CA Foundation Solutions For Business Laws Formation Of The Contract Of Sale

Sale Of Goods Act, 1930

Section 1: Short title, extent, and commencement.

Section 2: Definitions.

Section 3: Application of provisions of Act 9 of 1872.

Section 4: Sale and agreement to sell.

Section 5: Contract of Sale.

Section 6: Existing or future goods.

Section 7: Goods perishing before making of contract.

Section 8: Goods perishing before sale but after an agreement to sell.

Section 9: Ascertainment of price.

Section 10: Agreement to sell at valuation.

Section 11: Stipulations as to time.

Section 12: Condition and warranty.

Section 13: When condition to be treated as warranty.

Section 14: Implied undertaking as to title, etc.

Section 15: Sale by description.

Section 16: Implied condition as to quality.

Section 17: Sale by Sample.

Section 18: Goods must be ascertained.

Section 19: Property passes when intended to pass.

Section 20: Specific goods in a deliverable state.

Section 21: Specific goods to be put into a deliverable state.

Section 22: Specific goods in a deliverable state, when the seller has to do anything.

Section 23: Sale of unascertained goods and appropriation.

Section 24: Goods sent on approval.

Section 25: Reservation of right of disposal.

Section 26: Risk prima facie passes with property.

Section 27: Sale by person, not the owner.

Section 28: Sale by joint owners.

Section 29: Sale by the person in possession under voidable contract.

Section 30: Seller or buyer in possession after sale.

Section 31: Duties of Seller and Buyer.

Section 32: Payment and Delivery.

Section 33: Delivery.

Section 34: Effect of part delivery.

Section 35: Buyer to apply for delivery.

Section 36: Rules as to delivery.

Section 37: Delivery of wrong quantity.

Section 38: Instalments deliveries.

Section 39: Delivery to carrier.

Section 40: Risk where goods are delivered at distant places.

Section 41: Buyer’s right to examine the goods.

Section 42: Acceptance.

Section 43: Buyer not bound to return rejected goods.

Section 44: Liability of buyer for neglect or reflexing delivery of goods.

Section 45: Unpaid seller.

Section 46: Unpaid seller’s rights.

Section 47: Seller’s lien.

Section 48: Part delivery.

Section 49: Termination of lien.

Section 50: Right of stoppage in transit.

Section 51: Duration of transit.

Section 52: How stoppage in transit is affected.

Section 53: Effect of subscale.

Section 54: Sale not generally rescinded.

Section 55: Suit for price.

Section 56: Damages for non-acceptance.

Section 57: Damages for nondelivery.

Section 58: Specific performance.

Section 59: Remedy for breach of warrant.

Section 60: Repudiation of contract.

Section 61: Interest by way of damages.

Section 62: Exchange of implied terms

Section 63: Reasonable time.

Section 64: Auction sale.

Section 65: Repeal.

Section 66: Savings.

CA Foundation Solutions For Business Laws Formation Of The Contract Of Sale Self-Study Questions And Answers

Question 1. Describe the Introduction of Sales of Goods.

Answer:

The Introduction of Sales of Goods

- It is one of the special types of contract.

- Initially, it was the part of Indian Contract Act, 1 872.

- Later it was deleted and a separate Sale of Goods Act was passed in 1930.

- The basic provisions and requirements of the contract equally apply to the Sales of Goods Act.

- It contains and deals with the law relating to the sale of goods and not with mortgage or pledge.

- It received its assent on 15th March 1930 and came force into on 1st July 1930.

- It extends to the whole of India except the state of Jammu and Kashmir.

Question 2. What are the Definitions?

Answer:

Buyer: a person who buys or agrees to buy the goods.

Seller: a person who sells or agrees to sell the goods.

Goods: As per section 2(7), it means every kind of movable property other than actionable claims and money and includes stock and shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale.

Money means current money and it includes rate and old coins. Actionable claims mean what a person cannot make a present use of or enjoy, but can recover utilizing a suit or an action.

Existing Goods: It means such goods that are in existence at the time of the contract of sale i.e. owned or possessed by the seller.

- Specific Goods: It means goods identified and agreed upon at the time the contract of sale has been made.

- Ascertained Goods: It means that the goods are identified under the agreement after the contract, of sale has been made.

- Generic or Unascertained Goods: It means the goods that are not specifically identified but are indicated by description.

- Future Goods: As per section 2(6), it means goods to be manufactured produced, or acquired by the seller after making the contract of sale.

- Contingent Goods: This means the goods the acquisition of by the seller depend upon a contingency that may or may not happen.

- Agreement to sell can only be there in respect of future or contingent goods.

- Actual sales can take place only in respect of specific goods.

- Goods are said to be in a deliverable state when they are in such a condition that the buyer would, under contract, be bound to take delivery of them.

- Delivery: it means Voluntary transfer of possession by one person to another.

Document of the title of Goods: It includes a bill of lading, dock- warrant, warehouse keeper’s certain, wharfinger’s certificate, or any other document used in the ordinary course of business as proof of the possession or control of the goods or authoring or purporting to authorize either by endorsement or delivery, the possessor of the document to transfer or receive goods thereby represented.

- Property: It means the general property and not merely a special property.

- Insolvent: a person is said to be insolvent when he ceases to pay his debts in the ordinary course of business.

- Mercantile Agent: Is the agent having in the customary course of business as such agent authority either to sell or consign goods, etc.

- Price: Is the money consideration received for the sale of goods.

- Quality of Goods: It includes their state or condition.

Question 3. Describe the Sale and Agreement to Sell.

Answer:

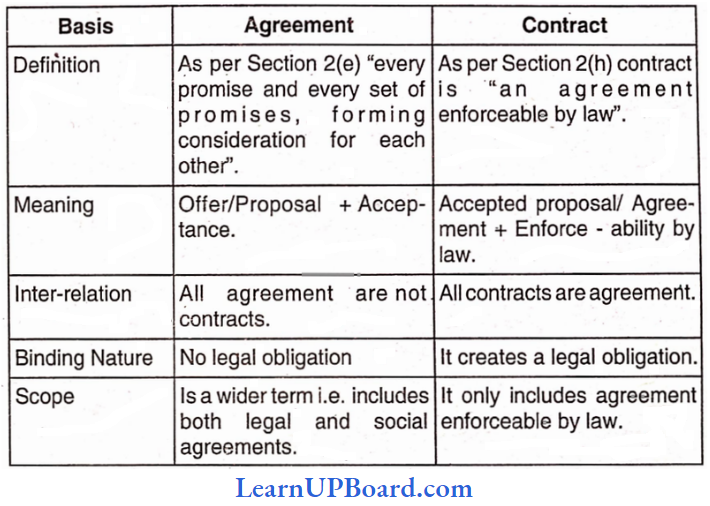

The Sale and Agreement to Sell

- As per section 4(3) of the Act, “ where under a contract of sale the property in the goods is transferred from the seller to the buyer, the contract is called a sale.”

- As per section 4(3) of the Act “where under a contract of sale the transfer of the property in the goods in to take place at a future time or subject to some condition thereafter to be fulfilled, the contract is called an agreement to sell.”

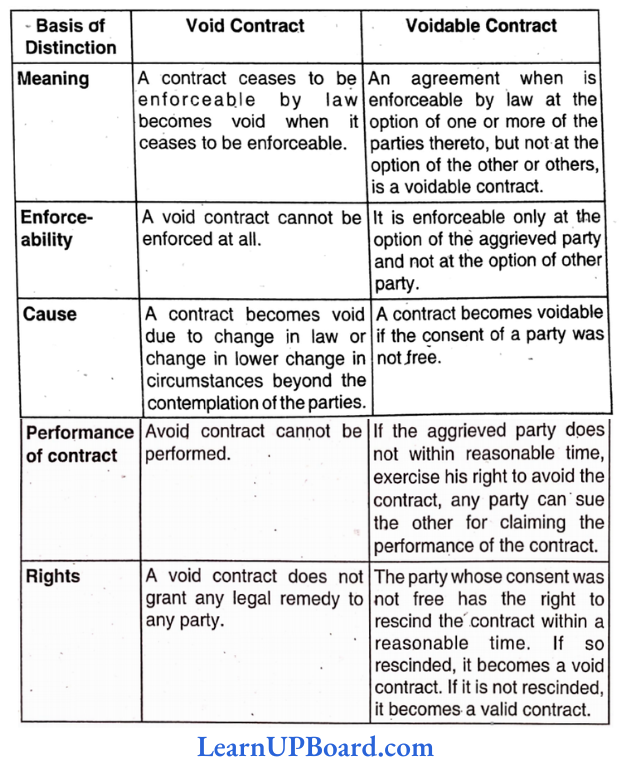

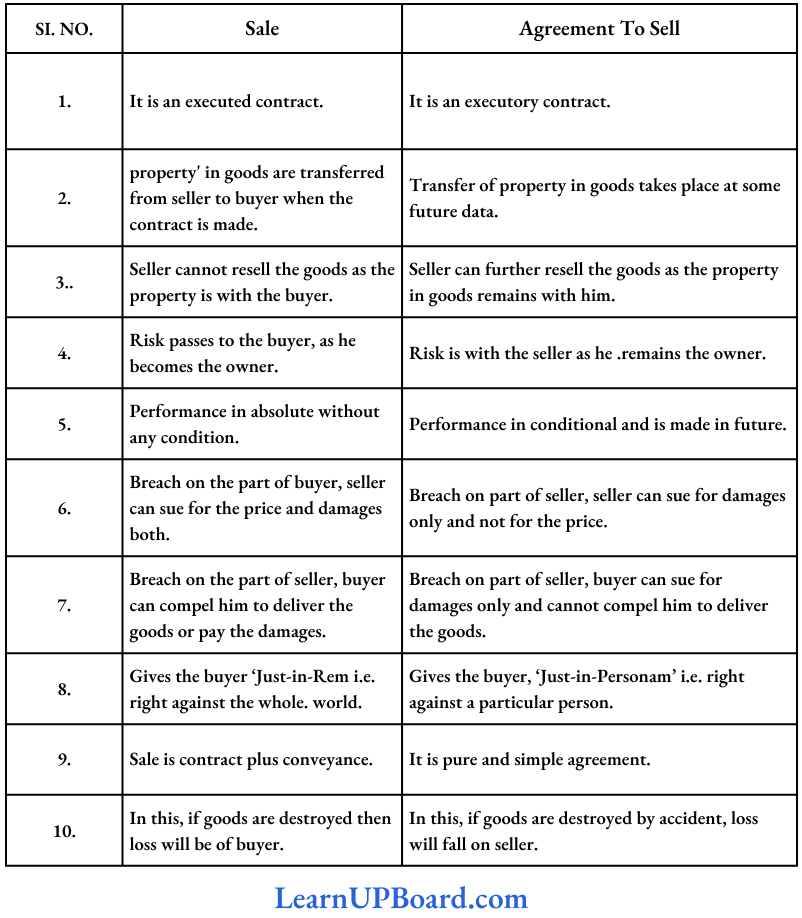

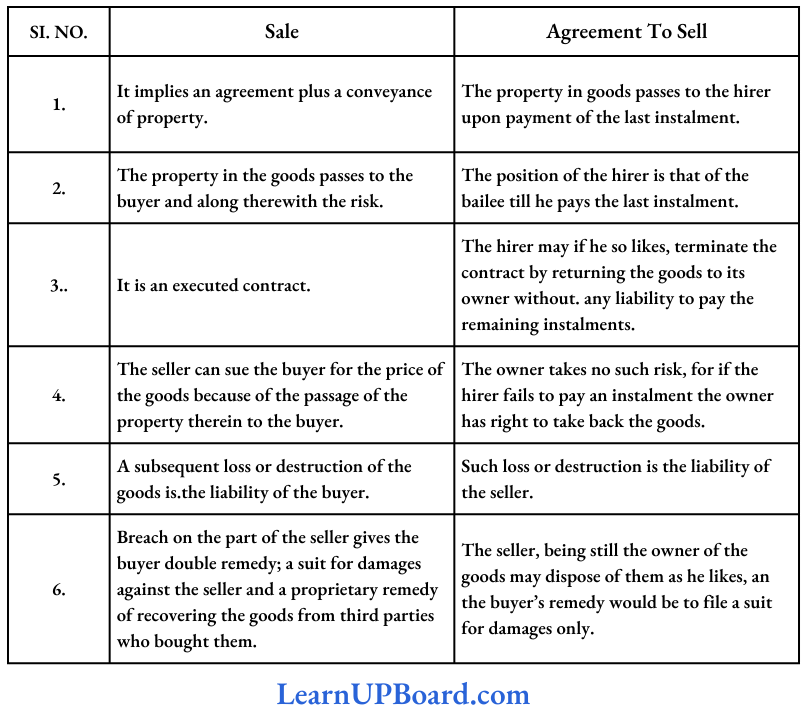

Question 4. The distinction between a Sale and an Agreement to Sell.

Answer:

The distinction between a Sale and an Agreement to Sell

Question 5. Define the distinguished from other similar contracts:

Answer:

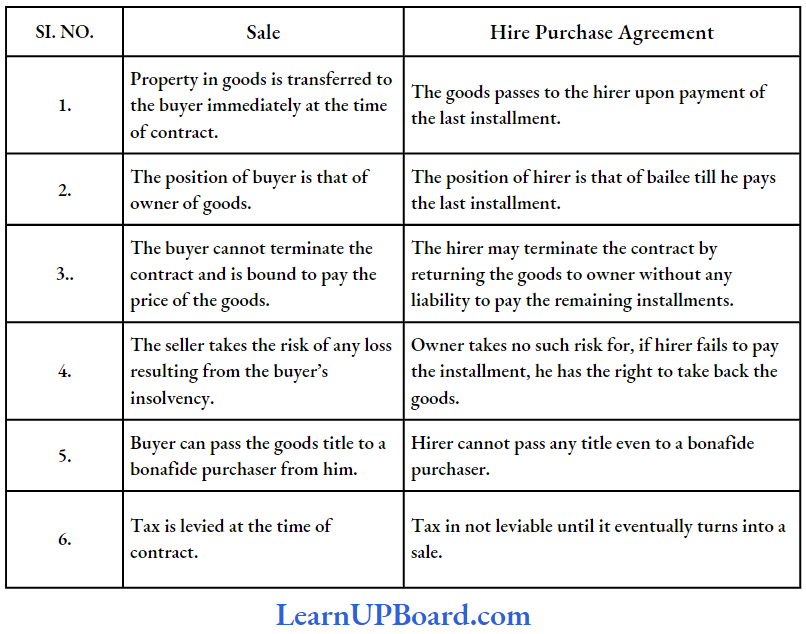

1. Sale and Hire Purchase Agreement:

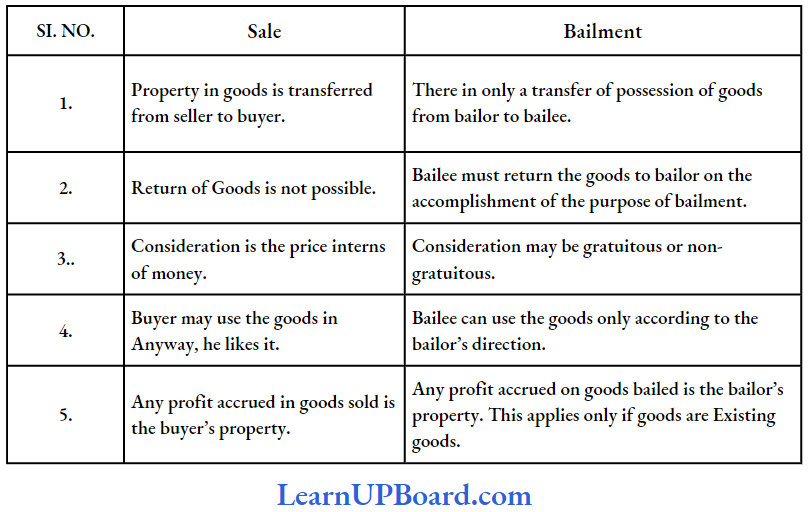

2. Sale and Bailment:

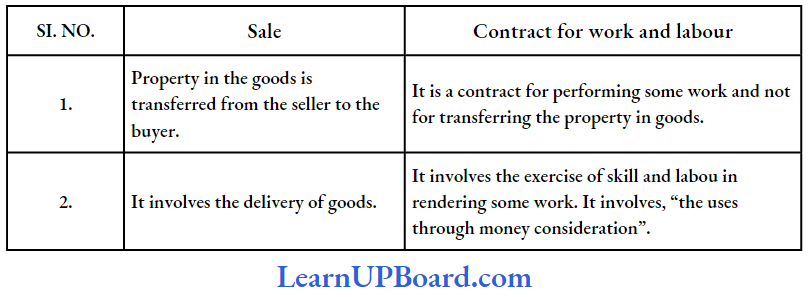

3. Sale and contract for work and labor:

Question 6. What are Contract of sale how made?

Answer:

Contract of sale

- There may be immediate delivery of goods.

- There may be immediate payment of the price, but it may be agreed that the delivery is to be made at some future date.

- There may be immediate delivery of the goods and an immediate payment of the price.

- It may be agreed that the delivery or payment or both are to be made in installments.

- It may be agreed that the delivery or payment or both are to be made at some future date.

Question 7. Define the Subject matter of the Contract of sale.

Answer:

As per section 6:

- Subject matter must always be goods which may be existing or future goods.

- Contract can also be made about the goods, the acquisition of which by the seller depends upon a contingency, which may or may not happen. Such contracts are contingent contracts.

- When the seller purports by his contract to effect a sale of future goods, the contract will operate only as an agreement to sell the goods and not as a sale.

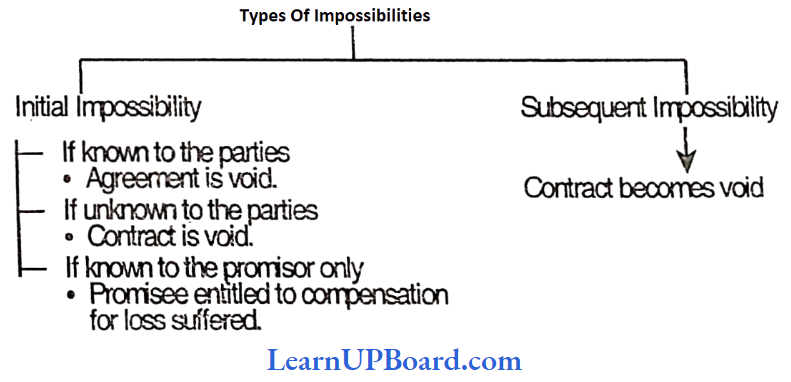

Goods perishing before making a contract (section 7):

- The contract is void ab initio.

- If the seller enters into the contract even on being aware of the destruction, he is estoppel from, disputing the contract.

- It also includes the goods that have lost their commercial value.

- Mutual mistake of fact essential to the contract renders the contract void.

Goods Perishing after Agreement to sell (Section 8) without any of the party’s default:

- An agreement becomes void.

- Provided the risk has not passed to the buyer.

- It applies only to the sale of specific goods.

- For uncertain goods sale, the perishing of the whole quantity of such goods in the possession of the seller won’t relieve him of his obligation to deliver.

Question 8. Describe the Ascertainment of price.

Answer:

Price: It means a monetary consideration for the sale of goods.

- It may be money paid or promised to be paid.

- No sale can take place without a price.

- Only money transactions are valid, no dealing in kind.

As per Section 9:

- Price may be

- Fixed by a contract,

- Agreed to be fixed is a manner provided by the contract, or

- Determined by the course of dealings between the parties.

- When it cannot be fixed in any of the above ways’, the buyer is bound to pay a reasonable price to the seller.

- Generally market price would be reasonable price.

As per Section 10:

- Price is to be determined by third-party

- Where there is an agreement to sell goods on the terms that the price is to be fixed by a third party, and he either does not or cannot make such a valuation, the agreement will be void.

- If the third party is prevented by the default of either party from fixing the price, the party at fault will be liable for the damages to the other party who is not at fault.

CA Foundation Solutions For Business Laws Formation Of The Contract Of Sale Objective Questions And Answers

Question 1. State with reasons whether the following statement is Correct or Incorrect: Exchange of goods for goods between the two parties amounts to sale under the Sale of Goods Act, 1930.

Answer:

Incorrect: When goods are exchanged for goods, it is not a sale but a barter (Shelon (v) Cox). In sales there must be consideration in the form of money, called the price.

Question 2. State with reasons whether the following statements are Correct or Incorrect:

- A bailment is the delivery of goods by one person to another for some purpose.

- Means every kind of movable property other than actionable claims and money.

Answer:

- Correct: The first important characteristic of bailment is that the goods must be handed over to the bailee for whatever is the purpose of bailment. Once this is done, bailment arises, irrespective of how this happens. Delivery of possession differs from mere custody. However, there is another important requirement for bailment is that the goods must be returned or otherwise disposed of according to the direction of the person delivering them.

- Correct: Goods means every kind of movable property i.e. property of every description [except immovable property, other than actionable claims and money. Section 2(7) of the Sale of Goods Act, 1930]. According to this definition, money and actionable claims are not goods and cannot be bought or sold.

Question 3. State with reasons whether the following statement is Correct or Incorrect: Contract of Sale can also take place by the conduct of the parties to the contract.

Answer:

Correct: Subject to the provisions, of any law for the time being in force, a contract of sale may be expressed or may be implied from the conduct of the parties (Section 5(2) of the Indian Contract Act, 1872).

Question 4. State with reasons whether the following statement is Correct or Incorrect: ‘Goods’ means every kind of property other than actionable claims and money.

Answer:

Incorrect: Sub-section (7) of Section 2 of the Sale of Goods Act, 1930 defines the term ‘goods’ as “every kind of movable property” other than actionable claims and money. The term property includes both movable and immovable properties. Thus, the subject matter of sale under the said Act is “movable property” only excluding actionable claims and money.

Question 5. State with reasons in brief whether the following is Correct or Incorrect. In an agreement to sell, the property in the goods passes to the buyer immediately.

Answer:

Incorrect: According to Section 4(3) of the Sale of Goods Act 1930, in an agreement to sell, property in the goods is to be transferred to the buyer at some future date, or subject to the fulfillment of some conditions.

CA Foundation Solutions For Business Laws Formation Of The Contract Of Sale Short Notes

Question 1. Write a short note on the formalities of a contract of sale.

Answer:

Formalities of contract of Sale: Except where specifically required by any law, no particular form is necessary to constitute a valid contract. The agreement may be expressed or may be implied from the conduct of the parties.

Section 5 of the Sale of Goods Act, of 1930 lays down the rule as to how a contract of sale may be made and has nothing to do with the transfer or passing of the property in the goods.

A contract of sale may be made in any of the following modes:

- There may be immediate delivery of the goods; or

- There may be immediate payment of price, but it may be agreed that the delivery is to be made at some future date; or

- There may be immediate delivery of the goods and an immediate payment of the price; or

- It may be agreed that the delivery or payment or both are to be made in instalments; or,

- It may be agreed that the delivery or payment or both are to be made at the same future date.

Question 2. Write a short note on the essentials of appropriation of goods.

Answer:

Essentials of Appropriation of Goods: Appropriation of goods involves the selection of, goods to use in the performance of the contract and with the mutual consent of the seller and the buyer.

The essentials are:

- The goods should conform to the description and quality stated in the contract.

- The goods must be in a deliverable state.

- The goods must be unconditionally (as distinguished from an intention to appropriate) appropriated to the contract either by delivery to the buyer or his agent or the carrier.

- The appropriation must be made by:

- The seller with the assent of the buyer, or

- The buyer with the assent of the seller.

- The assets may be express or implied.

- The assent may be given either before or after appropriation.

Question 3. Write a short note on: ‘Goods’ in a Contract of Sale.

Answer:

“Goods” in a Contract of Sale: In the Sales of Goods Act, 1930, ‘Goods’, means every kind of movable property, i.e. property of every description (except immovable property), actionable claims, and money and includes stocks, shares, growing crops, grass and things attached to or forming part

of the land.

For Example. growing trees, machinery fixed or embedded in the earth), which were agreed to be severed before sale or under the contract of sale. [Section 2(7)].

Goods can be of the following types:

- Existing i.e. which are in existence at the time of sale.

- Future goods i.e. which are in the process of manufacturing or production or acquisition by the seller after the contract of sale.

- Specific i.e. which have been identified at the time of sale.

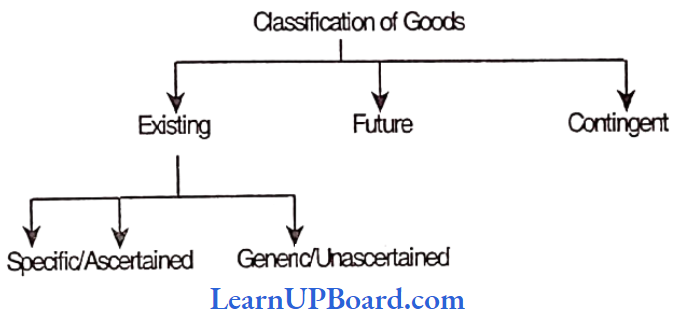

Question 4. Write a short note on the classification of goods in a contract of sale.

Answer:

Goods forming subject matter of the contract of sale may be classified as under:

- Existing’Goods

- Specific goods

- Unascertained goods

- Ascertained goods.

- Future Goods

- Contingent Goods

Existing Goods are those which are in actual existence at the time of the contract of sale. The seller is the owner of goods or he has the possession of such goods.

Existing goods may be of the following three types:

- Specific Goods: Goods that have either been identified or agreed upon by the parties at the time of the contract of sale.

- Ascertained Goods are those identified only after the formation of a contract of sale. When unascertained goods are identified and agreed upon by the parties, the goods are called Ascertained goods.

- Unascertained Goods are those not specifically identified at the time of contract of sale. They are described by the description or sample only.

- Future Goods are those which are not in existence at the time of contract. These goods are to be acquired or produced by the seller after the contract of sale is made. It is an agreement to sell and not sell.

- Contingent goods are like future goods. The acquisition of the goods by the seller depends upon the uncertain contingencies which may or may not happen For Example. goods will be supplied if the ship arrives.

CA Foundation Solutions For Business Laws Distinguish Between Formation Of The Contract Of Sale

Question 1. Distinguish between Existing goods and Contingent goods.

Answer:

Existing Goods and Contingent Goods:

The two terms can be distinguished on the following basis:

- Meaning: Goods that are physically in existence and which are in the seller’s ownership or possession at the time of entering the contract of sale are called existing goods.

- While goods, the acquisition of which by the seller depends upon an uncertain contingency are called contingent goods.

- They are a type of future goods. Future goods are the goods to be manufactured, produced, or acquired after the making of the contract.

- Type: A contract for the sale of contingent goods is always an agreement to sell while existing goods can be the subject matter of sale as well as an agreement of sale.

- Classification: Existing goods may be classified as specific, ascertained, or unascertained goods while there cannot be any such classification of contingent goods.

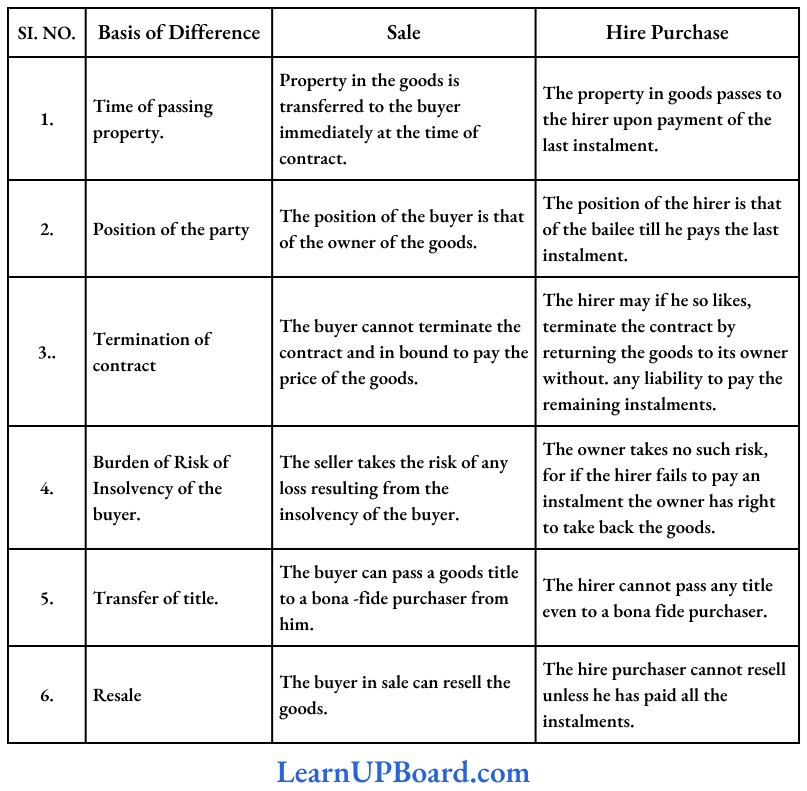

Question 2. Difference between Sale and Hire-purchase.

Answer:

Sale and Hire Purchase Agreements:

A contract of sale of goods is a contract whereby the seller transfers or agrees to transfer the property in goods to the buyer for a price.

- There may be a contract of sale between one part-owner and another. [Section 4(1) Sale of Goods Act]. A contract of sale may be absolute or conditional. [Section 4(2)].

- A hire purchase agreement is a contract whereby the owner of the goods lets them on hire to another person called hirer on payment of rent to be paid in installments and upon an agreement that when a certain number of such installments is paid, the ownership in goods will pass on to the hirer.

- The hirer may return the goods at any time without any obligation to pay the balance rent. It is not a contract of sale but only a bailment and the property in the goods remains in the owner during the continuance of the bailment.

Question 3. Briefly explain the distinction between Future goods and contingent goods.

Answer:

Future Goods and Contingent Goods: Those goods which are yet to be manufactured or produced or acquired by the seller after the making of the contract of sale, are called, “future goods”.

- Thus, future goods are not in existence at the time of the contract of sale or if they are in existence they have not yet been acquired by the seller by that time.

- When a present sale is made for some future goods, it is not a sale but an agreement to sell. (Section 2(6) and 6(3) of the Sale of Goods Act, 1 930).

- According to Section 6(2) of the Sale of Goods Act, contingent goods are goods the acquisition of which by the seller depends upon a contingency that may or may not happen.

- They are also a type of future goods and therefore, a contract for the sale of contingent goods operates as an agreement to sell.

Contingent goods are different from future goods in the same that the procurement of Contingent goods is dependent upon an uncertain event, whereas the obtaining of future goods does not depend upon any such uncertainty.

Question 4. Point out any four major differences between a sale and an agreement to sell.

Answer:

Difference between a sale and an agreement to sell: According to Section 4 of the Sale of Goods Act, 1930, a contract of goods is a contract whereby the seller transfers or agrees to transfer the property in the goods to the buyer for a price, whereas, under an agreement to sell, the transfer of the property in the goods is to take place at a future date.

- In a sale, the seller can sue the buyer for the price of the goods, but in an agreement to sell, the aggrieved party can sue for damages only and not for the price.

- In a sale, a subsequent loss or destruction of the goods is the liability of the buyer, but the liability remains with the seller if it is agreed to sell.

- In a sale, the seller’s breach gives the buyer to sue for damages and also a remedy of recovery of the goods from third parties who bought them. But in an agreement to sell, the buyer’s remedy is for a suit of damages.

Question 5. Distinguish between sale and agreement to sell under the Sale of Goods Act.

Answer:

Sale and Agreement to sell distinguished:

- A sale implies an agreement plus a conveyance of property. In an agreement to sell, there is no conveyance, the conveyance takes place at a future date.

- In a sale, the property in the goods passes to the buyer and risk also passes to the buyer. In agreement to sell, since property does not pass to the buyer, risk also does not pass to the buyer.

- A sale is an executed contract. An agreement to sell is an executory contract.

- In a sale, the seller can sue the buyer for the price of the goods. In an agreement to sell; the aggrieved party can sue for damages only and not for the price unless the price was payable at a stated date.

- In a sale, a subsequent loss or destruction of the goods is the liability of the buyer, but the liability remains with the seller, where the transaction only amounts to an agreement to sell.

- In an agreement to sell, the seller, being still the owner, may dispose of the goods as the likes and the buyer’s remedy would be to file a suit for damages.

- In a sale, however, the seller’s breach gives the buyer the double remedy, a suit for damages against the seller, and the remedy of recovering of goods from third parties who bought them.

- In a sale, in case of default by a buyer, the seller can sue the buyer for the price even if the goods are in his possession and can resell the goods. In an agreement to sell, the seller’s remedy in case of default, is to sue for damages for breach and not the price even though the goods are in the possession of the buyer.

- In case of sale, if the seller becomes insolvent, while the goods are still in his possession, the buyer shall have a right to claim the goods from the official receiver or assignee.

- In case of agreement to sell, when the seller becomes insolvent, the buyer’s remedy is to claim a rateable dividend from the estate of the insolvent seller for the price paid and not for the goods, since property in them still rests with the seller.

If the buyer becomes insolvent, the seller can refuse to deliver the goods to the official receiver or assignee unless the price is paid to him, in the case of an agreement to sell.

In the case of a sale, in the absence of a right of lien over the goods, the seller must deliver the goods to the official receiver or assignee of the buyer and is entitled to a rateable dividend only from the estate of the insolvent buyer.

Question 6. Differentiate between Ascertained and Unascertained Goods with example.

Answer:

Difference between Ascertained and Unascertained Goods

The basic point of distinction between ascertained and un-ascertained goods with examples can be discussed as under:

- Ascertained goods are those goods that are identified under the agreement after the contract of sale is made. This term is not defined in the act but has been judicially interpreted.

- In actual practice, the term ‘ascertained’ goods is used in the same sense as ‘specific’ goods’ when from a lot or out of the large quantity of unascertained goods, the number or quantity contracted for is identified, such identified goods are called ascertained goods.

Example: A wholesaler of cotton has 100 bales in his godown. He agreed to sell 50 bales and these bales were selected and set aside. On selection, the goods become ascertained.

- In this case, the contract is for the sale of ascertained goods, as the cotton bales to be sold are identified and agreed upon after the formation of the contract.

- Un-ascertained goods are goods that are not specifically identified or ascertained at the time of the making of the contract. They are indicated or defined only by description or sample.

Example: If A agrees to sell to B one packet of salt out of the lot of one hundred packets lying in his shop, it is a sale of un-ascertained goods because it is not known which packet is to be delivered. As soon as a particular packet is separated from the lot, it becomes ascertained or specific goods.

Question 7. Distinguish between ‘Sale’ and ‘Hire Purchase’ under the Sale of Goods Act, of 1930.

Answer:

The main points of distinction between the ‘sale’ and ‘hire purchase’ are as follows:

CA Foundation Solutions For Business Laws Formation Of The Contract Of Sale Descriptive Questions And Answers

Question 1. Describe the conditions implied in a contract for the sale of goods by

- Description, and

- Sample.

Answer:

1. Sale by description: Where there is a contract for the sale of goods by description, there is an implied condition that the goods shall correspond with the description. If the description of the article is different in any respect, the other party is not bound to take it.

The sale of goods by description may include:

- Where the buyer has not seen the goods and relied on the description given by the seller.

- Where the buyer has seen the goods but he relies not on what he has seen but what was stated to him and the deviation of the goods from the description is not apparent.

- The packing of the goods may sometimes be a part of the description.

2. Sale by Sample: In the case of a contract for sale by sample, there is an implied condition that

- The bulk shall correspond with the same in quality.

- The buyer shall have a reasonable opportunity to compare the bulk with the sample.

- The goods shall be free from any defect rendering them unmerchantable which would not be apparent on a reasonable examination of the sample.

- This implied condition applies only to latent defects, i.e., defects that are not discoverable on a reasonable examination of the sample.

The seller is not responsible for the defects which are patent i.e. visible by examination of the goods. In such a case, there is no breach of condition as to merchantability.

Section 15 of the Sale of Goods Act also provides that if the sale is by sample as well as by description, the goods must correspond both with the sample and with the description.

Question 2. How the price of the goods be ascertained in the case of the state of goods?

Answer:

Ascertainment of Price: The meaning of the price and the rule regarding ascertainment of the price of the goods are contained in Sections 2(10), 9, and 10 of the Sale of Goods Act respectively, as follows:

- ‘Price means’ the monetary consideration for the sale of goods. The price may be fixed by the contract or agreed to be fixed in a manner provided by the contract, For Example., by a valuer or determined by the cause of dealings between the parties.

- When it can not be fixed in any of the above ways, the buyer is bound to pay the seller a reasonable price. What is a reasonable price is a question of fact in each case (Section 9).

- Section 10 provides for the determination of price by a third party. Where there is an agreement to sell goods on the terms that the price has to be fixed by the third party and he either does not or cannot make such a valuation, the agreement will be void.

- In case the third party is prevented by the default of either party from fixing the price, the party at fault will be liable for the damages to the others to the other party who is not at fault.

However’ a buyer who has received and appropriated the goods must pay a reasonable price for them in any eventuality.

Question 3. “Agreement to sell, differs from sale.”

Answer:

Sale and Agreement to sell differ to each other:

According to Section 4(3) of the Sale of Goods Act, when the property in the goods is transferred to the buyer immediately on making of a contract, it is called a ‘sale’.

- On the other hand, when the property in the goods is to be transferred on some future date or the fulfillment of certain conditions, it is called an ‘agreement to sell’.

- Section 4(4) further provides that an agreement to sell becomes a sale when the time elapses or the conditions are fulfilled subject to which the property in the goods is to be transferred.

The main points of distinction between t, the two are as under:

Question 4. In a sale of goods ‘goods’ sold must be of merchantable quality.

Answer:

Goods Must be of merchantable Quality: It is one of the implied conditions that the goods sold to a customer must be of merchantable quality.

- Section 16(2) of the Sale of Goods Act provides that where goods are bought by description from a seller who deals in goods of that description (whether he is the manufacturer or producer or not), there is an implied condition that the goods are of merchantable quality.

- The expression “merchantable quality” though not defined in the Act, nevertheless connotes goods of such quality and in such condition that a man of ordinary prudence would accept them as goods of that description.

- Goods should also, be such as are commercially saleable under the description by which they are known in the market at their full value.

- If goods are of such a quality and in such a condition that a reasonable person acting reasonably would accept them after having examined them thoroughly, they are of merchantable quality.

Sub-section (2) of Section 16 further provides that where the buyer has examined the goods, there is an implied condition as regards defects, which such examination ought to have revealed. [Proviso to. Section 16(2)].

Question 5. What are the essentials of a Contract of Sale?

Answer:

Essentials of a Contract of Sale: Section 4(1). of the Sale of Goods Act, 1930, defines a contract of sale, as a contract whereby the seller transfers or agrees to transfer the property in goods to the buyer for a price.

From the above definition, the following essentials can be deduced:

- There must be at least two parties one seller, and two buyers.

- There must be an agreement between the two parties for sale or an agreement to sell.

- The subject matter of the contract must necessarily be goods, may be existing goods or future goods, ascertained goods, or unascertained goods.

- There should be a price, which is to be paid in money.

- A transfer of property in goods from seller to buyer must take place.

- The contract may be absolute or even conditional.

- All the essential characteristics of a valid contract must exist.

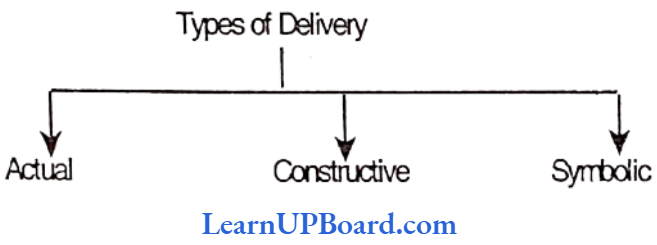

Question 6. What is meant by the delivery of goods under the Sale of Goods Act, of 1930? State various modes of delivery.

Answer:

The delivery of goods under the Sale of Goods Act, of 1930

Delivery means voluntary transfer of possession from one person to another. It may be made by doing anything, which has the effect of putting the goods, in the possession of the buyer, or any person authorized on his behalf.

Various modes of delivery are as follows:

- Actual delivery: Physical delivery of goods to the buyer.

- Constructive delivery: When it is effected without change in the custody or actual possession.

- Symbolic delivery: Where there is a delivery of a thing in token of a transfer of something else.

Question 7. Discuss the essential elements regarding the sale of unascertained goods and its appropriation as per the Sales, of Goods Act, 1930.

Answer:

Sale of unascertained goods and Appropriation:

Appropriation of goods involves the selection of goods to use in the performance of the contract and with the mutual consent of the seller and the buyer.

The essentials are:

- There is a contract for the sale of unascertained or future goods.

- The goods should conform to the description and quality stated in the contract.

- The goods must be in a deliverable state.

- The goods must be unconditionally (as distinguished from an intention to appropriate) appropriated to the contract either by delivery to the buyer or his agent or the carriers.

- The appropriation must be made by:

- The seller with the assent of the buyer; or

- The buyer with the assent of the seller

- The assent may be express or implied

- The assent may be given either before or after appropriation.

Question 8. Sonal went to a Jewellery shop and asked the sales girl to show her diamond bangles with Ruby stones. The jeweler told her that we have a lot of designs of diamond bangles but with red stones if she chooses for herself any special design of diamond bangles with red stones, they will replace red stones with Ruby stones. But for the Ruby stones, they will charge some extra cost. Sonal selected a beautiful set of designer bangles and paid for them. She also paid the extra cost of Ruby stones. The Jeweller requested her to come back a week later for delivery of those bangles. When she came after a week to take delivery of the bangles, she noticed that due to Ruby stones, the design of the bangles had been completely disturbed. Now, she wants to terminate the contract and thus, asked the manager to give her money back, but he denied for the same. Answer the following questions as per the Sale of Goods Act, of 1930.

- State with reasons whether Sonal can recover the amount from the Jeweller.

- What would be your answer if Jeweller says that he can change the design, but he will charge extra cost for the same?

Answer:

As per the Sale of Goods Act, of 1930, where under a contract of sale, the property in the goods is transferred from the seller to the buyer, the contract is called that of a sale, but where the transfer of property in goods is to take place at a future date, subject to fulfillment of some condition, the contract is called an agreement to sell.

- An agreement to sell becomes a sale when the time elapses or the conditions one fulfilled subject – to which the property in goods is to be transferred.

- Based on the above provisions and facts given in the question, it can be said that there is an agreement to sell between Sonal and Jeweller but not a sale.

- Even though the payment made was by Sonal, the property in bangles can be transferred only after the fulfillment of conditions fixed between buyer and seller.

- Since, during the replacement of the Ruby stones, the original design was disturbed, Sonal has the right to avoid the agreement to sell and can recover the price paid.

On the other hand, if Jeweller offers to bring the bangles to their original position by repairing them, he cannot charge extra cost from Sonal. Even if he has to bear some expenses for repair, he cannot charge it from Sonal.

Question 9. Mr. A contracted to sell his swift car to Mr. B. Both failed to discuss the price of the said swift car. Later, Mr. A refused to sell his swift car to’ Mr. B because the agreement was void being uncertain about the price. Does Mr. B have any right against Mr. A under the Sale of Goods Act, of 1930?

Answer:

As per section 9 of the Sale of Goods Act, of 1930,

- The price in a contract of sale may be fixed by the contract or may be left to be fixed in a manner thereby agreed upon or may be determined by the course of dealing between the parties.

- Where the price is not determined under the foregoing provisions, the buyer shall pay the seller a reasonable price. Estimation of a reasonable price depends upon the circumstances of each particular case.

- In the above case A contracted to sell his swift car to B but failed to discuss the price.

- Later, A refused to sell his car to B because the agreement was uncertain as the price was not discussed and declared the contract to be void.

Here B can legally demand the car from A and A can recover a reasonable price of the car from B as the contract of sale is still a valid contract even if the price is uncertain.