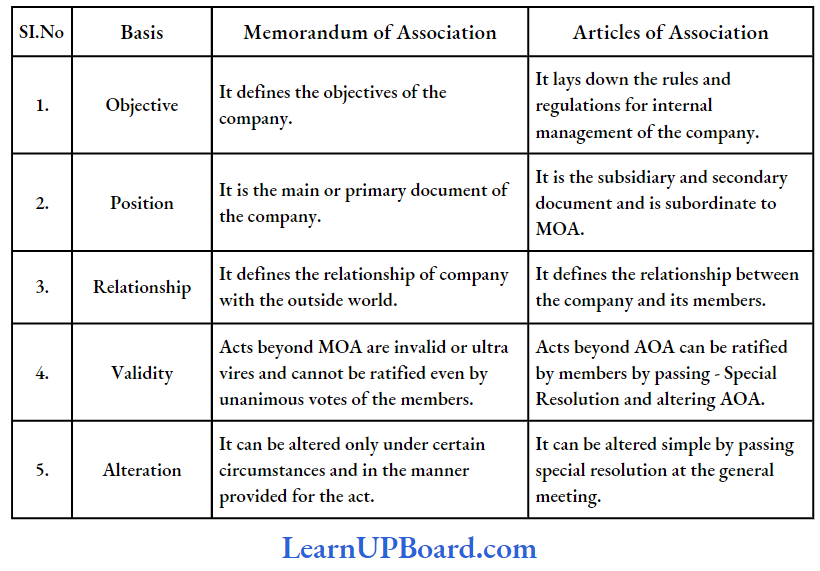

Difference between Memorandum of Association and Articles of Association:

11. Doctrine of Indoor Management:

The doctrine of Constructive Note:

- Since a memorandum and article is a public document it is considered that every person dealing with the company is deemed to have notice of the content of the memorandum and articles of the company.

- It is presumed that the person has not only read these documents but also has understood their proper meaning.

- Any person can now inspect the documents kept by the registrar by way of electronic means on payment of prescribed fees.

- If a person enters into a contract with the company which is beyond the power of the company as defined in MOA, or outside the authority of directors as per MOA or AOA, he cannot acquire any right under the contract against the company.

The doctrine of Indoor Management:

- It is an exception to the Doctrine of constructive notice.

- It protects the outsiders against the company, who acted in good faith.

- According to this doctrine, a person who deals with the company is not bound to enquire into the regularity of the internal procedures of the company.

- The contracting party may assume that every act is done under the procedures laid down in the articles of the company and hence not affecting adversely the rights of the outside parties in any manner due to irregularity of internal procedures.

- It is popularly known as the Turquand Rule

Relevant Case Law:

- The Royal British Bank V/Turquand.

- Turquand, a Co. had a clause in its constitution that allowed the company to borrow money once it had been approved by shareholders by passing a resolution at a general meeting.

- Turquand entered into a loan with the Royal British Bank and two of the directors signed and attached the company Seal on the loan agreement.

- The loan however was not been approved by the shareholders.

- The company defaulted in repayment of the loan and the bank sought restitution.

- Company refused to repay the loan claiming that directors had no right to enter into such agreement.

- It also claimed that the bank had constructive notice of the shareholders. approval clause in their constitution.

Held: Royal British Bank could enforce them. The bank could not be deemed to know or look into the company’s internal workings.

Exceptions to the Doctrine of Indoor Management:

- In case of Actual or Constructive knowledge of irregularity.

- Case Laws:

- Howard V/s Patent Ivory Manufacturing Co.

- Morris V/s Kansseon.

- Case Laws:

- In cases where a person dealing with the company has suspicion of irregularity, they have behaved negligently.

- Case Laws:

- Anand Bihari Lai V/s Dinshaw and Co.

- Haughton and Co. V/s Nothard, Lowe and Wills Ltd.

- Case Laws:

- In case of forgery

- Case Law:

- Ruben V/s Great Fingall Consolidate

- Case Law:

CA Foundation Solutions For Business Laws The Companies Act 2013 Descriptive Questions And Answers

Question 1. What is the main difference between a Guarantee Company and a Company having Share Capital?

Answer:

The main difference between a Guarantee Company and a Company having Share Capital

- Company limited by shares:

- In this case, the liability of members is limited to the extent of the unpaid value of shares held by them.

- This liability can be enforced either during the

- lifetime of the company

- winding -up of the company.

- Company Limited by Guarantee:

- Guarantee Company not having Share Capital:

- In this case, the liability of members is limited to the extent of the amount guaranteed by them.

- This liability can only be enforced at the time of winding up and not during the lifetime of the company.

- Guarantee Company having Share Capital:

- In this case, the liability of members is limited to the extent of:

- The amount guaranteed by them and

- Unpaid value of shares held by them

- Member can be demanded to pay call money at any time. throughout the lifetime of the company but the guaranteed amount can be called only at the time of winding up.

- In this case, the liability of members is limited to the extent of:

- Guarantee Company not having Share Capital:

Question 2. Define OPC (One Person Company) and state the rules regarding its membership. Can it be converted into a non-profit company under section 8 or a private company?

Answer:

OPC:

Section 2(62) of the Companies Act, 2013 defines a person company (OPC) as a company that has only one person as a member.

Rules Regarding its Membership:

- Only a natural person who is an Indian citizen and resident in India shall be eligible to incorporate an OPC or shall be a nominee for the sole member of an OPC.

- No minor shall become a member or nominee of the OPC or can hold a share with beneficial interest.

- No person shall be eligible to incorporate more than one OPC or become a nominee in more than one such company.

- OPC is a private company in nature.

- OPC cannot be incorporated or converted into a company under section 8 of the Act i.e. a non-profit company.

- OPC may be converted to private or public companies in certain cases.

- Such companies cannot carry out Non-Banking Financial Investment activities including investment in securities of any body corporate.

Question 3. State the limitations of the doctrine of indoor management under the Companies Act, 2013.

Answer:

The limitations of the doctrine of indoor management under the Companies Act, 2013

Doctrine of indoor management also known as the case of Royal British Bank Vs. Turquand i.e. Turquand’s rule is an exception to the doctrine of constructive notice.

- The doctrine says that outsiders can in no way be asked to be responsible or to enquire into the infernal management of the company.

- They can safely presume that the company must have done all that it was supposed to do at its internal level.

Question 4. There are cases, where company law disregards the principle of corporate personality or the principle that the company is a legal entity distinct from its shareholders or members. Elucidate.

Answer:

The cases based on which the principle of Corporate Personality of a company can be disregarded under the Companies Act, 2013 are:

- To determine the character of the company i.e. to find out whether the company is an enemy or friend: In the law relating to trading with the enemy where the list of control is adopted.

- To protect revenue or tax: In certain matters concerning the law of taxes duties and stamps particularly where the question of the controlling interest is in issue.

- To avoid a legal obligation: Where it was found that the sole, purpose for. the formation of the Company was to use it as a device to reduce the amount to be paid by way of bonuses to workmen.

- Formation of subsidiaries as agents: A company may sometimes be regarded as an agent or trustee of its members, or of another company and may therefore be deemed to have lost its individuality in favor of its principal. Here the principal will be held liable for the acts of that company.

- A company formed for fraud or improper conduct or to defeat law: Where the device of incorporation is adopted for some illegal or improper purpose For Example. to defeat or circumvent the law, to defraud creditors, or to avoid legal obligations.

Question 5. What do you mean by “Companies with charitable purpose” (section 8) under the Companies Act 2013? Mention the conditions of the issue and revocation of the license of such company by the government.

Answer:

“Companies with charitable purpose” (section 8) under the Companies Act 2013

Section 8 of the Companies Act, 2013 deals with the formation of companies that are formed to:

- Promote the charitable objects of commerce, art, science, sports, education, research, social, welfare, religion, charity, protection of environment, etc. Such a company intends to apply its profits in

- Promoting its objects and

- Prohibiting the payment of any dividend to its members.

Examples of section 8 companies t are ASSOCHAM, FICCI, NATIONAL SPORTS CLUB of INDIA, etc.

Powers of Central Government to issue license:

- Section 8 allows the Central Government to register such person or association of persons as a company with limited liability without the addition of the words ‘limited or’ private limited to its name, by issuing a license on such conditions as it deems fit:

- The registrar shall on an application register such person or association as a company under this section.

- On registration, the company shall enjoy the same privileges and obligations as a limited company.

Revocation of license:

The Central Government may by order revoke the license of the company where the company contravenes any of the requirements or the conditions of this section subject to which a license is issued or where the affairs of the company are conducted fraudulently, or violative of the objects of the company or prejudicial to the public interest.

- Before such revocation, the Central Government must give it a written notice of its intention to revoke the license and the opportunity to be heard in the matter.

- On revocation of the license, the Registrar shall put ‘limited’ or ‘private limited’ against the name of the company in its register.

Question 6. “The Memorandum of Association is a charter of a company”. Discuss. Also explain.in brief the contents of the Memorandum of Association.

Answer:

“The Memorandum of Association is a charter of a company”.

The Memorandum of Association of the company is its charter, it defines its constitution and the scope of the powers of the company With which it has been established under the Act.

- It is the very foundation on which the whole edifice of the company is built.

- It defines the scope of the company’s activities and its relations with the outside world. It is the charter of, the company.

- It contains the objects to pursue in which the company is formed. It lays down the scope of operations beyond which the company cannot go.

Contents of Memorandum:

- Name Clause: The name of the company must end with the words “limited” in case of public co., or “private limited” in case of private co.

- Registered office clause: It mentions the State in which the registered office of the company is situated.

- Object Clause: The object for which the company is proposed to be incorporated and any matter considered necessary in furtherance, therefore, is stated in this clause.

- Liability Clause: The liability of members of the company, whether limited or unlimited, and also states how the liability is limited,

- Capital Clause: It states the amount of authorized capital divided into shares of fixed amounts and the number of shares with the subscribers to the memorandum have agreed to take. A company not having share capital need not have this clause.

- Association Clause: It states the desire of the subscribers to be formed into a company. The Memorandum shall conclude the association clause. Every subscriber to the memorandum shall take atleast one share, and shall write against his name, the number of shares taken by him.’

Question 7. What are the significant points of Section 8 Company which do not apply to other companies? Briefly explain about provisions of the Companies Act, 2013.

Answer:

Formation of companies with Charitable Objects:

(Section 8) of the company deals with the formation of a company with charitable objects.

- License may be granted by the Central Government. If the following conditions are satisfied:

- The company’s object is to promote Art, Commerce, Science, Religion, Charity, or any other useful object.

- The company applies its income to promoting such objects.

- The company prohibits the payment of any dividend to its members.

- It is not required to use the words ltd or private ltd. at the end of its name even though it is a limited company.

- It shall enjoy all privileges and be subject to all obligations of the Ltd. company.

- A firm may become its member.

- A company can alter its object clause in MOA or AOA only by obtaining the previous approval of the Central Government in Writing.

- It can convert itself into a company of any kind only after complying with the prescribed conditions.

Conditions for Revoking Licence by Central Government:

- If the company contravenes any of the conditions subject to which the license was issued.

- If affairs are conducted fraudulently.

- If affairs are against the public interest.

On Revocation Central Government may also direct the Company to:

- To wound up.

- To amalgamate with another company registered u/s 8 if it is in the public interest.

On Revocation of Licence by Central Government:

- Words Ltd. or private Ltd. shall be inserted at the end of the company’s name.

- Company shall cease to enjoy exemptions granted by Central Government u/s 8.

- Before revocation, the Central Government shall give an opportunity of being heard to the company.

Question 8. Mike Limited company incorporated in India having a Liaison office in Singapore. Explain in detail the meaning of Foreign Company and analyze whether Mike Limited would be called a Foreign Company as it established a Liaison office in Singapore as per the provisions of the Companies Act, 2013.

Answer:

Foreign Company Section 2(42) of the Companies Act, 2013:

Foreign company means any company or body corporate incorporated outside India, that:

- Has a place of business in India, whether, by itself or through an agent physically or through electronic mode, and;

- Conduct any business activity in India in any manner. Thus, the companies doing business through electronic mode are also termed as foreign companies and need to company with specified provisions.

According to the given case, Mike Limited Company is incorporated in India having a liaison office in Singapore. Thus, as it is Incorporated in India it is an Indian Company and not a foreign company.

Question 9. Explain the Doctrine of ‘Indoor Management’ under the Companies Act, 2013. Also, state the circumstances where the outsider cannot claim relief on the ground of ‘Indoor Management’.

Answer:

The Doctrine of ‘Indoor Management’ under the Companies Act, 2013

Doctrine of Indoor Management: The Doctrine of Indoor Management is the exception to the doctrine of constructive notice.

- The aforesaid doctrine of constructive notice does’ in no sense mean that outsiders are deemed to have notice of the internal affairs of the company.

- For instance, if an act is authorized by the articles or memorandum, an outsider is entitled to assume that all the detailed formalities for doing that act have been observed.

- This can be explained with the help of a landmark case The Royal British Bank vs. Turquand. This is the doctrine of indoor management popularly known as the Turquand Rule.

Facts of The Royal British Bank vs. Turquand

Mr. Turquand was the official manager (liquidator) of the insolvent Cameron’s Coal Brook Steam, Coal, and Swansea and Loughor Railway Company. It was incorporated under the Joint Stock Companies Act, of 1844.

- The company had given a bond for £ 2,000 to the Royal British Bank, which secured the company’s drawings on its current account.

- The bond was under the company’s seal, signed by two directors and the secretary.

- When the company was sued, it alleged that under its registered deed of settlement (the articles of association),, directors only had the power to borrow up to an amount authorized by a company resolution.

- A resolution had been passed but did not specify how much the directors could borrow.

Held, it was decided that the bond was valid, so the Royal British Bank could enforce the terms. He said the bank was deemed to be aware that the directors could borrow only up to the amount of resolutions allowed.

- Articles of association were registered with Companies House, so there was constructive notice. But the bank could not be deemed to know which ordinary resolutions passed, because these were not registrable.

- The bond was valid because there was no requirement to look into the company’s internal workings. This is the indoor management rule, that the company’s indoor affairs are the company’s problem.

Exceptions to the doctrine of Indoor Management: Thus, you will notice that the aforementioned rule of Indoor Management is important to persons dealing with a company through its directors or other persons.

- They are entitled to assume that the acts of the directors or other officers of the company are validly performed if they are within the scope of their apparent authority.

- So long as an act is valid under the articles if done in a particular manner, an outsider dealing with the company is entitled to assume that it has been done in the manner required.

The above-mentioned doctrine of Indoor Management or Turquand Rule has limitations of its own. That is to say, it is inapplicable to the following namely:

- Actual or constructive knowledge of irregularity: The rule does not protect any person when the person dealing with the company has notice, whether actual or constructive, of the irregularity.

- In Howard vs. Patent Ivory Manufacturing Co. where the directors could not defend the issue of debentures to themselves because they should have known that the extent to which they, were lending money to the company required the assent of the general meeting which they had not obtained.

- Likewise, in Morris v Kansseen, a director could not defend an allotment of shares to him as he participated in the meeting, which made the allotment.

- His appointment as a director also fell through because none of the directors who appointed him was validly in office.

- Suspicion of Irregularity: The doctrine in no way, rewards those who behave negligently. Where the person dealing with the company is put upon an inquiry.

- For example, where the transaction is unusual or not in the ordinary course of business, the outsider must make the necessary inquiry.

- The protection of the “Turquand Rule” is also not available where the circumstances surrounding the contract are suspicious and therefore invite inquiry.

- Suspicion should arise, for example, from the fact that an officer is purporting to act in a matter, which is apparently outside the – scope of his authority.

- Where, for example, as in the case of Anand Bihari Lai vs. Dinshaw and Co. the plaintiff accepted a transfer of a company”s property from its accountant, the transfer was held void.

- The plaintiff could not have supposed, in the absence of a power of attorney that the accountant had the authority to effect the transfer of the company“s property.

- Similarly, in the case of Haughton and Co. v. Nothard, Lowe and Wills Ltd. where a person holding directorship in two companies agreed to apply the money of one company in payment of the debt to another.

- The court said that it was something so unusual “that the plaintiff was put upon inquiry to ascertain whether the persons making the contract had any authority in fact to make it:

- ” Any other rule would “place limited companies without any sufficient reasons for so doing, at the mercy of any servant or agent who should purport to contract on their behalf.”

- Forgery: The doctrine of indoor management applies only to irregularities that might otherwise affect a transaction but it cannot apply to forgery which must be regarded as nullity.

- Forgery may in circumstances exclude the ‘Turquand Rule’. The only clear illustration is found in the Ruben v Great Fingall Consolidated.

- In this case, the plaintiff was the transferee of a share certificate issued under the seal of the defendant’s company.

- The company’s secretary, who had fixed the seal of the company and forged the signature of the two directors, issued the certificate.

- The plaintiff contended that whether the signature was genuine or forged was a part of the internal management, and therefore, the company should be stopped from denying the genuineness of the document.

- But it was held, that the rule has never been extended to cover such a complete forgery.

Question 10. Explain the classification of the companies based on control as per The Companies Act, 2013.

Answer:

Classification of companies based on control:

- Holding and Subsidiary Company:

- Holding Company: A company is a holding company concerning one or more other companies, which means a company of which such companies are subsidiary companies.

- Subsidiary Company or Subsidiary: With the other company, (i.e. say the holding company), means a company in which the holding company.

- Control the composition of the Board of Directors or

- Exercises or controls more than one-half of the total voting power either

- At its own or

- Together with one or more of its subsidiary companies.

- Associate Companies: Associate Company concerning another company, means a company (other than a subsidiary) in which another company has significant influence and includes a joint venture company.

Question 11. What do you mean by the term Capital? Describe its classification in the domain of Company Law.

Answer:

Capital:

The term Capital has a variety of meanings. The contributions of persons to the common stock of the company form the Capital of the company. In the domain of company law, the term ‘capital’ is used in the following senses:

- Nominal or authorised or registered Capital: This form of capital has been defined in section 2 (8) of the Companies Act, 201 3.

- “Authorised Capital” or “Nominal Capital” means such capital as is authorized by the memorandum of a company to be the maximum amount of share capital of the company.

- Thus, it is the sum stated in the memorandum as the capital of the Company with which it is to be registered-being the maximum amount which it is authorized to raise by issuing shares, and upon which it pays the stamp duty.

- It is usually fixed at the amount, which, it is estimated, the company will need, including the working capital and reserve capital, if any.

- Issued Capital: Section 2(50) of the Companies Act, 2013 defines “Issued Capital” which means such capital as the company issues from time to time for subscription.

- It is that part of authorized capital that is offered by the company for subscription and includes the shares allotted. for consideration other than cash.

- Schedule 3 to the Companies Act, 2013, makes it obligatory for a company to disclose its issued capital in the balance sheet.

- Subscribed Capital: Section 2(86) of the Companies Act, 201 3 defines “Subscribed Capital” as such part of the capital which is for the time being subscribed by the members of a company: It is the nominal amount of shares taken up by the public.

- Called-up Capital: Section 2(15) of the Companies Act, 2013 defines “Called-up capital” as such part of the Capital, which has been called for payment. It is the total amount called up on the shares issued.

- Paid-up Capital: Paid-up is the total amount paid or credited as paid up on shares issued. It is equal to Called up capital less Calls in arrears.

Question 12. Explain the ‘doctrine of ultra vires under the Companies Act, 2013. What are the consequences of ‘ultra vires’ acts of the company?

Answer:

The doctrine of Ultra-vires and its consequences

- The legal phrase ultra-vires (i.e. beyond the power) applies only to the acts done over the legal powers of the company. It denotes that the powers of the company are limited in nature.

- To an ordinary citizen, the law permits whatever the law does not expressly forbid. But a company can do anything that is specified in its objects clause of the memorandum. Memorandum also has to operate within the boundaries set by the Act.

- Any act done by the company which is beyond the powers not only of the direction but also of the company, then such act is

- Wholly void and in operative in law and

- Not binding upon the company.

- The company can neither be sued nor can it sue on an ultra-vires transaction.

- The company can be restrained from employing funds for purposes other than those specified in its memorandum, or from carrying on a trade different from what it is authorized to do.

- A person who is coming to deal with the company must know about the powers of the company by going through its memorandum. As the memorandum is a public document, it is open for public inspection.

- Even after this, if anyone enters into an ultra-vires transaction with the company, then they cannot enforce it against the company.

- An ultra-vires transaction can never be made binding on the company. It cannot be made ultra-vires, even if the whole body of shareholders ratifies it.

- Ratification of ultra – vires actsAn act that is ultra-vires the company cannot be ratified even with the help of the unanimous consent of all the shareholders.

- An act ultra-vires the Articles can be ratified by altering the Articles by passing a special resolution in a general meeting.

- An act ultra-vires the directors but intra-vires the company can be ratified with the help of resolution in general meeting.

- Shareholders can ratify the irregularity but only such which is within the powers of the company.

Question 13. Explain listed companies and unlisted companies as per the provisions of The Companies Act, 2013.

Answer:

- Listed Company: As per the definition given in Section 2(52) of the Companies Act, 201 3, it is a company that has any of its securities listed on any recognized stock exchange.

- Unlisted Company: Unlisted company means a company other than listed company.

Question 14. Mike LLC incorporated in Singapore has an office in Pune, India. Analyse whether Mike LLC would be called a foreign company as per the provisions of The Companies Act, 2013. Also, explain the meaning of foreign company.

Answer:

Provision or Meaning of the foreign company:

According to Section 2(42) of the Companies Act, 2013. foreign company means any company or body corporate incorporated outside India that:

- Has a place of business in India whether itself or through an agent, physically or through electronic mode, and

- Conducts any business activity India has in any other manner. In the present case Mike LLC is incorporated in Singapore and has its control and management from Pune, India, hence, Mike LLC would be called as a foreign company as per the provisions of the Companies Act, 2013.

Question 15. Explain the concept of ‘Corporate Veil’. Briefly state the circumstances when the corporate veil can be lifted as per the provisions of the Companies Act, 2013.

Answer:

‘Corporate Veil’

As per the provisions of Companies Act, 201 3, the corporate veil refers to a legal concept whereby the company is identified separately from the members of the company. Thus, the shareholders are protected from the acts of the company.

The following are the cases where the company law disregards the principle of corporate personality:

- To determine the character of the company i.e. to find out whether co-enemy or friend: It is true that, unlike a natural person, a company does not have a mind or conscience, therefore it cannot be a friend or foe.

- It may however be characterised as an enemy company if its affairs are under the control of the people of an enemy country.

- For this purpose, the court may examine the character of the persons who are really at the helm of the affairs of the company.

- To protect revenue or tax: In certain matters where a corporate entity is used to evade or circumvent tax, the court can disregard the corporate entity.

- To avoid legal obligation: Where it is found that the sole purpose for the formation of the company was to use it as a device to reduce the amount to be paid by way of bonus to the workman, the Supreme Court upholds the piercing of the veil to look at the real transaction.

- Formation of subsidiaries to act as agents: A company may sometimes be regarded as an agent or trustee of its members, or of another company, and therefore be deemed to have lost its individuality in favor of its principal. Here the principal will be held liable for the acts of the company.

- The company formed for fraud or improper conduct or to defect law: Where the device of incorporation is adopted for some illegal or improper purpose, For Example., to defeat or circumvent the law, to defraud creditors, or to avoid legal obligations.

Question 16. Ravi Private Limited has borrowed ₹ 5 crores from Mudra Finance Ltd. This debt is ultra vires to the company. Examine, whether the company is liable to pay this debt. State the remedy if any available to Mudra Finance Ltd.?

Answer:

When an act is performed, which though legal in itself, is not authorized by the object clause of the memorandum, or by the statute, it is said to be ultraviolet the company, and hence null and void. This is known as the “Doctrine of ultra-vires”.

- The impact of the doctrine of ultra-vires is that a company can neither be sued on an ultra-vires transaction nor can sue on it. If you enter into a transaction that is ultra-vires the company, you Cannot enforce it against the company.

- If you have lent money to the company in such a transaction, you cannot recover it from the company. But, if the money has not been expended, then the lender may bring an injunction order on the Co. to stop it from parting from it.

This is because the company does not become an owner of it.

- However, if the money has been used, then the lender slips into the shoes of the debtor paid – and consequently can recover his loan to that extent.

- In the given case, the transaction is ultra-vires and hence the company Ravi Private Limited is not liable to pay the debt. Mudra Finance Ltd. may be an injunction order on Ravi Pvt. Ltd. to stop it from parting with the funds.

Question 17. A company registered under Section 8 of the Companies Act, 2013, earned huge profits during the financial year that ended on 31st March 2018 due to some favorable policies declared by the Government of India and implemented by the company. Considering the development, some members of the company wanted the company to distribute dividends to the members of the company. They approached you to advise them about the maximum amount of dividend that can be declared by the company as per the provisions of the Companies Act, 2013. Examine the relevant provisions of the Companies Act, 2013, and advise the members accordingly.

Answer:

According to the facts of this case, there exists a situation in which certain members of a Section 8 company have approached a person to seek relevant

- Informed advice on the amount of dividend that can be distributed amongst them from the pool of profits made over a financial year by a company registered under Section 8.

- The first and foremost thing in this case that such members need to be educated about is the definition and objects of a Section 8 company which clearly states that “ a Section 8 company is formed to promote the charitable object of commerce, art, science, sports education.

Research, social welfare, religion, charity, protection of the environment, etc, and a section 8 company intends to apply its profit in –

- Promoting its objects

- Prohibiting the payment of any dividend to its members.

Now when it is evident that a Section 8 company is not statutorily bound to pay dividends to its members unlike a public or private company then automatically the demand of the members for dividends stands invalid and cannot be enforced on the company.

Question 18. Mr. X had purchased some goods from M/s ABC Limited on credit. A credit period of one month was allowed to Mr. X. Before the due date Mr. X went to the company and wanted to repay the amount due from him. He found only Mr. Z there, who was the factory supervisor of the company. Mr. Z told Mr. X that the accountant and the cashier were on leave, he is in charge of receiving money and he may pay the amount to him. Z issued a money receipt under his signature. After two months M/s ABC Limited issued a notice to Mr. X for non-payment of the dues within the stipulated period. Mr. X informed the company that he had already cleared the dues and he is no longer responsible for the same. He also contended that Mr. Z is an employee of the company to whom he had made the payment and being an outsider, he trusted the words of Mr. Z as duty distribution is a job of the internal management of the company. Analyze the situation and decide whether Mr. X is free from his liability.

Answer:

In this case, according to the facts provided it is observable that the situation points towards the applicability of the Doctrine of Indoor Management in relevance to the affairs of the company M/s ABC Limited.

- According to the terms of the Doctrine of Indoor Management, if an act is authorized by the articles or memorandum, an outsider is entitled to assume that all the detailed formalities for doing that act have been observed.

- Here in this case we view the facts from the perspective of the applicability of the Doctrine.

Question 19. Sound Syndicate Ltd. a public company, its articles of association empower the managing agents to borrow both short and long-term loans on behalf of the company, Mr. Liddle, the director of the company, approached Easy Finance Ltd. a nonbanking finance company for a loan ₹ 25,00,000 in name of the company. The Lender agreed and provided the above-said loan. Later on, Sound Syndicate Ltd. refused to repay the money borrowed on the pretext that no resolution authorizing such a loan had been passed by the company and the lender should have enquired about the same before providing such a loan hence the company was not liable to pay such loan. ’Analyse the above, situation in terms of the provisions of Doctrine of Indoor Management under the Companies Act, 2013 and examine whether the contention of Sound Syndicate Ltd. is correct or not.

Answer:

As per the doctrine of Indoor Management, outsiders are entitled to assume that all the detailed formalities for doing an act authorized by the articles have been observed.

- Outsiders are not at all required to inquire into the internal affairs of the company. In the case of The Royal British Bank Vs. Turquand, this doctrine was clearly explained.

- The bond signed by the director and secretary on behalf of the company was held to be valid and the bank was not required to inquire whether any ordinary resolution was passed or not.

This is the Indoor Management rule, that the company’s indoor affairs are the company’s problem. In the given case, the articles of the company, authorize the director to borrow on behalf of the company.

- Mr. Liddle a director borrowed money but, later on company denied its liability to repay on the pretext that no resolution was so passed and the lender should have enquired about the same before providing the loan.

- Held, the contention of Sound Syndicate Ltd. is not correct, as the outsider is not obligated to enquire into the internal affairs of the company.

Question 20. Popular Products Ltd. is a company incorporated in India, having a total Share Capital of ₹ 20 Crores. The Share capital comprises 12 Lakh equity shares of ₹ 100- each and 8 Lakh Preference Shares of ₹ 100 each. Delight Products Ltd. And Happy Products Ltd. hold 2,50,000 and 3,50,000 shares respectively in Popular Products Ltd. Another company Cheerful Products Ltd. holds 2,50,000 shares in Popular Products Ltd. Jovial Ltd. is the holding company for all the above three companies namely Delight Products Ltd; Happy Products Ltd; Cheerful products ltd. Can Jovial Ltd., be termed a subsidiary company of Popular Products Ltd., if it Controls the composition of directors of Popular Products Ltd. State the related provision’ in favour of your answer.

Answer:

Holding and Subsidiary companies are relative terms. A subsidiary company in relation to any other company means a company in which the holding company

- Controls the composition of the Board of Directors; or

- Exercises or controls more than one-half of the total share capital either on its own or together with one or more of its subsidiary companies.

In the given case. Jovial Ltd. is controlling the composition of the Board of Directors of Popular Products Ltd. and hence it can be called as Holding Co. of Popular Products Ltd. and Popular Products Ltd., its subsidiary.

Question 21. Mr. Anil formed a Person Company (OPC) on 16th April 2018 to manufacture electric cars. The turnover of the OPC for the financial year ended 31st March 2019 was about ₹ 2.25 Crores. His friend Sunil wanted to invest in his OPC, so they decided to convert it voluntarily into a private limited company. Can Anil do so?

Answer:

As per Companies Act, 201 3 OPC cannot convert voluntarily into any kind of company unless two years have expired from the date of incorporation, except where the paid-up share capital is increased beyond fifty lakh rupees or its average annual turnover during the relevant period exceeds two crore rupees.

- In the given case Mr. Anil formed OPC on 16th April 2018 and the turnover for the first financial year ending is about ₹ 2.25 crore. He wants to voluntarily convert it into a private limited company.

- Held, Mr. Anil can do so as the threshold limit of turnover is crossed, thus the OPC can be converted into a Private Limited Company even before the expiry of two years from incorporation.

Question 22. A, an assessee, had a large income in the form of dividends and interest. To reduce his tax liability, he formed four private limited companies and transferred his investments to them in exchange for their shares. The income earned by the companies was taken back by him as a pretended loan. Can A be regarded as separate from the private limited company he formed?

Answer:

The facts of the given case are similar to that of “Dinshaw Maneckjee Petit”, it was- held that the company was not genuine at all but merely the assessee himself disguised under the legal entity of a limited company.

- The assessee earned huge income by way of dividends and interest.

- So he opened some companies and purchased their shares in exchange for his income by way of dividends and interest.

- This income was transferred back to the assessee by way of a loan.

- The Court decided that the private companies were a share and the corporate veil was lifted to decide the real owner of the income.

Thus, A cannot be regarded as separate from the private limited company he formed.

Question 23. ABC Limited has allotted equity shares with voting rights to XYZ Limited worth ₹ 15 Crores and issued Non-Convertible Debentures worth ₹ 40 Crores during the Financial Year 2019-20. After that total Paid-up Equity Share Capital of the company is ₹ 100 Crores and Non-Convertible Debentures Stand at ₹ 120 Crores. Define the Meaning of Associate Company and comment on whether ABC Limited and XYZ Limited would be called Associate Company as per the provisions of the Companies Act, 2013.

Answer:

Associate Company:

Section 2(6) of the Companies Act, 2013:

Associate company in relation to another company means a company in which that other company has a significant influence.

- However, it is not a subsidiary company of the company having such influence and includes a joint venture company.

- Significant influence means control of atleast 20% of the. the total share capital of a business decision under an agreement.

- In the given case, ABC Ltd. is not an associate company. We will ignore the non-convertible portion and we will see the convertible portion which is also not stated thus we will do (15/100) x 1 00 = 15% Thus not touching 20% hence, it is not an associate company.

Question 24. ABC Limited was registered as a public company. There were 245 members in the company. Their details are as follows:

Directors and their relatives – 190

Employees – 15

Ex-employees (shares were allotted when they were employees) – 20

Others(Including 10 joint holders holding shares jointly in the name of father and son) – 20

The Board of Directors of the company proposes to convert it into a private company. Advice on whether the reduction in the number of members is necessary for conversion.

Answer:

According to section 2(68) of the Companies Act, 2013, “Private company” means a company having a minimum paid-up share capital as may be prescribed, and which by its articles, except in the case of One Person Company, limits the number of its members to two hundred.

However, where two or more persons hold one or more shares in a company jointly, they shall, for this clause, be treated as a single member.

It is further provided that

- Persons who are in the employment of the company; and

- Persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be embers after the employment ceased, Shall not be included in the number of members.

In the instant case, the Total No. of Members of ABC Ltd. will be Counted as follows:

Directors and their relatives – 190

Others (10 Couple) (10×1) – 10

= 200

Since No. of members does not exceed 200. Therefore, there is no need for a reduction in the number of members.

Question 25. SK Infrastructure Limited has a paid-up share capital divided into 6,00,000 equity shares of INR 100 each, 2,00,000 equity shares of the company are held by the Central Government and 1,20,000 equity shares are held by the Government of Maharashtra. Explain regarding relevant provisions of the Companies Act, 2013, whether SK Infrastructure Limited can be treated as a Government Company.

Answer:

Legal Provision – As per Section 2(45) of the Companies Act, 2013 Government company means any company in which not less than 51% of the paid-up share capital is held by

- The Central Government, or

- By any State Government or Governments, or

- Partly by the Central Government and partly by one or more State Governments, and the section includes a company which is a subsidiary company of such a Government company.

Facts: Here in the given problem out of 6 Lac equity shares of SK Infrastructure Ltd. 3,20,000 (2,00,000 + 1,20,000) shares are with the Central Govt, and Govt, of Maharashtra which is more than 51 % of the paid-up share capital of SK Infrastructure Ltd.

Conclusion: Applying the above legal provision we can say, that SK Infrastructure Ltd. is. a Government.Company.

Question 26. Y incorporated a “One Person Company (OPC)” making his sister Z as nominee. Z is leaving India permanently due to her marriage abroad. Due to this fact, she is withdrawing her consent of nomination in the said OPC. Taking into consideration the provisions of The Companies Act, 2013 answer the questions given below:

- Is it mandatory for Z to withdraw her nomination in the said OPC, if she is leaving India permanently?

- Can Z continue her nomination in the said OPC, if she maintains the status of Resident of India after her marriage?

Answer:

As per the provisions of the Companies Act, 2013, “Only a person Resident in India is allowed to become and carry on as a nominee of OPC.

“If a person stays in India for not less than 182 days during the immediately preceding financial year, then he becomes a resident in India.

In the given case we can conclude as follows:

Since, in this case, ‘Z’ is leaving India permanently, she will no longer hold a residential status. Thus, it is mandatory for ‘Z’ to withdraw her nomination to the OPC.

In this case, ‘Z’ can maintain her residential status in India even after her marriage. Thus, Z can carry on her nomination in the said OPC.

Question 27. AK Private Limited has borrowed ₹ 36 crores from BK Finance Limited. However, as per the memorandum of AK Private Limited, the maximum borrowing power of the company is ₹ 30 crores. Examine, whether AK Private Limited is liable to pay this debt. State the remedy, if any available to BK Finance Limited.

Answer:

- When an act is performed, which though legal in itself, is not authorized by the object clause of the memorandum, or by the statute, it is said to be ultraÿ vires the company, and hence null and void. This is known as the “ Doctrine of ultra vires”.

- The Impact of the doctrine of ultra viresis that a company can neither be sued on an ultra-vires transaction nor can sue on it. If an individual enters into a transaction that is ultra vires the company, he or she cannot enforce it against the company.